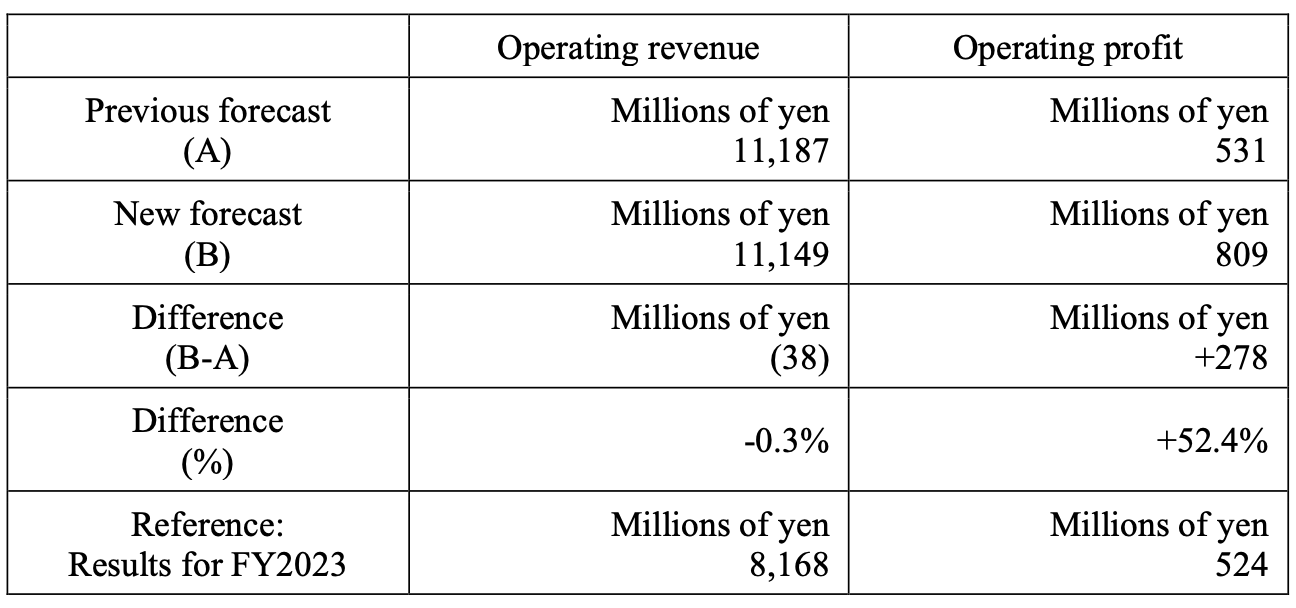

WealthNavi raises operating profit forecast by 52%

WealthNavi has revised upwards its earnings forecasts for the fiscal year ending December 31, 2024, (FY2024) which was previously announced on August 9, 2024.

Note that in the interim, MUFG Bank has made a tender offer for all outstanding shares and stock acquisition rights of WealthNavi, a publicly traded robo-advisor company listed on the Tokyo Stock Exchange Growth Market. The offer period ends on January 20, 2025.

Revenue in line, expenses lower than expected

Regarding the robo-advisor “WealthNavi,” the company launched the “Robo-NISA” in January in full alignment with the new NISA program. The company enhanced the advertising activities including the launch of new TV promotions and a new YouTube channel.

In addition to the robo-advisor service, in May WealthNavi launched an online insurance advisory service which assists its users to select and review life insurance products.

Moreover, in the same month, WealthNavi started offering "WealthNavi R” to provide Rakuten Securities users investment and investment advisory services replicating “WealthNavi” with a mutual fund scheme.

As a result, WealthNavi expects that the operating revenue for FY2024 is to be largely in line with the previous forecast.

WealthNavi expects the expenses to increase from the previous fiscal year mainly due to the product development of the financial advisory platform “MAP”, and office relocation.

However, it is expected that some expenses to fall short of the plan including marketing expenses, personnel and hiring expenses, and real estate expenses.

Consequently, operating revenue for FY2024 is expected to total 11,149 million yen (38 million yen or 0.3% decrease from the previous forecast), and operating profit is expected to total 809 million yen (278 million yen or 52.4% increase from the previous forecast).

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.