Toyota Group to issue first security token bond

Toyota Financial Services, Toyota Finance, Daiwa Securities, MUFG Bank, Mitsubishi UFJ Trust and Banking, and Progmat plan to issue the Toyota Group's first publicly offered security token bonds.

Toyota Financial Services and Toyota Finance have developed financial services to allow each and every customer to drive their car with peace of mind, based on the group mission of "providing sound financial services to Toyota customers and contributing to their enriched lives." They are also working every day to develop financial services that pursue the possibilities of future mobility.

The Toyota Group's first ST bond (nicknamed Toyota Wallet ST bond) will utilize blockchain technology to strengthen the bond between the Toyota Group and individual investors. By utilizing this feature, Toyota hopes to increase the number of people who sympathize with and support the Toyota Group's business and activities by offering special gifts via "TOYOTA Wallet".

The number of ST bond issuance cases is increasing both domestically and overseas, and they are moving towards maturity after various issues have been resolved. Through this ST bond, Toyota hopes to contribute to the development of the market together with others who are engaged in similar studies.

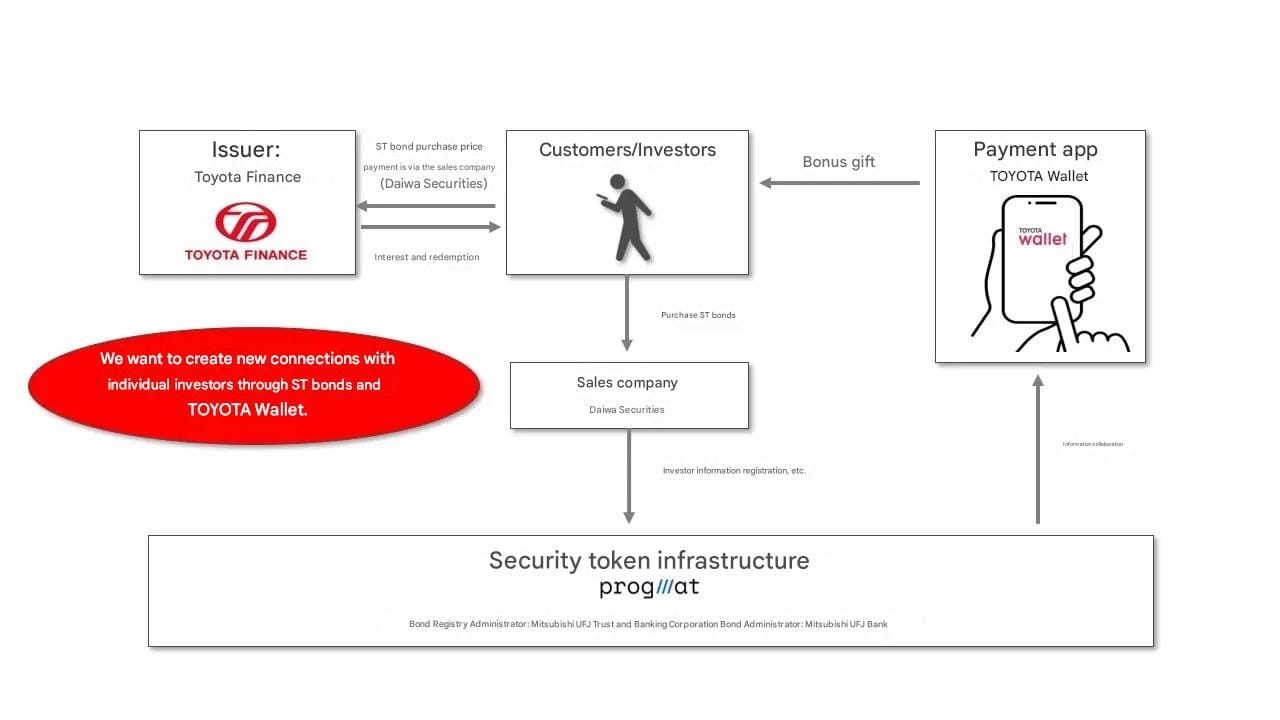

Scheme

The ST Bonds will be issued using Progmat (SaaS), a digital asset issuance and management platform provided by Progmat. Through information sharing between TOYOTA Wallet and Progmat, security token issuers or related businesses will be able to grasp investor information in a timely manner and provide services based on the latest information.

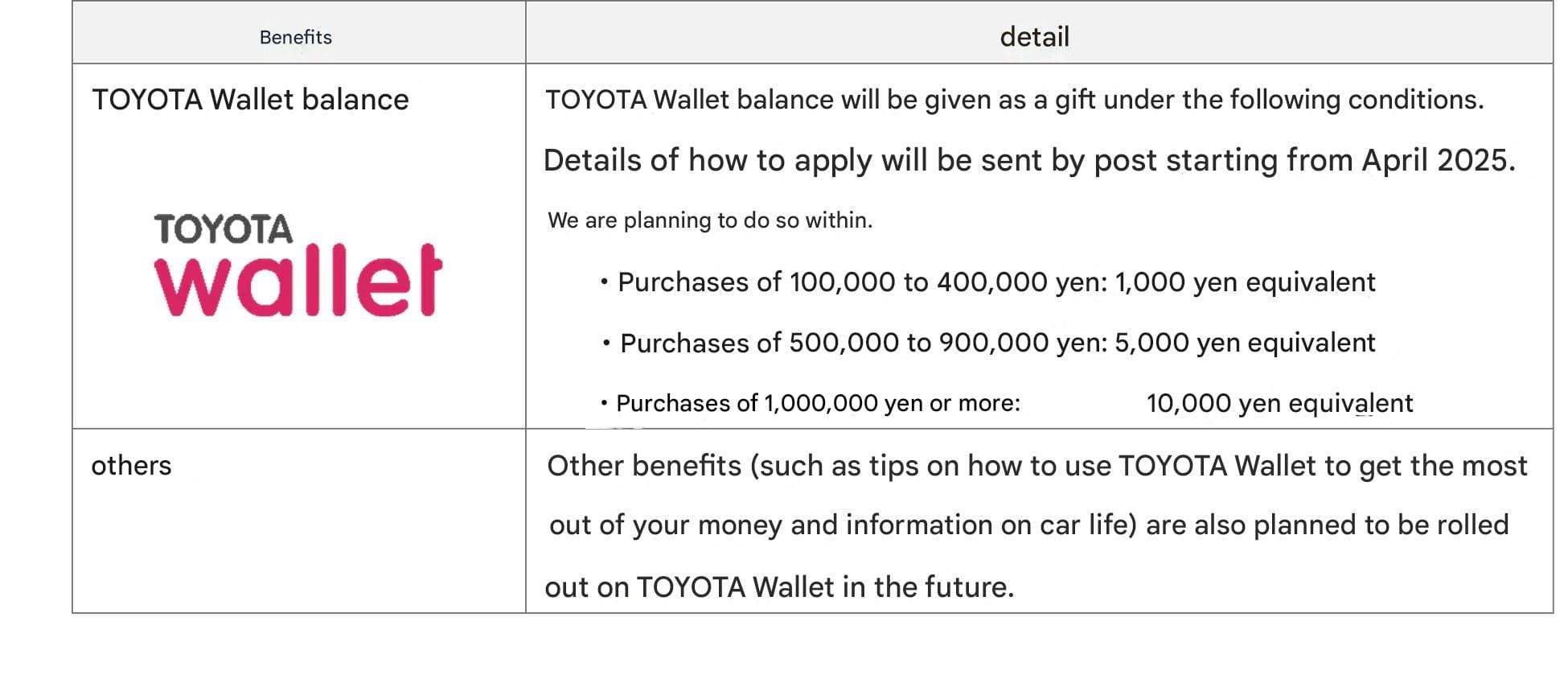

Benefits

Daiwa Securities will underwrite the bonds and sell them to individuals at 100,000 yen per unit. The unique feature of this digital bond is that in addition to the usual interest rate, purchasers will receive Toyota Group electronic money worth between 1,000 and 10,000 yen depending on the number of units purchased.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.