TIS invests in double jump.tokyo to jointly provide stablecoin payment support service

double jump.tokyo, which develops applications using blockchain technology at their core, has raised funds from TIS, a member of the TIS Intec Group that has supported payment infrastructure for many years. By combining double jump.tokyo's knowledge of blockchain technology and enterprise web3 wallets with TIS's strengths in the payment and financial fields, the partners will promote the social implementation of web3 and blockchain technology.

Background

Since the dawn of 2018, double jump.tokyo has been focusing on web3 game development, including the development of the blockchain game "My Crypto Heroes." In addition to games, the company is also a startup with the leading track record in Japan of enterprise web3 wallet implementation, and is expanding its business in the blockchain field by utilizing its cryptocurrency data analysis and accounting and tax know-how.

TIS is a leading company in the domestic payment system market, boasting a share of approximately 50% in the development of core systems for credit cards and over 80% in the development of systems for branded debit cards and related services. In recent years, the company has also been focusing on creating new businesses that utilize blockchain technology, and is working to build a next-generation digital currency payment infrastructure.

Through this investment, double jump.tokyo will combine its knowledge of blockchain technology and enterprise solutions with TIS's strengths in payment infrastructure and the financial field to build a new business foundation. This will promote further social implementation of web3 and blockchain technology. As part of this, the two companies will jointly provide a "stablecoin payment support service" that supports the introduction of smartphone and tablet apps and wallets required for stablecoin payments.

Stablecoin payment support service

The use of new digital currencies that utilize blockchain technology, such as crypto assets and stablecoins, is increasing around the world. As of December 2024, the number of crypto asset holders exceeded 659 million, and the total market capitalization of stablecoins reached approximately 30 trillion yen. In the United States, Singapore, and other countries, stablecoins are increasingly being used as a means of paying for outsourcing fees, and further market growth is expected in the future.

In Japan, the revised Payment Services Act came into effect in June 2023, and stablecoins are expected to be fully used in fiscal year 2025. In addition, the number of foreign visitors to Japan is expected to exceed 36 million in 2024, and there is a growing need for the use of stablecoins in inbound consumption, especially among foreigners, for whom stablecoins are already widespread. However, the current situation is that systems and payment terminals that support stablecoin payments are not yet widespread in Japan.

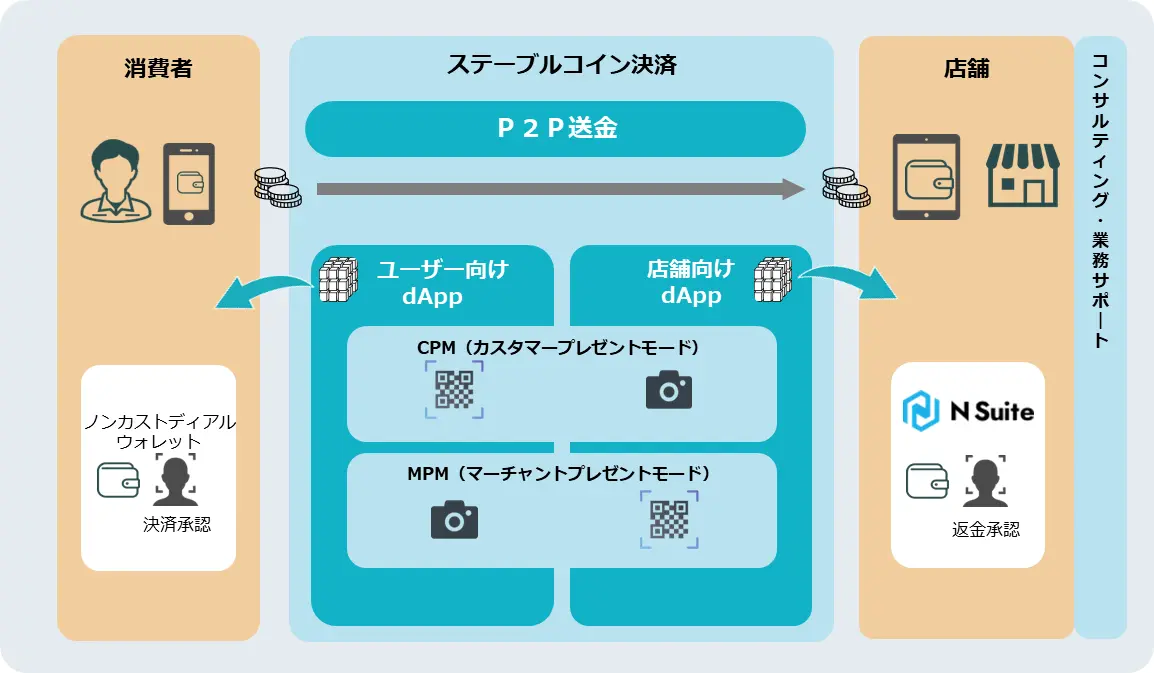

In order to promote the spread of stablecoin payments, double jump.tokyo and TIS will launch a comprehensive support service for businesses. This service will utilize "N Suite" provided by double jump.tokyo to help stores smoothly introduce stablecoin payments.

The main features of the services are envisioned as follows.

- Direct remittance payment using blockchain technology: Using blockchain technology, stores can receive stable coins directly from consumers. Stores do not need dedicated payment terminals as long as they have a smartphone or tablet, and support will be provided from opening accounts at cryptocurrency exchanges to installing the application.

- Increased use by foreign tourists visiting Japan: Foreign tourists visiting Japan who hold stable coins issued overseas, such as those based in US dollars, can use them without the hassle of carrying cash or exchanging it for cash. Utilizing the stable coin market, which has a total market capitalization of over 30 trillion yen worldwide, will promote inbound consumption.

- Reduced merchant fees: Compared to traditional cashless payments such as credit cards, this system has fewer intermediary businesses, and stablecoin payments reduce fees by about 1-2%.

- Open and flexible payment services: Provided by TIS, an independent system integrator focused on utilizing blockchain technology, this service will realize an open and flexible payment infrastructure that is not limited to specific economic zones or specific cryptocurrency exchanges or electronic payment method traders.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.