The Philippine's GCash expands Japan payments with Alipay+ and PayPay

Filipino travelers to Japan can now enjoy expanded cashless payment options at over 3 million merchants, thanks to a new collaboration between GCash, Alipay+, and PayPay. This partnership allows GCash users to seamlessly pay via QR code at a wide range of businesses, from bustling city centers like Tokyo and Osaka to charming smaller towns and rural areas. This means easier access to everything from local izakayas and traditional wagashi shops to unique anime merchandise stores and cozy guesthouses.

According to GCash International General Manager Paul Albano, this initiative reflects GCash's commitment to enhancing the travel experience for Filipinos, who increasingly favor Japan as a top destination. He emphasized the convenience and security of using a familiar payment method abroad, eliminating worries about limited payment options. By simply scanning a PayPay QR code or presenting their own GCash-generated QR code via the "Pay abroad with Alipay+" feature, users can transact smoothly and view their receipts in both Japanese Yen and Philippine Pesos.

Since its 2023 launch in Japan, GCash has been working to broaden its reach through Alipay+. This latest collaboration with PayPay, Japan's leading QR payment provider, further supports Japan's focus on boosting tourism. GCash users benefit from real-time, competitive exchange rates, no service charges, and exclusive in-app discounts through A+ Rewards when using the Global Pay QR feature, maximizing their travel budget.

Albano highlighted the importance of this partnership in bridging the gap in global tourism through seamless cashless transactions. He expressed GCash's dedication to providing users with the best possible travel experience, whether they are exploring Japan's vibrant metropolises or venturing off the beaten track this holiday season.

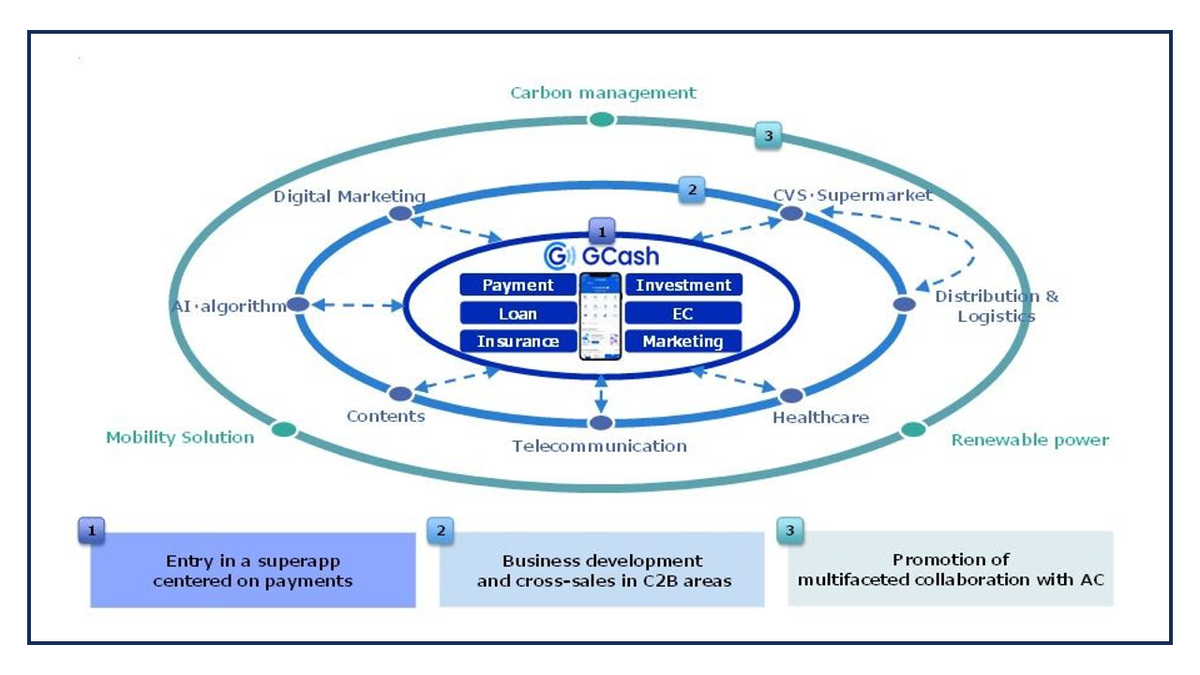

In August 2024, MUFG Bank invested USD 393 million in Globe Fintech Innovations (“Mynt”), the #1 finance super app and digital cashless ecosystem in the Philippines, pushing Mynt’s valuation to USD 5 billion, more than doubling its $2 billion valuation from the last funding round in 2021. As of 2023, Mynt recorded PHP 6.7 billion of net income.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.