Sumitomo Mitsui Trust Bank invests in Japan Hydrogen Fund

Sumitomo Mitsui Trust Bank has made an impact equity investment in the "Japan Hydrogen Fund", a fund established by the Japan Hydrogen Association in cooperation with Advantage Partners that specializes in investments in hydrogen-related areas.

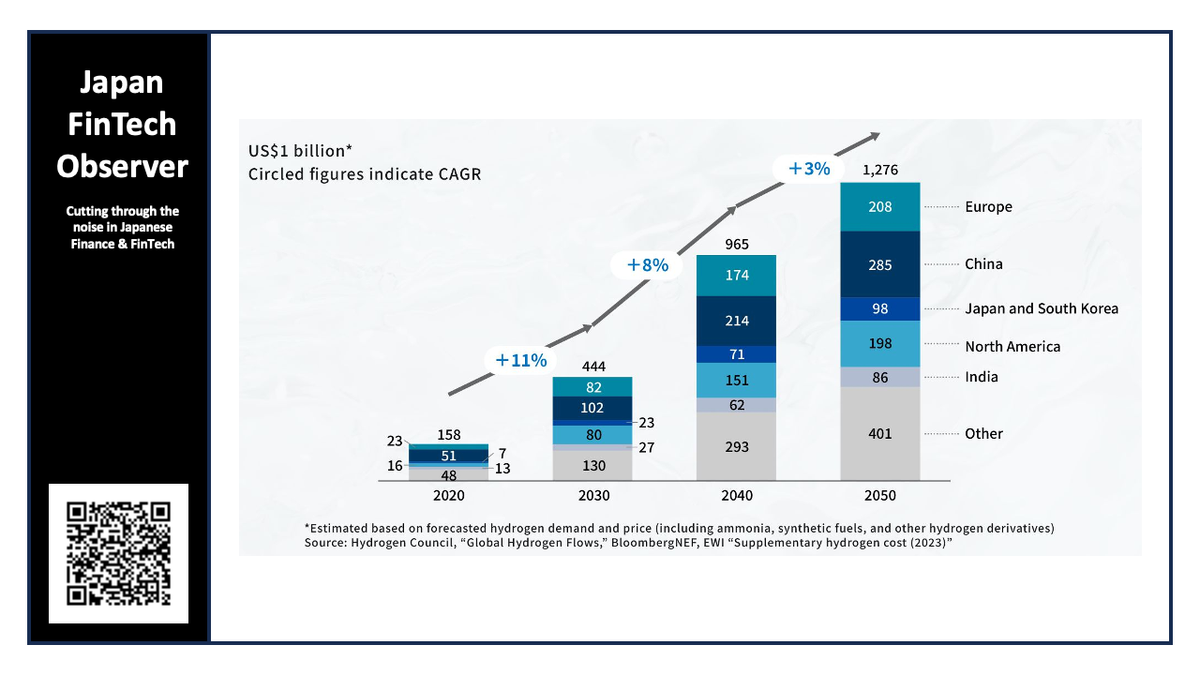

SuMi TRUST Bank will utilize a capital surplus from April 2022 that was generated by the reduction of strategic investments promoting impact equity investment to support challenges and initiatives aimed at resolving social issues through the provision of risk money. Through this investment in the Fund, SuMi TRUST Bank intends to invest in upstream, mid-stream and downstream hydrogen-related assets and companies around the world, including in Japan, and contribute to the early realization of hydrogen society in Japan by supporting the establishment of a supply chain for hydrogen and its by-products, as well as reducing the costs of hydrogen use through the expansion of global hydrogen supply.

Sumitomo Mitsui Trust Group's purpose is "Trust for a flourishing future" and it is promoting efforts to achieve the creation of both social and economic value. In addition, the Group will contribute to the realization of a sustainable society by developing and providing products and services aimed at solving social issues and promoting a virtuous cycle of funds, assets, and capital, as a leader in the field of creating new markets and opportunities.

In September 2024, Sumitomo Mitsui Banking Corporation (SMBC) executed an investment agreement with the Japan Hydrogen Fund as one of the major LP investors, and Sumitomo Mitsui DS Asset Management (SMDAM) participates in the fund as a service provider.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.