SSBJ issues inaugural sustainability disclosure standards to be applied in Japan

The Sustainability Standards Board of Japan (SSBJ) was established in July 2022 to develop sustainability disclosure standards to be applied in Japan and to contribute to the development of international sustainability disclosure standards, following the establishment of the International Sustainability Standards Board (ISSB).

In developing the sustainability disclosure standards, in order to ensure that its standards would be developed in a way that the information disclosed in accordance with its standards would achieve international comparability, the SSBJ decided, as its basic policy, to align its sustainability disclosure standards with the ISSB’s IFRS Sustainability Disclosure standards, and has held extensive discussions.

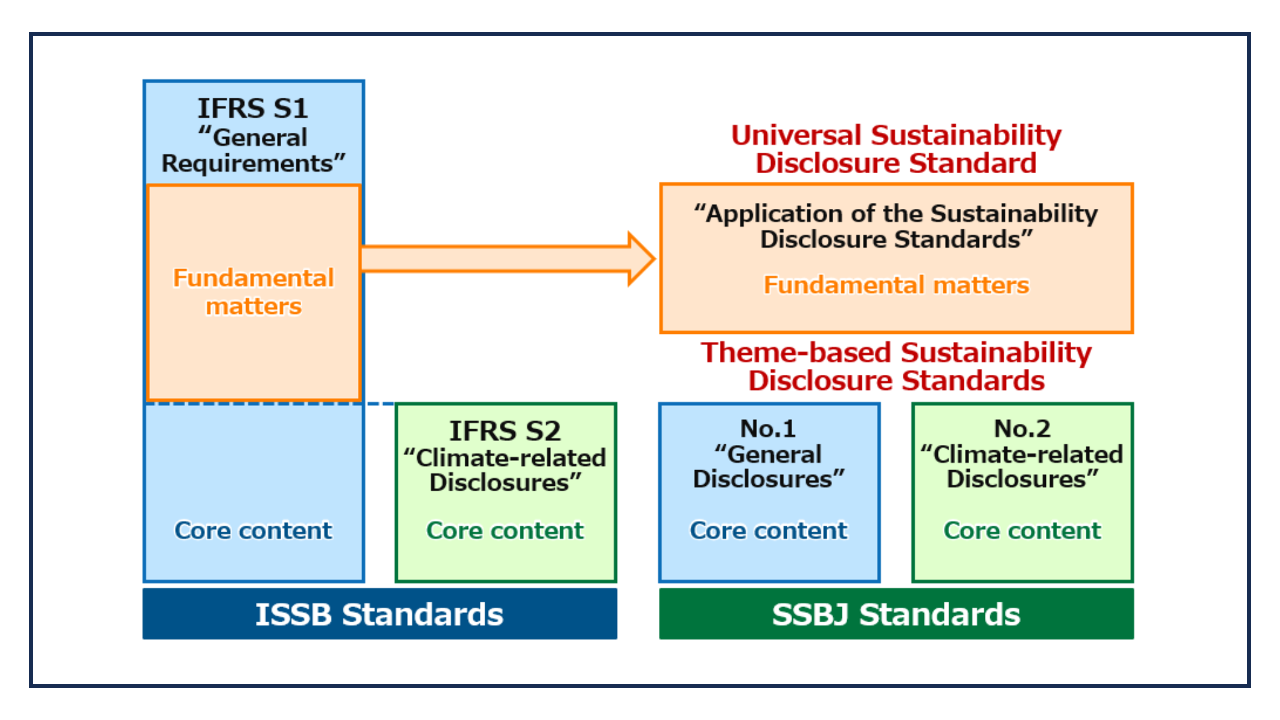

The SSBJ has now issued its inaugural sustainability disclosure standards, comprising the following three Sustainability Disclosure Standards:

- Universal Sustainability Disclosure Standard “Application of the Sustainability Disclosure Standards”

- Theme-based Sustainability Disclosure Standard No. 1 “General Disclosures”

- Theme-based Sustainability Disclosure Standard No. 2 “Climate-related Disclosures”

For the convenience of users of SSBJ Standards, the standard corresponding to ISSB’s IFRS S1 “General Requirements for Disclosure of Sustainability-related Financial Information” has been divided into two standards and issued separately. Specifically, the requirements in the “Core content” section of IFRS S1 that prescribe disclosures regarding sustainability-related risks and opportunities have been included in the General Standard, and the requirements other than those included in the “Core content” section of IFRS S1 that prescribe the basic requirements for preparing sustainability-related financial disclosures have been included in the Application Standard. The SSBJ thinks that dividing the standard corresponding to IFRS S1 into two standards would not affect the resulting disclosures by entities applying SSBJ Standards, because all three standards need to be applied together.

SSBJ Standards were developed under the assumption that SSBJ Standards would eventually be required, under the Japanese securities laws and regulations, to be applied by entities listed on the Prime Market of the Tokyo Stock Exchange.

SSBJ Standards are available in the Japanese language only. Nevertheless, for the convenience of English speakers, the overview of SSBJ Standards is available in the English language. In addition, the schedule of differences and the table of concordance between ISSB Standards and SSBJ Standards prepared in the English language will be published shortly.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.