SMFG's Q3/FY2025 Earnings

Sumitomo Mitsui Financial Group (SMFG) is demonstrating strong financial performance in the first three quarters of FY3/2025, with consolidated net business profit reaching 90% of its target and bottom-line profit at 98%, significantly driven by domestic business growth and gains on stock holdings. The Medium-Term Management Plan initiatives are progressing well in a favorable business environment. The company is proactively considering measures, including forward-looking provisions, for potential future risks, along with losses from low-profit asset sales in 4Q. The recent policy rate hike is expected to contribute significantly to increased net interest income. SMFG is on track to surpass an 8% ROE for the fiscal year.

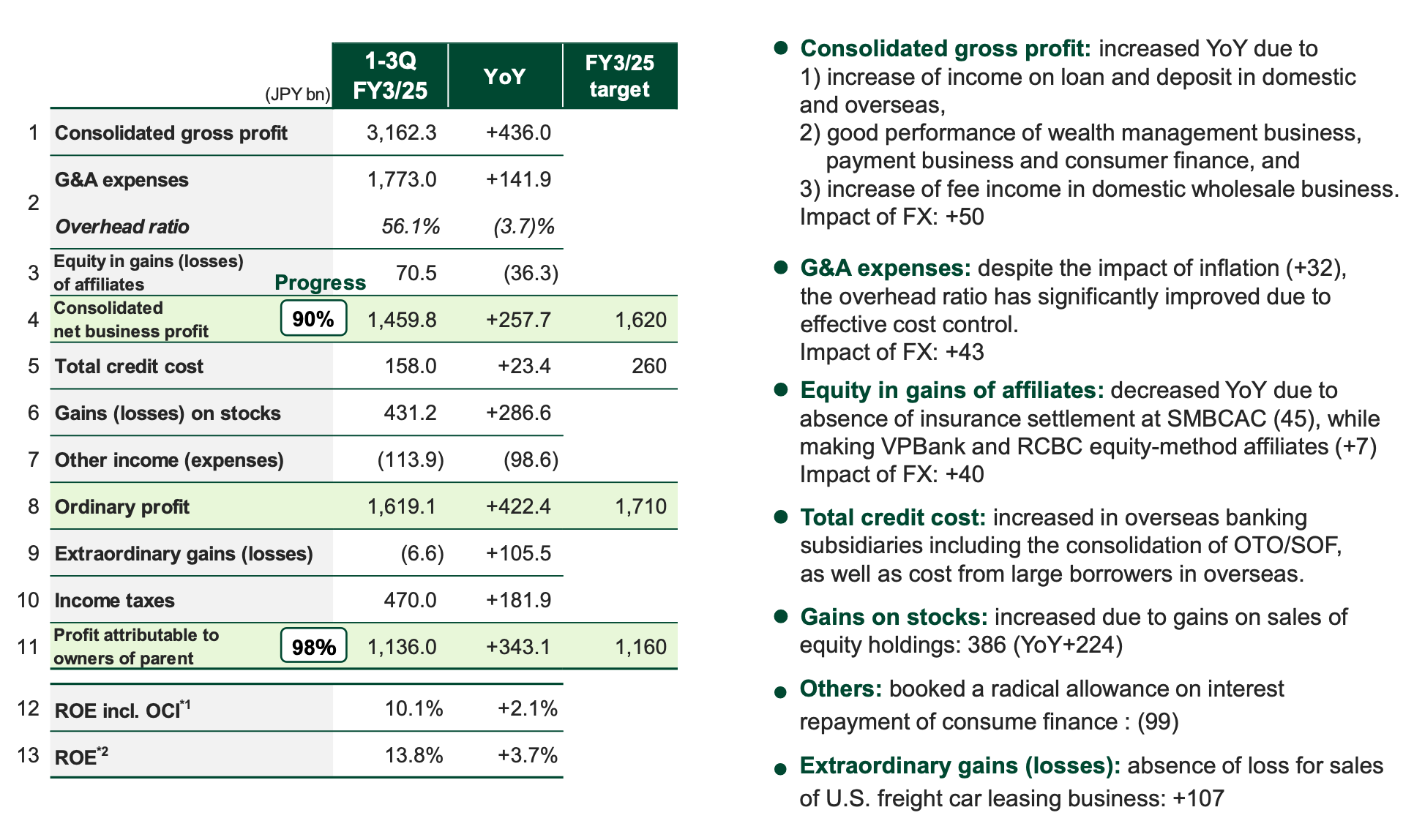

1. Strong Financial Performance

- Profitability: Consolidated net business profit reached 90% of the full-year target, at JPY 1,459.8 billion, a significant increase of JPY 257.7 billion year-over-year. Bottom-line profit has reached 98% of its target, reaching JPY 1,136 billion, an increase of JPY 343.1 billion year-over-year, driven by strong domestic business and gains on stocks.

- Revenue Growth: Consolidated gross profit was JPY 3,162.3 billion, a robust year-over-year increase of JPY 436 billion. This growth was fueled by several factors:

- Increased income from loans and deposits both domestically and overseas.

- Strong performance in wealth management, payment services, and consumer finance.

- Increase in fee income in the domestic wholesale business.

- Expense Management: G&A expenses increased to JPY 1,773.0 billion, mainly driven by the impact of inflation (+32 billion JPY), however, the overhead ratio improved due to "effective cost control."

- Gains on Stocks: Significant gains on sales of equity holdings, totaling JPY 431.2 billion (YoY +286.6bn), contributed significantly to overall profitability.

- Of this, gains on sales of equity holdings was 386 JPY billion (YoY +224bn)

- ROE: The company is on pace to surpass 8% ROE for the full year, with current ROE at 13.8% (+3.7%)

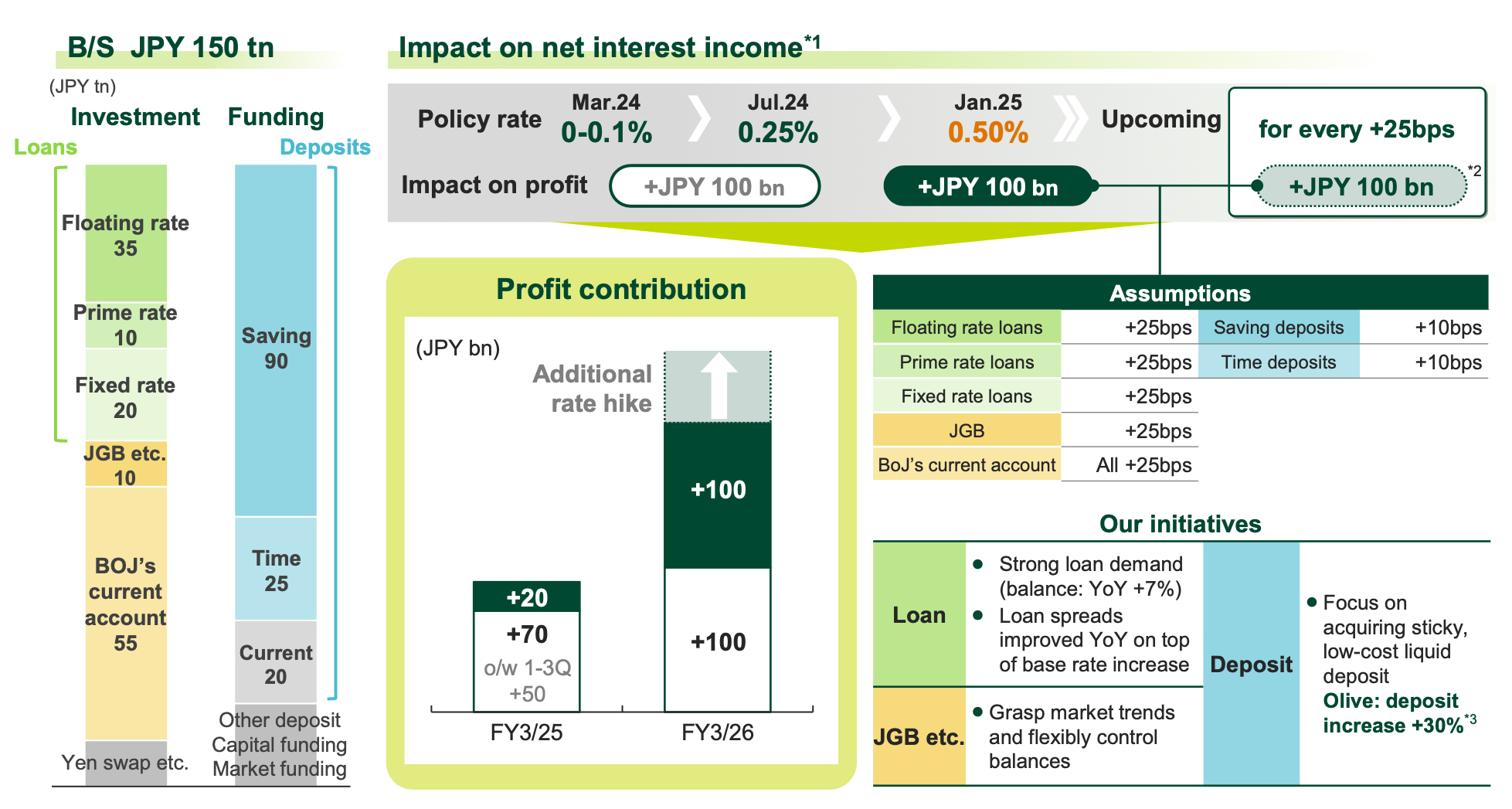

2. Impact of Interest Rate Hikes

- Policy Rate Benefit: The policy rate hike in January 2025 is projected to result in a JPY 20 billion increase in net interest income in FY3/25. Previous rate hikes are expected to generate another 200bn JPY, 90bn of which will be realised in FY3/25. Every 0.25% rate increase will generate an additional JPY 100 bn annually.

- Net Interest Income: The document highlights how changes in floating rates, saving deposits, time deposits, and government bonds will affect net interest income.

- Assumptions: The earnings report outlines specific assumptions on how loan and deposit rates will respond to policy rate hikes, as well as on the BOJ’s current account.

3. Business Unit Performance Highlights

- Retail Business (RT): Strong performance due to increased income on deposits from rising interest rates, alongside strong performance in asset management and payment business. This led to increases in both gross profit and net business profit.

- Wholesale Business (WS): Significant increase in income on loans and deposits driven by increased volume and improved spreads. Fee income related to finance also performed strongly.

- Global Business (GB): Banking profit increased steadily due to “nimble portfolio management”. However, net business profit decreased due to the absence of an insurance settlement from SMBCAC in 3Q FY3/24 (JPY 40 bn) and an increase in credit costs.

- Global Markets Business (GM): Sales and trading operations showed good performance, capturing client flows, resulting in increases in both gross profit and net business profit.

- SMBC Nikko: Sales division operating revenue has decreased. However the GIB division has increased. This is mainly driven by sales on credit, receipt agency, and loan guarantee revenue. However, SMBC Nikko’s overall net income decreased YoY.

- SMCC (including SMBCCF): Overall, there was a growth in operating revenue, although not in net income. Significant increases in loan loss provisions and for interest repayment impact the bottom line.

4. Strategic Initiatives & Risk Management

- Forward-Looking Provisions: The company is proactively considering "forward-looking provisions" to prepare for future risks in 4Q FY3/25. This indicates a commitment to maintaining a strong balance sheet and managing future uncertainties.

- Asset Sales: Losses from the sale of "low-profit assets" (announced in Nov. 2024) are expected in the 4th quarter, which is part of a strategy to optimize the portfolio.

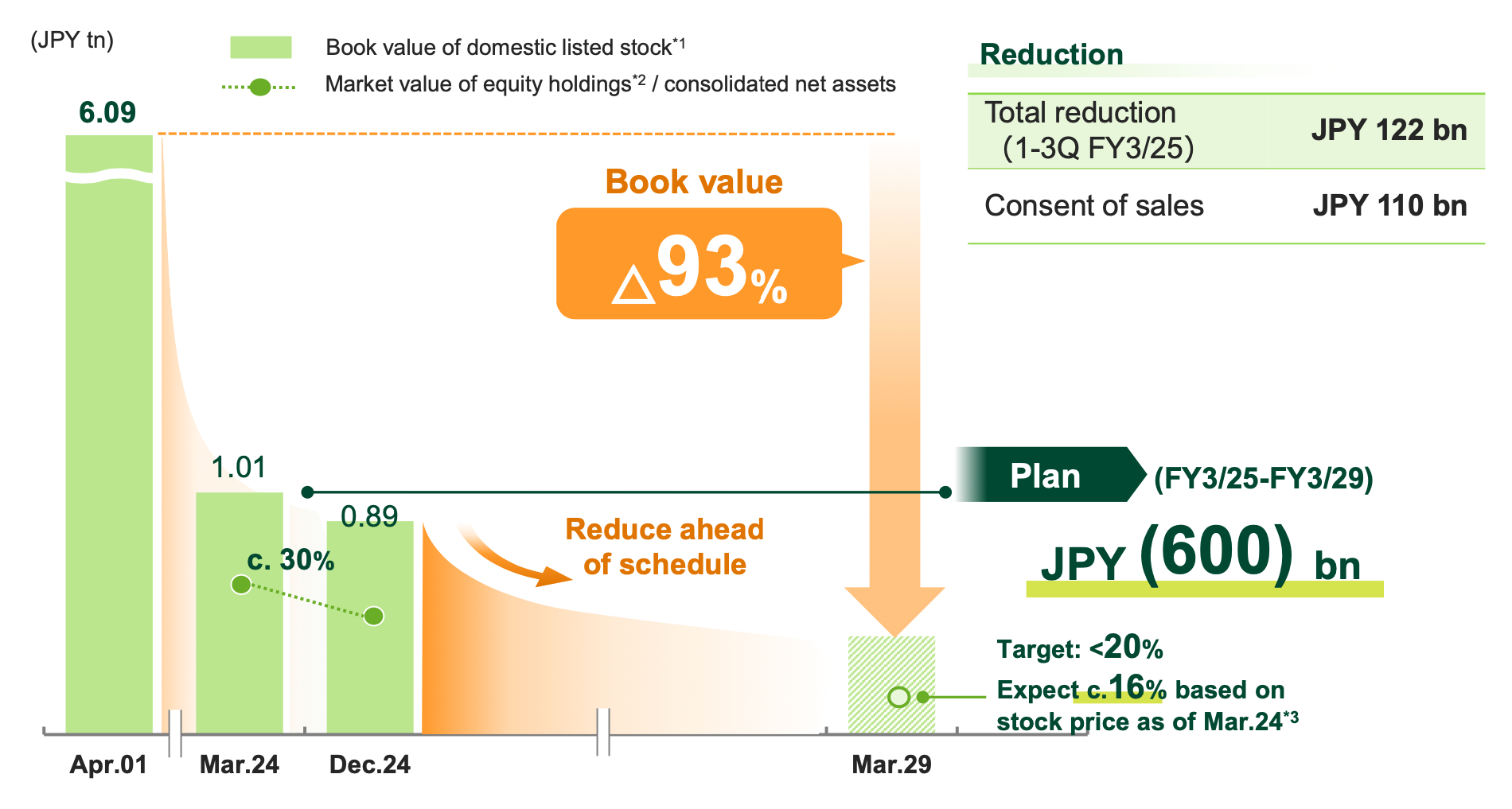

- Reduction of Equity Holdings: The company is progressing rapidly on reducing equity holdings, reducing JPY 122bn in 1-3Q FY3/25 which is ahead of the targeted reduction of JPY 600bn over five years.

- Loan Growth: Strong loan demand resulted in a loan balance increase of 7% YoY, with improved loan spreads. The loan balance increased in both domestic and overseas markets.

- Deposit Strategy: The company focuses on acquiring "sticky, low-cost liquid deposits." There has been a strong growth in Olive deposits, with an increase of 30%.

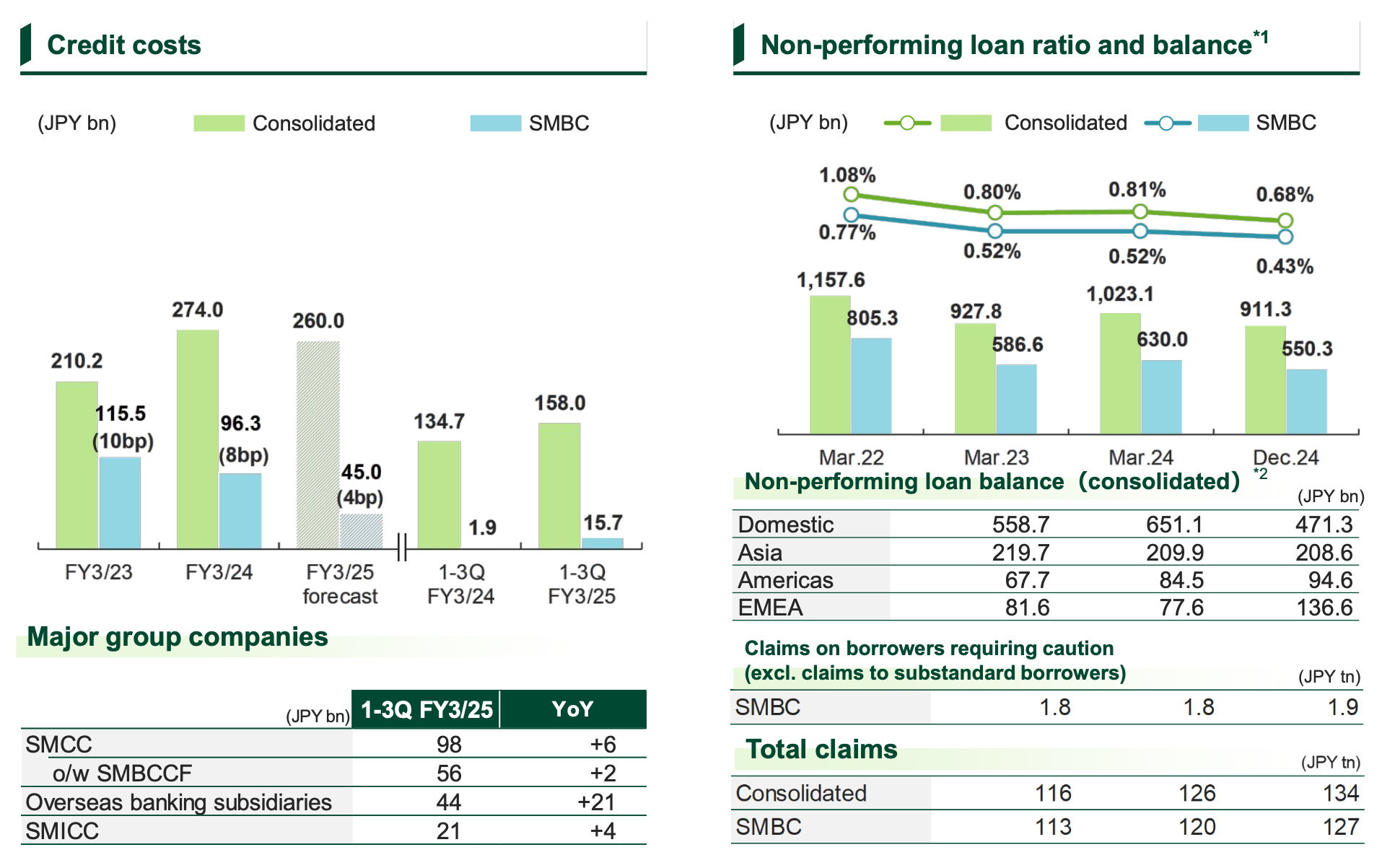

- Asset Quality: Increased credit costs in overseas banking subsidiaries, including the consolidation of OTO/SOF, and costs from large overseas borrowers.

- Securities Portfolio Management: Risk volume is actively controlled through hedging. The document outlines unrealized gains (losses) for various security types.

5. Balance Sheet Highlights

- Total Assets: Total assets were JPY 310.9 trillion as of December 2024.

- Loans: Domestic loans totalled JPY 67.0 tn and deposits totaled 130.9 tn, while overseas loans totaled JPY 64.9 tn.

- Securities: The portfolio contains 9.1tn JPY in JGB’s and 19.1tn in foreign bonds.

- Foreign Currency: The non-JPY balance sheet totals USD 587 bn.

Conclusion

SMFG's 3Q FY3/2025 results demonstrate strong performance driven by domestic growth, efficient cost control, and strategic portfolio management. The company is well-positioned to exceed its full-year ROE target. While proactively addressing potential risks through forward-looking provisions, the company is clearly benefiting from a favorable economic environment and is executing its Medium-Term Management Plan effectively. The impact of rising interest rates is expected to further contribute to profits.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.