SMFG reports H1/FY2025 earnings, raises forecast & announces share repurchase

Sumitomo Mitsui Financial Group (SMFG) announced its financial results for the first half of the fiscal year 2025 (H1 FY3/25), ending…

Sumitomo Mitsui Financial Group (SMFG) announced its financial results for the first half of the fiscal year 2025 (H1 FY3/25), ending September 30, 2024. The group reported strong performance across the board, driven by solid business performance and larger-than-anticipated gains on stock sales. Key highlights include:

- Record high H1 results for consolidated gross profit, net business profit, and bottom-line profit.

- Upwardly revised full-year net profit guidance to ¥1.16 trillion, a 9.4% increase from the previous forecast of ¥1.06 trillion.

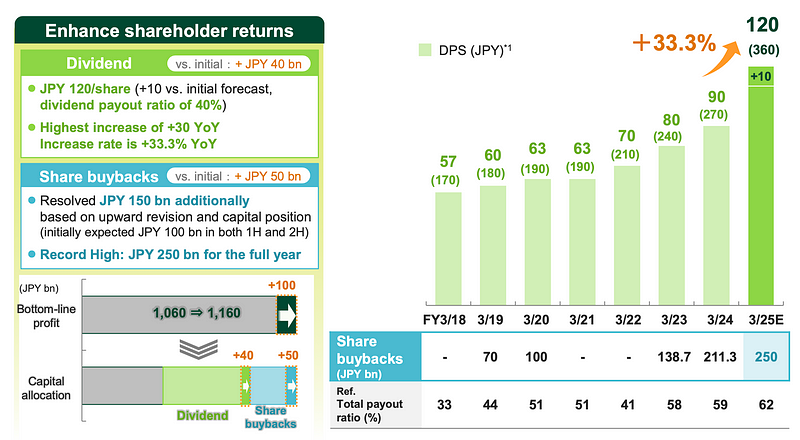

- Increased dividend per share (DPS) to ¥120, reflecting a payout ratio of 40%.

- Announced additional share buybacks of up to ¥150 billion, bringing the total for the full year to ¥250 billion.

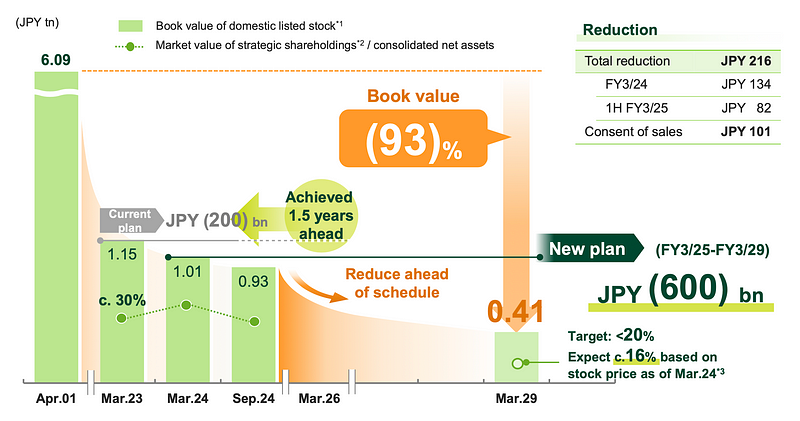

- Achieved initial equity holdings reduction plan 1.5 years ahead of schedule and set a new five-year reduction plan.

Financial Performance

- Consolidated Gross Profit: ¥2,045.3 billion, up 227.9 billion year-over-year (YoY). This increase was primarily due to higher income on loans and deposits (both domestic and international), strong performance in wealth management, payment services, and consumer finance, as well as higher fee income from domestic wholesale banking. Foreign exchange movements also contributed positively.

- Consolidated Net Business Profit: ¥918.2 billion, exceeding expectations and representing 57% progress towards the full-year target. This result was supported by a significant increase in sales of cross-shareholdings, as well as gains in domestic and overseas fund income (including investment trust redemption gains).

- Net Profit: ¥725.2 billion, a 38% YoY increase, driven by the factors mentioned above.

- Total Credit Cost: Decreased to ¥83.9 billion, primarily due to lower costs at SMBC, partially offset by the consolidation of OTO/SOF and expansion of overseas banking subsidiaries.

- Gains on Stocks: Surged by ¥247.4 billion YoY, largely due to gains from equity sales. This significant contributor helped offset the impact of a one-time ¥99 billion (pretax) charge related to SMBC Consumer Finance’s interest refund reserve.

- DPS Hike and Share Buybacks: The company increased its DPS target to ¥120 and announced additional share buybacks of up to ¥150 billion, underscoring management’s confidence in the business and commitment to shareholder returns.

Business Unit Performance

- Retail Banking: Strong performance across all business lines, with notable growth in income on deposits driven by rising interest rates. Overhead ratio improved. Net income and ROCET1 showed improvement when excluding the allowance related to interest repayment.

- Wholesale Banking: Loan volume and margin expansion, combined with robust performance in securities-related businesses, drove an increase in both gross profit and net business profit. Gains on equity holdings sales also contributed significantly.

- Global Banking: Gross profit and net business profit grew due to higher loan margins, increased loan volumes, and growth in loan-related fees. However, net income declined due to increased expenses, including higher credit costs resulting from the OTO/SOF consolidation.

- Global Markets: Stable banking profit growth despite volatile market conditions, fueled by effective operations. Sales and trading performed well, capitalizing on client flows.

- SMBC Nikko Securities: Net operating revenue increased by ¥53.6 billion YoY in H1 FY3/25, driven by asset-based and flow revenues. Operating profits also grew substantially, reflecting the positive impact of business growth.

Key Initiatives and Future Outlook

SMFG raised its FY3/25 guidance to reflect the strong H1 performance and acceleration of cross-shareholding sales. While acknowledging measures taken to enhance future profitability, including a one-time charge for interest repayment allowances and provisions for low-profit asset sales, the revised outlook emphasizes a net positive impact from several key factors. These factors include:

- Strong core business growth: Projected to contribute ¥100 billion.

- Gains from equity sales: Projected to contribute ¥170 billion.

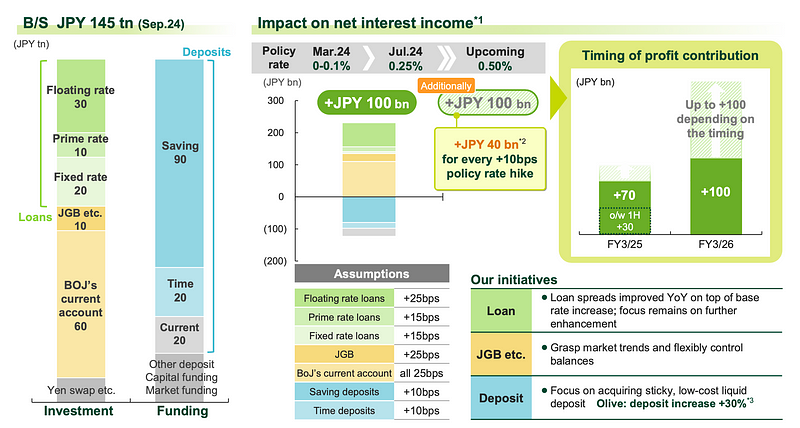

- Rises in interest rates: Anticipated impact of ¥20 billion.

The group anticipates further benefits from the rising interest rate environment. Simulations suggest that a rise in the policy rate to 0.50% could add another ¥100 billion annually to net interest income.

SMFG’s proactive equity holdings reduction initiative, exceeding initial targets, aims to further optimize capital allocation and reduce volatility. The new five-year plan targets a significant reduction in book value and aims to bring the market value of strategic shareholdings to less than 20% of net assets.

Conclusion

SMFG’s H1 FY3/25 results demonstrate the group’s resilience and ability to navigate a dynamic market environment. Strong business momentum, successful initiatives, and a focus on shareholder returns position the company for continued growth in the second half of the fiscal year. The increased profit guidance and shareholder-friendly actions signal management’s confidence in achieving its long-term objectives. While challenges such as global economic slowdown and inflationary pressures remain, SMFG’s diversified business model and strategic initiatives should help mitigate these risks.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.