SMBC & SMFL introduce financing for semiconductor manufacturing equipment

Sumitomo Mitsui Banking Corporation (SMBC), in collaboration with SMFL MIRAI Partners (SMFL MP), a subsidiary of Sumitomo Mitsui Finance and Leasing, has released a new finance scheme for supporting capital investment in semiconductor manufacturing equipment.

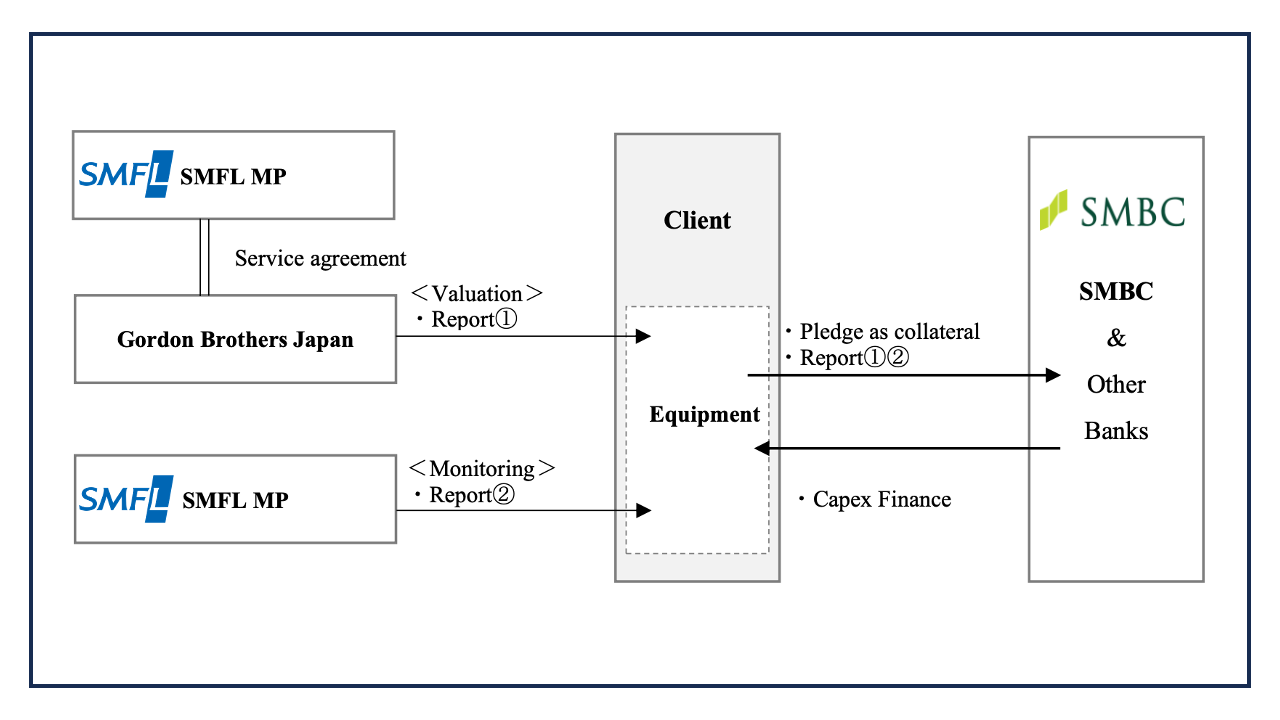

In this new scheme, SMFL MP will leverage its expertise in the valuation of semiconductor manufacturing equipment through its business in the secondary equipment market, collaborating with Gordon Brothers Japan, a leading company in the movable property business, to conduct valuations of semiconductor manufacturing equipment.

SMBC will structure the financing based on the valuations, while SMFL MP will be responsible for monitoring the equipment throughout the financing period, ensuring its operational status.

This scheme is expected to enable customers utilizing it to expand their financing capacity by leveraging the value of the equipment.

Notably, this scheme was first applied in a loan agreement concluded in September 2024 between Kioxia Holdings and Kioxia, and a syndicate of banks including SMBC.

SMFG remains committed to contributing to the resolution of customer challenges by providing innovative solutions that harness the full strength of the Group in the semiconductor industry, which is anticipated to experience further growth.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.