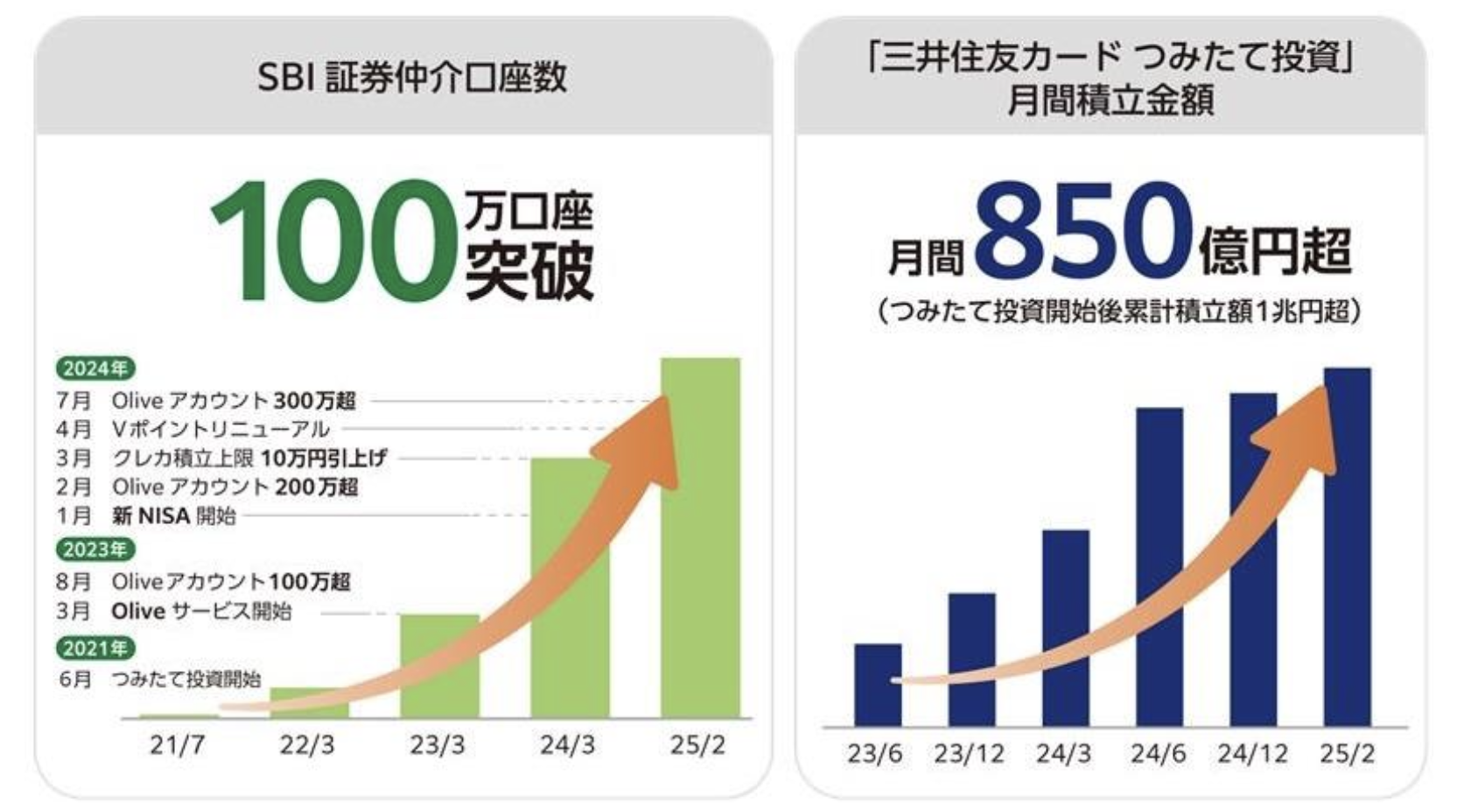

SMBC has intermediated 1m brokerage accounts to SBI Securities

The total number of SBI Securities financial product accounts intermediated through Sumitomo Mitsui Card and Sumitomo Mitsui Banking Corporation has exceeded 1 million, and the monthly investment amount for "Sumitomo Mitsui Card Regular Investment" has exceeded 85 billion yen.

Since June 2021, Sumitomo Mitsui Card has partnered with SBI Securities to offer "Sumitomo Mitsui Card Regular Investment," which allows customers to invest in mutual funds regularly while earning V Points through credit card payments. Since May 2022, Sumitomo Mitsui Card also launched "V Point Investment," enabling customers to purchase mutual funds using accumulated V Points.

Additionally, since March 2023, SBI Securities has been providing securities functions for "Olive," a comprehensive financial service for individual customers, working to deliver highly convenient securities-related services.

Currently, customers under 30 years of age account for 53.8% of SBI Securities intermediary accounts, indicating that many young people are actively engaged in asset building. For "Sumitomo Mitsui Card Regular Investment," the largest number of customers are investing the maximum monthly amount of 100,000 yen. The service has gained popularity due to its compatibility with NISA accounts, the convenience of continuous investment without the need for additional deposit procedures to securities accounts, and the benefit of earning V Points based on investment amounts.

Sumitomo Mitsui Card will continue to enhance service functions and strengthen partnerships with financial services to provide greater convenience, helping customers of all generations enrich their lives through asset formation.

Securities-Related Services Available through Olive and Sumitomo Mitsui Card

- Open an SBI Securities intermediary account simultaneously with Olive or credit card application

When opening an Olive account or applying for a Sumitomo Mitsui Card credit card, you can easily open an SBI Securities intermediary account at the same time. The information entered during the initial application is carried over, eliminating the need to re-enter your name, address, and other details, making the process simple. - Securities service integration with Sumitomo Mitsui Banking App and Vpass App

You can check your SBI Securities account balance and profit/loss status on the Sumitomo Mitsui Banking App and Vpass App. You can also smoothly transition to the SBI Securities website for transactions such as mutual fund investments. - Earn V Points with "Sumitomo Mitsui Card Regular Investment" and other services

You can earn V Points through "Sumitomo Mitsui Card Regular Investment" which allows mutual fund investments via credit card, "SBI Securities V Point Service" which awards points based on your trading activities with SBI Securities, and "V Point Up Program" which increases your V Point reward rate at designated convenience stores and restaurants when you achieve specific securities transactions.

Notes on Financial Product Intermediary Services

Sumitomo Mitsui Card is a financial product intermediary with SBI Securities as its affiliated financial instruments business operator. Unlike financial instruments business operators, Sumitomo Mitsui Card does not directly accept customers' money or securities, and all customer account holding and management is performed by the financial instruments business operator. Additionally, financial product intermediaries do not have proxy rights for financial instruments business operators. This does not apply to customers who opened SBI Securities accounts through intermediaries other than Sumitomo Mitsui Card.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.