Seven Bank's third quarter results

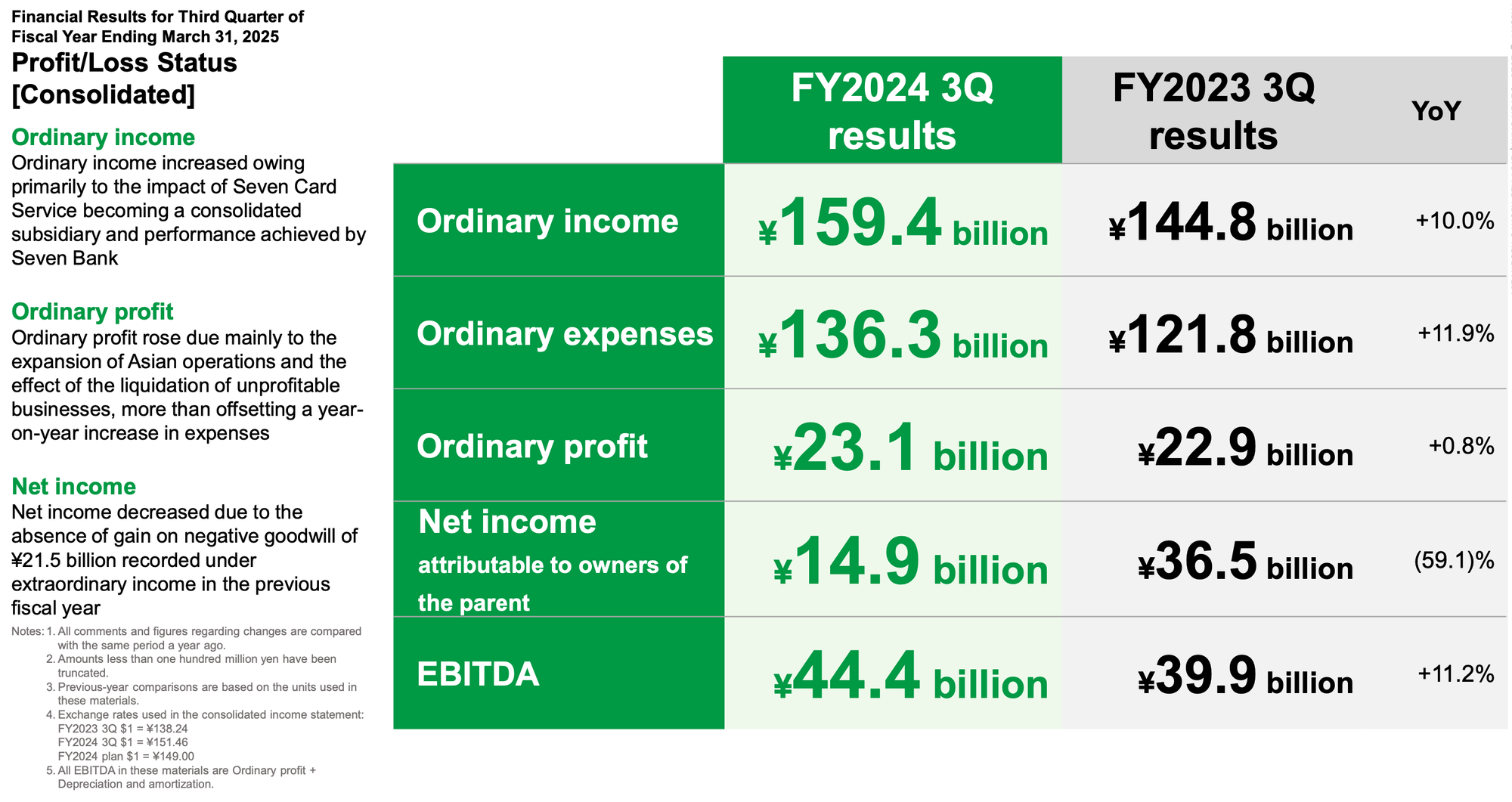

Seven Bank reported a mixed bag of results on a consolidated basis, exhibiting growth in overall income but a significant decrease in net income compared to the same period in the previous fiscal year. The consolidated ordinary income reached ¥159.4 billion, a notable 10.0% increase from the ¥144.8 billion reported in the third quarter of fiscal year 2023. This growth was primarily attributed to two major factors: the consolidation of Seven Card Service as a subsidiary and the overall strong performance of Seven Bank's core operations. The inclusion of Seven Card Service's financials significantly boosted the top line.

However, this increase in ordinary income did not translate directly to the bottom line. While ordinary profit saw a slight increase of 0.8%, reaching ¥23.1 billion (up from ¥22.9 billion), net income attributable to owners of the parent experienced a substantial decline of 59.1%, falling to ¥14.9 billion from ¥36.5 billion in the prior year's corresponding quarter. This dramatic drop is explained by a one-time event in the previous fiscal year: a significant gain on negative goodwill of ¥21.5 billion was recorded under extraordinary income when Seven Card Service was initially consolidated. The absence of such a large, non-recurring gain in the current period makes the year-over-year comparison appear unfavorable, even though the underlying business operations showed improvement.

Ordinary expenses also increased by 11.9%, reaching ¥136.3 billion. This rise in expenses is a critical aspect to consider, as it partially offset the gains in ordinary income. The expansion of Asian operations and the liquidation of unprofitable businesses contributed to the increase in ordinary profit. The fact that ordinary profit increased despite these factors highlights strong efficiency improvements that outweighed the increase in expenses.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a key indicator of operational profitability, showed a healthy increase of 11.2%, reaching ¥44.4 billion, up from ¥39.9 billion. This demonstrates that Seven Bank's core operations are generating increased cash flow, even if the net income figure paints a different picture due to the aforementioned accounting event. The trend in third-quarter performance shows consistent growth in ordinary income and profit over the past three years (FY22, FY23, and FY24), further solidifying the positive trend in the underlying business. The net income trend, however, is skewed by the negative goodwill gain in FY23, making it appear as though there was a decline in FY24 when the core operational performance improved.

Seven Bank's Standalone Performance

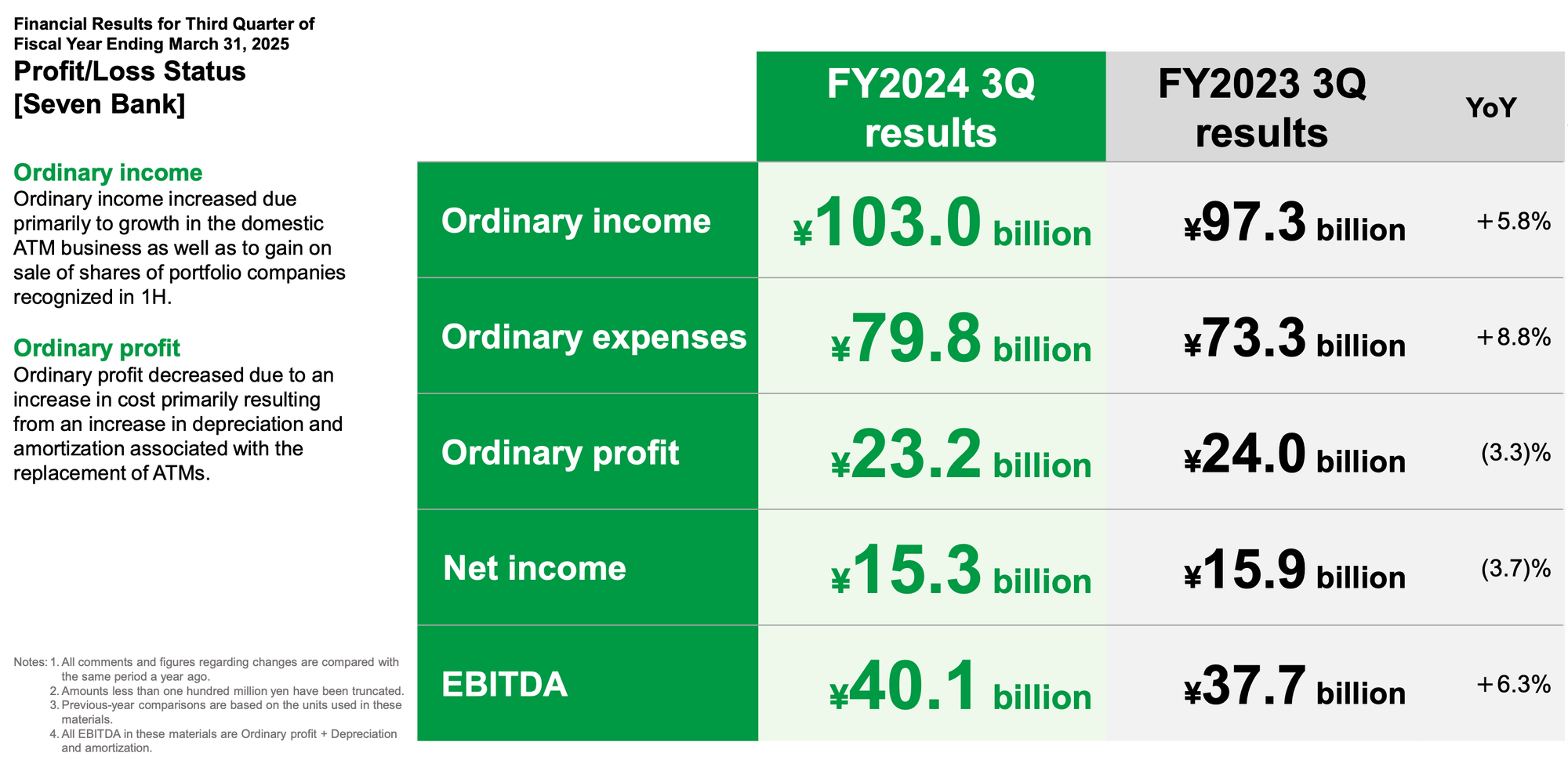

When examining Seven Bank's performance on a non-consolidated basis (excluding subsidiaries like Seven Card Service), a slightly different perspective emerges. Ordinary income for Seven Bank itself reached ¥103.0 billion, representing a 5.8% increase from ¥97.3 billion in the previous year. This growth was primarily driven by the robust performance of the domestic ATM business and, notably, a gain on the sale of shares of portfolio companies recognized in the first half of the fiscal year. This indicates that Seven Bank is not only growing its core ATM business but is also actively managing its investments to generate additional income.

However, unlike the consolidated results, ordinary profit on a non-consolidated basis decreased by 3.3%, falling to ¥23.2 billion from ¥24.0 billion. This decline is directly attributed to increased costs, specifically a significant rise in depreciation and amortization expenses related to the ongoing replacement of ATMs with newer, fourth-generation models. This is a crucial point: Seven Bank is making a substantial investment in upgrading its ATM infrastructure, which is temporarily impacting profitability but is expected to yield long-term benefits in terms of efficiency, security, and enhanced customer experience.

Net income on a non-consolidated basis also saw a decrease of 3.7%, falling to ¥15.3 billion from ¥15.9 billion, mirroring the trend in ordinary profit. The increased depreciation costs associated with the ATM upgrades are the primary driver of this decline. Despite these decreases, EBITDA for Seven Bank alone increased by 6.3%, reaching ¥40.1 billion. This underscores the point that the underlying cash-generating ability of the core business remains strong, even with the significant investment in ATM upgrades.

Key Business Segments: A Detailed Breakdown

To gain a deeper understanding of Seven Bank's performance, it's essential to analyze the individual business segments: Domestic ATM Business, Domestic Retail Business, and Overseas Business.

Domestic ATM Business

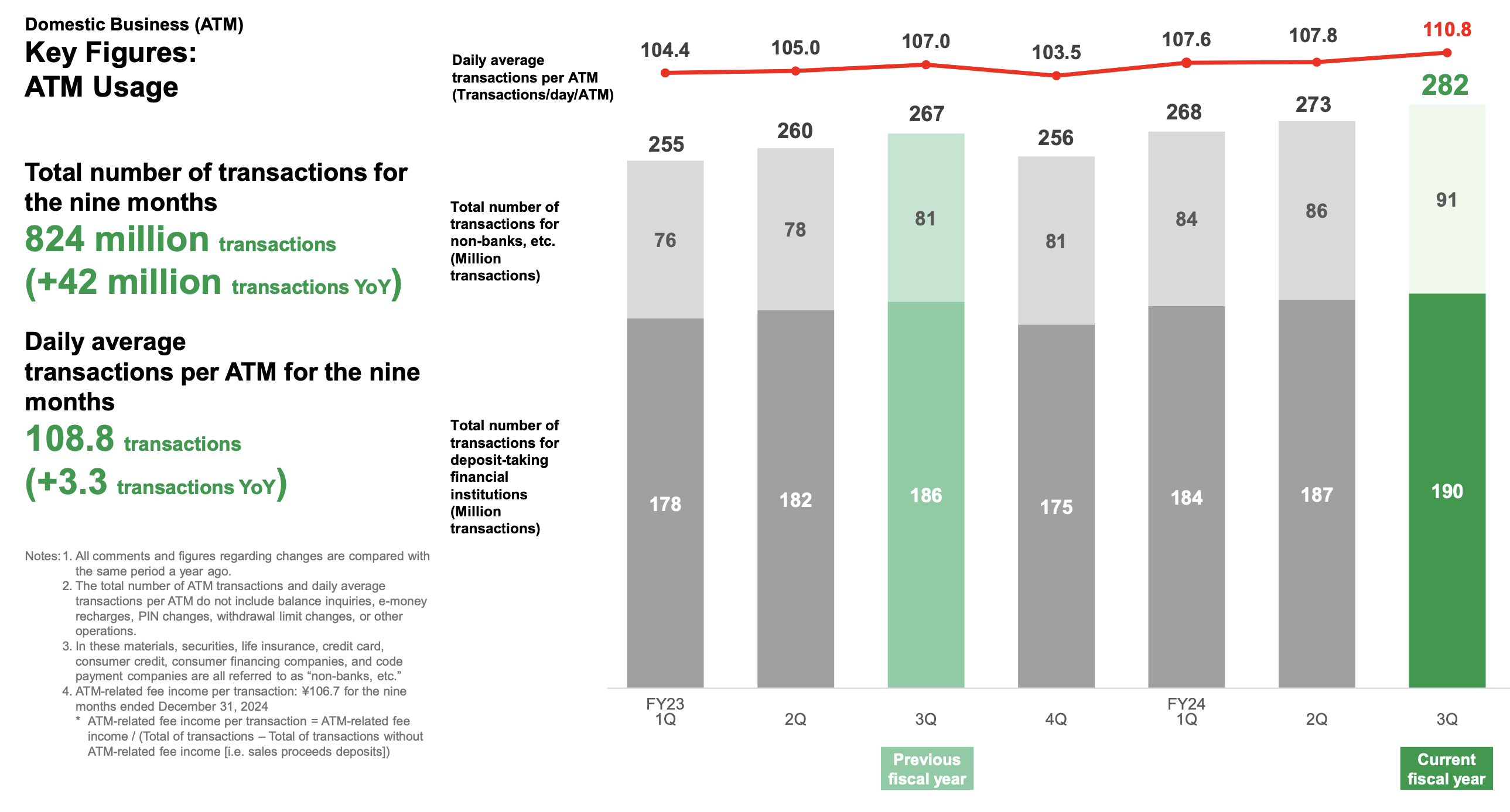

This segment remains the cornerstone of Seven Bank's operations. The number of transactions continued to grow, particularly from code payment companies. This indicates increasing adoption of digital payment methods, and Seven Bank's ATMs are serving as a crucial bridge between the digital and physical worlds of finance.

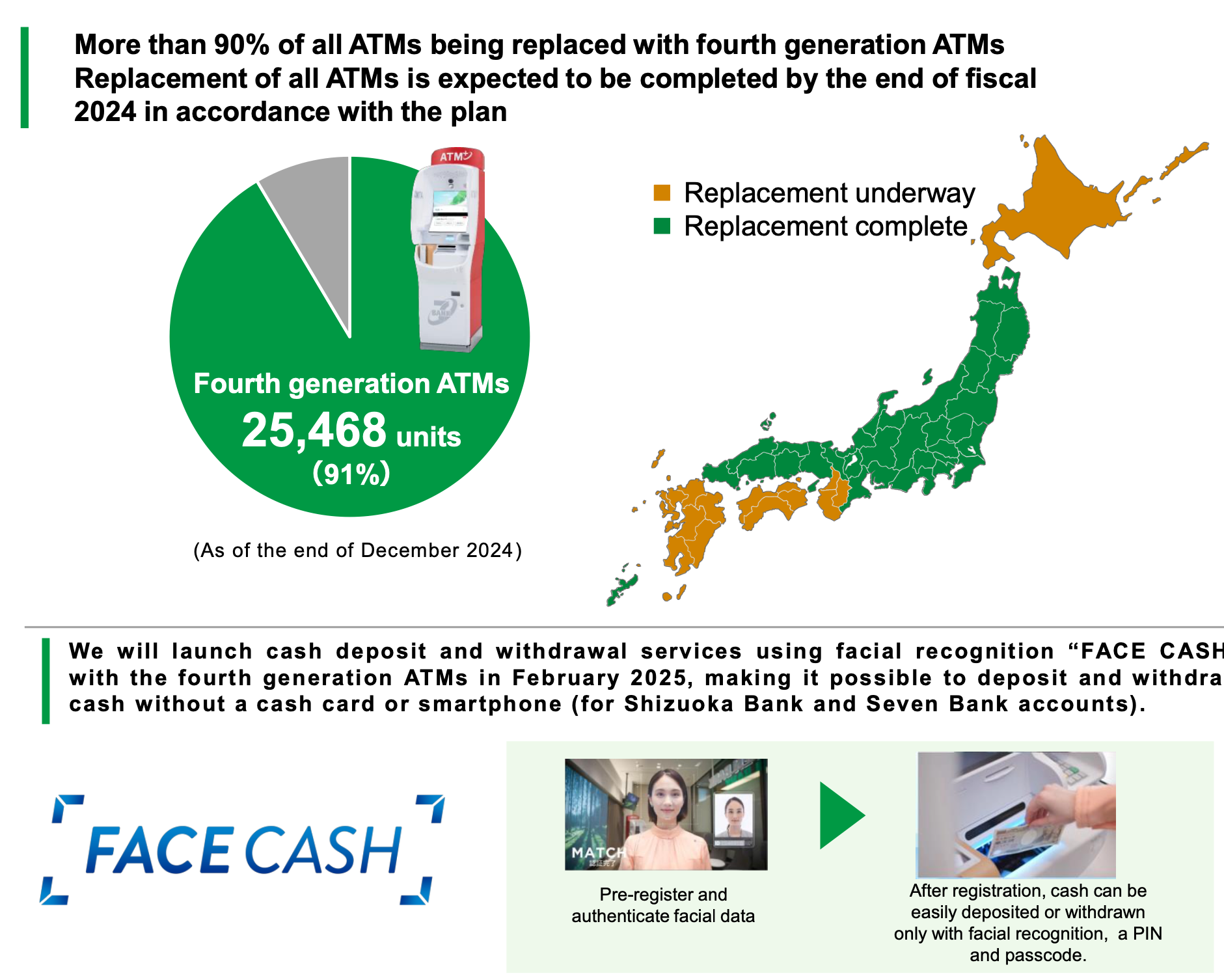

Seven Bank is nearing the completion of a major initiative to replace its entire ATM fleet with fourth-generation machines. This project is on track to be completed by the end of fiscal year 2024. The new ATMs offer enhanced functionality, including facial recognition for cash deposits and withdrawals (branded as "FACE CASH"), initially available for Shizuoka Bank and Seven Bank accounts. This represents a significant technological advancement and a move towards enhanced security and convenience for customers. The ATM replacement program, while impacting short-term profitability due to depreciation, is a strategic investment in the future.

The key figures for the Domestic ATM business highlight its growth. The total number of transactions for the nine months reached 824 million, a substantial increase of 42 million transactions year-over-year. The daily average transactions per ATM also rose to 108.8 transactions, up 3.3 transactions from the previous year. This indicates increased utilization of Seven Bank's extensive ATM network. The breakdown of transactions shows a healthy mix between deposit-taking financial institutions and non-banks (including securities, insurance, and code payment companies).

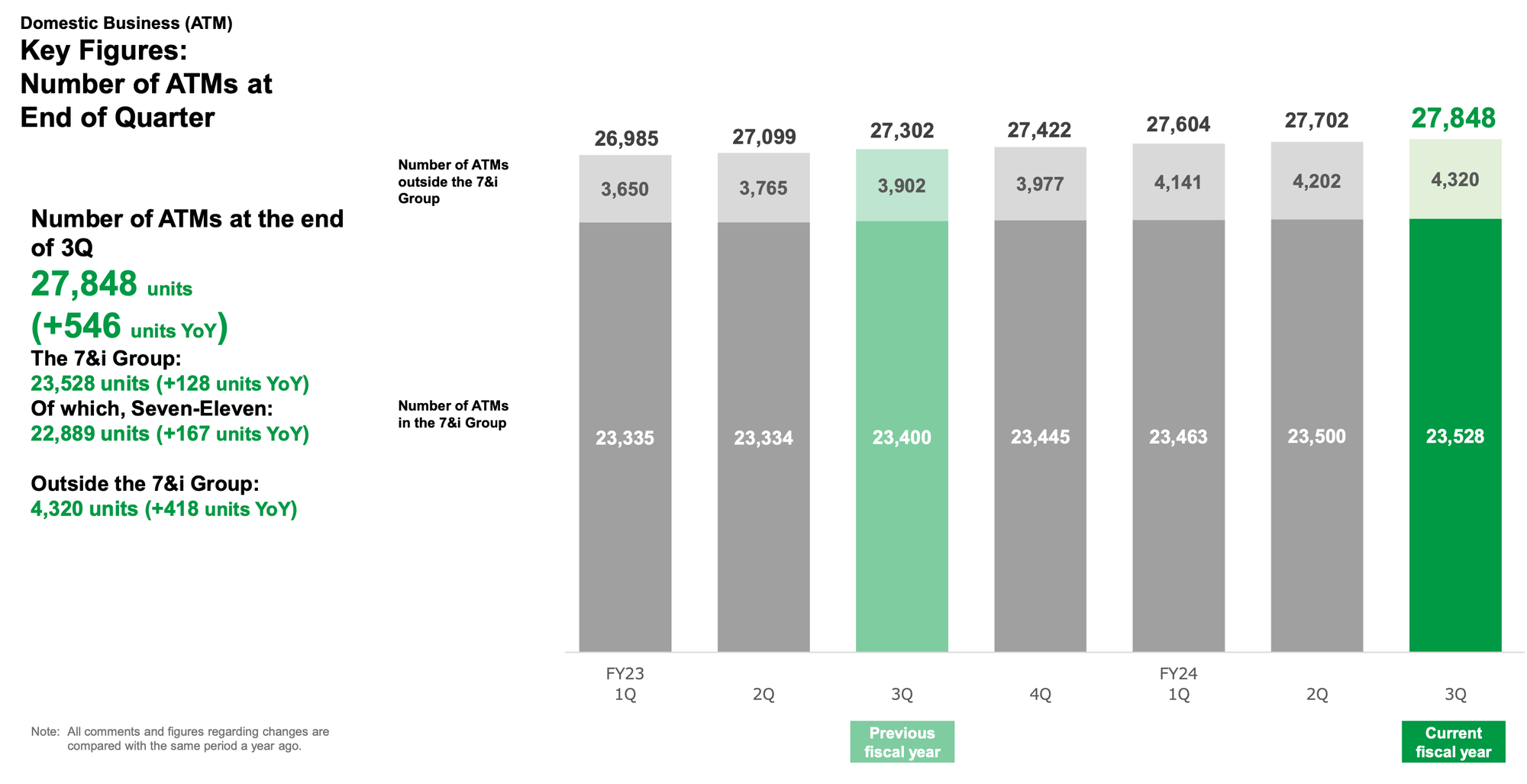

The number of ATMs at the end of the third quarter stood at 27,848 units, an increase of 546 units year-over-year. The majority of these ATMs are located within the 7 & i Group stores (23,528 units), primarily in Seven-Eleven locations, but a growing number (4,320 units) are located outside the 7 & i Group, demonstrating Seven Bank's expanding reach.

Domestic Retail Business

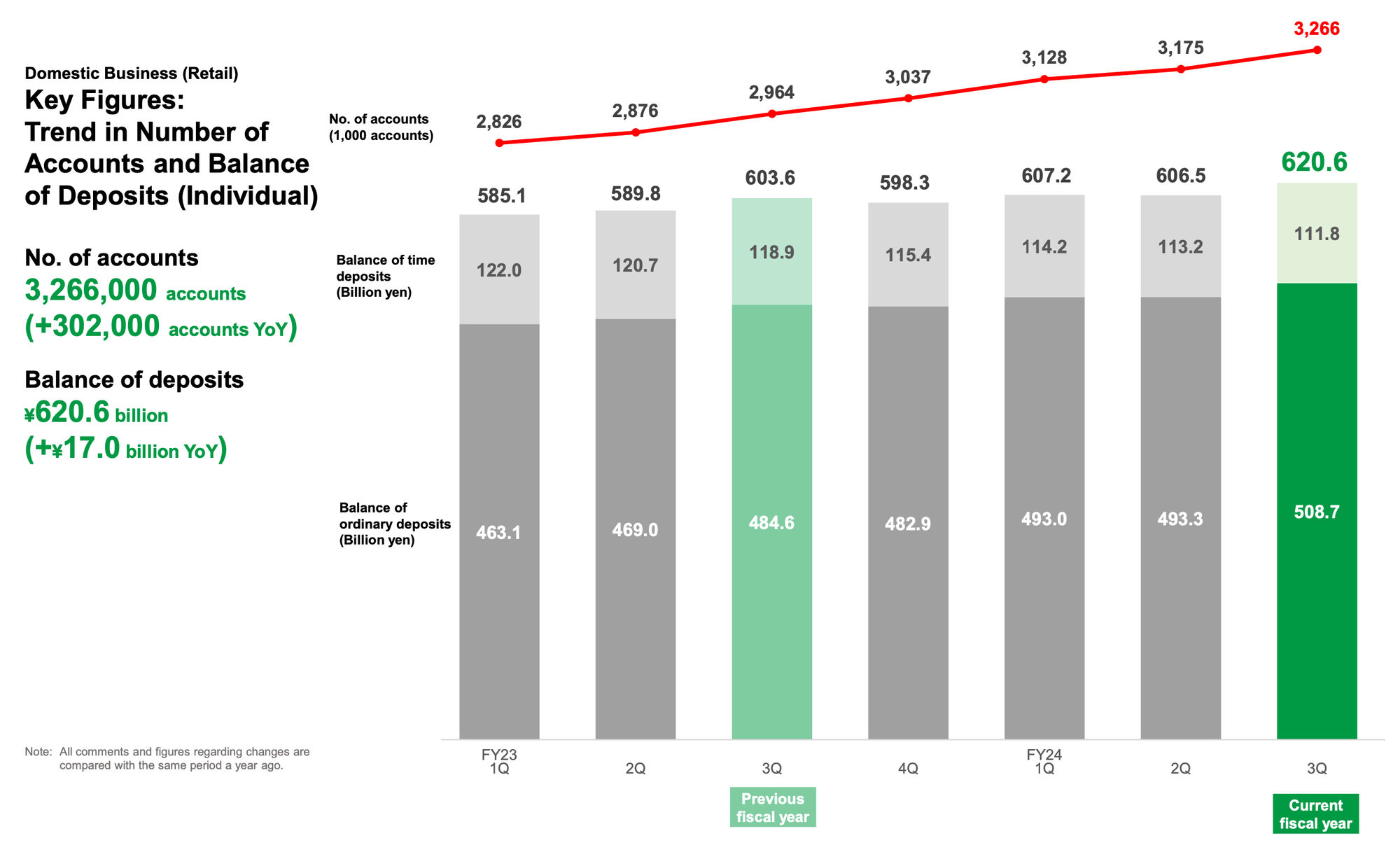

This segment focuses on providing banking services directly to individual customers. Seven Bank reported steady growth in account services and continued efforts to promote its credit card offerings. The number of accounts reached 3,266,000, a significant increase of 302,000 accounts year-over-year. The balance of deposits also grew to ¥620.6 billion, up ¥17.0 billion. This growth indicates increasing customer trust and adoption of Seven Bank's retail banking services. A breakdown of deposits shows that ordinary deposits make up the majority (¥508.7 billion), with time deposits accounting for the remainder (¥111.8 billion).

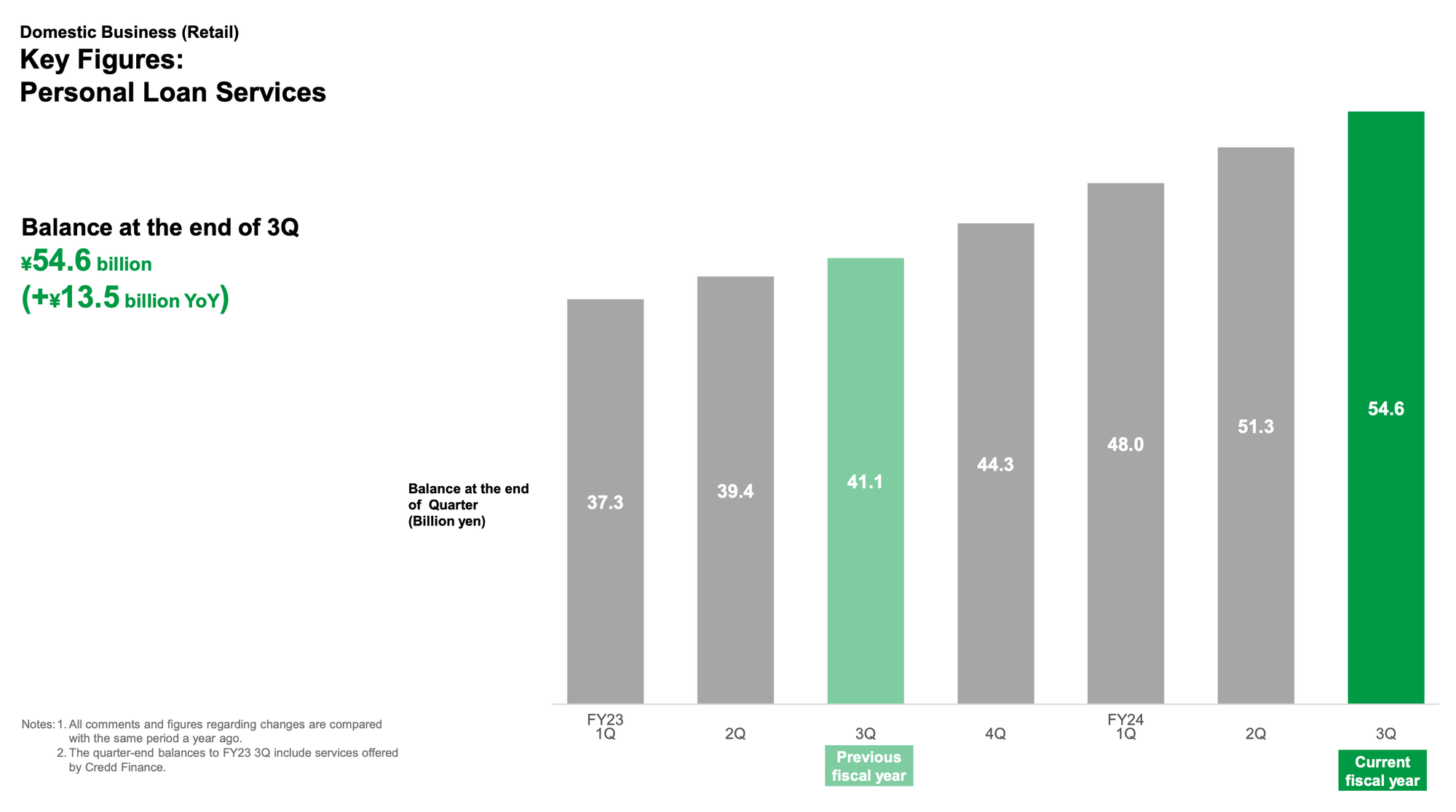

The personal loan services segment also showed strong growth. The balance at the end of the third quarter reached ¥54.6 billion, a substantial increase of ¥13.5 billion year-over-year. This suggests increasing demand for Seven Bank's loan products.

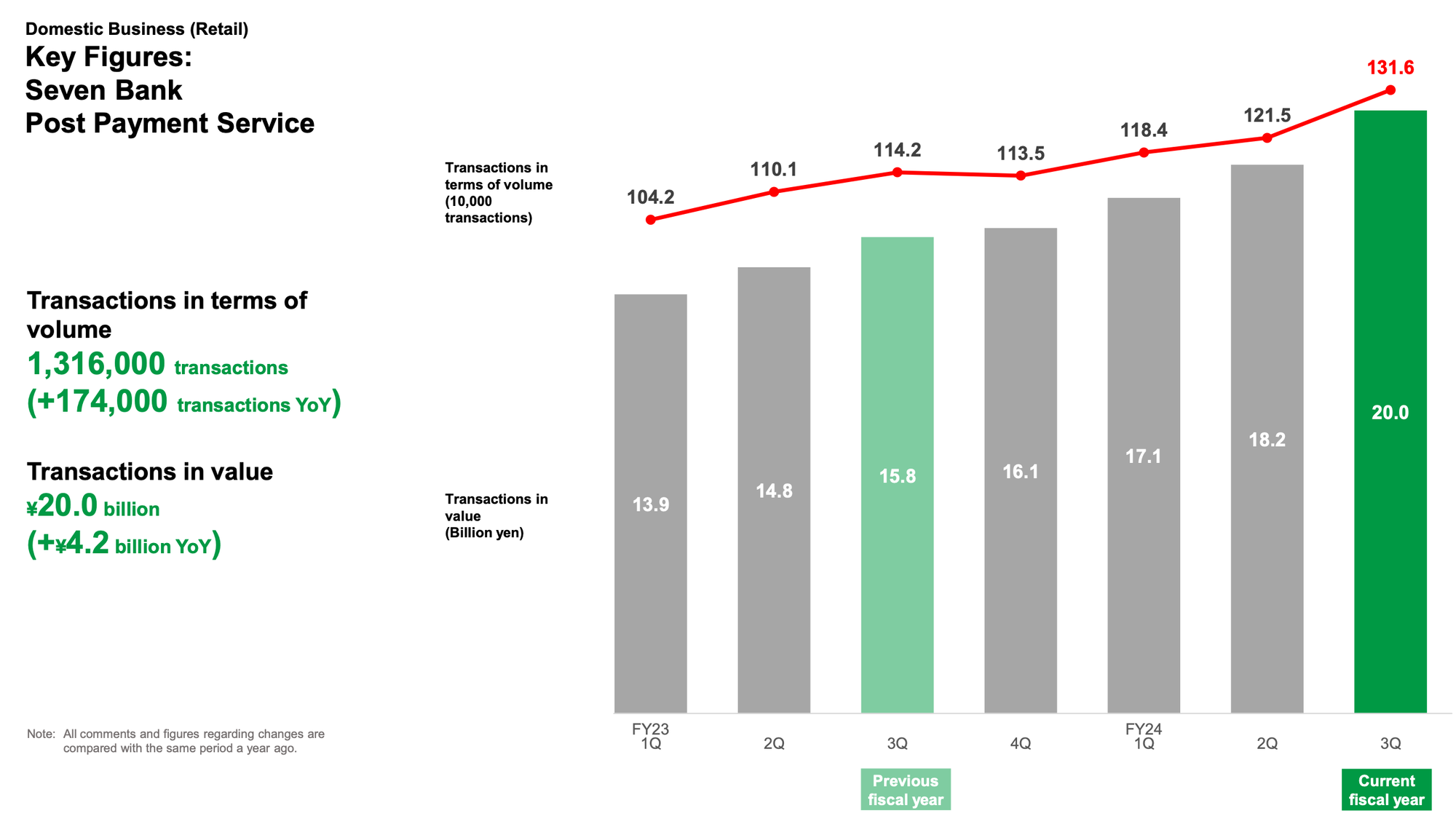

Seven Bank's Post Payment Service (a service facilitating payments after purchases) also saw considerable growth. Transactions in terms of volume reached 1,316,000, and transactions in value reached ¥20.0 billion, both showing significant year-over-year increases. This indicates that Seven Bank is successfully expanding its service offerings beyond traditional banking.

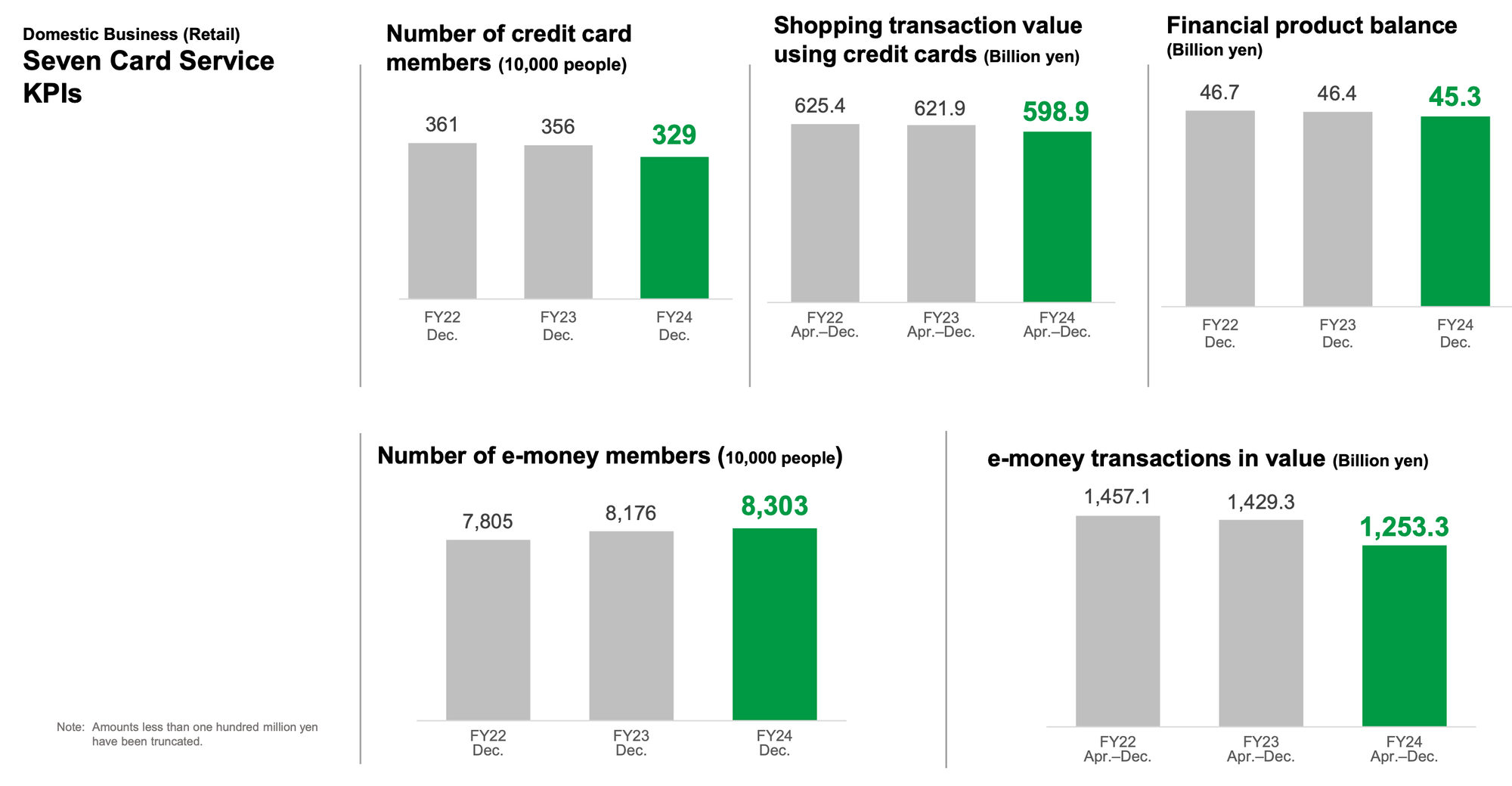

Seven Card Service, now a consolidated subsidiary, is a key part of the Domestic Retail Business. Key performance indicators for Seven Card Service show 329,000 credit card members, a shopping transaction value using credit cards of ¥598.9 billion, and a financial product balance of ¥45.3 billion. The number of e-money members reached 8,303,000, with e-money transactions in value totaling ¥1,253.3 billion. Seven Bank has been actively promoting its credit card offerings, including a large-scale point redemption campaign to acquire new members and encourage credit card usage. This has led to changes in member demographics and card usage patterns.

Overseas Business

This segment represents Seven Bank's international expansion efforts, primarily in the United States (through FCTI) and Asia (Indonesia through ATMi, and the Philippines through PAPI). The Overseas Business showed a mixed performance.

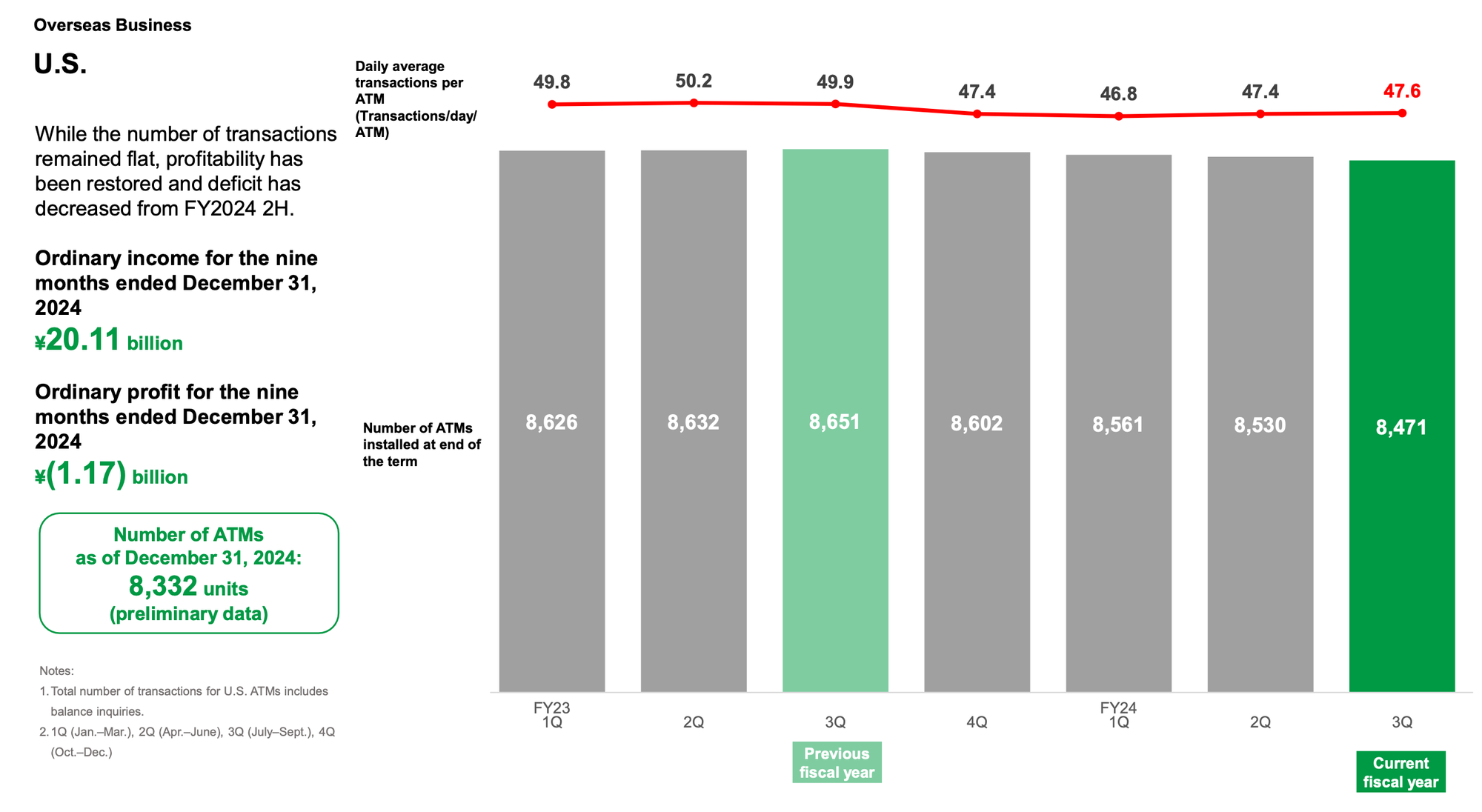

In the U.S., profitability returned in the second half of the fiscal year, and the deficit shrank compared to previous periods. However, the number of transactions remained relatively flat. Ordinary income for the U.S. operations for the nine months ended December 31, 2024, was ¥20.11 billion, but the ordinary profit was still negative at ¥(1.17) billion, although this represents an improvement. The number of ATMs in the U.S. as of December 31, 2024, was 8,332 units (preliminary data).

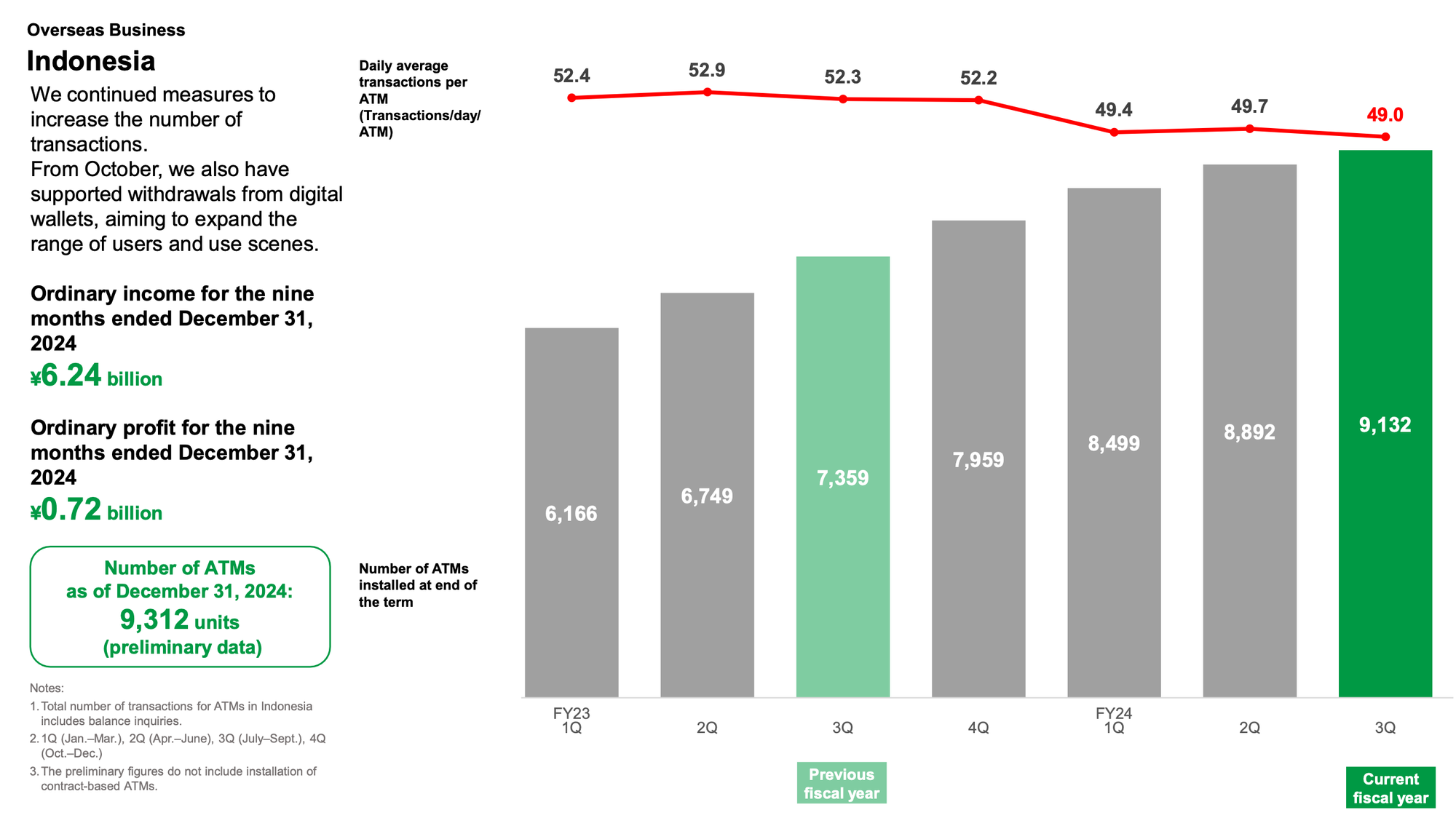

In Asia, the results were more positive. Seven Bank saw continued strong growth in the number of transactions, particularly in Indonesia. Ordinary income for the Indonesian operations reached ¥6.24 billion, with an ordinary profit of ¥0.72 billion. The number of ATMs in Indonesia reached 9,312 units (preliminary data). Seven Bank has been implementing measures to increase transaction volume in Indonesia, including supporting withdrawals from digital wallets, demonstrating a focus on adapting to local market trends.

In the Philippines, the number of transactions also continued to grow, and Seven Bank continued its efforts to reduce operating costs. Ordinary income for the Philippines operations was ¥5.92 billion, with an ordinary profit of ¥0.23 billion. The number of ATMs in the Philippines reached 3,515 units (preliminary data).

Notably, Seven Bank is expanding its presence in Asia further by launching ATM services in Malaysia, starting in January 2025. This expansion will initially involve installing 100 cash recycling ATMs under the brand name "Reachful," primarily in 7-Eleven stores across three Malaysian states. This marks a significant step in Seven Bank's strategy to grow its international footprint.

Future Outlook and Strategic Initiatives

Seven Bank's full-year forecasts for financial results and dividends for fiscal year 2024 (ending March 31, 2025) remained unchanged. The company anticipates consolidated ordinary income of ¥215.0 billion and consolidated ordinary profit of ¥28.0 billion. The net income attributable to owners of the parent is projected to be ¥19.5 billion. The annual dividend is expected to remain at ¥11 per share. These forecasts reflect the ongoing trends observed in the third quarter, including the positive impact of Seven Card Service's consolidation, the continued growth in the Domestic ATM and Retail businesses, and the ongoing efforts to improve profitability in the Overseas Business. The anticipated net income is lower than the previous year's result due to the absence of the one-time gain on negative goodwill.

Significant structural changes are planned within the broader 7-Eleven group. Seven Bank will eventually become an equity-method affiliate of the newly formed 7-Eleven Corporation (tentative name), which is currently Seven & i Holdings. This restructuring aims to optimize the capital relationships within the group, with distinct business segments (CVS, SST, and Financial) operating under the 7-Eleven Corporation umbrella. This change will not directly impact Seven Bank's immediate operations but is a significant strategic shift within the larger corporate structure.

Key Takeaways and Conclusion

Seven Bank's third-quarter results demonstrate a company navigating a period of significant investment and strategic shifts. The core Domestic ATM business remains strong and is undergoing a major technological upgrade. The Domestic Retail business is steadily growing, driven by increased customer adoption of banking and payment services. The Overseas Business presents a mixed picture, with improvements in the U.S. and continued growth in Asia. The consolidation of Seven Card Service has significantly boosted the top line, although the absence of a one-time gain from the previous year has impacted the net income comparison.

The key takeaways are:

- Underlying Growth: Despite the complexities of the consolidated financials and the impact of one-time accounting events, Seven Bank's core operations are showing healthy growth.

- Strategic Investments: The company is making significant investments in its ATM infrastructure and expanding its overseas presence, positioning itself for future growth.

- Focus on Innovation: The introduction of facial recognition technology in ATMs and the expansion of digital payment support demonstrate Seven Bank's commitment to innovation.

- Adaptability: The company is adapting to evolving market trends, particularly in Asia, by supporting digital wallets and expanding into new markets like Malaysia.

- Structural changes The company is being integrated into a different corporate structure.

In conclusion, Seven Bank's third-quarter performance reflects a company in transition, balancing the need for short-term profitability with strategic investments for long-term growth and adaptation to the evolving financial landscape. The underlying strength of its core businesses, coupled with its commitment to innovation and expansion, suggests a positive outlook for the future, despite the near-term challenges presented by increased expenses and the complexities of consolidating new acquisitions.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.