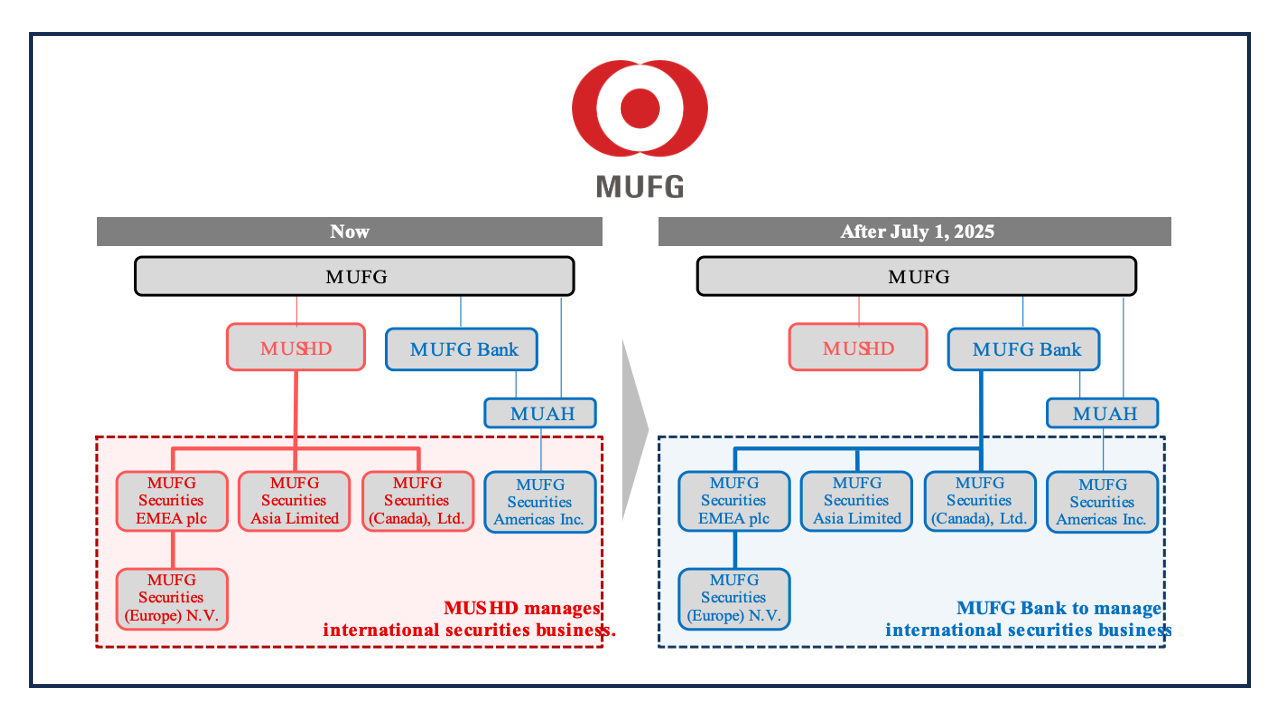

Reorganization of overseas securities entities within MUFG

MUFG Bank will acquire 100% of shares of the following overseas securities subsidiaries: MUFG Securities EMEA, MUFG Securities Asia, and MUFG Securities (Canada), currently owned by MUSHD, making them direct subsidiaries of MUFG Bank. The reorganization is scheduled for July 1, 2025, subject to the completion of necessary procedures, including approvals from the relevant regulatory authorities in Japan and abroad.

Purpose of the group reorganization

The medium-term business plan (MTBP) of MUFG, starting from the 2024 fiscal year, established seven strategies dedicated to pursuing “growth” one of which is the “evolution of an integrated GCIB /Global Markets business model". Based on MUFG’s integration strategy, the GCIB Business Unit and the Global Markets Business Unit have promoted integrated operations between the overseas securities entities and MUFG Bank.

However, in order to address the diverse challenges and needs of our clients within the international wholesale business, MUFG considers it is essential to transcend the traditional boundaries of banking and securities operations to allow for more integrated group-wide decisions swiftly, allocation of resources flexibly and efficiently and establishment of a platform for further advancement in their business-support frameworks.

By integrating the management of the international securities business into MUFG Bank and reorganizing the overseas securities subsidiaries as direct subsidiaries of the Bank, MUFG aims to strengthen the integrated operational framework of the Bank and Securities in their international wholesale business and to achieve the “evolution of the GCIB/Global Markets integrated business model” allowing for enhanced product competitiveness and value chain strengthening.

Management of the international securities business after the group reorganization

At present, the business of the overseas securities subsidiaries, including MUFG Securities Americas, which is already a subsidiary of MUFG Bank, is managed by MUSHD based on its expertise. With the group reorganization, the capital relationships and management framework of the overseas securities subsidiaries will be integrated under the Bank. However, MUFG will continue to leverage the expertise within the international securities business accumulated by MUSHD to manage the international securities operations. Additionally, while maintaining operational synergies between the domestic and the international securities businesses, MUFG will work on establishing a management and business promotion framework that integrates the frameworks of both the Bank and Securities.

Future plans

Based on this decision, MUFG will proceed with the necessary legal procedures, including obtaining approvals from the relevant regulatory authorities in Japan and abroad. Considering the preparation period required for these procedures, MUFG plans to complete this Bank reorganization on July 1, 2025.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.