Rakuten Bank's third quarter results

Rakuten Bank's third quarter of fiscal year 2024, ending December 31, 2024, demonstrated significant growth across key financial metrics, solidifying its position as a leading digital bank in Japan. The bank achieved record highs in ordinary income, gross operating profit, ordinary profit, and profit attributable to owners of the parent. This impressive performance was largely driven by a substantial increase in interest income, fueled by the accumulation of diversified investment assets and the positive impact of the Bank of Japan's policy rate hike.

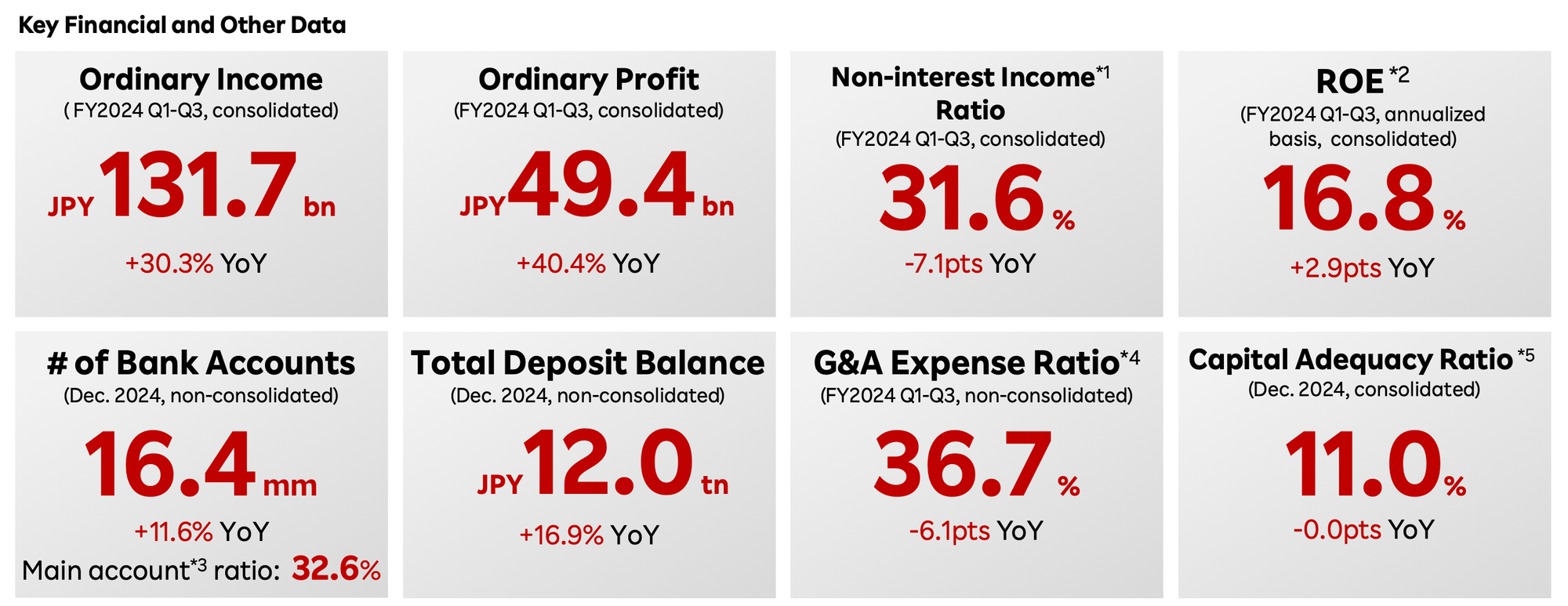

Ordinary income for the first three quarters of FY2024 reached JPY 131.7 billion, a 30.3% increase year-over-year. Ordinary profit saw an even more substantial rise, growing by 40.4% to JPY 49.4 billion. Profit attributable to owners of the parent also surged by 40.2% to JPY 35.1 billion. These figures not only highlight the bank's strong financial performance but also exceeded the growth rate of the earnings forecast that was revised upward in November 2024.

The remarkable growth was primarily propelled by a 45.5% year-over-year increase in interest income, which amounted to JPY 89.5 billion. The non-interest income ratio was to 31.6%. This signifies a shift in the bank's income composition, as interest income has been growing at a faster pace than non-interest income since the Bank of Japan lifted its negative interest rate policy. The change of ordinary profit, +14.2 billion Yen, was mostly driven by the +18.7 billion Yen difference in adjust net interest income.

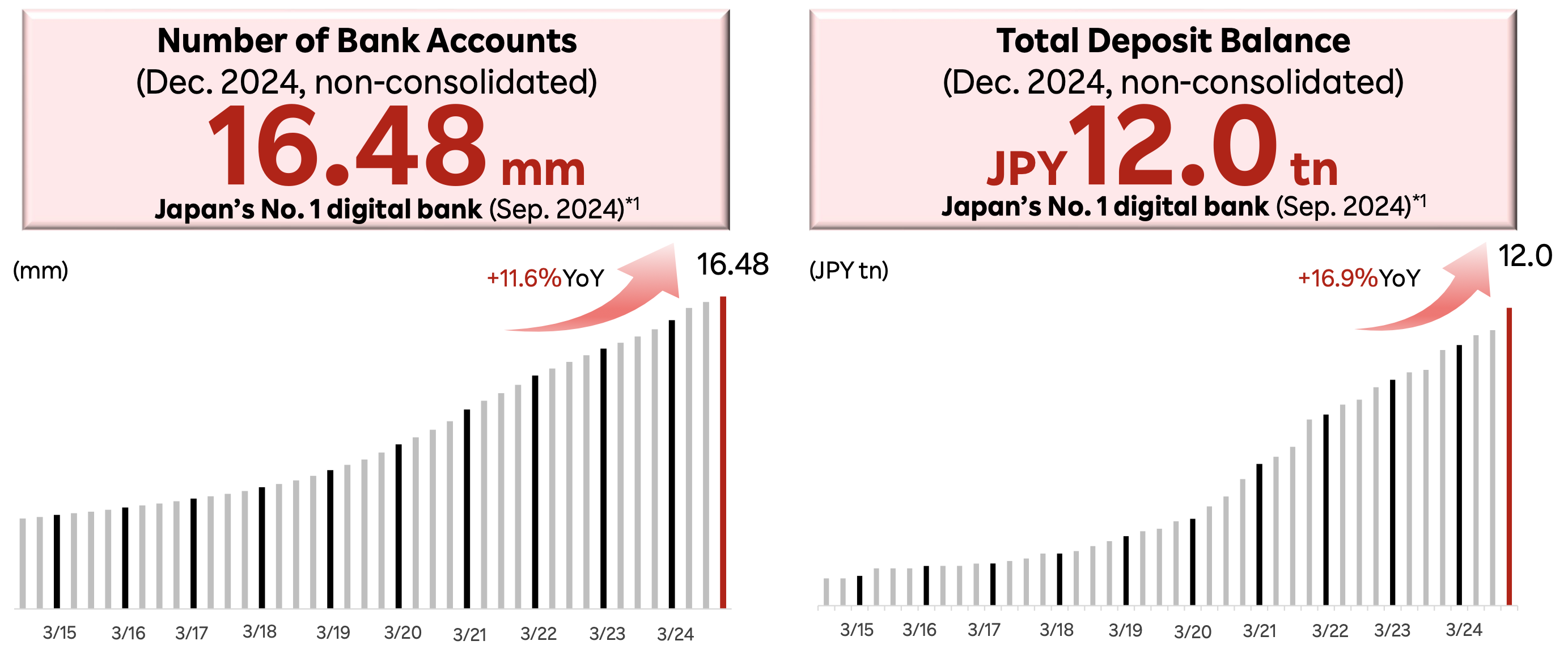

The bank's operational scale also expanded significantly. The number of bank accounts reached 16.48 million as of December 2024, an 11.6% increase year-over-year, maintaining its status as Japan's No. 1 digital bank in terms of account numbers. Crucially, the number of "main accounts," defined as those used for direct debit or direct deposit of payroll, grew at a faster rate of 16.0%, indicating an increase in highly profitable and active users. The main account ratio, reflecting the proportion of main accounts to total accounts, improved to 32.6%.

Total deposit balance experienced robust growth as well, reaching JPY 12.0 trillion, a 16.9% increase year-over-year, and also ranking Rakuten Bank as the No. 1 digital bank in Japan by deposit balance. This growth outpaced the increase in the number of accounts, signifying higher deposit balances per account, particularly among main account holders. The bank celebrated a significant milestone, surpassing JPY 12 trillion in deposits within just five months of reaching JPY 11 trillion.

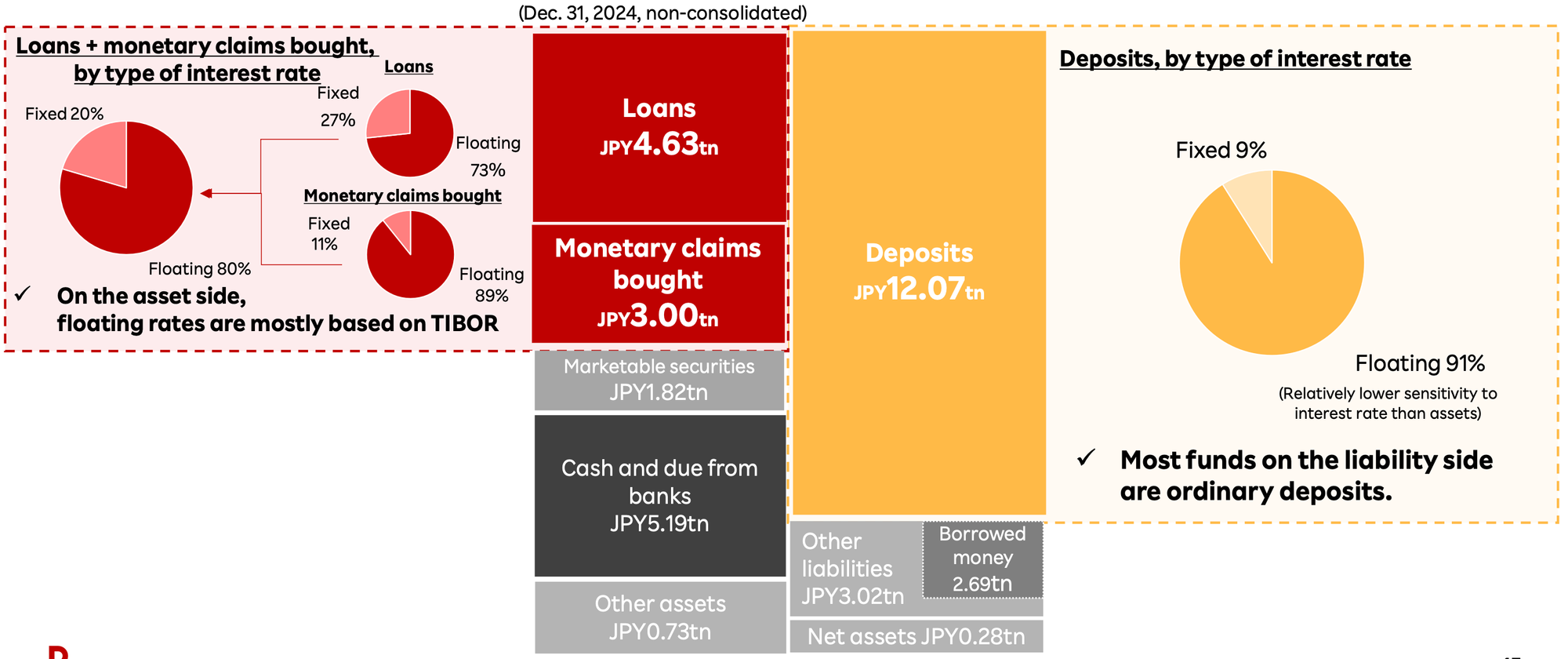

The expansion of the bank's loan portfolio and monetary claims bought contributed significantly to the growth in interest income. Each category of loans and monetary claims bought exhibited balanced growth. Total loans reached JPY 4,630.2 billion, a 17.4% increase from December 31, 2023, while monetary claims bought increased by 13.7% to JPY 3,001.0 billion. Within the loan portfolio, notable growth was observed in investment property loans (18.3% increase) and ABL (Asset-Based Lending) (10.9% increase).

The bank's medium- to long-term vision focuses on expanding investment assets, particularly middle-risk assets. The balances of card loans (personal loans), investment property loans, ABL, and monetary claims bought (others) all showed steady growth, demonstrating the bank's progress in diversifying its asset portfolio. The total balance of categories that include middle-risk assets increased by 13.8% from December 31, 2023, reaching JPY 2,570.2 billion.

Rakuten Bank's balance sheet reflects its investment strategy and risk profile. Approximately 80% of the bank's investment assets adopt floating rates, primarily linked to TIBOR (Tokyo Interbank Offered Rate). This makes the bank's interest income sensitive to changes in short-term interest rates. The due from the Bank of Japan is also linked to changes in policy rates. On the liability side, 91% of deposits are floating rate, although their sensitivity to interest rate changes is lower than that of assets. Most of the bank's funding comes from ordinary deposits.

Regarding asset quality, Rakuten Bank maintained a low credit cost ratio, although credit costs increased due to a rise in non-guaranteed personal loans. The credit cost ratio remained at 0.06% for Q1-Q3 FY2024. The bank's focus on maintaining asset quality is crucial for sustainable profitability.

In terms of capital adequacy, Rakuten Bank maintained a sound capital adequacy ratio of 11.0% as of December 2024, demonstrating its ability to absorb potential losses and support future growth. The bank actively accumulated investment assets, leveraging capital raised through the public offering at the time of its IPO. Total risk-weighted assets increased to JPY 2,673 billion.

General and administrative expenses (non-consolidated) increased, but the bank's business scale expansion boosted management efficiency. The G&A expense ratio, which measures general and administrative expenses as a percentage of gross operating profit, improved to 36.7% in Q1-Q3 FY2024, down from 42.9% in the same period of the previous year.

Rakuten Bank revised its consolidated forecast for FY2024 upward, reflecting its strong performance in the first three quarters. The revised forecast projects ordinary income of JPY 183.6 billion (a 33.1% increase year-over-year), ordinary profit of JPY 69.0 billion (a 42.6% increase), and net income of JPY 48.9 billion (a 42.0% increase). These revisions underscore the bank's confidence in its continued growth trajectory.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.