Rakuten Bank crushes expectations, raises guidance

Rakuten Bank’s first-half 2024 results are in, and they have blown past expectations. Profits are up significantly, and the bank has raised…

Rakuten Bank’s first-half 2024 results are in, and they have blown past expectations. Profits are up significantly, and the bank has raised its full-year net profit guidance by a whopping 22%, from ¥37.8 billion to ¥46.2 billion. This performance beat stems from a combination of factors, including lower restructuring costs than anticipated and the positive impact of the July interest rate hike by the Bank of Japan (BOJ). While the dividend policy remains unchanged, the overall picture is overwhelmingly positive.

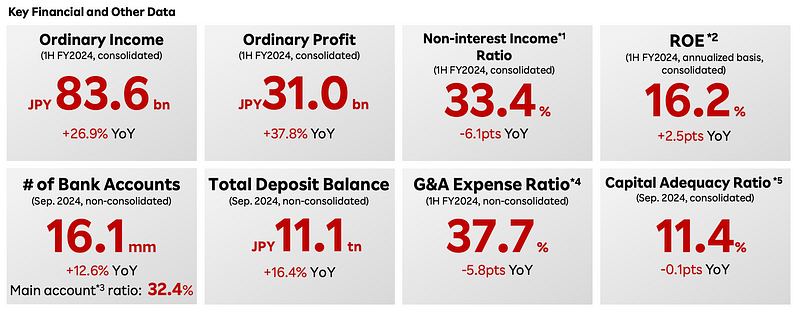

Key Financial Highlights (First Half 2024)

- Ordinary Income: ¥83.6 billion (+26.9% year-over-year)

- Ordinary Profit: ¥31.0 billion (+37.8% year-over-year)

- Net Income: ¥22.1 billion (+37.5% year-over-year)

- ROE (Annualized): 16.2% (+2.5pts year-over-year)

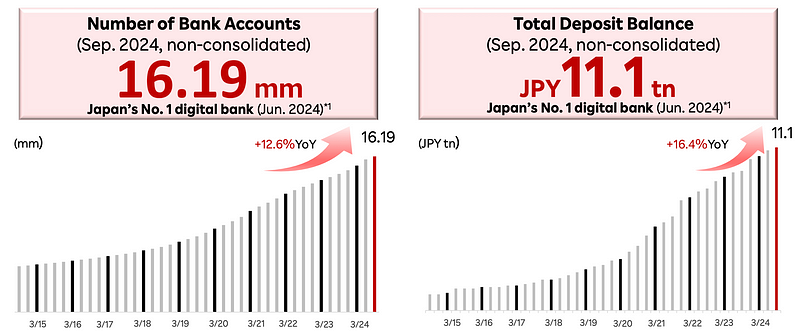

- Total Deposits: ¥11.1 trillion (+16.4% year-over-year)

- Number of Accounts: 16.1 million (+12.6% year-over-year)

- Main Account Ratio: 32.4%

These figures represent record highs for the first half of the year, showcasing the bank’s robust financial health and effective strategies.

Driving Forces Behind the Success

Several key factors contributed to Rakuten Bank’s stellar performance. Firstly, the BOJ’s rate hike in July had a substantial positive impact, boosting net interest income by ¥4.4 billion. This boost resulted from higher interest rates on the bank’s floating-rate assets (which represent a hefty 78% of its investment assets).

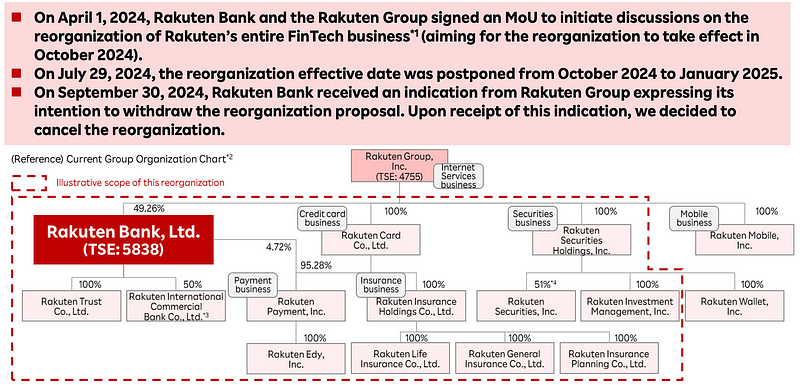

Rakuten Bank also benefited from lower restructuring costs than initially projected due to the cancellation of the planned FinTech reorganization. Finally, the bank experienced faster-than-anticipated business expansion, with non-Rakuten Card monetary claims surpassing expectations in terms of both balance and yield.

Guidance Upgrade and Future Outlook

The impressive first-half results prompted Rakuten Bank to raise its guidance for the full fiscal year 3/25:

- Ordinary Revenue: ¥178.5 billion (+29.4% year-over-year, up 9.8% from initial guidance)

- Ordinary Profit: ¥65.0 billion (+34.5% year-over-year, up 22.1% from initial guidance)

- Net Profit: ¥46.2 billion (+34.2% year-over-year, up 22.3% from initial guidance)

The upward revisions are primarily attributed to the factors mentioned earlier: strong business expansion, the BOJ’s July rate hike, and lower restructuring costs.

Business Expansion and Strategic Initiatives

Rakuten Bank is capitalizing on its position within the broader Rakuten ecosystem to fuel growth. Key initiatives include:

- Focus on Middle-Risk Assets: The bank is actively growing its middle-risk assets, which have increased by ¥296 billion (+13.6%) over the past year. This includes card loans, investment property loans, asset-based lending (ABL), and purchased monetary claims. The bank aims to further accelerate growth in these areas.

- Lending Growth: The parent loan balance grew 1.3% quarter-over-quarter to ¥4.3 trillion. This growth is driven by strategic lending across various categories, including card loans, investment property loans, and securitized assets. While housing loans saw a decline, the bank is targeting high-income earners in this segment.

- Investment in Marketable Securities: Anticipating higher yen rates, Rakuten Bank has been actively investing in marketable securities, with new purchases of ¥182.7 billion in the second quarter, up from ¥104.3 billion in the first quarter. These investments include government-guaranteed bonds, Japanese government bonds, and corporate bonds.

- Digital Focus: As a digital bank with no physical branches, Rakuten Bank is uniquely positioned to offer innovative financial services. It boasts 16.2 million accounts, with a main account (accounts used for direct debit or salary deposit) ratio of 32.4%. The bank is leveraging its digital platform and user-friendly interface to attract new customers and enhance engagement.

- Customer Acquisition and Engagement: Rakuten Bank is actively acquiring new customers, leveraging its position within the Rakuten ecosystem. It reported a 12.6% year-over-year increase in the number of accounts and a 16.4% increase in deposits. The bank’s innovative services, like the newly implemented shareholder benefit program, are designed to deepen customer engagement and attract new investors.

- Cost Efficiency: Rakuten Bank’s G&A expense ratio reached 37.7%, a significant improvement of 5.8 points from the first half of 2023. This demonstrates the bank’s commitment to operational efficiency, a key strength of its digital business model.

Challenges and Risks

While the current outlook is positive, Rakuten Bank faces certain challenges and risks:

- Competition: The online banking landscape in Japan is becoming increasingly competitive, with multiple players vying for market share. Rakuten Bank needs to continuously innovate and offer compelling services to differentiate itself.

- Credit and Funding Costs: Changes in macroeconomic conditions could impact credit and funding costs, affecting the bank’s profitability.

- Rakuten Card Growth: The growth of Rakuten Card assets is crucial for the bank’s securitization business. Any slowdown in this area could pose a challenge.

Overall Assessment

Rakuten Bank’s first-half 2024 results indicate strong financial performance and strategic execution. The bank’s focus on middle-risk assets, lending growth, investment in marketable securities, and cost efficiency are all contributing to its success. Leveraging the broader Rakuten ecosystem for customer acquisition and engagement is a key differentiator. While competition and potential fluctuations in credit and funding costs pose challenges, Rakuten Bank appears well-positioned for continued growth in the evolving digital banking landscape.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.