PayPay raises per-transaction limit from JPY 500,000 to 1 million yen to accommodate high-value…

PayPay has increased the per-transaction and 24-hour payment limit of its cashless payment service from 500,000 yen to 1 million yen. For…

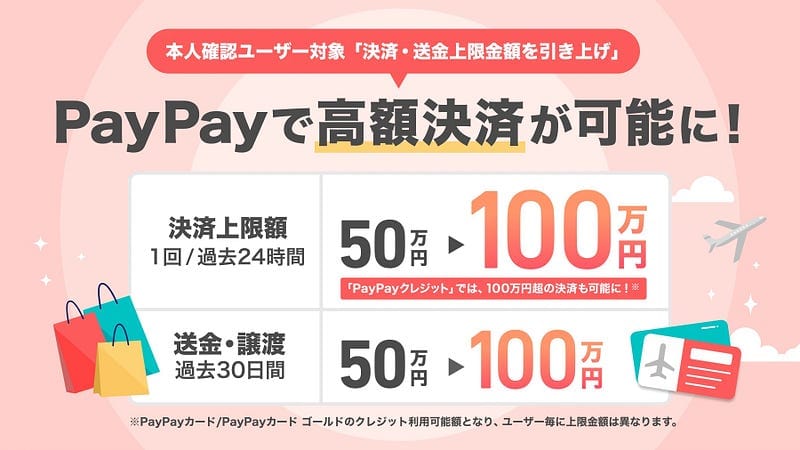

PayPay raises per-transaction limit from JPY 500,000 to 1 million yen to accommodate high-value payments

PayPay has increased the per-transaction and 24-hour payment limit of its cashless payment service from 500,000 yen to 1 million yen. For payments using the blue screen “PayPay Credit,” which previously had a maximum payment limit of 500,000 yen (per transaction and within 24 hours), the new change means that transactions can now exceed 1 million yen per transaction, with limits determined by the user’s “PayPay Card (including PayPay Card Gold)” credit line, similar to regular credit cards. Additionally, due to recent increased demand for money transfers, the 30-day limit for sending money using the “Send/Receive” feature has been raised from 500,000 yen to 1 million yen. These increased payment and transfer limits only apply to users who have completed identity verification (eKYC).

While “PayPay” has primarily been used for everyday payments at convenience stores, supermarkets, and drugstores, there has been a recent increase in high-value transactions at department stores, travel sites, and online shopping platforms. Furthermore, with the launch of “PayPay Salary Receipt,” which allows users to receive their salaries in their PayPay accounts, use cases for “PayPay Balance” are expanding, and demand for high-value payments is expected to increase further. This increase in payment limits will enable users to make larger purchases beyond daily shopping, such as furniture, electronics, airline tickets, and luxury brand items. Starting November 2024, “PayPay” will be gradually accepted on “Trip.com,” one of the world’s largest online travel sites for booking flights and hotels, as PayPay continues to expand into high-value payment scenarios. Additionally, in late November, “PayPay Investment” will allow users to purchase securities using PayPay Money up to 1 million yen per transaction and within 24 hours, making asset management more convenient than ever.

Regarding money transfers, the 30-day transfer limit has been increased from 500,000 yen to 1 million yen due to growing demand. PayPay’s “Send/Receive” feature allows instant transfers of PayPay Balance 24/7 with no fees. It is widely used for splitting restaurant bills and household allowances, commanding approximately 95% market share in smartphone payment transfers, with transfer amounts exceeding 1 trillion yen from October 2023 to September 2024. Furthermore, since August 2024, “PayPay” has been available as a payment method for online donations to charitable organizations and donation service providers, leading to the decision to increase transfer limits in anticipation of growing transfer demand.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.