PayPay payments now available through direct debits from PayPay Bank accounts

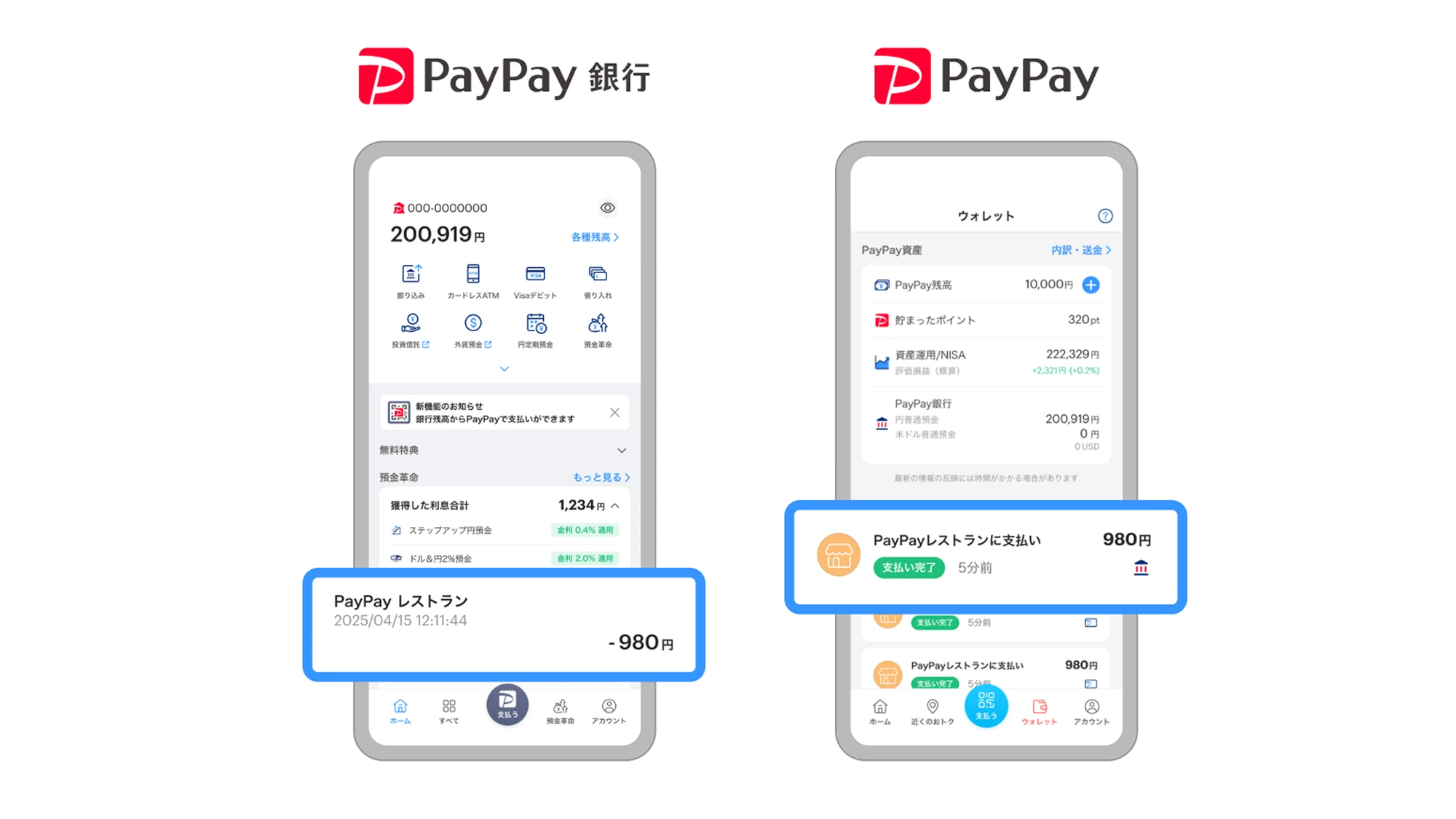

PayPay Corporation has launched a new payment method, "PayPay Bank Balance," starting April 15, 2025. This payment option is available through the PayPay Bank app provided by PayPay Bank Corporation. Payments made through the PayPay interface within the PayPay Bank app will be directly debited from the Japanese yen savings deposit balance at PayPay Bank.

With the introduction of "PayPay Bank Balance," a new PayPay payment icon will appear in the PayPay Bank app. Simply tap the icon, and a navy-colored payment screen will pop up. Users can make payments either by presenting their code for the store to scan or by scanning a QR code displayed at the store. There is no need for top-ups beforehand, as the payment amount is immediately deducted from the yen savings deposit balance at PayPay Bank, making it a highly convenient way to pay. Please note that this payment method will not be eligible for the PayPay STEP program.

By meeting balance requirements based on age, PayPay Bank offers a special interest rate of 0.4% per annum (0.31% after tax), roughly twice the industry standard for yen savings deposit interest rates. By leveraging this program, users can efficiently manage their finances by depositing unused funds into PayPay Bank to earn interest and paying directly through their PayPay Bank account using PayPay when shopping. This unique benefit and ease of use are exclusive to PayPay Bank.

After payments, users can check transaction histories via both the PayPay app and the PayPay Bank app, confirming merchant names, transaction dates, and amounts. Users concerned about overspending with cashless transactions can confidently monitor their spending by checking their PayPay Bank balance. Please note that "PayPay Bank Balance" is available to users who have verified their identity with PayPay (eKYC) and hold a yen savings deposit account with PayPay Bank.

PayPay and PayPay Bank are committed to strengthening collaboration and will continue to update its services and apps to provide a convenient and user-friendly experience.