PayPay offers “Influenza Insurance” again this year via the PayPay App

PayPay Insurance, a group company of LY Corporation, Z Financial Corporation, and PayPay announced that the Influenza Insurance is again on…

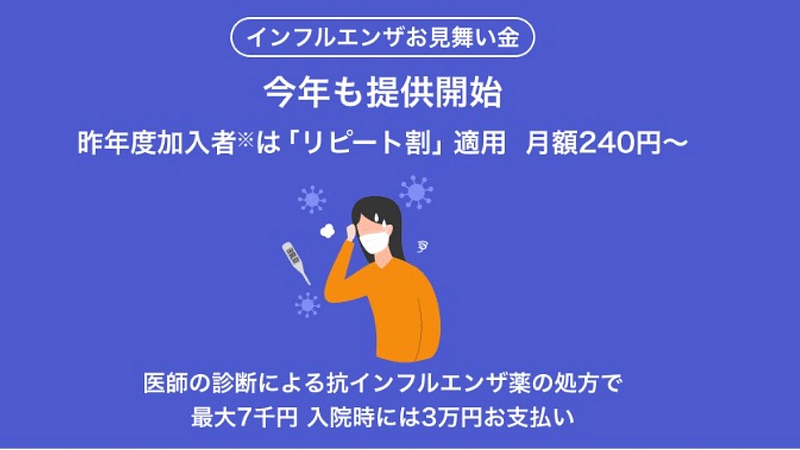

PayPay Insurance, a group company of LY Corporation, Z Financial Corporation, and PayPay announced that the Influenza Insurance is again on offer in the PayPay Insurance mini app within the cashless payment service PayPay. This Insurance was launched in January 2023 as the first product in Japan specifically designed for influenza, and has been well received by many users, with the total number of subscriptions exceeding 78,000. A repeat discount is available this year, allowing last year’s subscribers to apply for as little as 240 yen a month.

According to preliminary data released by the National Institute of Infectious Diseases, influenza cases are already increasing particularly around Okinawa. Similarly, the publication by the Tokyo Metropolitan Infectious Disease Surveillance Center shows that outbreaks are already happening in elementary and junior high schools. Responding promptly, PayPay Insurance Service has reintroduced the Insurance to help users prepare against such conditions.

Subscribers to this insurance receiving antiviral prescriptions for Influenza A or B during the insurance term will be eligible for medical treatment benefits. Additionally, a hospitalization benefit is granted for admissions of two days (one-night stay) or more if aimed at treating Influenza A or B. Users can easily subscribe for as little as 250 yen per month, and benefits can be received as quickly as the same day.

Family coverage is also available through a single application, addressing potential household infections with children or elderly family members. Users can choose from three monthly plans — Easy, Basic, and Safety — tailored to individual needs, payable using PayPay Balance including PayPay Points or PayPay Credit.

This insurance policy has been well received by many users as the first insurance product in Japan designed specifically for influenza, garnering approximately 32,000 applications in the first three months since its launch in January 2023. From October 2023, it saw 46,000 enrollments over six months, with cumulative subscriptions surpassing 78,000. Among the subscribers, those in their 30s to 50s tend to opt for family plans, while across all age groups, over half select the Safety Plan, which pays up to 7,000 yen in treatment benefits. The hospitalization benefit stands at 30,000 yen; however, the Koredake Medical Insurance product offers more extensive inpatient coverage.

Since the mini app PayPay Insurance was launched in December 2021, in just over two years and eight months, it has amassed over 4.3 million enrollments across all products. PayPay Insurance Service will continue to help users by providing high-quality insurance products that suit their needs to make insurance even more accessible.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.