Over 100 million “My Number Cards” issued

An NLI Research report published on October 16, 2024, covered the state of “My Number Card” issuance, and analyzed it from the social…

An NLI Research report published on October 16, 2024, covered the state of “My Number Card” issuance, and analyzed it from the social marketing perspective. The following is a translation of this report.

The new administration took office in October 2024. Key issues for them include the shift to a system primarily based on the “My Number Card as Health Insurance Card” (Myna Insurance Card) scheduled for this December, and the integration of driver’s licenses with My Number Cards (Myna Driver’s License) planned within the fiscal year. These “digitalization of administrative services” initiatives will continue to be closely monitored.

The Digital Agency is promoting the online processing of administrative procedures to improve efficiency and user convenience, based on the “Key Plan for Realizing a Digital Society” approved by the Cabinet in June 2023. Many municipalities are concerned about maintaining public services due to future labor shortages. Streamlining inefficient and inconvenient administrative procedures while ensuring equitable access to public services for people in rural areas and remote islands is crucial for strengthening the foundation of a sustainable society.

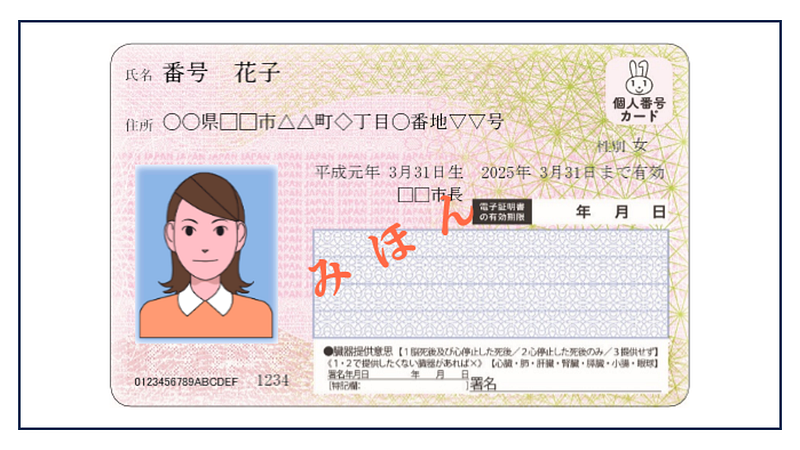

The “My Number Card” is at the core of these digital government services. The card is issued upon application (Article 17 of the My Number Act), and acquisition is voluntary. However, in August 2024, approximately eight years and eight months after its launch in January 2016, the cumulative number of issued cards finally reached 100 million. Furthermore, the utilization registration rate (valid registration rate) as a health insurance card reached 80% of the number of cards held, meaning many people can already use it as their health insurance card.

This increased utilization is expected to streamline medical examination and dispensing operations, benefiting the medical, pharmaceutical, insurance, and healthcare industries. Furthermore, the introduction of the “Digital Authentication App” on smartphones will enable simplified authentication, further streamlining administrative procedures. These initiatives will form an essential foundation for providing sustainable administrative services, contributing to improved living conditions and well-being.

The Journey Since January 2016: The “Myna Points Project” and Card Dissemination

The path to this widespread adoption has not been entirely smooth. Although issuance began in January 2016, the cumulative issuance rate was only 15.5% nationwide as of March 2020, indicating slow adoption. The turning point was the Myna Points Project. This system allows consumers who obtain a My Number Card to receive Myna Points redeemable through electronic payment services. The first phase started on July 1, 2020, and the second phase on January 1, 2022. Subsequently, the cumulative issuance rate accelerated to an average annual growth of over 15%. The second phase of the project was repeatedly extended from its initial deadline of February 2023, finally ending in September of the same year, suggesting its significant contribution to My Number Card adoption.

The Psychology of Incentives and Loss Aversion: Examining Dissemination Through a Social Marketing Lens

How can these trends be interpreted from a social marketing perspective? Offering financial incentives like cashless payment points could have successfully motivated behavioral change by presenting consumers with concrete and immediate benefits, encouraging card acquisition. While financial incentives are an important tool in social marketing, they may have helped people overcome barriers to action (e.g., time-consuming procedures).

The repeated extensions of the point application deadline in the second phase are also noteworthy. In social marketing and behavioral economics, setting deadlines for incentives is known as an effective approach to promote desired behavior. The repeated extensions may have created a sense of urgency (“Act now or lose the opportunity”), prompting acquisition. Indeed, of the 14.26 million cards issued in FY2023, 83.5% were concentrated in the period leading up to the September deadline, demonstrating the last-minute rush. This suggests that the deadline and its extensions may have framed missing out on points as a loss, motivating people to avoid that loss by taking action.

With the increasing adoption of My Number Cards, it appears that the government’s digital administrative services are gaining trust and making significant strides. However, the Digital Agency also points out in the aforementioned key plan that a certain number of people “do not view the digitalization of society positively.”

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.