ORIX's third quarter results

ORIX showcased robust financial performance in the first three quarters of fiscal year 2025 (Q1-Q3 FY25.3), with net income reaching 271.8 billion JPY. This represents a substantial 24% increase year-over-year (YoY), demonstrating the company's resilience and adaptability in a dynamic economic landscape. This result also places ORIX at 70% progress towards its full-year net income target of 390 billion JPY. The annualized Return on Equity (ROE) stood at a healthy 9.0%. The third quarter itself (Q3) contributed 88.8 billion JPY to the net income. The company is focused on achieving record annual net income.

Pre-tax profit for Q1-Q3 was equally impressive, totaling 383.4 billion JPY, marking another 24% YoY increase. The third quarter's pre-tax profit amounted to 126.4 billion JPY. This strong performance was attributed to a combination of factors across ORIX's three core business categories: Finance, Operation, and Investments.

The "Finance" segment experienced growth primarily due to expanded investment income within the Insurance segment. This positive effect helped offset lower profits stemming from the Credit business's strategic transition to an equity-method affiliate.

Within the "Operation" segment, ORIX saw a resurgence in asset management earnings and airport concession earnings, reflecting a broader recovery in travel and tourism. Furthermore, contributions from Santoku Senpaku, a shipping company, played a significant role in driving profit growth in this segment.

The "Investments" category showcased substantial gains, booking investment profits in each quarter of the period. These gains were realized across diverse segments, including domestic Private Equity (PE), Real Estate, and Environment and Energy, highlighting ORIX's successful capital recycling strategy.

ORIX's commitment to shareholder returns was also evident. The company completed a 50 billion JPY share buyback program and canceled all treasury stock exceeding 2% of total shares outstanding, demonstrating a proactive approach to enhancing shareholder value. Looking ahead, ORIX forecasts a dividend per share (DPS) equivalent to either 39% of net income or the FY24.3 dividend, whichever is higher, further underscoring its dedication to returning value to investors.

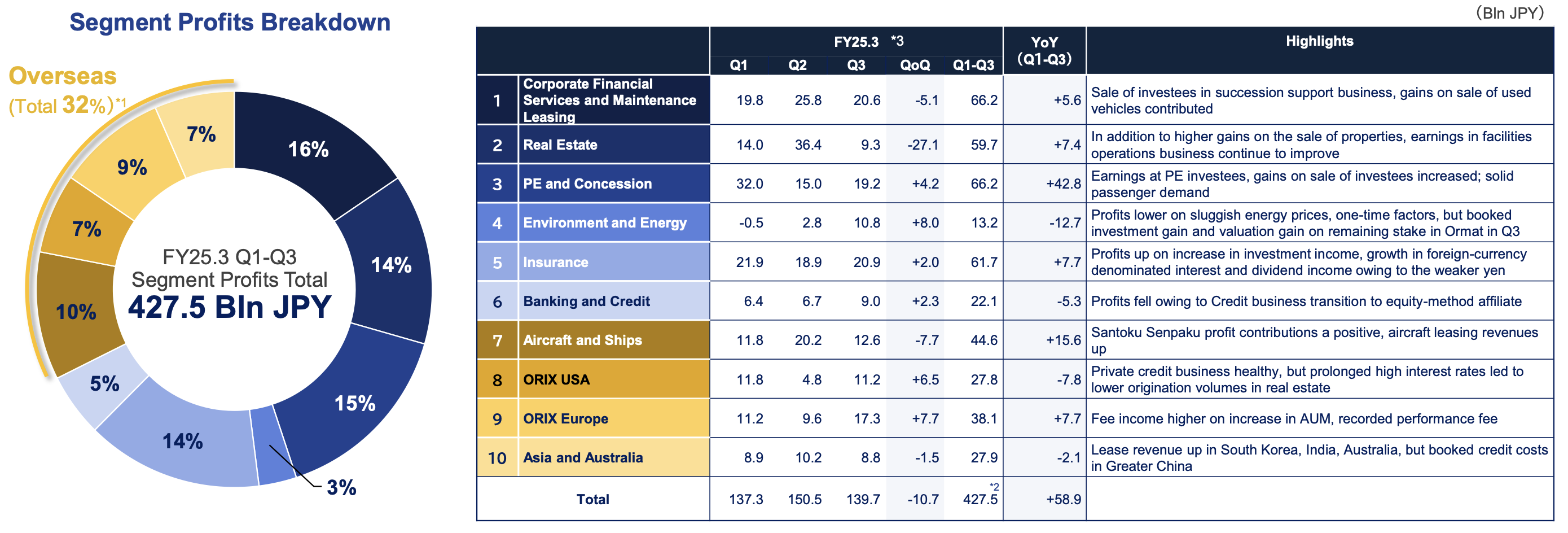

Detailed Segment Analysis

ORIX's operations are structured across ten distinct segments, categorized under the broader umbrellas of Finance, Operation, and Investments. This diversified approach allows the company to mitigate risks and capitalize on opportunities across various industries and geographies.

Corporate Financial Services and Maintenance Leasing

This segment generated profits of 66.2 billion JPY in Q1-Q3, a 9% increase YoY. The Corporate Financial Services division saw increased profits due to robust fee businesses, including real estate and insurance brokerage, and the sale of investees like Tokyo Soil Research. The Auto division is on track to a record annual profit, and benefited from strong used auto sales, with Rentec excelling in leasing, because of Windows replacement demand.

Real Estate

This segment's Q1-Q3 profits reached 59.7 billion JPY, a 14% YoY increase. The RE Investment and Facilities Operation division saw a significant boost from the sale of the multi-purpose building, Hundred Circus, coupled with increased room capacity from new hotel openings. Daikyo, ORIX's real estate business, experienced lower Q1-Q3 profits year-over-year but anticipates a rise in units sold in Q4.

PE Investment and Concession

This segment demonstrated significant growth, with Q1-Q3 profits soaring to 66.2 billion JPY, a remarkable 184% increase YoY. This surge was driven by higher profits from existing investees, including DHC and Toshiba, and the successful sale of Sasaeah Holdings. The Concession division also reported its sixth consecutive quarter of profit growth, fueled by the rebound in international passenger demand at Kansai International Airport.

Environment and Energy

This segment faced headwinds, with Q1-Q3 profits declining to 13.2 billion JPY, a 49% decrease YoY. The domestic business experienced higher costs for rebuilding existing facilities and reduced profit margins in power retailing. Overseas, lower wholesale power prices and lower-than-expected wind power generation in Spain impacted profitability. However, a gain was booked on the sale of Ormat shares in Q3.

Insurance

This segment showed consistent growth, with Q1-Q3 profits reaching 61.7 billion JPY, a 14% YoY increase. The strong performance was driven by higher investment income, reflecting the segment's expanded investment assets. The company's revised pricing strategy on level premium whole life insurance and the successful launch of the Moonshot single-premium whole life insurance product contributed to its market share growth.

Banking and Credit

This segment's Q1-Q3 profits amounted to 22.1 billion JPY, a 19% decrease YoY. While Banking experienced higher financial revenues due to rising interest rates, the Credit division saw lower profit contributions following the sale of a partial stake in ORIX Credit in the previous year.

Aircraft and Ships

This segment delivered strong results, with Q1-Q3 profits totaling 44.6 billion JPY, a substantial 54% increase YoY. The Aircraft division benefited from higher lease revenue due to growing air travel demand and gains on aircraft sales. The Ships division saw positive contributions from Santoku Senpaku, despite some one-time negative factors.

ORIX USA

This segment faced challenges, with Q1-Q3 profits declining to 27.8 billion JPY, a 22% decrease YoY. While the Private Credit business remained healthy, excluding a prior-year gain on sale, the Real Estate division experienced lower profits due to high interest rates, although origination volumes are recovering. The PE division saw increased profits thanks to an investment gain booked in Q3, reflecting an improving market climate.

ORIX Europe

This segment reported robust growth, with Q1-Q3 profits reaching 38.1 billion JPY, a 25% increase YoY. Assets Under Management (AUM) reached a record high for the second straight quarter, driving higher fee revenue. A performance fee was also booked in Q3.

Asia and Australia

This segment's Q1-Q3 profits amounted to 27.9 billion JPY, a 7% decrease YoY. While lease revenue increased in South Korea, India, and Australia, economic conditions in Greater China remained stagnant, leading to lower segment profits due to the booking of credit costs.

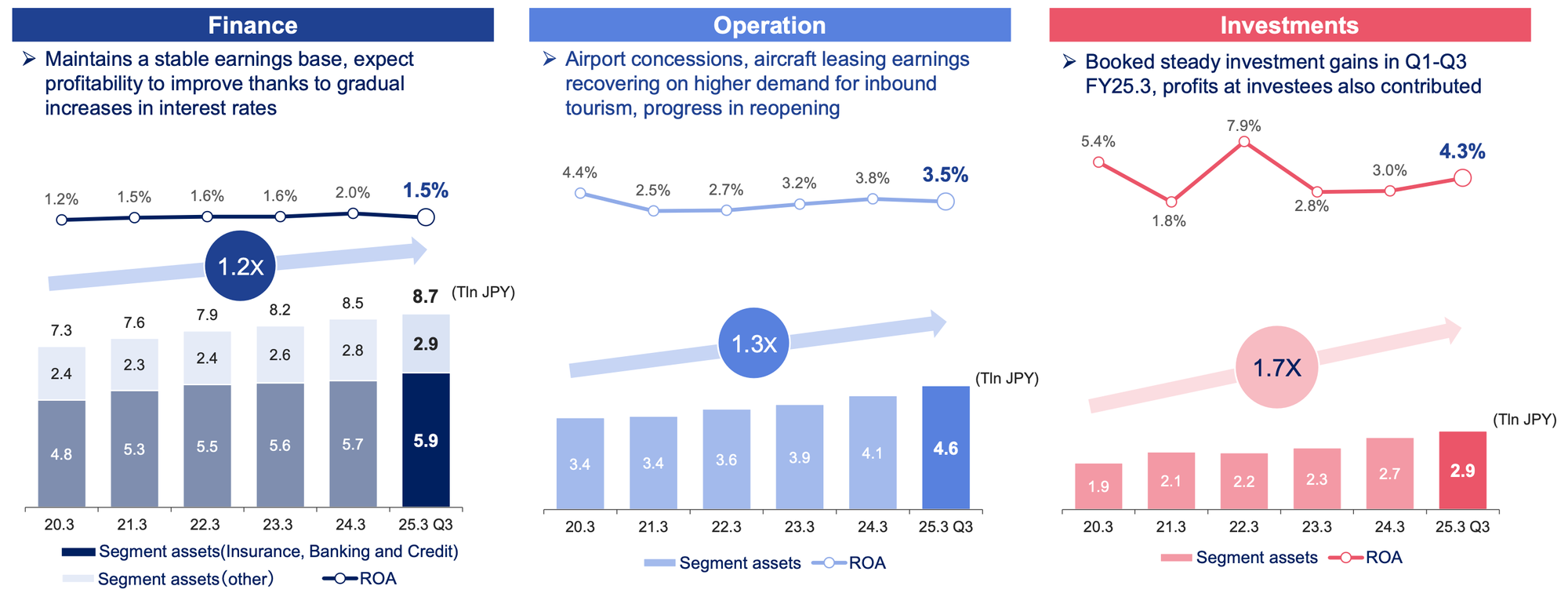

Assets and ROA

Total segment assets reached 16.5 trillion JPY, reflecting a 456.3 billion JPY increase compared to the end of FY24.3. This growth was primarily attributed to aircraft acquisitions and new loan executions in ORIX Bank's merchant banking business. Changes in foreign exchange rates also contributed to the increase.

Segment asset ROA varied across the different categories. The Finance segment (Insurance, Banking, and Credit) maintained a stable earnings base and is expected to benefit from gradual interest rate increases. The Operations segment is seeing recovery in airport concessions and aircraft leasing, driven by increased demand for inbound tourism. The Investments segment booked steady investment gains throughout Q1-Q3, with profits at investees also contributing positively.

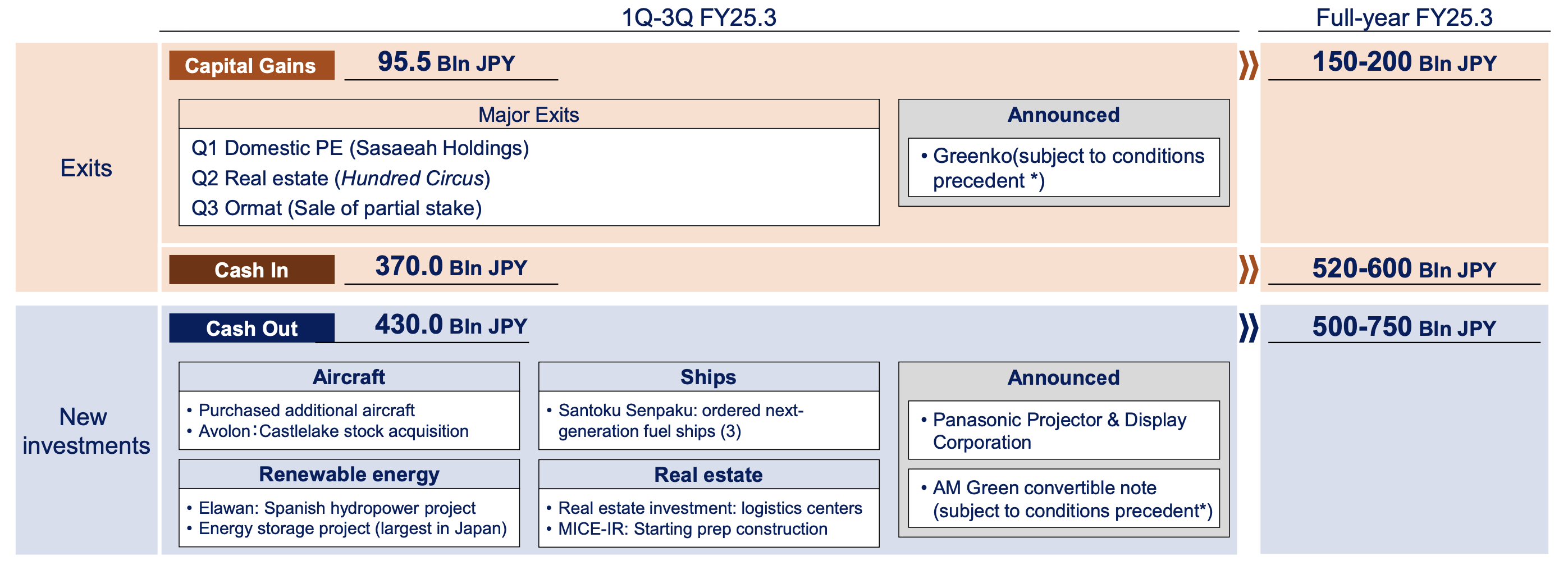

Capital Recycling Strategy

ORIX continued to actively execute its capital recycling strategy, which involves strategically selling assets and reinvesting the proceeds in new opportunities. During Q1-Q3 FY25.3, the company realized 95.5 billion JPY in capital gains from major exits, including the sale of Sasaeah Holdings (Domestic PE), Hundred Circus (Real Estate), and a partial stake in Ormat (Environment and Energy). Cash in from these and other exits was 370 billion Yen.

Simultaneously, ORIX made new investments totaling 430.0 billion JPY. These investments spanned various sectors, including aircraft purchases and acquisitions (Avolon's Castlelake stock acquisition), renewable energy projects (Elawan's Spanish hydropower project and an energy storage project in Japan), ship orders (Santoku Senpaku's next-generation fuel ships), and real estate investments (logistics centers and MICE-IR preparation).

Looking ahead, ORIX aims to generate 150-200 billion JPY in capital gains for the full fiscal year. Cash in is forcasted to be 520-600 billion Yen, while new investments will amount to 500-750 billion Yen. The company also announced the planned sale of a partial stake in Ormat shares in Q3 and a share transfer agreement for Greenko Energy, along with a new investment in AM Green, subject to conditions precedent.

Macro Climate and Strategic Direction

ORIX acknowledged the uncertain global economic environment, particularly in the US, where the impact of potential policy changes under a new administration remains unclear. However, the company emphasized its diversified business portfolio and its ability to adapt to changing conditions.

The company provided detailed insight into its strategic direction across its core business categories.

In Finance, the company will carefully asses risks, while targeting better rate spreads in Japan. It plans to focus on trends, and cautiosly approach the chinese market.

In Operations, ORIX plans to capitalize on the growing inbound demand, expand earnings, and proactively develop inflation-resistant businesses, while furthering its transition to an asset manager model. The company will also proceed with new and existing renewable energy projects, carefully monitoring interest rates, foreign exchange rates, and inflation trends.

In Investments, ORIX aims to achieve ROA improvement through capital recycling, focusing on "value enhancement" opportunities and carefully timing sales to maximize returns. The company will also maintain a cautious approach to risk, making strategic decisions to add or reduce exposure based on market conditions.

Conclusion

ORIX Corporation's third-quarter results demonstrate the company's resilience, adaptability, and strategic focus on long-term growth. Its diversified business model, active capital recycling strategy, and commitment to shareholder returns position it well to navigate the complexities of the global economic landscape. The company's focus on expanding its asset management business, capitalizing on the recovery in travel and tourism, and investing in renewable energy further underscore its commitment to sustainable and profitable growth. The results show steady progress towards record annual net income.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.