Orico reports H1/2025 results, revises revenue & profit target downwards

Orico reported financial results for the second quarter of the fiscal year ending March 2025 on November 15, 2024, revising its earnings…

Orico reported financial results for the second quarter of the fiscal year ending March 2025 on November 15, 2024, revising its earnings per share forecast downwards by 40%, below the previous fiscal year’s level .

Orico is in transition, focused on leveraging its expertise in installment credit profitably into a variety of partnerships (Mizuho FG, Rakuten Group, AEON Financial Service), and advancing its digital transformation agenda to enhance corporate value.

In this post, we will cover Orico’s financial performance, strategic initiatives, and future outlook.

Financial Performance Summary (Q2 FY2024)

- Operating Revenue: Increased significantly by ¥11.2 billion YoY, primarily driven by the contribution from three newly consolidated subsidiaries (¥8.9 billion) and revenue from real estate sales (¥1.3 billion). Growth was observed in settlement and guarantee, bank loan guarantee, and installment credit segments.

- Operating Expenses: Rose by ¥10.0 billion YoY, largely due to consolidation effects (¥10.5 billion from the three subsidiaries) and increased financial expenses from higher market interest rates. Partially offset by reduced information technology expenses following the completion of core system depreciation.

- Ordinary Profit: Increased by ¥1.2 billion YoY (+21%), benefiting from cost containment efforts in non-consolidated operations and lower bad debt expenses due to improved collection practices.

- Net Profit: Decreased by ¥6.3 billion YoY (-63%), impacted by the absence of extraordinary gains from the previous fiscal year and an increase in deferred income taxes.

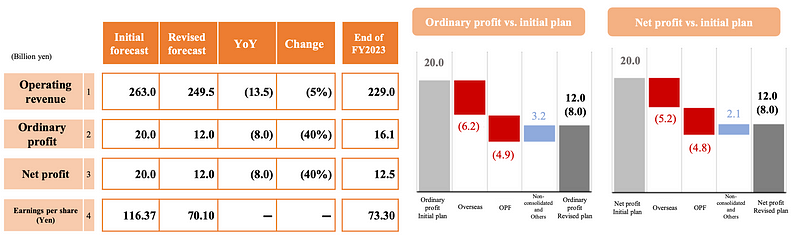

FY2024 Plan Revision

Orico revised its full-year forecast for FY2024, primarily due to underperformance in overseas operations and the OPF (Orico Product Finance) segment. While non-consolidated performance improved, these segments weighed on the overall outlook. The year-end dividend forecast remains unchanged at ¥40 per share.

Key Factors and Measures for Plan Revision

- Overseas Operations (Thailand and Indonesia): Performance declined due to sluggish economies, weak auto sales, and higher bad debt expenses related to increased vehicle inventory and losses on repossessed vehicles. Orico is implementing fundamental reforms in sales, credit, and collection processes, including system refreshes, process transformations, and targeted strategies to improve receivables quality and reduce losses.

- OPF: Experienced a revenue decline due to changes in sales strategy following a business improvement order, a shift away from smaller member stores, and the impact of rising market interest rates on securitization revenue. Orico is accelerating Post-Merger Integration (PMI), focusing on profitability through interest rate revisions, risk-based lending, efficient sales structures, and expansion of product offerings.

Direction for Enhancing Corporate Value

Orico’s direction focuses on leveraging its expertise in installment credit, partnerships (Mizuho FG, Rakuten Group, AEON Financial Service), and digital technology to enhance corporate value.

Future Outlook (3–5 Year Vision)

Breaking Away from the Traditional Credit Sales Model: Orico aims to complete its transition away from the traditional model by focusing on strengths in credit assessment, customer base, and sales networks.

Strategic Growth Areas:

- Expanding digital installment payments to capture the growing e-commerce and brick-and-mortar split needs of individual customers.

- Developing the SME market by providing financing and DX support solutions.

- Expanding card business in Southeast Asia.

- Capturing individual leasing needs amidst changing consumer preferences.

- Expanding rent payment guarantees and accounts receivable settlement guarantees.

Financial Structural Reforms: Targeting a Price-to-Book Ratio (PBR) of 1 and formulating a new capital policy.

Business Strategies

- Cultivating Key Markets and Exploring New Businesses: Focusing on settlement and guarantee services, along with exploring new opportunities in areas like supporting home-sharing utilizing vacant houses.

- Establishing Market-In Sales Approach: Prioritizing customer needs by offering services like “Orico Priority Navi” for member stores and developing AI-powered assessment models for corporations in collaboration with MoneyForward.

- Creating New Products and Services through Collaboration: Partnering with companies in different industries and cutting-edge companies to develop innovative solutions, such as digital cards and enhanced business card settlement services.

- Delving Deeper into Process Innovation: Leveraging digital technology and AI to optimize business processes, improve customer experience, and reduce costs, including initiatives like RPA, Orico AI Chat, and paperless statements.

Business Structural Reforms

Orico has transitioned from the “Installment Credit Structure Reform Project Team” to “Business Structural Reform Headquarters” led by the president. The focus has expanded beyond installment credit to encompass related businesses like card, settlement, and guarantee services. Key initiatives include establishing segment strategies, reviewing interest rate conditions, and optimizing the organizational structure and sales channels.

Management Foundations

- Human Resources Strategy: Transitioning to a new personnel system, promoting employee engagement, and fostering a mutually beneficial relationship between the company and its employees. Initiatives include mission-based HR, revised retirement benefit system, and the abolition of unwanted transfers.

- Sustainability Management: Enhancing ESG ratings and integrating sustainability initiatives throughout the organization. Achievements include CDP B score and MSCI ESG “A” rating.

- Capital Policy: Maintaining a balanced approach between financial soundness, shareholder returns, and capital efficiency. R&I upgraded Orico’s rating from A to A+.

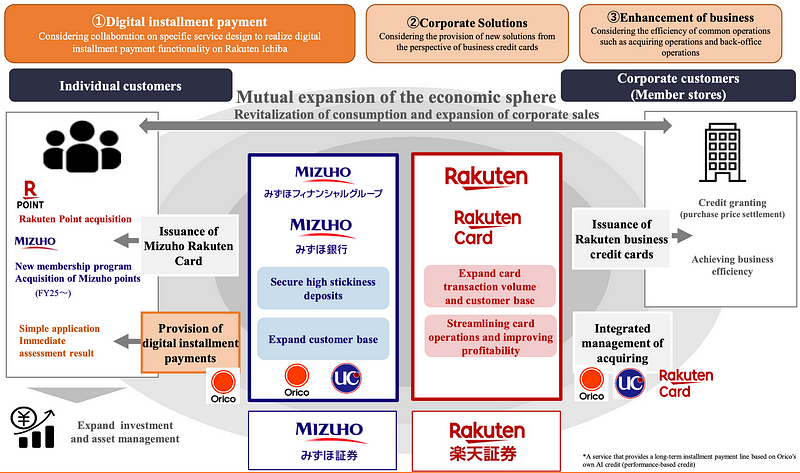

Business Alliances

Mizuho and Rakuten

Orico entered into a business alliance with Mizuho FG, Mizuho Bank, UC Card, Rakuten Group, and Rakuten Card. This alliance aims to provide enhanced services to individual and corporate customers, including digital installment payments, corporate solutions, and operational efficiency improvements.

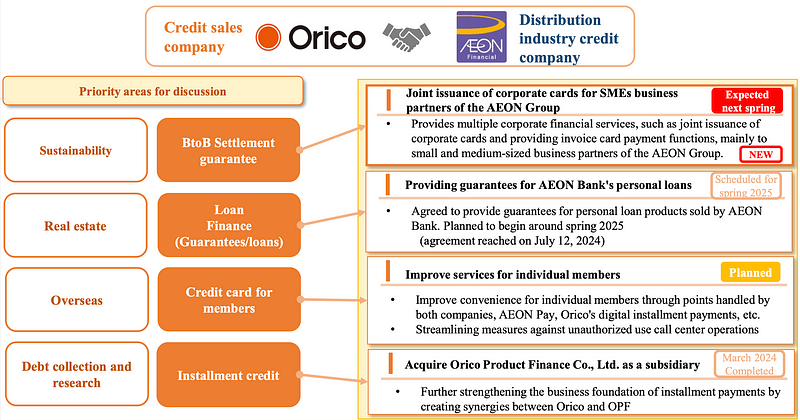

AEON Financial Service

Following the acquisition of OPF, Orico has partnered with AEON Financial Service to provide guarantees for personal loan products sold by AEON Bank. Mutual staffing in card business and corporate payment guarantees has also commenced.

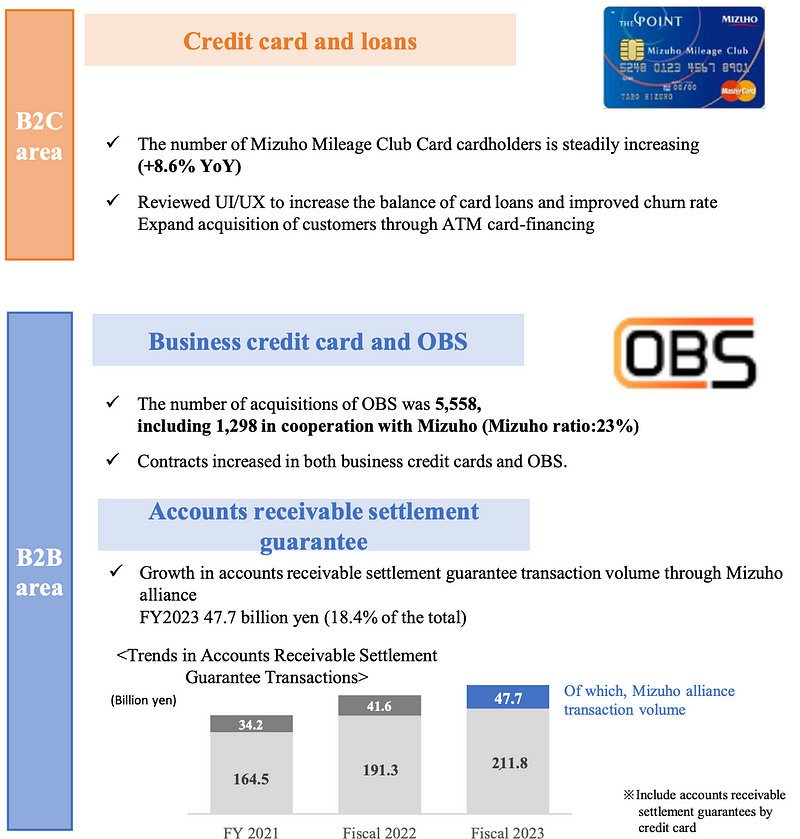

Mizuho Alliance Progress

Collaboration with Mizuho has expanded across B2C and B2B segments. Orico has begun acting as an intermediary in accounts receivable settlement guarantees and has seen growth in business credit card and OBS acquisition.

Growth Area Details

- Digital Installment Payments: Focus on providing new user experiences through an improved UI/UX and partnerships with major retailers and e-commerce businesses.

- SME Market Development: Expanding business partnerships through B2B card settlement and DX support services, along with co-branded credit card issuance with AEON Financial Service.

- Southeast Asia Card Business: Investing in Honest, an Indonesian fintech company, to capitalize on the growing credit card market.

- Individual Leasing: Capturing the shift from ownership to use by offering individual auto leasing services.

- Rent Payment and Accounts Receivable Settlement Guarantees: Expanding market share and business domain by responding to evolving business needs and leveraging partnerships like the Mizuho alliance.

Conclusion

This comprehensive summary provides a detailed overview of Orico’s Q2 FY2025 performance, strategic initiatives, and future outlook. The company is focusing on adapting to changing market dynamics, strengthening its core businesses, and forging strategic partnerships to achieve sustainable growth and enhance corporate value.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.