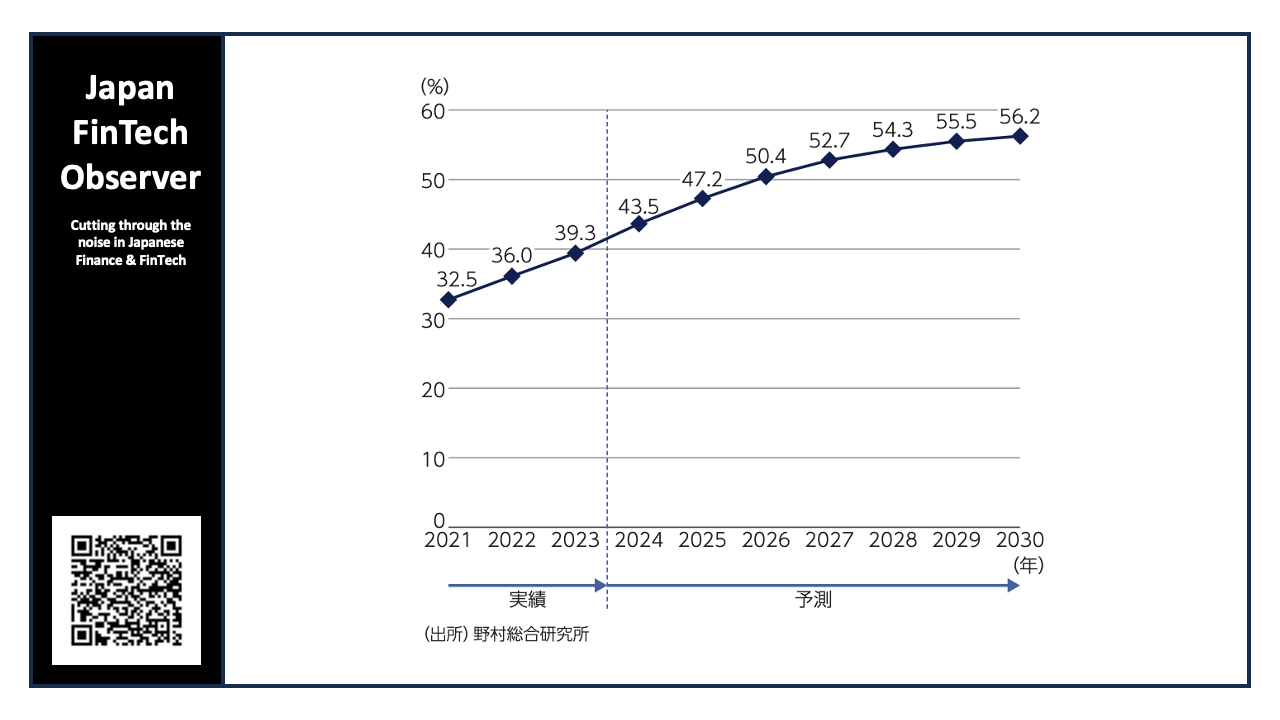

NRI: Cashless Payment Ratio Estimated at 56% by 2030

In the current issue of the Nomura Research Institute's "Financial Information Technology Focus", Daisuke Tanaka lays out projections for individual payment instruments through 2030, based on available 2023 data.

According to various statistical data, the total amount of cashless payments in 2023 (defined here as the sum of credit cards, debit cards, electronic money, and code-based payments) increased by 14% from the previous year, reaching approximately 127 trillion yen. While the growth rate is expected to gradually decrease, the cashless payment market will continue to expand, estimated to reach about 195 trillion yen by 2030.

Credit cards will continue to lead market expansion, growing from approximately 106 trillion yen in 2023 to about 152 trillion yen by 2030. Expansion is expected in public transportation, convenience stores, supermarkets and other small-amount transactions. In the B2B sector, usage is expected to extend beyond expense management to include procurement and other general business transactions, which will significantly contribute to growth.

Code-based payments are also expected to expand considerably, from about 11 trillion yen in 2023 to approximately 25 trillion yen by 2030. Usage is expected to grow from current small-amount transactions in convenience stores and supermarkets to larger payment amounts. Major code-based payment providers are already issuing credit cards through their own companies or group companies, and these cards have secured a certain market share. In the future, enhanced integration between code-based payments and credit cards is anticipated among these companies. By 2030, the boundary between code-based payments and credit cards may become quite ambiguous.

Significant expansion is not expected for debit cards and electronic money. This is because they haven't implemented large-scale promotional measures like those for credit cards and code-based payments. While debit card usage is expected to increase as regional banks actively issue them, their presence remains small compared to credit cards and code-based payments. For electronic money, the system of storing balances on IC cards and other media is technically difficult to adapt to recent payment styles utilizing internet payments and smartphones, so expansion will be limited.

The "cashless payment ratio" calculated and announced by the Ministry of Economy, Trade and Industry (METI) was 39.3% in 2023. Assuming a growth rate of 1.04% in private final consumption expenditure (nominal) over the next seven years (based on the average growth rate over the past seven years), and using the estimated cashless payment amounts mentioned above, the cashless payment ratio is projected to reach 56.2% by 2030. Hence, reaching the "future world-class level of 80%" appears challenging.

Please also note that in the interim, METI has published the actual cashless payment ratio for 2024 as 42.8%, so slightly below the projection presented above.