Norinchukin Bank's capital enhancement and third quarter results

The Norinchukin Bank is undertaking significant capital enhancement initiatives to strengthen its profitability base. This involves increasing Tier 1 and Tier 2 capital through new issuances and redeeming existing debt. Concurrently, the bank is selling low-yielding assets to improve its investment portfolio. While these actions are designed to improve long-term stability, the 3rd quarter results reflect a substantial loss primarily due to the aforementioned sales of assets. The bank emphasizes that these actions are supported by its member cooperatives.

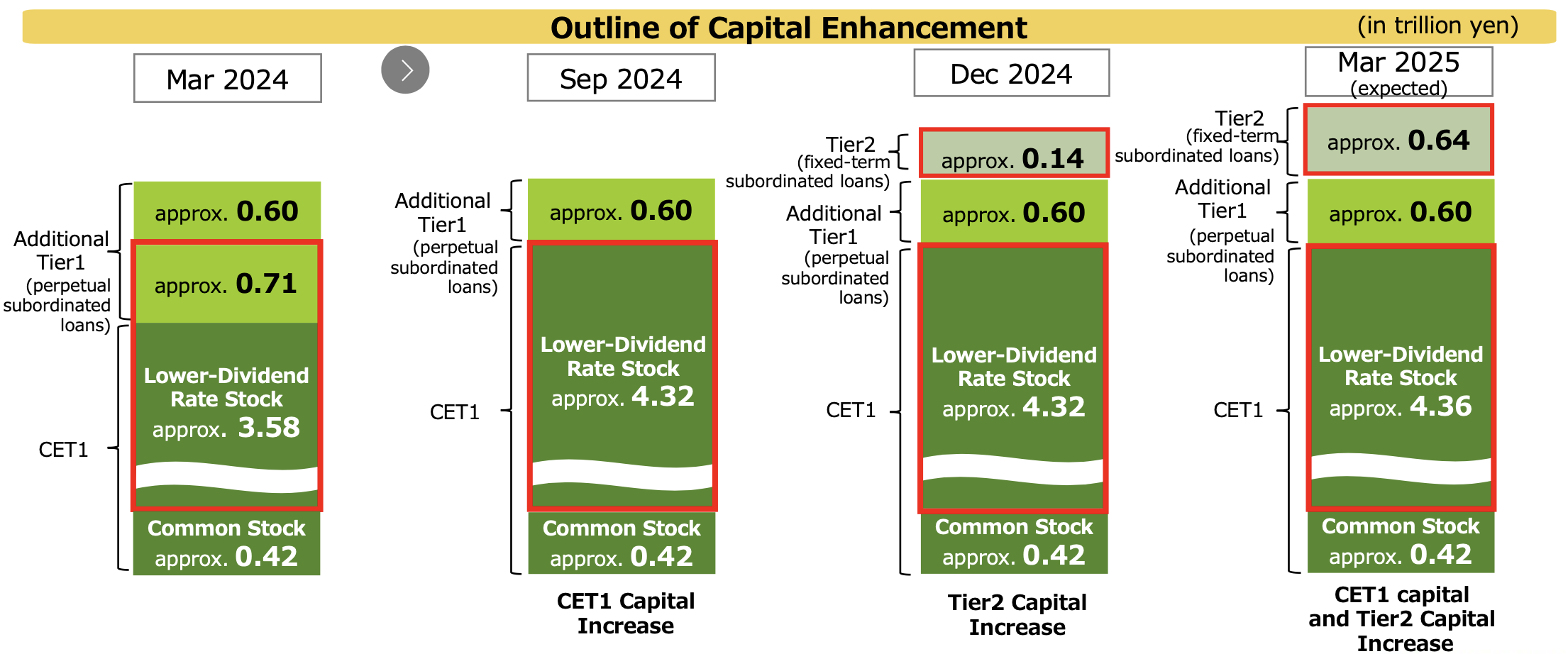

Capital Enhancement Initiatives

- CET1 Capital Increase: The bank is accepting a new capital increase of 41.1 billion yen in lower-dividend rate stocks (CET1 capital) from its member cooperatives, scheduled for March 31, 2025. This follows the redemption of "716.9 billion yen of its perpetual subordinated loans (AT1 capital) and issuing 736.0 billion yen of its lower-dividend rate stocks (CET1 capital)" completed on September 30, 2024.

- Tier 2 Capital Increase: The bank has resolved to increase the total issuance amount of fixed-term subordinated loans (Tier 2 capital) to its members to 642.8 billion yen. Of this, 141.9 billion yen was issued on November 29, 2024, and the remaining 500.8 billion yen is scheduled for March 28, 2025. This is an increase from what was previously announced on August 1, 2024.

- Rationale: The bank states that "With the series of its capital enhancements during this fiscal year, the Bank will steadily improve its investment portfolio and pursue initiatives to establish an even more robust profitability base."

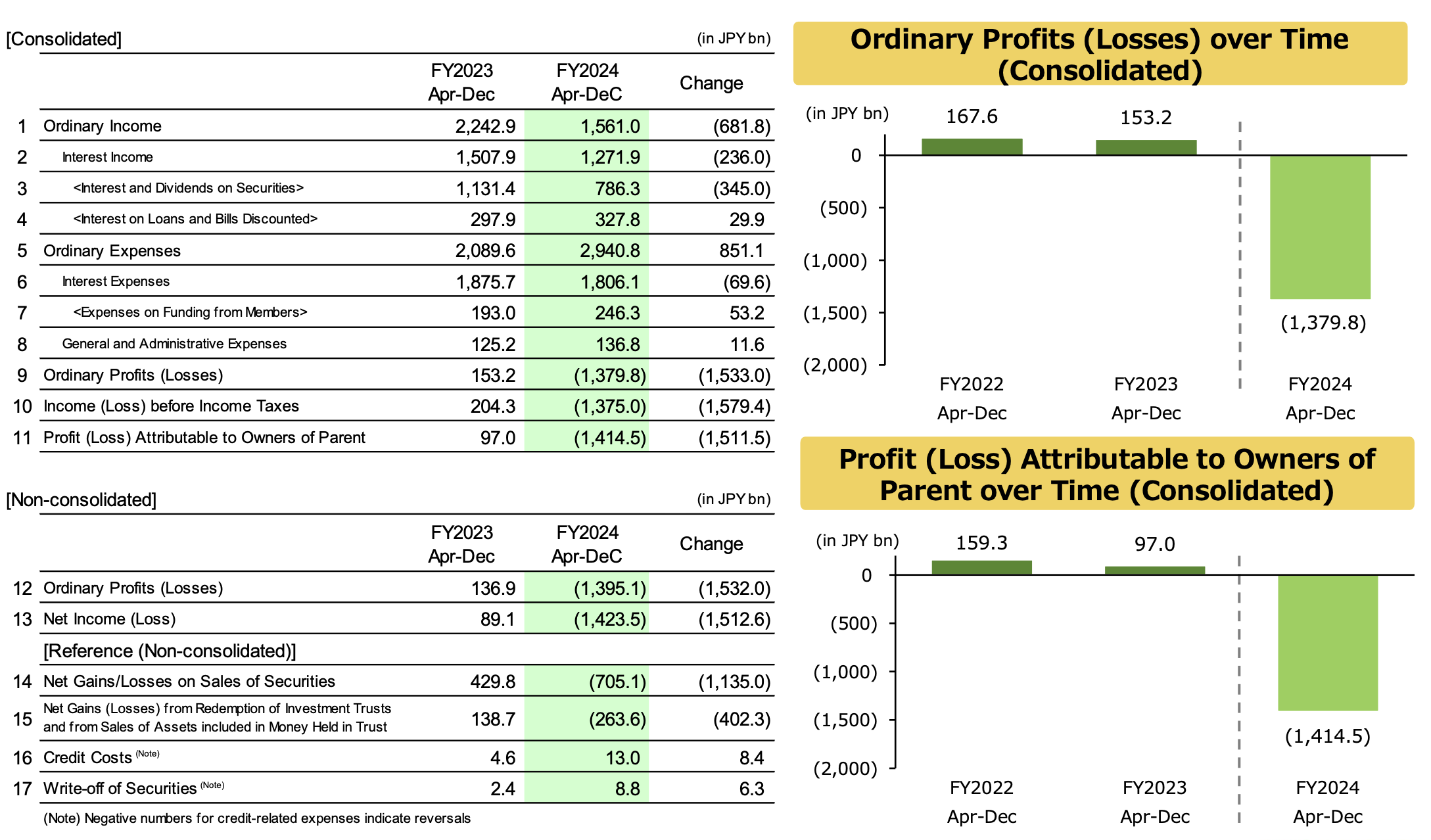

Financial Performance

- Significant Losses: The bank experienced considerable losses in the first three quarters of FY2024. Consolidated Profit Attributable to Owners of Parent was (1,414.5) billion Yen, compared to 97.0 billion Yen in the same period of FY2023. Non-consolidated Net Income (Loss) was (1,423.5) billion Yen, compared to 89.1 billion Yen in the same period of FY2023.

- Key Drivers of Loss: The primary driver of the losses is "losses from the sale of low-yielding assets". Non-consolidated "Net Gains/Losses on Sales of Securities" fell dramatically from 429.8 billion yen to (705.1) billion yen.

- Decline in Income: Consolidated Ordinary Income decreased from 2,242.9 billion Yen to 1,561.0 billion Yen, with a notable decrease in interest and dividends on securities: "

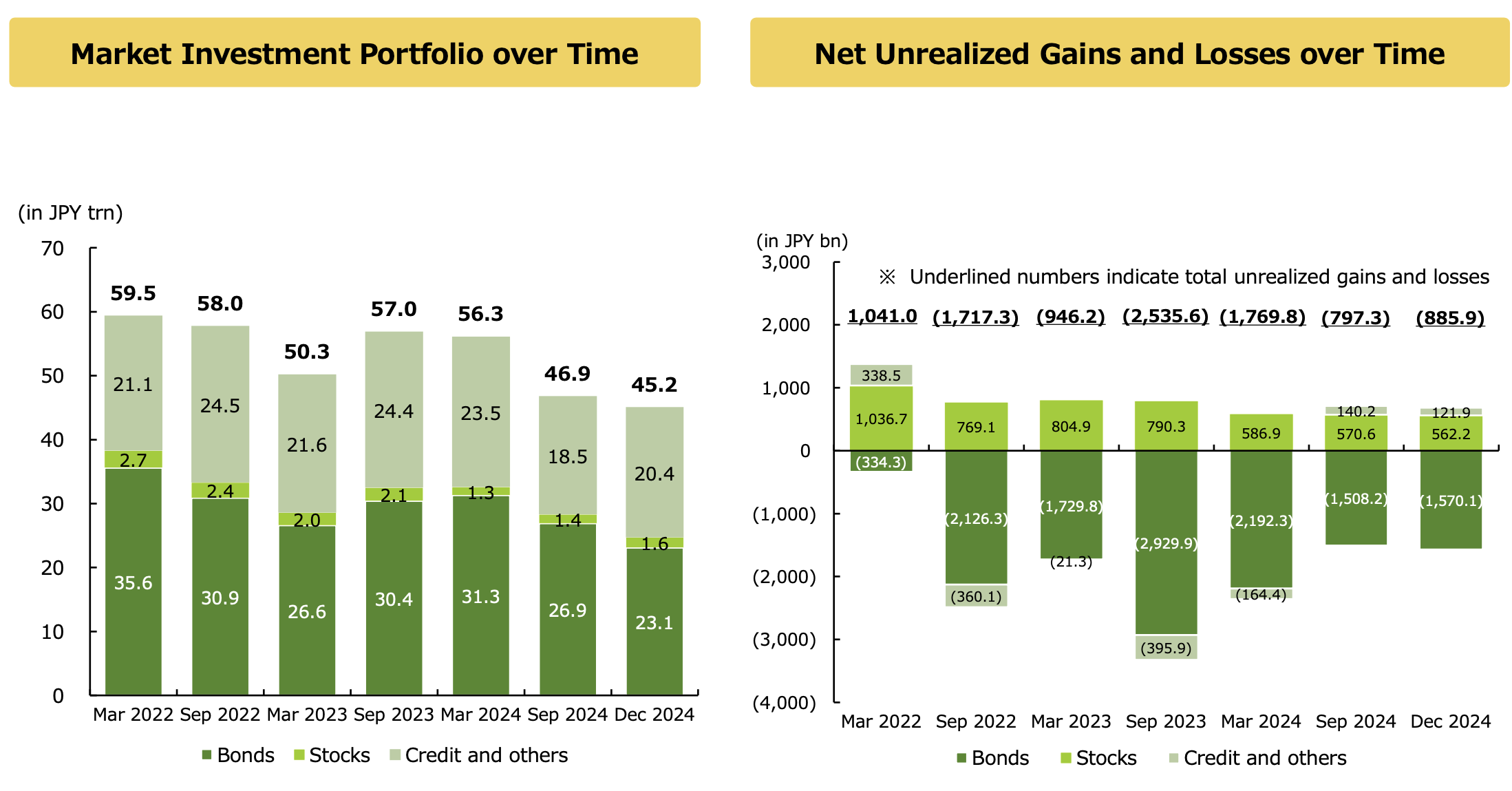

- Balance Sheet Changes: Total Assets (Consolidated) decreased from 99.8 trillion Yen in March 2024 to 88.1 trillion Yen in December 2024. Securities holdings decreased substantially: "Securities 43,800.2 35,605.0 (8,195.2)." Payables under repurchase agreements also decreased: "Payables under Repurchase Agreements 13,215.4 6,205.6 (7,009.8)."

Portfolio Improvement Strategy

- Low-Yielding Asset Sales: The Bank has been actively selling low-yielding assets. "The total amount of low-yielding asset sales accumulated to approximately 12.8 trillion yen by the end of December 2024." These sales are primarily in U.S. and EU government bonds.

- New Investments: The Bank intends to use the improved CET1 capital to invest in various asset classes. The earnings release mentions "Secured capacity for new investment and loans and support steady portfolio improvement".

Market Investment Portfolio

- The bank provided a breakdown of its market investment portfolio: Bonds (51%), Stocks (4%), and Credit and others (45%).

- The bank holds CLOs (Collateralized Loan Obligations), which account for 18% of its investment portfolio. The bank emphasizes a conservative approach: "Only triple-A rated and held-to-maturity securities."

Funding

- The bank relies on deposits from members and non-members: "Deposits from the members 55.1 (JPY:trn)" and "Deposits from non-members 6.4 (JPY:trn, 10%)" as of December 31, 2024.

Key Quotes

- On Capital Enhancement: "With the series of its capital enhancements during this fiscal year, the bank will steadily improve its investment portfolio and pursue initiatives to establish an even more robust profitability base."

- On Low-Yielding Asset Sales: "The total amount of low-yielding asset sales accumulated to approximately 12.8 trillion yen by the end of December 2024 for future earning improvement, primarily U.S and EU government."

- On CLOs: "Solely on the most senior, triple-A rated tranche"

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.