Nomura's Q3/FY2025 Results

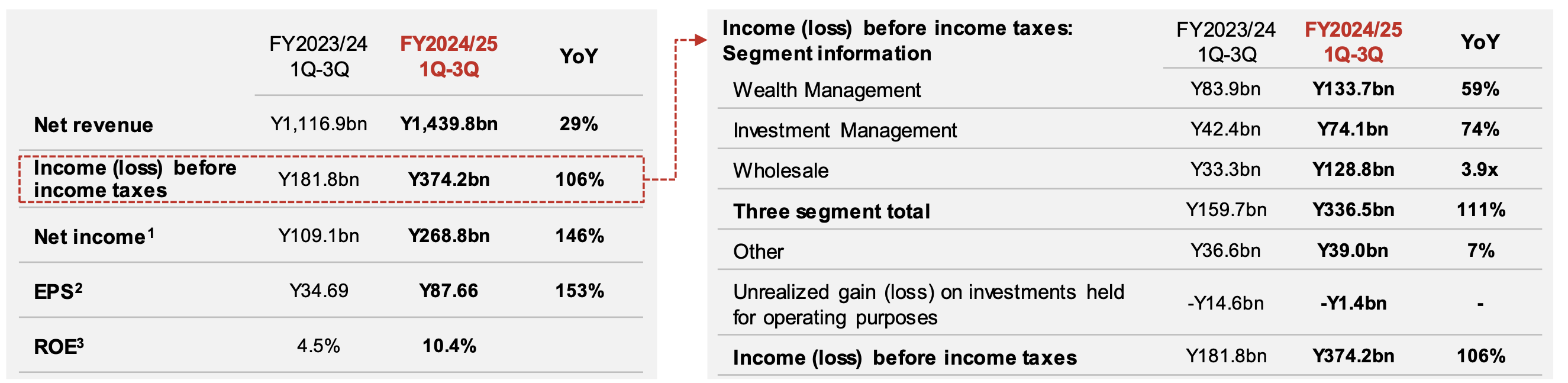

Nomura reported strong financial results for the third quarter of fiscal year 2024/25, with significant year-over-year (YoY) growth in net revenue, income before income taxes, net income, EPS, and ROE. All business segments (Wealth Management, Investment Management, and Wholesale) contributed to this growth. The company highlighted its robust financial position and progress in achieving key performance indicators (KPIs). While there were some QoQ declines in specific areas such as total sales in Wealth Management, overall, the company demonstrated strong performance.

Strong Financial Performance

- Net revenue increased 29% YoY for the first three quarters of FY2024/25, reaching Y1,439.8 billion.

- Income before income taxes increased 106% YoY to Y374.2 billion.

- Net income attributable to Nomura Holdings shareholders increased 146% YoY to Y268.8 billion.

- EPS increased 153% YoY to Y87.66.

- ROE reached 10.4% for the first three quarters.

Business Segment Performance

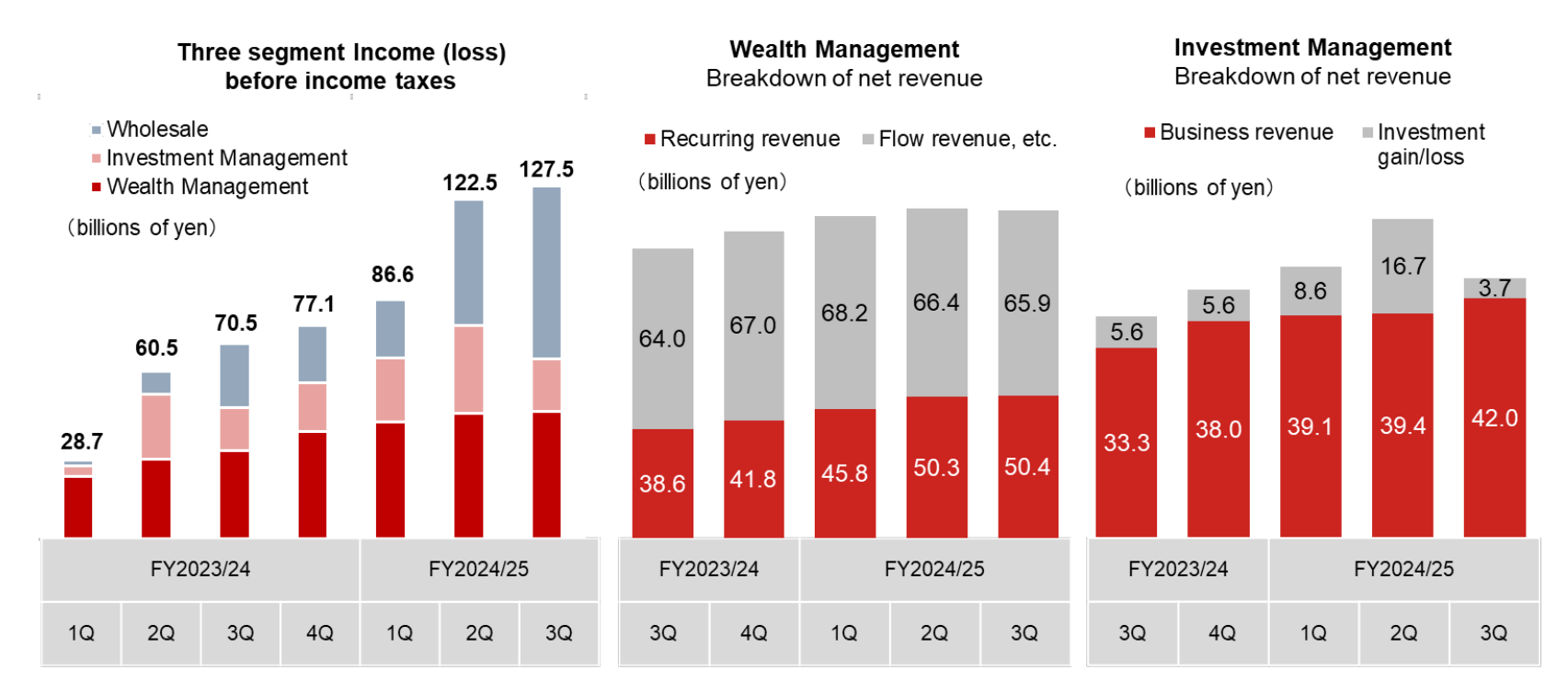

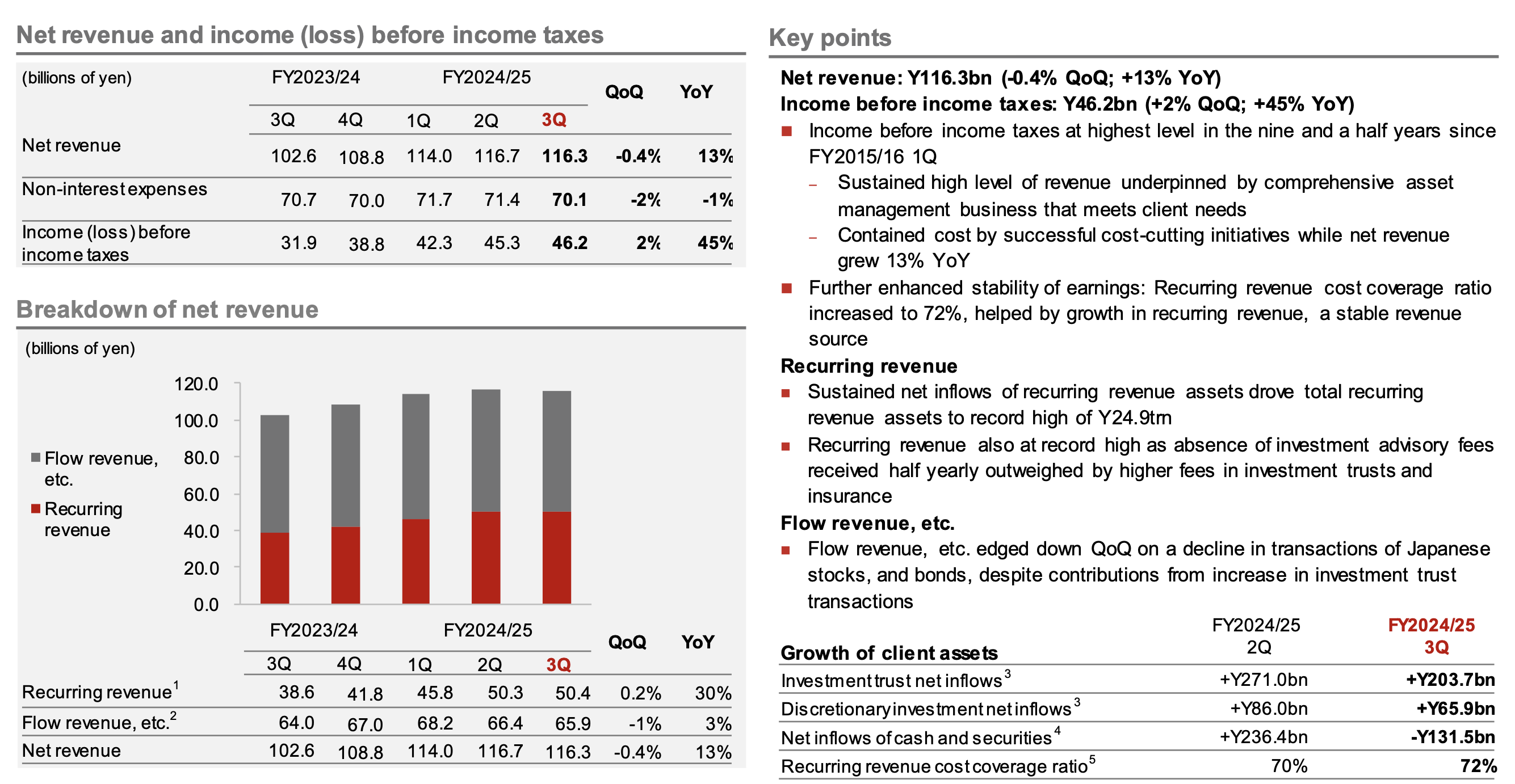

- Wealth Management: Income before income taxes at highest level in nine and a half years. Net revenue was Y116.3 billion (-0.4% QoQ; +13% YoY), and income before income taxes was Y46.2 billion (+2% QoQ; +45% YoY).

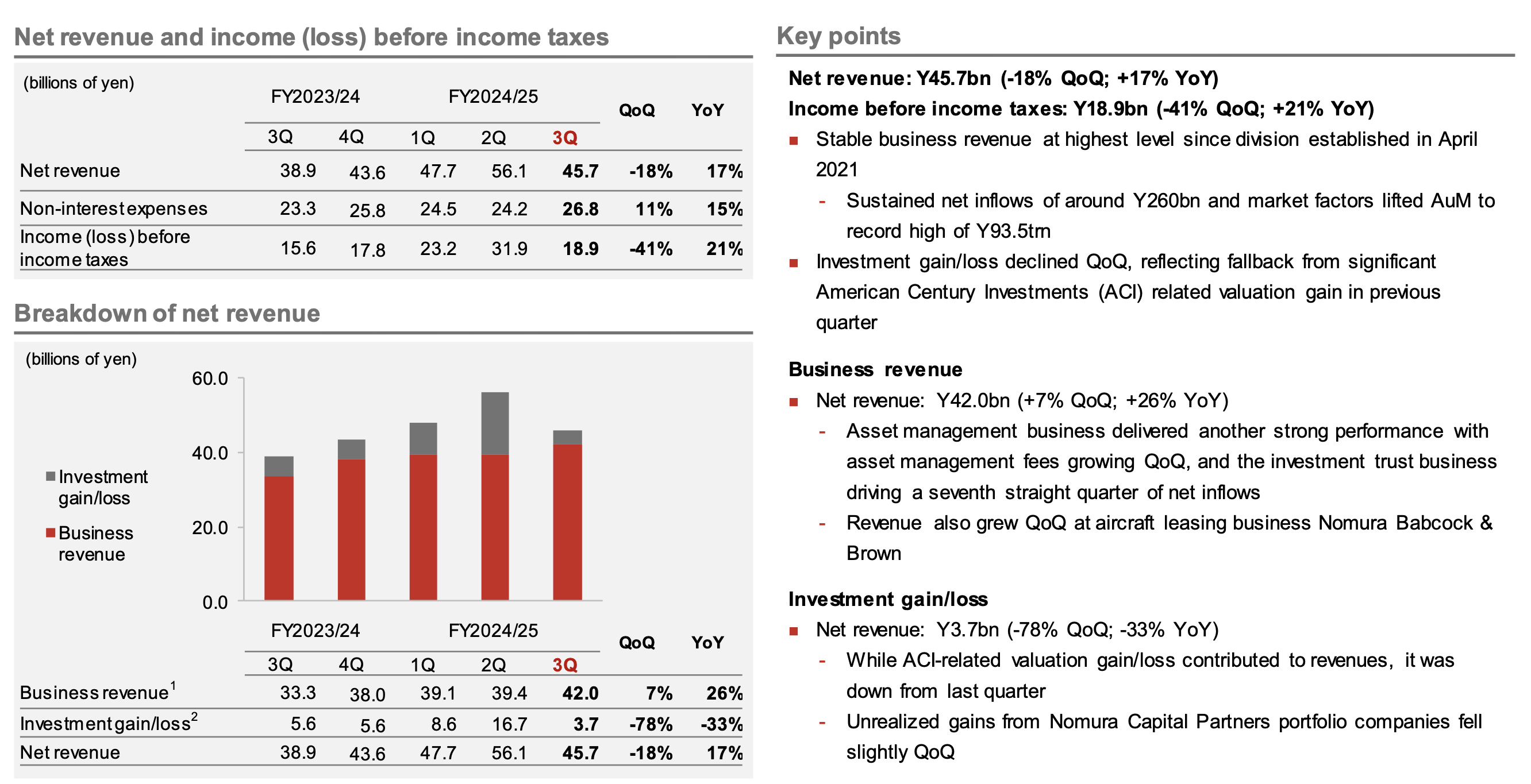

- Investment Management: Assets Under Management (AuM) reached a record high of Y93.5 trillion. Net revenue was Y45.7 billion (-18% QoQ; +17% YoY), and income before income taxes was Y18.9 billion (-41% QoQ; +21% YoY). *Quote (Presentation): "Assets under management at the end of December stood at 93.5 trillion yen."

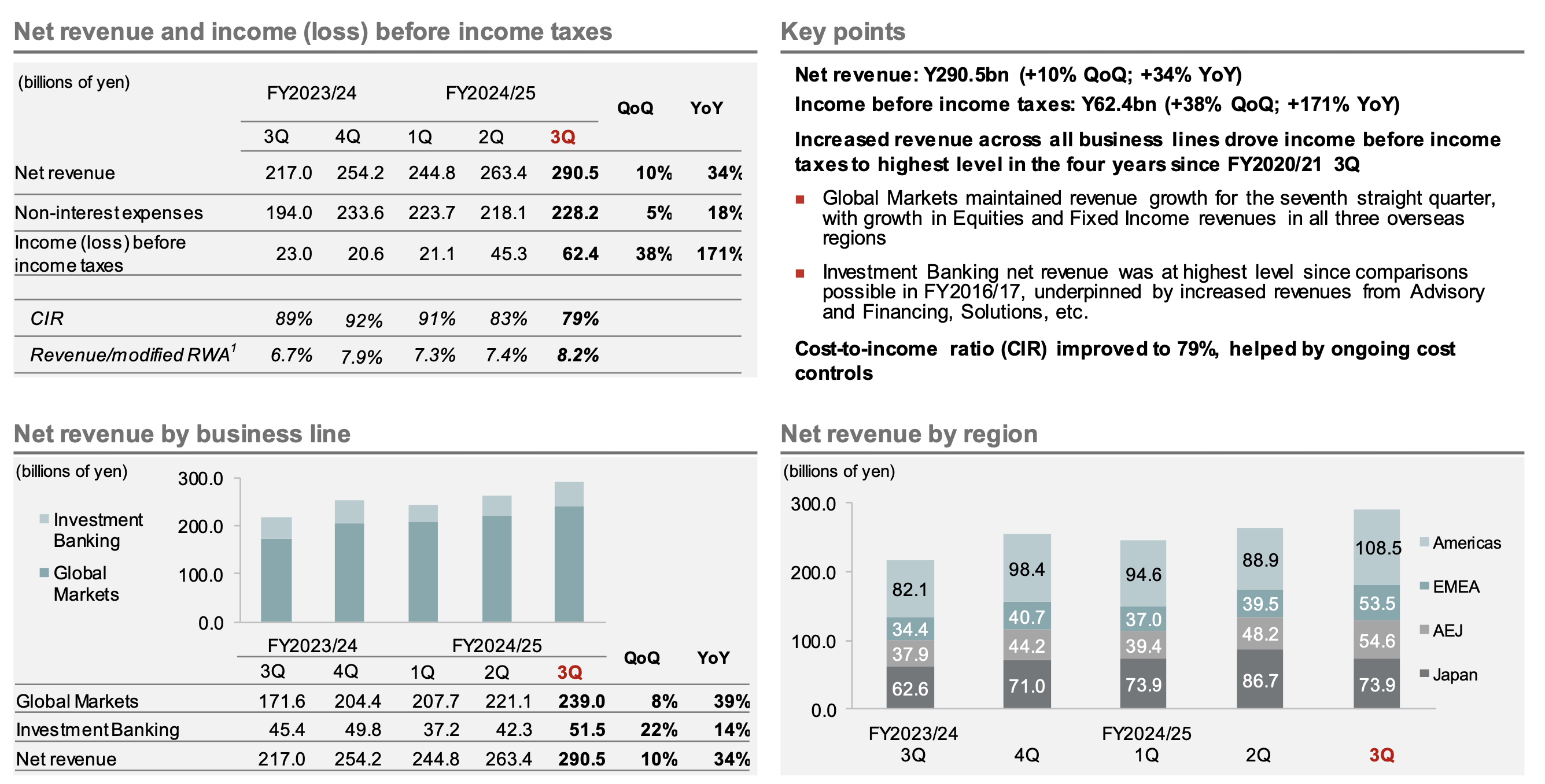

- Wholesale: Increased revenue across all business lines. Net revenue was Y290.5 billion (+10% QoQ; +34% YoY), and income before income taxes was Y62.4 billion (+38% QoQ; +171% YoY). Global Markets net revenue grew for the seventh straight quarter. Investment Banking revenues were at the highest level since comparisons possible in FY2016/17.

Wealth Management Insights

- Total sales declined 11% QoQ, primarily driven by a decrease in stock sales due to investor hesitancy ahead of political events.

- Stocks: Secondary sales of Japanese stocks decreased as investors stayed on the sidelines due to political events and range-bound markets. Primary stock subscriptions rose roughly by 40% QoQ.

- Bonds: Increased sales of Japanese government bonds (JGBs) to individual investors due to higher yen interest rates. Sales of foreign bonds declined.

- Investment Trusts: Inflows mainly into a newly established investment trust, which invests in private credit, and various global growth stock funds

- Discretionary Investments: SMA and Fund Wrap contracts declined QoQ, but demand for investment diversification remained strong

- Insurance: Sales of insurance products fell QoQ but remained at an elevated level, tapping into demand for retirement funds and estate planning

- Net inflows of cash and securities in Wealth Management totalled -Y131.5 billion, due to definitional changes in 2023/24.

- The company is ahead of target in KPIs such as net inflows of recurring revenue assets.

- Flow business client numbers ahead of FY2024/25 target (1.46mn)

- Steady growth in provision of workplace services, mainly driven by ESOP. Achieved FY2024/25 target (3.66mn) ahead of schedule

Investment Management Details

- AuM at record high of Y93.5trn.

- ETFs booked outflows of Y350bn, while investment trusts (excl. ETFs, MRFs, etc.) booked inflows of Y490bn and MRFs, etc. booked inflows of Y350bn

- Internationally, outflows from high-yield bond and Asia equity funds

Wholesale Division Highlights

- Increased revenue across all business lines drove income before income

- Global Markets net revenue grew for the seventh straight quarter on growth in EMEA, the Americas, and AEJ

- Fixed Income revenues grew 9% QoQ, driven by contributions from Securitized Products and FX/EM

- Investment Banking revenues at highest level since comparisons possible in FY2016/17 as we executed multiple M&A and ECM deals and revenues rose QoQ in all regions

Robust Financial Position

- Tier 1 capital of roughly 3.6 trillion yen, up by 0.2 trillion yen from the end of September.

- Risk-weighted assets also rose by 0.8 trillion yen to 19.9 trillion yen

- Tier 1 capital ratio of 18.1 percent and a Common Equity Tier 1 ratio

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.