Nomura reports second quarter earnings

Nomura Holdings announced its consolidated financial results for the second quarter and first half of the fiscal year ending March 31…

Nomura Holdings announced its consolidated financial results for the second quarter and first half of the fiscal year ending March 31, 2025.

Net revenue in the second quarter was 483.3 billion yen (US$3.4 billion), up 6 percent quarter on quarter and 31 percent year on year. Income before income taxes increased 29 percent from last quarter and 134 percent compared to the second quarter last year to 133.0 billion yen (US$928 million). Net income attributable to Nomura Holdings shareholders was 98.4 billion yen (US$687 million), up 43 percent quarter on quarter and 179 percent year on year.

For the six months to September, Nomura reported net revenue of 937.8 billion yen (US$6.5 billion), up 31 percent from the same period last year. Income before income taxes increased 129 percent to 235.9 billion yen (US$1.6 billion), and net income attributable to Nomura Holdings shareholders was 167.3 billion yen (US$1.2 billion), up 186 percent from the same period last year.

Wealth Management

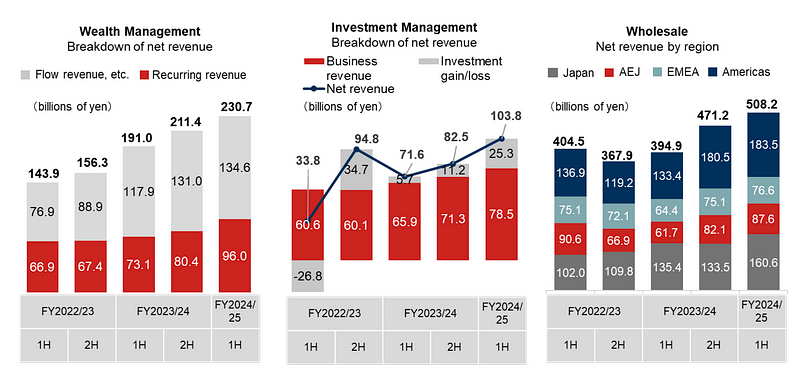

Wealth Management reported net revenue of 116.7 billion yen, increasing 2 percent quarter on quarter and 18 percent from the same period last year. Income before income taxes was 45.3 billion yen, up 7 percent quarter on quarter and 56 percent year on year.

Wealth Management booked its highest pretax income in nine years as progress in its asset management business initiatives led to a 30 percent increase in recurring revenue compared to last year.

Despite volatile markets, earnings momentum continued with net inflows of recurring revenue assets increasing to 438.3 billion yen, underscoring progress in the division’s segment-based approach and initiatives to expand the asset management recurring business. Recurring revenue was at an all-time high.

Investment Management

Investment Management net revenue was 56.1 billion yen, up 18 percent quarter on quarter and 24 percent year on year. Income before income taxes was 31.9 billion yen, increasing 38 percent from both the previous quarter and year.

Investment Management booked its strongest business revenue since it was established in April 2021 and investment gain/loss improved, doubling the division’s pretax income year on year.

The division had solid inflows of 1.1 trillion yen into the investment trust business and the investment advisory and international businesses. Private asset initiatives continued to gain traction, with alternative assets under management remaining over 2 trillion yen despite market factors (yen appreciation).

Wholesale

Wholesale reported net revenue of 263.4 billion yen, higher by 8 percent quarter on quarter and 29 percent year on year. Income before income taxes was 45.3 billion yen, up 114 percent from last quarter and 5.5 times from the previous year.

Wholesale performance rebounded strongly on higher revenues across all business lines and regions and rigorous cost controls.

In Global Markets, Macro Products and Equity Products reported stronger revenues. Investment Banking revenues grew as it supported multiple ECM deals in Japan and executed a large M&A transaction in EMEA. Cost-to-income ratio was 83 percent as revenues grew and costs were contained.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.