Nomura participates in Plasma's Seed & Series A

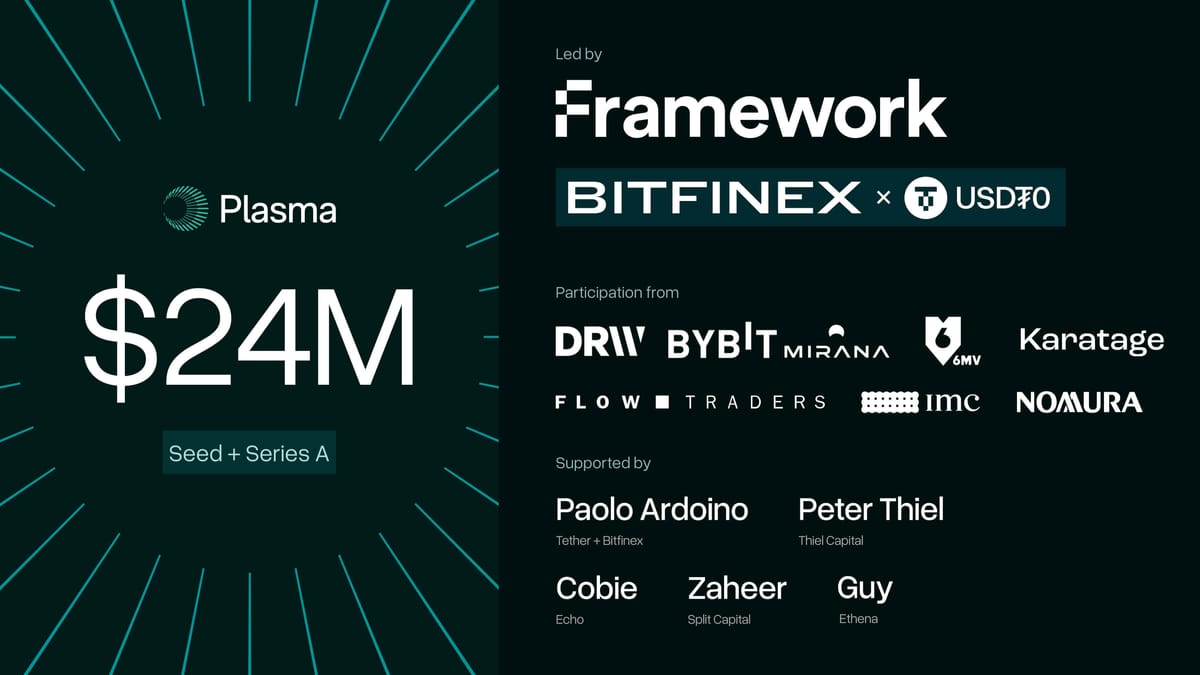

Plasma has raised $24M across their Seed and Series A, led by Framework and Bitfinex/USD₮0. Other participants include global leaders in the stablecoin and payments industry—DRW/Cumberland, Bybit, Flow Traders, 6th Man Ventures, IMC, Nomura, Karatage—as well as industry-leading angels and advisors including Paolo Ardoino, Peter Thiel, Cobie, and Zaheer Ebtikar.

The Trillion Dollar Stablecoin Opportunity

Stablecoins have emerged as one of crypto’s most critical use cases, redefining global money movement by enabling near-instant, low-cost, 24/7 global, and permissionless payments while providing access to leading fiat currencies like the US dollar.

Over the last few months, we have seen unprecedented levels of excitement about the vertical, both from traditional financial institutions and the public sector, including the White House. Consider Stripe’s $1.1 billion acquisition of Bridge, US President Donald Trump’s executive order to promote the development of dollar-backed stablecoins, US Senator Hagerty’s new stablecoin bill, and Crypto Czar David Sacks’ endorsement of stablecoins as a primary driver for US dollar dominance with the potential to generate trillions of dollars in demand for US treasuries.

Yet, despite this explosion of interest and growth, the stablecoin market faces a major obstacle: legacy blockchains limit the rate of adoption. Most blockchains were designed long before stablecoins gained traction—or even existed. Today, stablecoins have over $220 billion in supply, and trillions of dollars are transferred monthly. However, this activity currently settles on blockchains with obstacles like high transaction fees, centralization issues, high transaction failure rates, and a lack of specialized features that are required to support stablecoins from first principles. Plasma has been built to solve all of these challenges.

Plasma – The Endgame Blockchain For Stablecoins

Plasma, founded by Paul Faecks and Christian Angermayer, is the purpose-built blockchain that will drive global stablecoin adoption to the next level and unlock trillions of dollars onchain. Engineered from the ground up to address the unique needs of stablecoins, Plasma provides a scalable, efficient, and secure foundation for the next generation of money movement.

As a Bitcoin sidechain, Plasma features a trust-minimized BTC bridge and anchors state roots to Bitcoin. By combining Plasma's own consensus mechanism with a fully EVM-compatible execution layer, Plasma delivers the speed, scalability, and specialized features that stablecoins demand — all built on a robust and secure foundation.

Plasma is uniquely positioned in the market, and we aim to capture the trillion-dollar stablecoin opportunity starting with USD₮, issued by Tether. USD₮ is the largest stablecoin worldwide and commands nearly a 70% market share. Backed by Bitfinex and USD₮0, Plasma enables zero-fee USD₮ transfers, making it the most efficient and scalable blockchain for stablecoin payments available today.

Looking Ahead

This $24M raise is not just a financial milestone—it’s a strong vote of confidence in a future powered by stablecoins. As Plasma accelerate the development of their testnet as well as mainnet and expand their ecosystem to support payments, remittances, DeFi, and personal financial solutions, they remain committed to unlocking the full potential of stablecoins.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.