Nomura AM to merge "1 trillion yen fund" after long under-performance

Nomura Asset Management plans to merge the "Nomura Japan Equity Strategy Fund" (the Fund) and align it with the investment strategy of the more successful "Nomura Japan Open" (NJO) fund. These changes are driven by a comprehensive product review initiated by Nomura AM in December of the prior year, aimed at improving the overall quality and performance of the Fund.

Nomura AM acknowledges that the Fund has not delivered satisfactory performance relative to its benchmark (TOPIX, including dividends) and its peer group. After extensive internal analysis, the company has concluded that a fundamental overhaul of the Fund's investment strategy and structure is necessary. This requires merging the underlying master funds, changing the Fund's name, reducing management fees, and altering the fiscal period, all requiring investor approval.

The Fund was established in February 2000 and its net assets climbed to as high as 1.167 trillion yen ($7.8 billion) in May of that year as it profited from tech-sector bets amid the IT bubble.

But its performance has deteriorated since then, with its returns falling short of the Topix stock index in four of the past five years. The fund’s expense ratio, the cost for investors to put their money in the product, also exceeded the industry’s level, at 2.08% versus the median 1.65% in the sector. Its net assets have shrunk to around 5% of its peak, at ¥55.7 billion.

Key Proposed Changes

Nomura AM proposes the following key changes:

- Investment Strategy Alignment: The Fund's investment objective will be changed to mirror that of the "Nomura Japan Open Mother Fund." This is a significant change requiring beneficiary approval because it constitutes a "major change" to the Terms (effective June 19, 2025).

- Master Fund Merger: If approved, the Fund's underlying assets will be gradually reallocated to match the holdings of the "Nomura Japan Open Mother Fund." This will eventually lead to a merger of the two master funds, with the "Nomura Japan Open Mother Fund" surviving.

- Fund Name Change: The Fund's name will be changed to "Nomura Domestic Equity Active Open."

- Management Fee Reduction: The annual trust fee (management fee) will be reduced from 2.09% (1.90% excluding tax) to 1.672% (1.52% excluding tax) of net assets.

- Fiscal Period Change: The Fund's fiscal periods will change from March and September (ending on the 20th) to February and August (ending on the 27th).

- Change to Applicable Trust Law. The applicable trust law is changed from the old to the new.

Rationale for the Proposed Changes

Nomura AM explains its decision to propose these significant changes:

- Underperformance: The Fund has consistently underperformed its benchmark, the TOPIX (including dividends), since its inception in February 2000.

- Failed Improvement Efforts: Despite various attempts to improve performance, including changes to the investment team, investment model, and portfolio construction process, the Fund has not shown significant improvement.

- High Expense Ratio: The Fund's relatively high expense ratio has negatively impacted its performance and made it less competitive compared to similar funds.

- Lack of Added Value: Nomura AM acknowledges that the Fund has not provided sufficient added value to investors, given its persistent underperformance and high costs.

- Need for Fundamental Change: The company believes that a fundamental shift in the investment strategy is necessary to improve the Fund's prospects and serve the best interests of the beneficiaries.

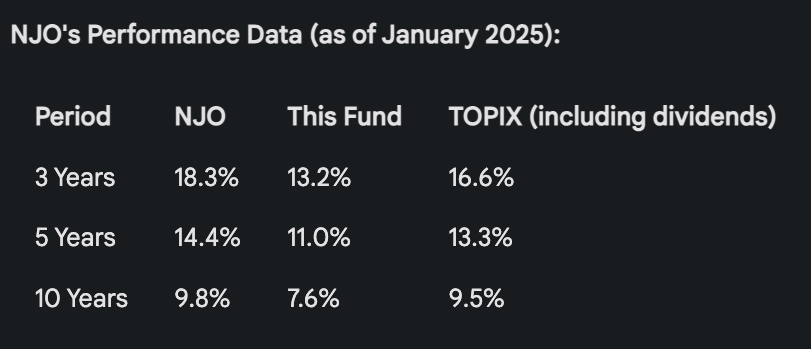

Characteristics of NJO

- Investment Philosophy: NJO employs a bottom-up approach, focusing on identifying companies with strong competitive advantages and long-term growth potential across all listed Japanese stocks.

- Focus on Change: NJO seeks companies that can adapt to changing business environments, including "growth companies" benefiting from new opportunities and "winning companies" that are consolidating market share in mature industries.

- Valuation: NJO invests in companies that are considered undervalued based on their long-term intrinsic value.

- Concentration: NJO is willing to hold concentrated positions in high-conviction stocks to achieve superior returns.

- Benchmark: NJO also uses the TOPIX (including dividends) as its benchmark.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.