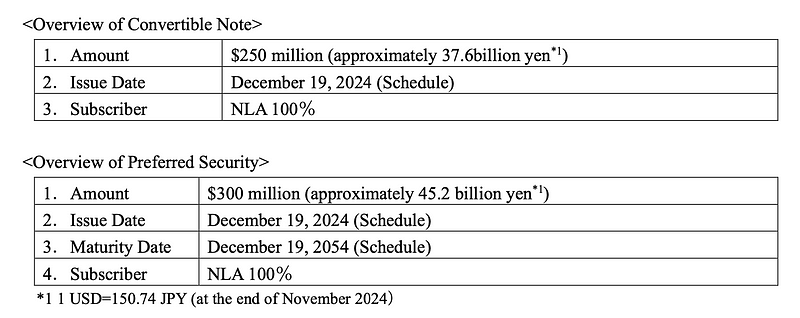

Nissay invests USD 550m in convertible note and preferred security issued by TCW

Nippon Life Insurance, Nippon Life Americas (NLA), a subsidiary of Nippon Life, and TCW, an equity-method affiliate of Nippon Life, have…

Nippon Life Insurance, Nippon Life Americas (NLA), a subsidiary of Nippon Life, and TCW, an equity-method affiliate of Nippon Life, have reached an agreement that NLA would subscribe to a convertible note and preferred security issued by TCW.

TCW, an asset management company with strengths in U.S. fixed income investments, has been contributing to the improvement of investment return of Nippon Life group’s insurance products by utilizing its advanced investment skills since Nippon Life’s investment in December 2017.

Furthermore, TCW has been providing Japanese customers with investment opportunities in global assets, mainly in the United States.

Aiming to develop the Asset Management Business as an additional pillar alongside the Life Insurance Business over the long term, Nippon Life has been promoting initiatives for raising the growth rate of the business by further strengthening businesses for third parties through the enhancement of global investment capabilities and sales.

In addition, one of Nippon Life’s top strategic priorities is to establish a global asset management capability and TCW is a core company within the group asset management business alongside Nissay Asset Management and Nippon Life India Asset Management.

In order to support for accelerated growth of TCW, Nippon Life has decided to invest in convertible note and preferred security issued by TCW through NLA.

Moreover, Nippon Life intends to commit up to $3.25 billion to TCW private credit strategies to expand TCW’s business and to strengthen Nippon Life’s investment capabilities by utilizing TCW’s investment know-how.

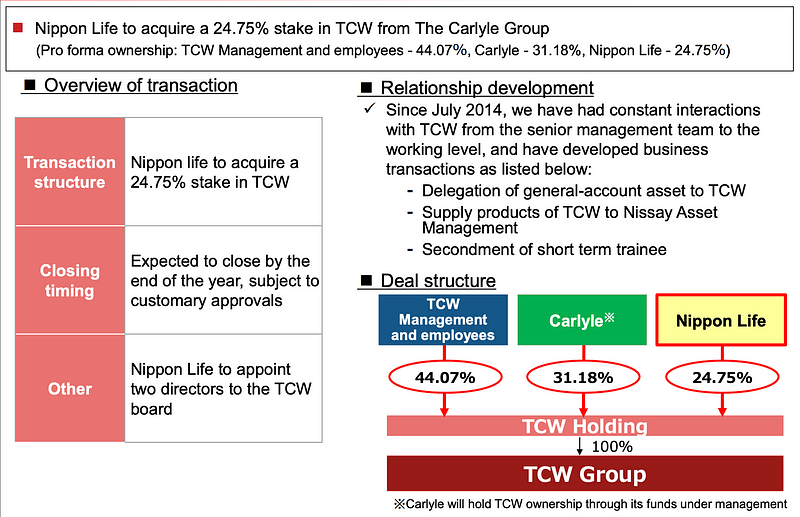

Nippon Life acquired a 24.75% stake in TCW from The Carlyle Group in 2017, and currently holds approximately 27%, which could increase substantially, depending on the terms of the convertible bond.

Nippon Life will continue to improve investment return on insurance products by acquiring and utilizing the advanced investment skills of each of its group asset management companies, thereby contributing to policyholder interests.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.