MUFG's Q3/FY2025 Results

MUFG's third quarter earnings significantly exceeded expectations, driven by strong performance in customer segments, capital markets-related business, gains from strategic shareholding sales, and equity method investment income (particularly from Morgan Stanley). Net income is already at 99% of full-year guidance. MUFG expects a positive impact from the BOJ's recent interest rate hike. Analysts at Goldman Sachs are maintaining their "Buy" rating and raising its target price, anticipating continued profit expansion.

Gemini helped us to turn the MUFG's results into a Japan FinTech Observer podcast episode, available on YouTube above, or via its Spotify page, which also includes the links to Amazon Music and Apple Podcasts.

Strong Financial Performance

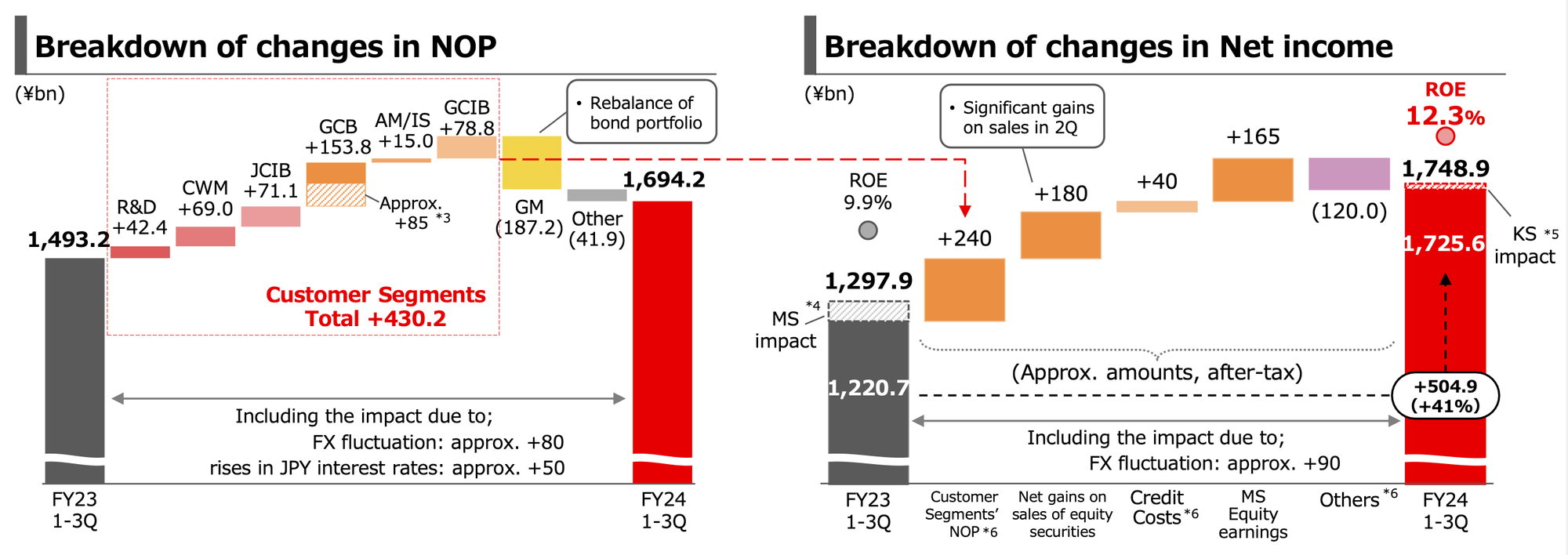

- Net Income: MUFG reported consolidated 1-3Q net business profits of ¥1,714.6 bn (+13% yoy, 87% of guidance) and net income rose 35% yoy to ¥1,748.9 bn (99% of guidance of ¥1.75 tn). This was significantly above Goldman Sachs' estimate of ¥1,545.4 bn.

- According to the MUFG Financial Highlights, the net income of ¥1,748.9bn is "Highest profits since MUFG established, driven by the increase of NOP, gains from the sales of equity securities, and the equity in earnings of equity method investees".

- Net Operating Profits (NOP): Marked record-high NOP due to sharp rise in customer segments (YoY +¥430.2bn / +30%)

Key Drivers of Profitability

- Customer Segments: Customer Segments’ NOP rises sharply with a YoY increase of +¥430.2bn.

- Strategic Shareholding Sales: Sale of large strategic shareholdings, mainly in 2Q, helped drive strong progress against full-year guidance.

- MUFG reduced its strategic shareholdings (cross-holdings) by ¥55 bn in 3Q (acquisition cost basis).

- Capital Markets and Morgan Stanley: Strong performance in US capital markets-related business and equity-method investment income (Morgan Stanley).

- Net Interest Income: Net interest income was ¥2,174.0 bn (+21% yoy).

- The MUFG Financial Highlights state that gross profits were driven by "the overseas acquisitions, an increase in net interest income with the improved margins, and captured the impact of JPY interest rate hike, favorable performance of the fee business in both domestic and global, such as solutions, wealth management and AM/IS business, and by the KS impact of ¥174.0bn".

Interest Rate Impact

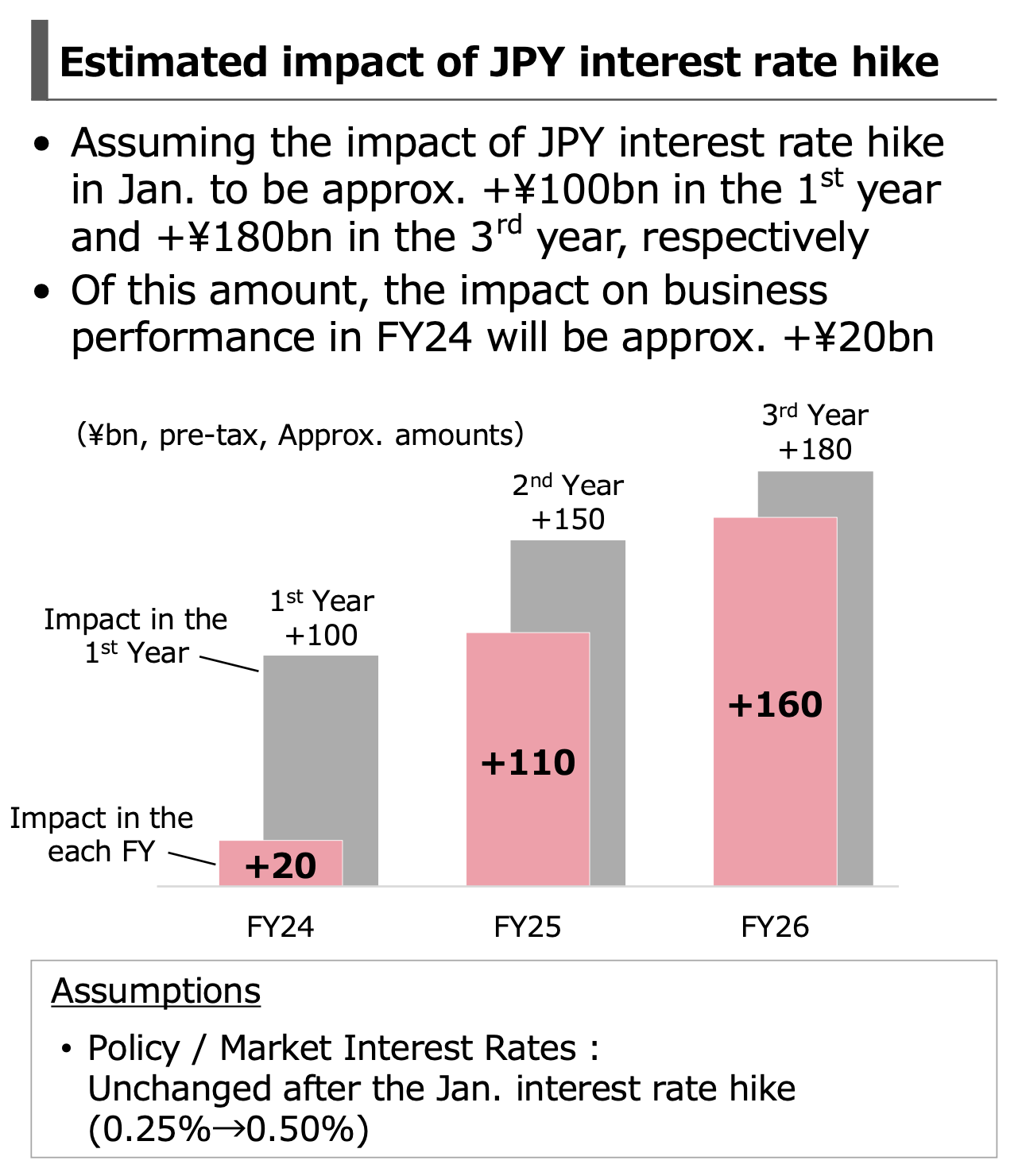

- MUFG expects the BOJ’s January 2025 rate hike to have a positive impact: +¥20 bn (pre-tax) in FY3/25, +¥110 bn in FY3/26, and +¥160 bn in FY3/27. MUFG anticipates the impact of JPY interest rate hike in Jan. to be approx. +¥100bn in the 1st year and +¥180bn in the 3rd year, respectively

Strategic Initiatives

- Capital Efficiency: MUFG is accelerating group-wide initiatives aimed at improving capital efficiency.

- Strategic Shareholding Reduction: Aiming to reduce strategic shareholdings (book value) by an aggregate ¥700 bn by end-FY3/27 versus end-FY3/24; 32% of this target was reached by the end of 3Q3/25.

- Bond Portfolio Rebalancing: MUFG saw strong progress in net income despite restructuring its foreign bond portfolio. The company will "Utilize the gains on sales of equity securities to implement initiatives enhancing the future profitability, such as bond portfolio rebalance".

- Overseas Expansion: Increased by mainly driven by the overseas acquisitions

Revised Forecasts and Target Price (Goldman Sachs)

- FY3/25-FY3/27 net income forecasts raised by +4%/+6%/+4%.

- 12-month target price lifted to ¥2,400 (24% upside), based on a target P/B of 1.29X and end-FY3/26E BPS estimate of ¥1,834.

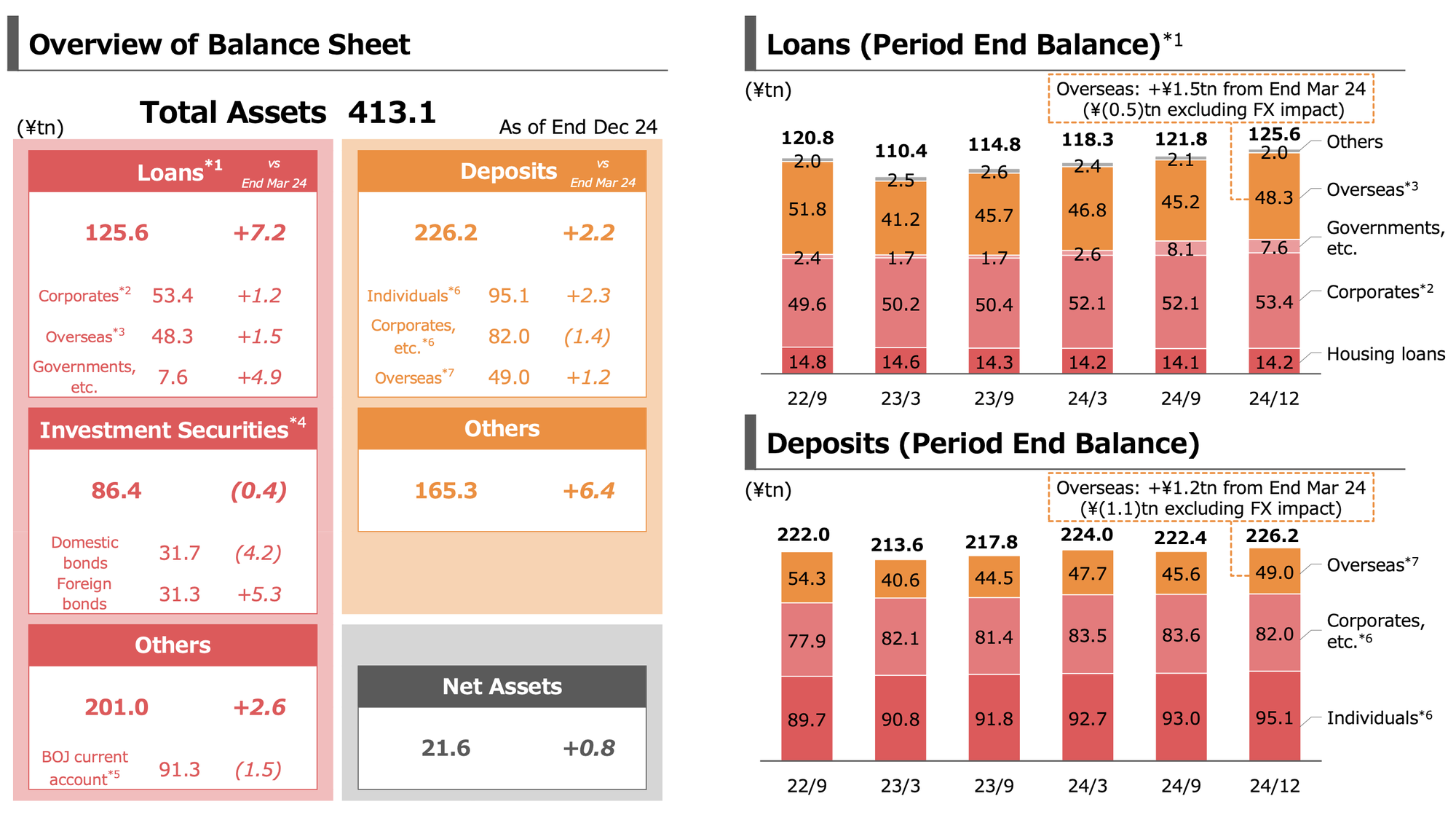

Balance Sheet Highlights

- Total Assets: ¥413.1 tn

- Loans: ¥125.6 tn (+¥7.2tn from End Mar 24)

- Deposits: ¥226.2 tn (+¥2.2tn from End Mar 24)

- The financial highlights mentions that Domestic Corporate Lending Spreads are up, and that Overseas loans increased by +¥1.5tn from end Mar.24 ((¥0.5)tn excluding FX impact) and Overseas deposits increased by Overseas: +¥1.2tn from End Mar 24 (¥(1.1)tn excluding FX impact)

Asset Quality

- NPL ratio increased slightly, from 1.40% to 1.51%.

Conclusion

MUFG's strong Q3 performance and proactive strategic initiatives position it well for continued growth. The expected positive impact from interest rate hikes and the ongoing reduction of strategic shareholdings support a positive outlook.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.