MUFG's Q3/FY2025 Results

MUFG reported a strong financial performance for the first three quarters of the fiscal year ending in March 2025, highlighting record-high net operating profits (NOP) and net income, driven by robust customer segment growth, gains from equity sales, and increased earnings from equity method investments.

The earnings release also addresses the impact of a recent JPY interest rate hike and provides a glimpse into expected performance for the remainder of the fiscal year. Key drivers include successful overseas acquisitions, improved net interest margins, growth in fee-based businesses, and the accounting impacts of changes at Morgan Stanley (MS) and Krungsri (KS).

Exceptional Profitability

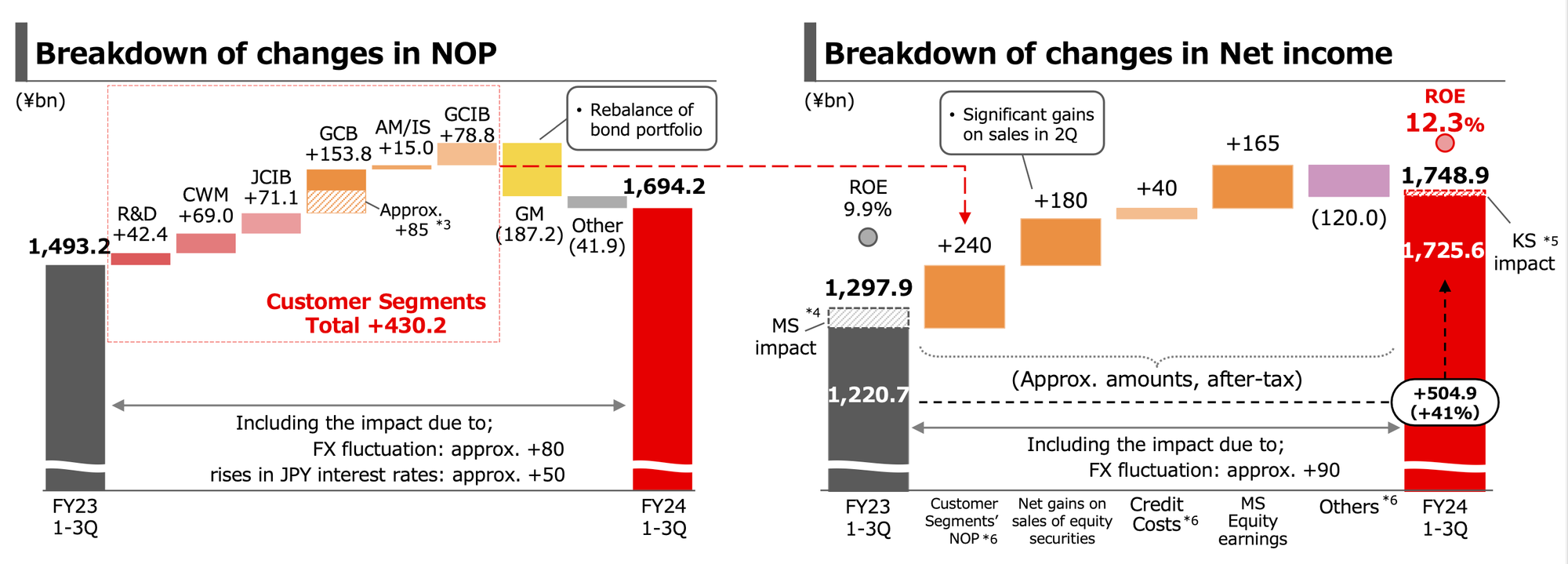

- Record-High Net Operating Profits (NOP): MUFG achieved a record-high NOP of ¥1,714.6 billion, a ¥194.4 billion increase year-over-year (YoY). This represents 87% progress towards their fiscal year target. A major driver was a sharp rise in customer segment NOP (YoY +¥430.2bn / +30%).

- Record-High Net Income: Net income reached ¥1,748.9 billion, up ¥451.0 billion YoY, representing 99% progress towards their fiscal year target. This is the highest profit since MUFG's establishment.

- Key Profit Drivers: The increased profitability is attributed to:

- Customer segment growth

- Gains from sales of equity securities

- Increased earnings from equity method investments

- Favorable foreign exchange (FX) fluctuations

- Return on Equity (ROE): ROE has increased significantly to 12.3% on a MUFG basis, surpassing their internal target of 9%.

Segment Performance

- Strong Growth in Customer Segments: Customer segments saw a significant boost of ¥430.2 billion in NOP. Specific segments like Commercial Banking & Wealth Management (CWM), Japanese Corporate & Investment Banking (JCIB), and Global Commercial Banking (GCB) showed strong year-over-year growth.

- Global Markets Challenges: The Global Markets business group experienced a significant decline in NOP due to losses in treasury activities.

- Asset Management & Investor Services (AM/IS): This segment showed solid growth, driven by the Investor Services sub-segment

- Krungsri (KS) Contribution: KS demonstrated substantial increases in gross profits and NOP, significantly contributing to the overall growth with a significant increase in income and profits

Impact of Accounting Changes

- Morgan Stanley (MS): The change in MS’s financial closing date had an impact of ¥77.2bn in the prior and ¥84.1bn in the current fiscal year due to FX translation adjustments.

- Krungsri (KS): A significant accounting change, switching the consolidated closing period for KS from January-December to April-March to align with MUFG's fiscal year, led to an impact. This had significant positive influence on the 1-3Q numbers in the current fiscal year.

Japanese Yen (JPY) Interest Rate Hike

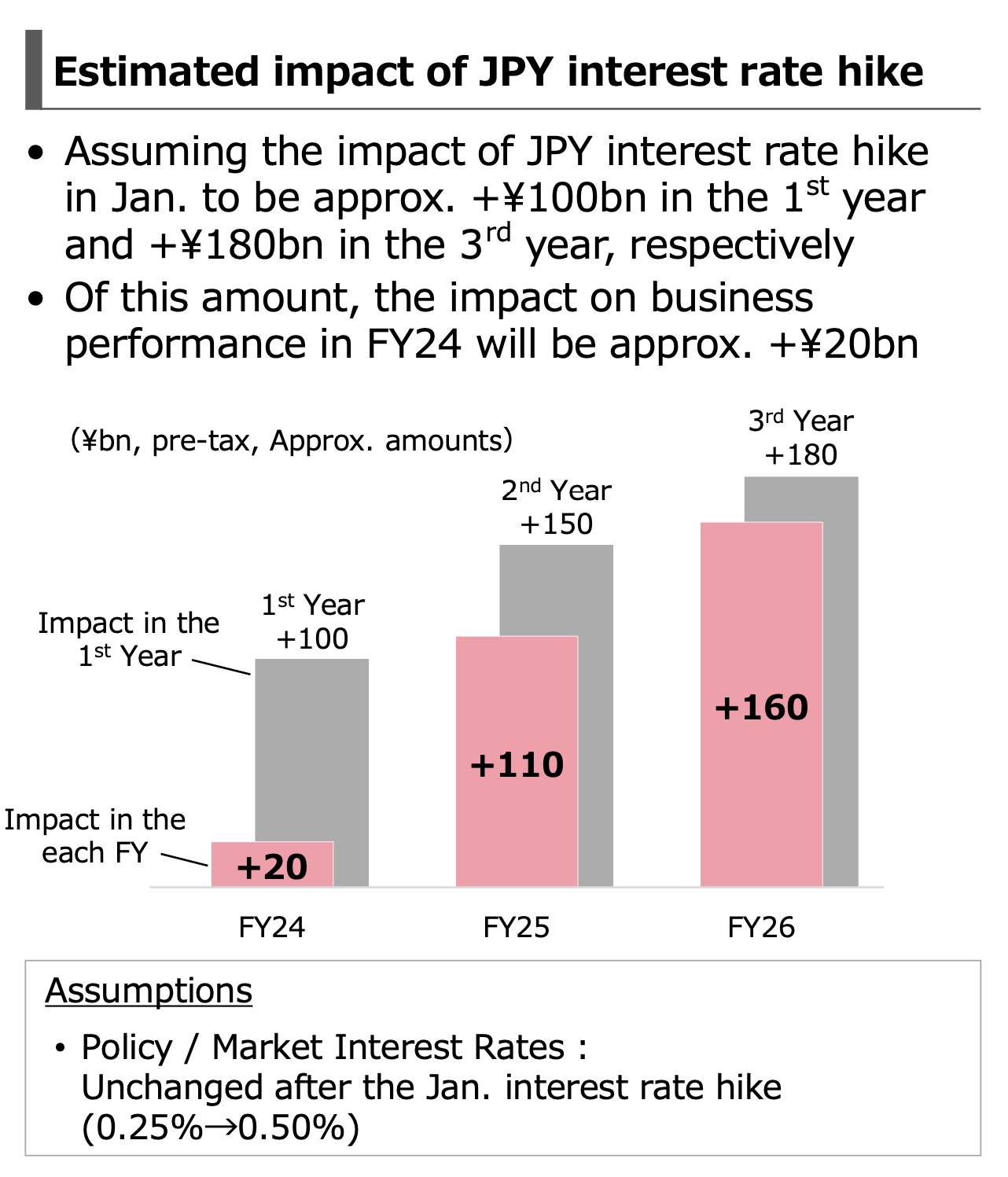

- Positive Impact: MUFG expects a positive impact from the recent JPY interest rate hike. This is estimated to be approximately ¥100 billion in the first year (with a projected +¥20bn impact in the current fiscal year) and +¥180 billion by the third year.

Equity Gains

- Strategic Use of Gains: Gains from equity sales will be utilized to enhance future profitability, including strategic bond portfolio rebalancing.

Balance Sheet Highlights

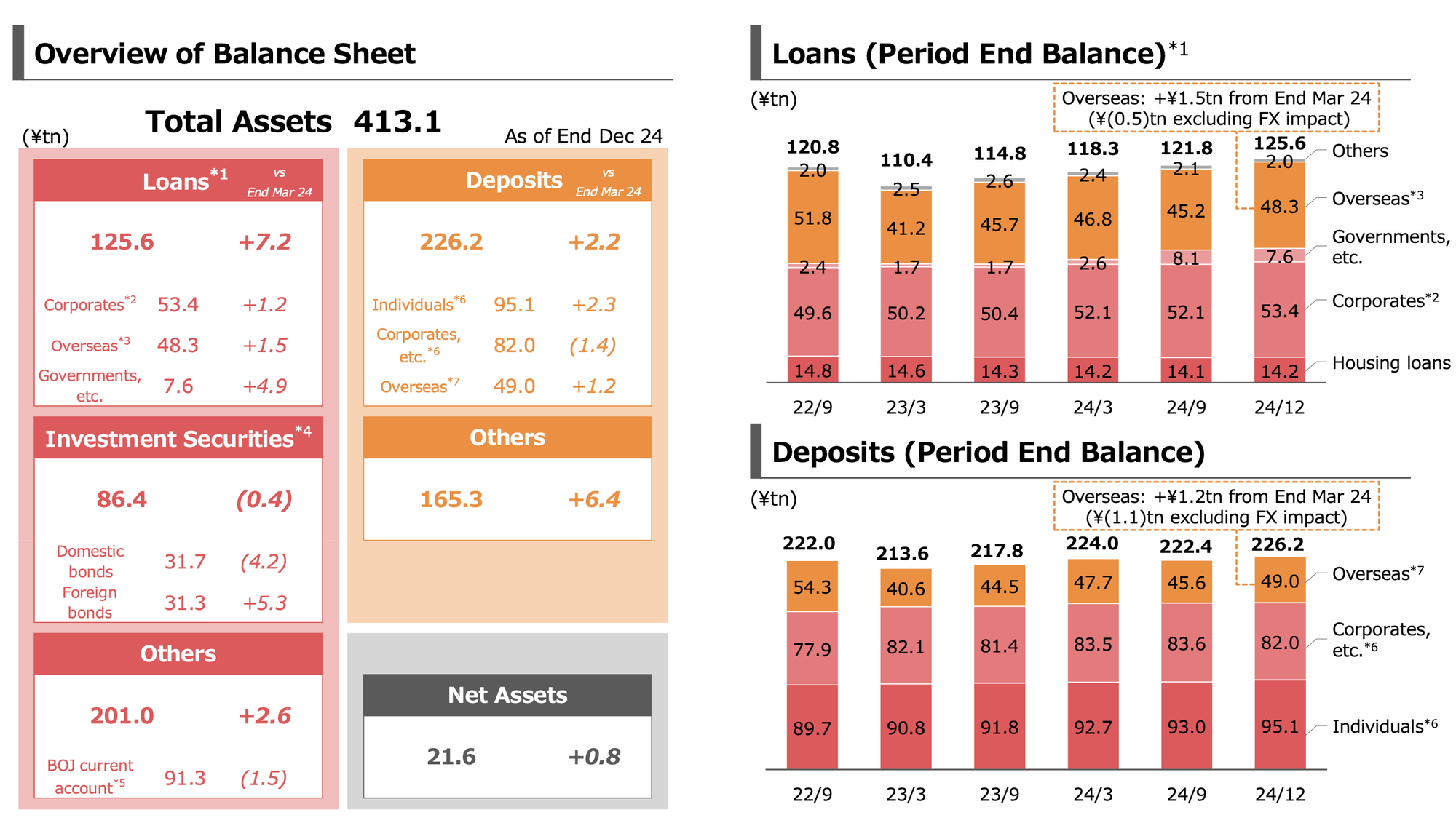

- Loan Growth: Overall loans are up, particularly overseas loans. Domestic loans are showing slight increases in spreads.

- Deposit Growth: Deposits are also increasing, particularly overseas deposits, reflecting a positive trend.

- Investment Securities: MUFG is strategically managing its investment securities portfolio, rebalancing and selling equity holdings. The sold amount of equity holdings was ¥225bn in the 3Q for the current fiscal year, leading to a total of ¥473bn agreed to be sold over this and the next two fiscal years.

- Asset Quality: While Non-Performing Loans (NPL) ratios saw slight increases, total credit costs decreased due to the absence of the previous year's provision for credit losses at the Bank.

Implications

- Positive Outlook: The earnings release paints a highly positive picture of MUFG’s current financial health and future outlook.

- Strategic Execution: MUFG's strategy of growth in customer segments, strategic equity sales, and the positive impact of a JPY interest rate hike are clearly paying off.

- Proactive Management: MUFG is actively managing its balance sheet and investment portfolio to maximize profitability and prepare for future market conditions.

- Global Expansion: Overseas operations are a significant driver of growth.

Key Action Points (Potential)

- Monitor JPY interest rate impact: Closely track the actual impact of the interest rate hike on business performance over the coming quarters and ensure to take full benefit.

- Strategic Bond Portfolio Rebalancing: Continue and monitor effectiveness of initiatives to rebalance bond portfolio

- Continue Focus on Core Growth Areas: Focus on growth in customer segments and global operations, while managing any underperforming segments.

- Maximize Gains from Equity Sales: Continue to strategically manage the equity holdings and realize benefits

- Track KS Integration: Track the positive impact of Krungsri’s performance on the Group

Conclusion

MUFG's Q3 FY24 results show a financial institution operating at a high level, with significant profitability and a clear strategy for continued growth. The successful execution of strategic initiatives and favorable market conditions have resulted in strong performance.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.