MUFG H1/2025: Smashing expectations and raising the bar

Mitsubishi UFJ Financial Group (MUFG) delivered a stellar performance in the first half of fiscal year 2025, exceeding expectations and…

Mitsubishi UFJ Financial Group (MUFG) delivered a stellar performance in the first half of fiscal year 2025, exceeding expectations and prompting an upward revision of full-year targets. The results, announced on November 14, 2024, showcase the bank’s robust financial health and strategic execution.

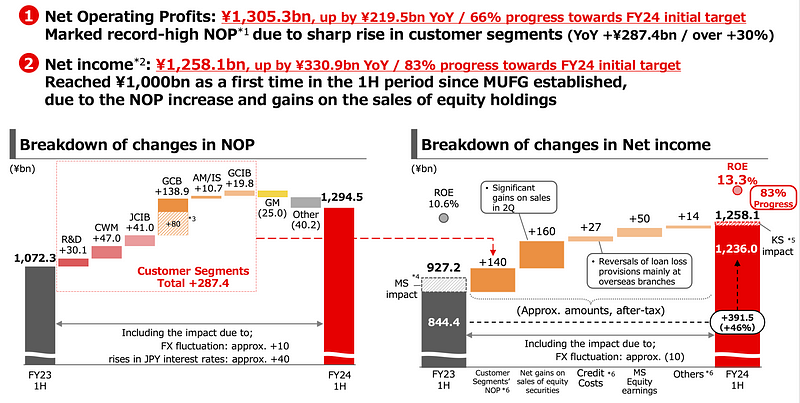

Profit Surge: A Record-Breaking First Half

MUFG’s consolidated net business profits for the first half soared to ¥1,305.3 billion, a remarkable 21% increase year-over-year. This represents a whopping 66% of the initial full-year guidance of ¥1.95 trillion. Net income also saw a significant jump, reaching ¥1,258.1 billion, a 36% increase compared to the same period last year. This figure includes a ¥22.1 billion impact from a change in the Bank of Ayudhya’s accounting period.

Importantly, this first-half net income represents an impressive 83% of the full-year guidance of ¥1.5 trillion, surpassing consensus estimates from both Goldman Sachs (GSe: ¥985.2 bn vs. ¥966.9 bn consensus) and Bloomberg (¥1,179.5 bn consensus).

Several factors contributed to this impressive profit growth:

- Booming Customer Segments: Net operating profits in the customer segment saw substantial growth, adding ¥287.4 billion (over 30%) year-over-year. This highlights MUFG’s ability to capitalize on favorable market conditions and deepen customer relationships.

- Strategic Shareholdings Sales: Gains from the sale of large strategic shareholdings in the second quarter provided a significant boost to profits.

- Loan Loss Provision Reversals: Overseas loan loss provisions were reversed, further contributing to the profit surge.

- Rising Yen Interest Rates: The impact of the Bank of Japan’s July interest rate hike added approximately ¥40 billion to net operating profits, demonstrating MUFG’s positive sensitivity to rising rates. This positive impact is expected to continue, with estimates of +¥25bn for FY24, +¥40bn for FY25 and +¥80bn for FY26.

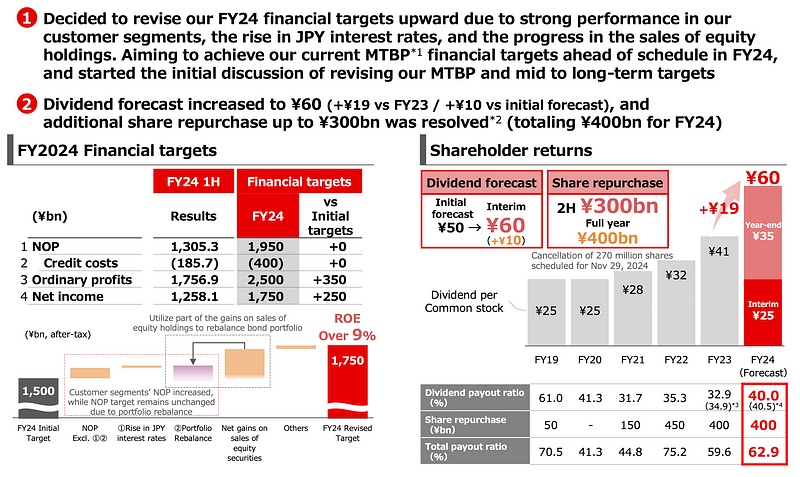

Raising the Roof: Upward Revision of Financial Targets

Given the stronger-than-expected first-half performance and the anticipated impact of the Bank of Japan’s interest rate hike, MUFG confidently raised its full-year net income guidance by 17%, from ¥1.5 trillion to ¥1.75 trillion. This revised guidance exceeds the Bloomberg consensus of ¥1.62 trillion and the net income target of ¥1.6 trillion set in the medium-term plan ending in FY3/27.

Management’s commentary during the results briefing hinted at the potential for even greater things to come. With the bank on track to achieve its Return on Equity (ROE) target of around 9% ahead of schedule, potentially reaching 9–10%, MUFG is initiating a review of its medium-term plan. This suggests that the bank may set even more ambitious targets for the future, reflecting its strong momentum.

Sharing the Wealth: Increased Dividends and a ¥300 Billion Buyback

In line with its 40% payout ratio policy, MUFG increased its full-year dividend per share (DPS) guidance from ¥50 to ¥60. This represents a ¥19 increase compared to FY23 and a ¥10 increase from the initial forecast. Furthermore, the bank announced a share buyback of up to ¥300 billion (1.96% of outstanding shares), surpassing market expectations of ¥200–250 billion. The buyback will take place from November 15, 2024, to March 31, 2025. This combined approach, with a total payout ratio of 63% and a total return yield rising to 5.3%, signals MUFG’s commitment to returning value to shareholders.

Strong Capital Position: CET1 Ratio Exceeds Target

MUFG’s Basel III final Common Equity Tier 1 (CET1) ratio, excluding Accumulated Other Comprehensive Income (AOCI), increased by 80 basis points to 11.2% in the second quarter, up from 10.4% in the first quarter. This exceeds the company’s target range of 9.5–10.5%, demonstrating the bank’s robust capital position. While the CET1 ratio is expected to dip below the 10.5% ceiling by the end of FY3/25 due to factors like profit concentration in the first half and anticipated RWA growth in the second half, MUFG remains well-capitalized.

Strategic Asset Allocation: Equity Holdings Reduction

MUFG is actively managing its equity holdings. Based on evolving market conditions and progress in ongoing negotiations, the bank raised its reduction target for equity holdings to ¥700 billion during the current medium-term business plan (MTBP) period. This strategic move aims to optimize the bank’s investment portfolio and further enhance capital efficiency. Simultaneously, MUFG aims to reduce its equity holdings to less than 20% of net assets during the current MTBP period.

Segment Performance Overview

A closer look at the performance of individual business groups provides further insights into MUFG’s strengths:

- Retail & Digital Business Group (R&D): NOP growth driven by higher interest income from rising rates and a recovery in consumer finance.

- Commercial Banking & Wealth Management Business Group (CWM): Strong performance across all products, with growth in loan and deposit interest income and wealth management business benefiting from a favorable stock market.

- Japanese Corporate & Investment Banking Business Group (JCIB): Increased NOP driven by higher interest rates, improved lending spreads, and increased fee income from solutions and M&A activities.

- Global Commercial Banking Business Group (GCB): Higher NOP driven by loan growth, particularly at Adira Finance, though net income was affected by rising credit costs.

- Asset Management & Investor Services Business Group (AM/IS): Growth in Assets Under Management (AuM) and successful expansion of bundled services and M&A activity in the investor services sector contributed to higher NOP.

- Global Corporate & Investment Banking Business Group (GCIB): Increased project finance fees, primarily in the US, and higher net interest income from lending contributed to NOP growth, while net income was affected by higher credit costs.

- Global Markets: Strong performance in FX products amidst market volatility, while fixed-income trading underperformed.

Transformation and Innovation: Towards an AI-Native Future

Beyond its financial achievements, MUFG is also focused on driving transformation and innovation. The bank is actively exploring and implementing Artificial Intelligence (AI) solutions, including expanding the use of ChatGPT and collaborating with other companies on cutting-edge AI technologies. These initiatives are part of a broader effort to enhance digital service competitiveness, improve customer experience, and foster a more agile and innovative organizational culture.

Addressing Administrative Actions and Governance

MUFG is also taking proactive steps to address previous administrative actions. The bank has established a framework to prevent recurrence and is focused on implementing improvement measures across six key areas. This includes revising procedures and rules, enhancing training, reviewing performance evaluations, strengthening monitoring frameworks, and enhancing overall management framework. These efforts underscore MUFG’s commitment to enhancing governance and risk management practices.

Conclusion:

MUFG’s outstanding first-half results for fiscal year 2025 are a testament to its strong business model, strategic execution, and ability to adapt to a changing environment. The bank is well-positioned for continued success, with its focus on customer-centric growth, innovation, and shareholder value creation. The upward revision of financial targets, increased dividends, and substantial share buyback signal MUFG’s confidence in its future prospects and its commitment to delivering strong returns to investors. The ongoing efforts in AI development and addressing governance issues further enhance the bank’s long-term outlook.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.