Money Forward presents first quarter results

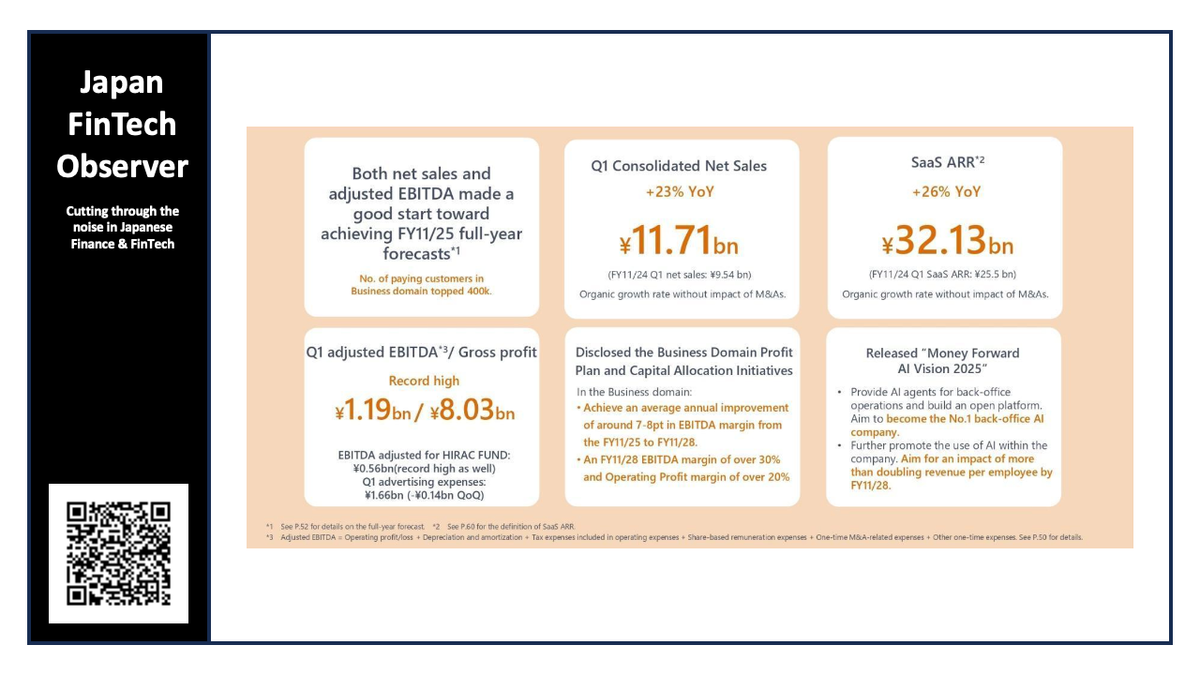

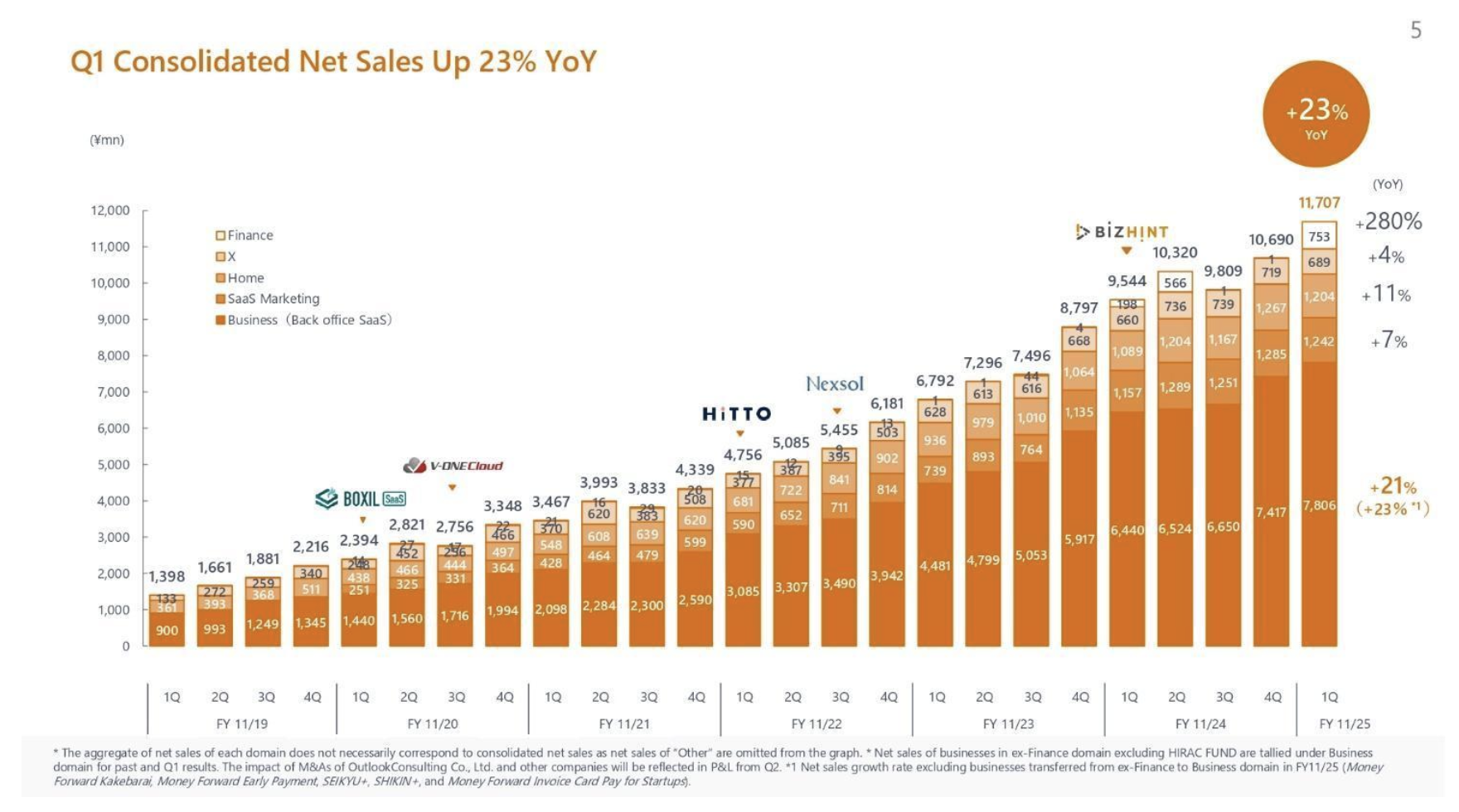

Money Forward reported strong Q1 FY2025 results, demonstrating significant year-over-year (YoY) growth in sales (23%), SaaS ARR (26%), and adjusted EBITDA, achieving record highs.

The company is confident in achieving its full-year forecast. Key strategic initiatives highlighted include a proactive approach to potential macroeconomic risks (specifically related to US tariff policies), the unveiling of their "Money Forward AI Vision 2025" focusing on "AI Transformation" (AX), and a detailed business domain profit plan aiming for substantial margin improvement by FY2028.

Furthermore, Money Forward announced strategic capital allocation initiatives, including the transfer of the insurance agency business and considerations for alliances or stake transfers in other domains. The company emphasizes its "Talent Forward" and "Society Forward" strategies and the ongoing evolution of its integrated report into a "Vision Report."

1. Strong Q1 FY2025 Financial Performance

- Record Highs: Money Forward achieved record highs in Q1 for sales (JPY11.71 billion, +23% YoY), gross profit (JPY8.03 billion), and adjusted EBITDA (JPY1.19 billion). Even excluding the impact of proceeds from the HIRAC FUND sale, EBITDA reached a record JPY0.56 billion.

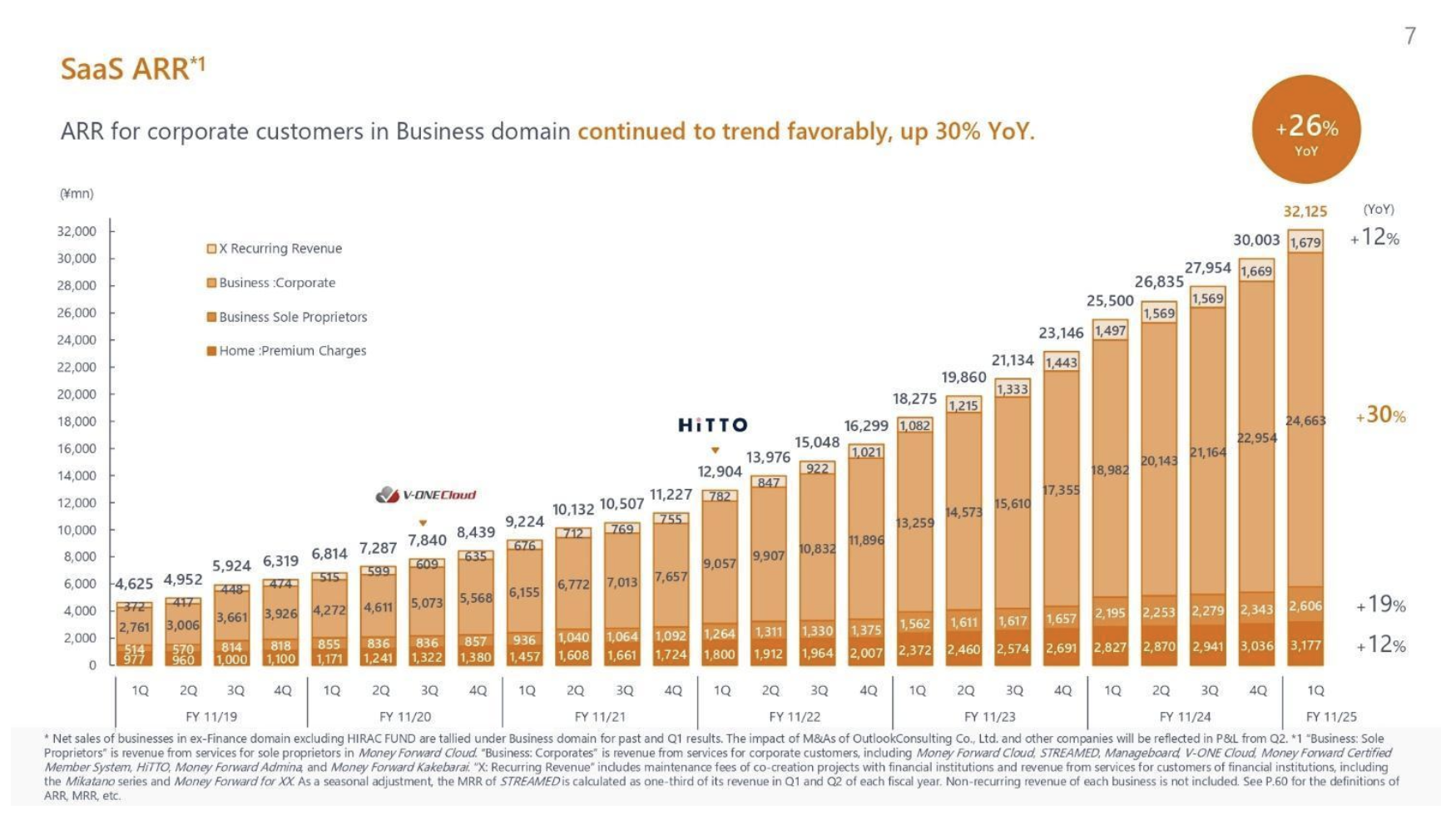

- Robust SaaS ARR Growth: SaaS ARR grew by a healthy 26% YoY to JPY32.13 billion, entirely organic without M&A contributions. Corporate recurring revenue within the business domain showed strong growth of 30% YoY.

- Positive KPIs: The number of paying corporate customers exceeded 400,000. Medium-sized company ARR, a key focus area, grew significantly at 41% YoY. Corporate ARPA also showed an upward trend, increasing by over 3% YoY.

- Confidence in Full-Year Guidance: The company stated they have "made a good start toward achieving our full-year forecast for both net sales and adjusted EBITDA for Q1."

2. Proactive Response to Macroeconomic Uncertainty

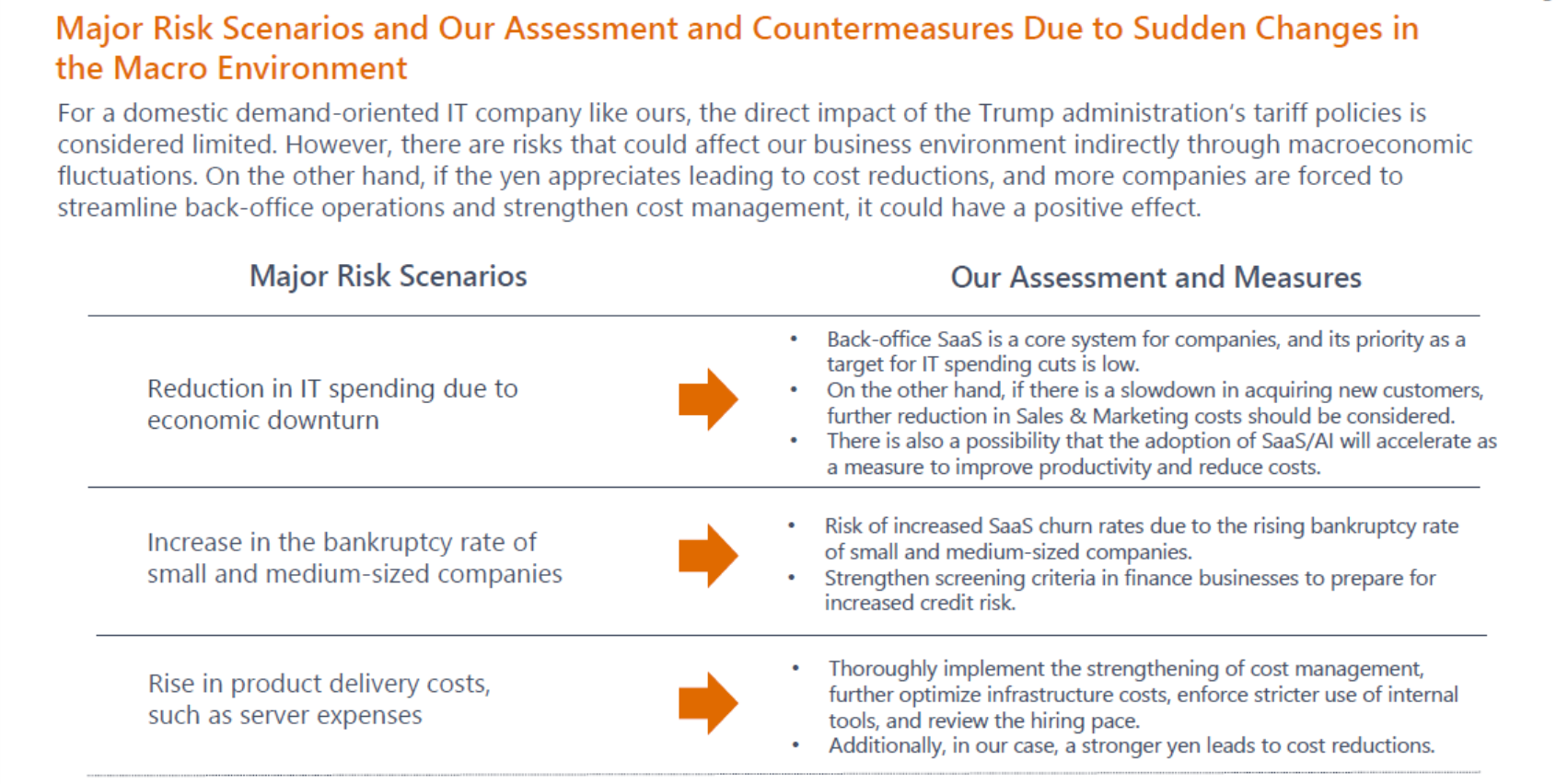

- Awareness of Risks: Money Forward acknowledges the rapidly changing macro environment and the uncertainty stemming from factors like President Trump's tariff policy.

- Three Main Risk Scenarios Identified:

- Reduction in IT spending due to economic downturn.

- Increase in customer bankruptcy rates.

- Rise in product delivery costs due to supply chain changes from tariffs.

3. "Money Forward AI Vision 2025" and AI Transformation (AX)

- Shift from DX to AX: The company is moving from Digital Transformation (DX) to AI Transformation (AX), envisioning a future where "digital workers work instead of people."

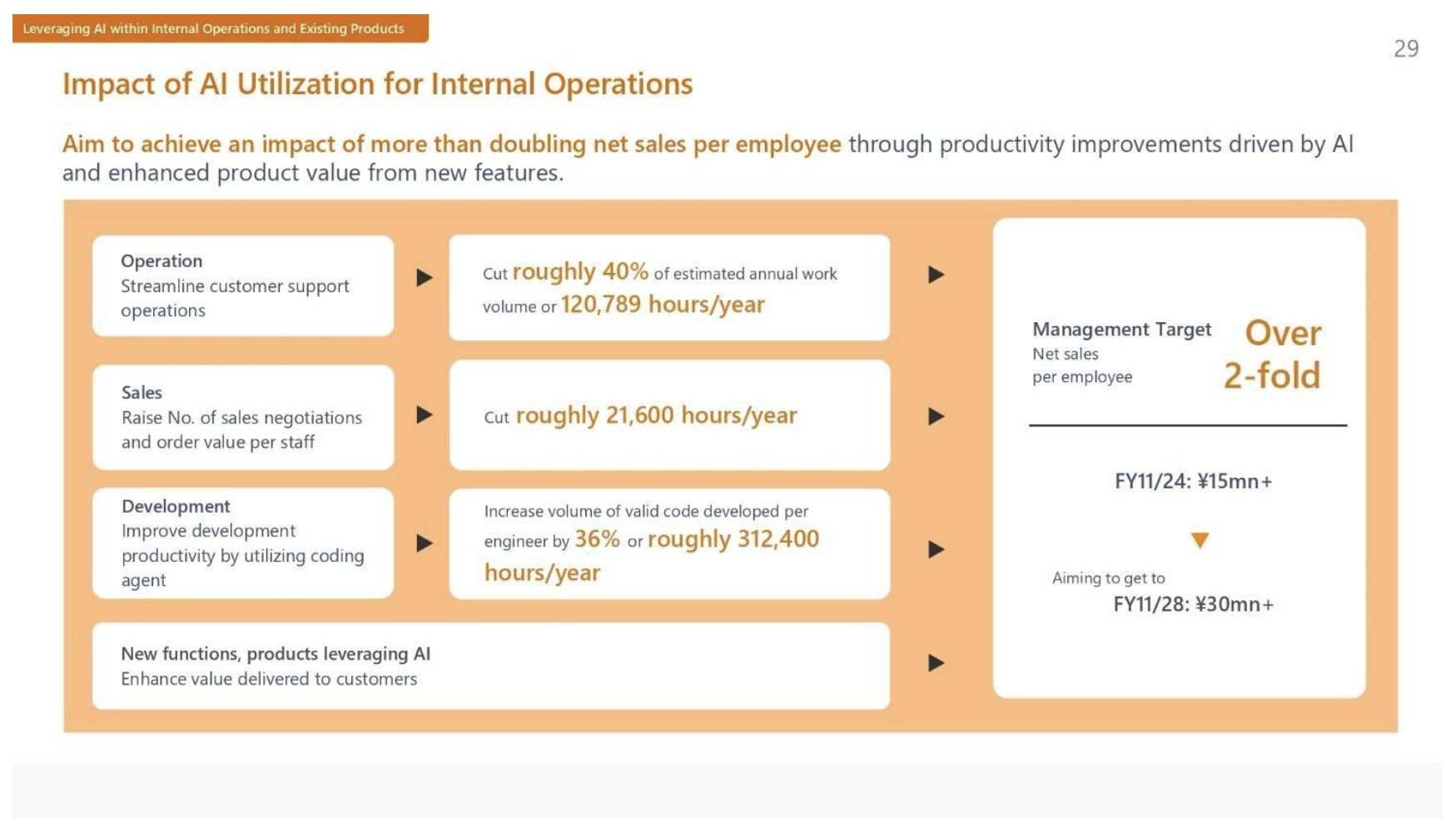

- Leveraging AI Internally and in Existing Products: Money Forward is actively implementing AI to improve internal productivity (aiming to more than double sales per employee by FY2028) and enhance existing products (e.g., Money Forward Cloud Accounting Plus, Cloud Contracts).

- AI Agent Concept and Open Ecosystem: The core of the AX vision involves AI agents that autonomously perform back-office tasks, possess high expertise, and continuously learn. Money Forward aims to build an open ecosystem where their AI agents and those of partners can connect with various SaaS services and data through a central data mart.

- AX Consulting: Money Forward will offer AX consulting services to medium- to large-sized companies and financial institutions, leveraging their existing consulting arms and back-office know-how.

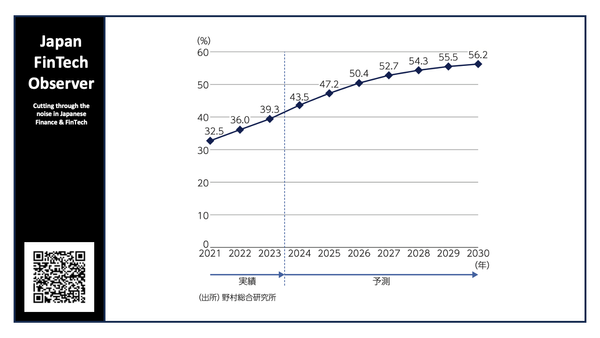

- Significant Market Potential: Money Forward sees a large Total Addressable Market (TAM) for AI-powered solutions, estimating it could replace a significant portion of labor costs.

4. Business Domain Profit Plan and Capital Allocation Optimization:

- Ambitious Margin Improvement Targets: Money Forward disclosed its business domain profit plan, targeting an average EBITDA margin improvement of 7% to 8% per year from FY2025 to FY2028, aiming for a margin of 30% or more and operating income of 20% or more in the business domain by FY2028. This is crucial for achieving the company-wide targets of JPY100 billion+ in sales and JPY30 billion+ in EBITDA by FY2028.

- Strategic Cost Management: The plan involves optimizing the recording of advertising, personnel, and SG&A expenses while monitoring investment efficiency. While sales are expected to grow strongly, the rate of increase in these costs will be controlled to generate profits.

- Focus on Acquisition Efficiency: The target CAC Payback Period, especially in the mid-market, is aimed to be within 18 to 24 months.

- Rule of 40 Target: Money Forward aims to achieve the Rule of 40 in FY2026, indicating a balance between growth and profitability.

- Sequential Change of Business Resources: The company is strategically reallocating business resources to maximize corporate value. This includes focusing on the core corporate back-office SaaS business, particularly in the medium-sized segment with high ARR growth.

- Home Domain JV: The strategic joint venture with Sumitomo Mitsui Card (Money Forward holding 51%) aims to accelerate growth in the Home business and generated a significant cash inflow for the Group.

- Transfer of Insurance Agency Business (Nexsol): The insurance agency business was transferred to Sumitomo Mitsui Card and Sony Life Insurance as part of a strategic review. Money Forward expects to record a gain in Q2 due to this transaction and has revised its net sales forecast accordingly (consolidated and Home domain). Adjusted EBITDA and operating profit forecasts remain unchanged.

- Consideration for X Domain and SaaS Marketing Domain (Smart Camp): While the X domain has been spun off, the company is considering capital and business alliances. Similarly, with Smart Camp aiming for an IPO, Money Forward has started considering the transfer of its equity stake.

5. Talent Forward and Society Forward Initiatives:

- Emphasis on Human Capital: "Talent Forward" is a key theme, with an annual report detailing the Group's human capital policy, future growth, and initiatives. The "Talent Forward 2025" report was recently published.

- External Recognition: Money Forward has received several "Great Place to Work" awards and recognition in the "ONE CAREER Job Search Review Award," highlighting a positive company culture."

- Vision Report (Formerly Integrated Report): The annual report has been renamed "Vision Report" and focuses on the company's future aspirations, roadmap, and the contributions of its employees, providing qualitative insights beyond financial data.

Conclusion

Money Forward's Q1 FY2025 results demonstrate a continuation of strong growth and improving profitability. The company is proactively addressing potential macroeconomic headwinds while simultaneously outlining an ambitious future driven by its "AI Vision 2025." The strategic shift towards AX, the development of AI agents, and the focus on building an open ecosystem signal a significant evolution in their business strategy. Furthermore, the detailed business domain profit plan and strategic capital allocation decisions indicate a clear path towards achieving their mid- to long-term financial targets and maximizing shareholder value. The emphasis on talent and their broader vision ("Society Forward") underscores a holistic approach to growth and impact.