Mizuho's Q3/FY2025 Results

Mizuho Financial Group reported results for the third quarter of the current fiscal year, providing an assessment of its performance, strategy, and outlook.

Financial Performance & Outlook

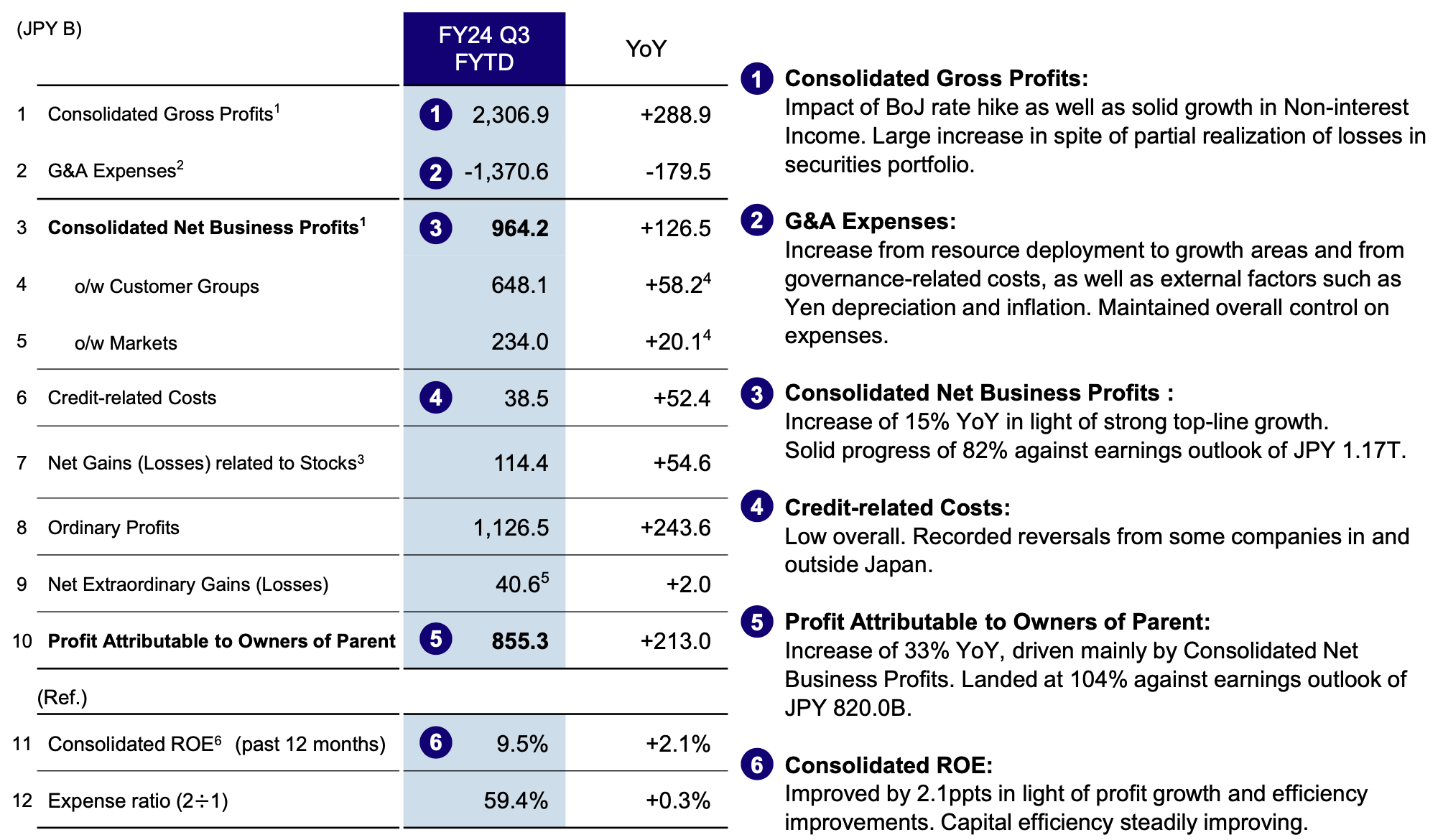

- Strong Q3 FY24 Performance

- Consolidated net business profits + ETF gains/losses: ¥964.2 bn (+15% YoY), 82% of FY3/25 guidance, exceeding analyst expectations

- Net profits: ¥855.4 bn (+33% YoY), 104% of FY3/25 guidance.

- Revised Earnings Estimates

- Goldman Sachs increased FY3/26-3/27 net profit estimates by +4%/+4% "to factor in stronger net interest income and an increase in some operating expenses (on a weaker yen and inflation)."

- Profitability Metrics

- ROE (GS Estimates): 7.0% (3/24), 8.2% (3/25E), 8.3% (3/26E), 8.7% (3/27E)

- Net Interest Income

- Increased to ¥737.2 bn (+12% YoY) in Q3 FY24.

- Domestic lending spread widened from 0.86% in 1H to 0.88% at the end of 3Q.

- Overseas loan-deposit spread widened from 1.35% in 1H to 1.38% at the end of 3Q.

- Loans

- Domestic loans outstanding were ¥56.9 tn, up ¥1.1 tn from the end of FY3/24, but loans to individuals (such as mortgages) decreased.

- Overseas loans edged up to $237.4 bn (+$1.4 bn QoQ).

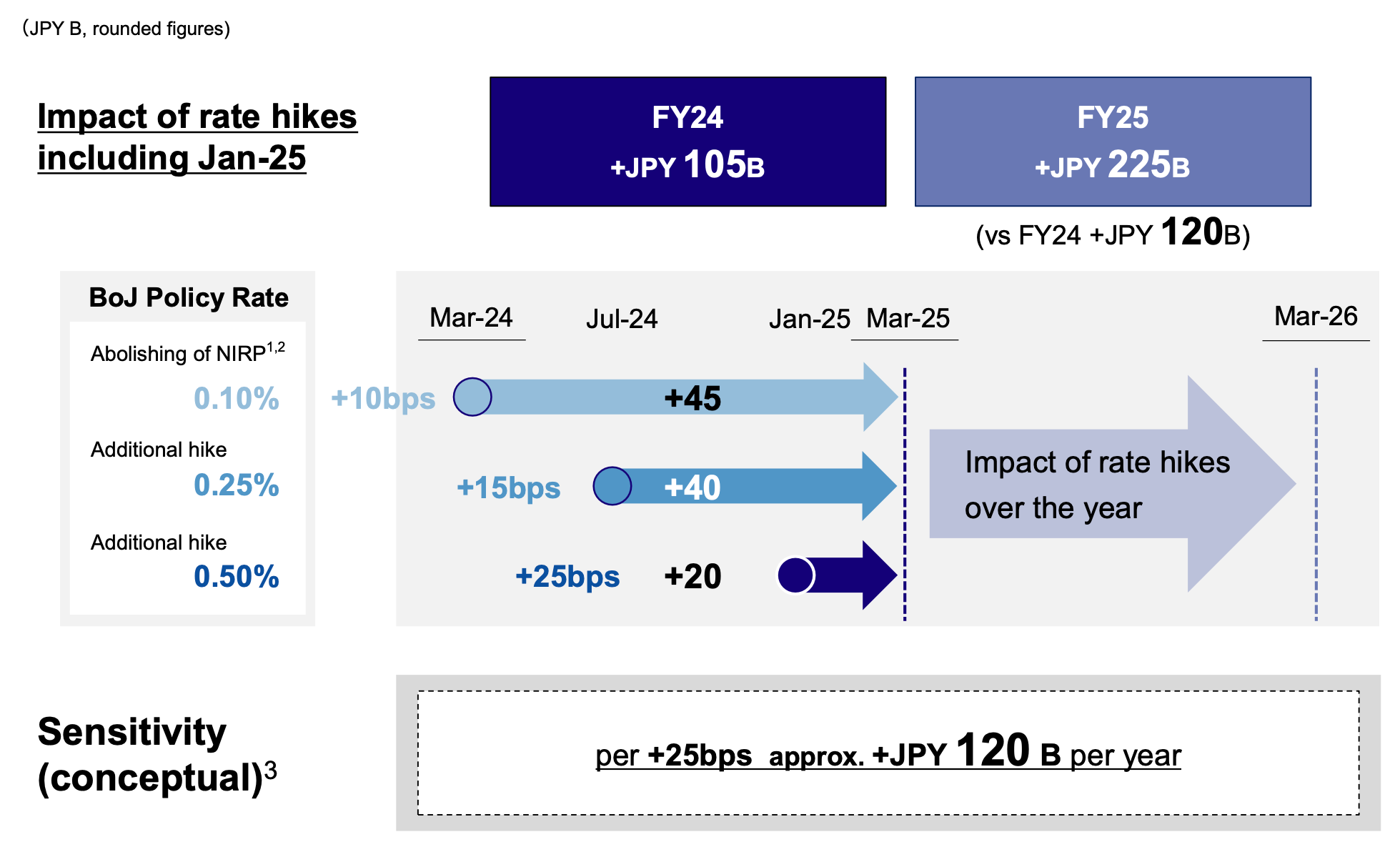

- Impact of BOJ Rate Hikes

- Estimated pre-tax impact of FY3/25 BOJ rate hikes: +¥105 bn.

- Expected pre-tax impact of FY3/26 BOJ rate hikes: +¥225 bn.

- "Mizuho said it expects every 0.25 pp rate hike to have an impact of around +¥120 bn in annual terms."

III. Business Segments & Strategy

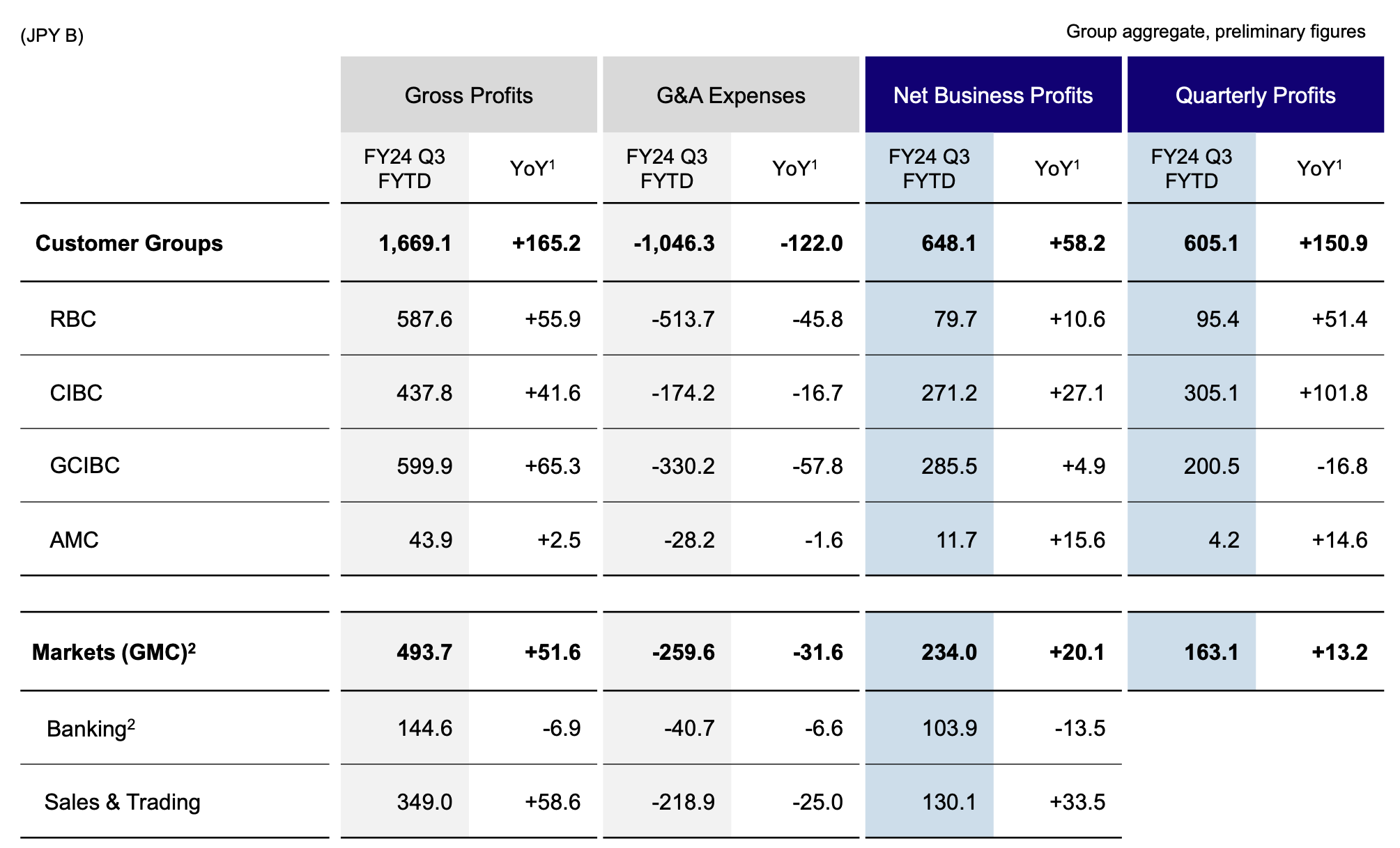

- Segment Performance: Customer Groups all show YoY increases in Gross Profits in FY24 Q3. Markets also shows positive growth.

- Domestic Business: Focus on investment products, individual annuities, and residential mortgages. Growth in J-Coin Pay users and affiliated merchants.

- Overseas Exposure: Significant exposure to the US, EMEA, and APAC regions. Overseas lending is a key driver.

- Trust Business: Focus on real estate, pension/asset management, and stock transfer agency.

- Securities Business: Increase in customer base (cash management and NISA accounts) and AUM.

- GCIBC: Increased non-interest income

- Asset Quality: Non-performing Loans based on Banking Act and Financial Reconstruction Act are detailed.

Investment Thesis

- Profit growth through resource allocation to priority areas (domestic/overseas corporate business).

- Improvement of capital efficiency and ROE by shifting resources from low-margin to high-margin assets.

- Strengthening of growth investments and shareholder returns while maintaining a CET1 ratio in the 9-9.5% range.

- Catalysts: BOJ rate hikes, share buybacks, investment in Rakuten Card, CFO meeting, and updates on the midterm plan.

- Revised Target Price: Goldman Sachs increased their 12-months target price from ¥4,500 to ¥4,750, based on a target P/B of 1.09X and end-FY3/26E BPS estimate of ¥4,361.

Key Takeaways & Implications

- Mizuho FG is demonstrating strong financial performance, exceeding expectations in Q3 FY24.

- The bank is poised to benefit from BOJ rate hikes and is focused on improving capital efficiency and ROE.

- Strategic investments and a focus on high-growth areas are expected to drive future profitability.

- Global economic conditions and geopolitical risks remain key factors to watch.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.