Mizuho reports H1/FY2025 strong performance, upbeat outlook, and shareholder-friendly moves

Mizuho Financial Group (MFG) reported robust first-half (H1) FY24 results, exceeding expectations and prompting an upgrade to full-year…

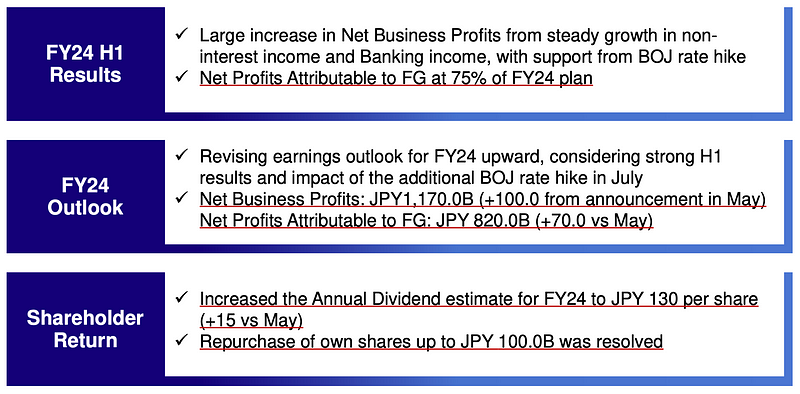

Mizuho Financial Group (MFG) reported robust first-half (H1) FY24 results, exceeding expectations and prompting an upgrade to full-year guidance. The company also announced its first share buyback in 16 years and increased its dividend, signaling confidence in its future performance and a commitment to rewarding shareholders.

Key Highlights

- Earnings Beat: H1 consolidated net business profits, including ETF gains/losses, reached ¥696.6 billion, surpassing initial guidance and consensus estimates. Net profits also exceeded expectations at ¥566.1 billion.

- Guidance Upgrade: Mizuho raised its full-year net profit guidance by 9% to ¥820 billion, driven by strong H1 performance and the positive impact of the Bank of Japan’s (BOJ) July rate hike.

- Dividend Hike: The dividend was increased to ¥130 per share, aligning with the company’s 40% payout ratio target.

- Share Buyback: Mizuho announced a ¥100 billion share buyback, its first in 16 years, demonstrating confidence in its capital position and future profitability.

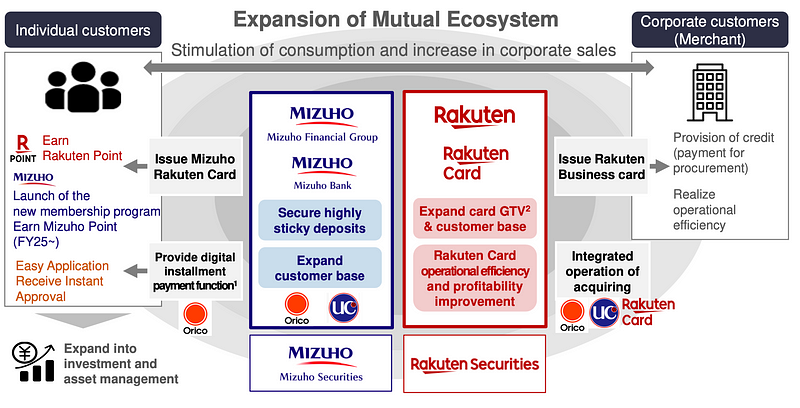

- Rakuten Card Investment: A strategic investment in Rakuten Card (14.99% stake) positions Mizuho to expand its presence in the mass retail segment and enhance its digital offerings.

Drivers of Profit Growth

The strong H1 performance was fueled by several factors:

- Banking Business Strength: The banking business within the markets segment and the customer segment’s CIBC business were key contributors to profit growth.

- Rising Interest Rates: The BOJ’s monetary policy shift benefitted Mizuho’s net interest income.

- Capital Investment Demand: Increased demand for capital investment related to the reshoring of production bases to Japan and digital transformation (DX) initiatives provided growth opportunities.

- Credit Cost Reversals: Improved credit quality led to reversals of previously booked credit costs.

- Strategic Shareholdings: Accelerated sales of strategic shareholdings boosted profits.

Dividend and Buyback

The dividend hike and share buyback reflect Mizuho’s commitment to returning capital to shareholders. The total payout yield, including the buyback, reaches 3.7%. This buyback marks a shift from previous buybacks primarily aimed at mitigating dilution; this one is clearly intended to reward shareholders.

Rakuten Card Partnership

The Rakuten Card investment is a strategic move to enhance Mizuho’s presence in the mass retail market. The partnership will launch a co-branded credit card, the Mizuho Rakuten Card, offering attractive rewards and seamless integration with Mizuho accounts. The company views this as a crucial investment for building a competitive edge in the retail segment, with plans to deepen cooperation before moving to equity-method accounting.

Financial Performance Details

- Net Interest Income: Rose substantially due to higher interest rates.

- Non-Interest Income: Showed healthy growth, particularly in banking and solutions businesses.

- Credit Quality: Remains strong, with low credit-related costs and reversals in some areas.

- Loan Growth: Continued expansion in both domestic and overseas loan portfolios.

- Securities Portfolio: Slightly decreased in size, but benefited from unrealized gains on Japanese stocks.

- Capital Ratios: The CET1 ratio improved to 10.5%, reflecting strong profit accumulation and a decrease in risk-weighted assets.

Outlook

While Mizuho’s updated full-year guidance is positive, the company’s assumptions for credit costs and equity gains remain unchanged, potentially suggesting a conservative approach and a buffer against uncertainties in the second half of the year.

Investment Thesis and Risks

Mizuho’s ongoing transformation, focused on cultural change and DX, coupled with its stable system operations, positions it for continued growth. Key investment considerations include:

- Profit Growth: Continued allocation of resources to priority areas and growth in core businesses.

- Capital Efficiency: Improvement in ROE through strategic asset allocation.

- Shareholder Returns: Potential for further growth investments and shareholder returns while maintaining healthy capital ratios.

Downside risks include

- Global Economic Slowdown: A potential decline in long-term interest rates amid global economic weakness.

- Geopolitical Risks: Worsening of the credit cycle due to prolonged geopolitical instability.

- Cost Overruns: Larger-than-expected cost increases related to system upgrades and business management initiatives.

Conclusion

Mizuho’s H1 FY24 results showcase strong financial performance, driven by various factors including rising interest rates, robust banking business, and strategic investments. The company’s upgraded guidance, dividend hike, and share buyback reflect confidence in its future prospects. The Rakuten Card partnership adds a new dimension to its retail strategy and enhances its digital offerings. While downside risks exist, Mizuho appears well-positioned for continued growth and value creation.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.