Mitsubishi UFJ Securities reports second quarter earnings

MUFJ Securities delivered strong financial results for the second quarter and first half of FY2024, driven by robust performance in…

MUFJ Securities delivered strong financial results for the second quarter and first half of FY2024, driven by robust performance in Retail/Middle Markets and Investment Banking. While investor appetite remained generally strong, market fluctuations posed some challenges, particularly for Global Markets.

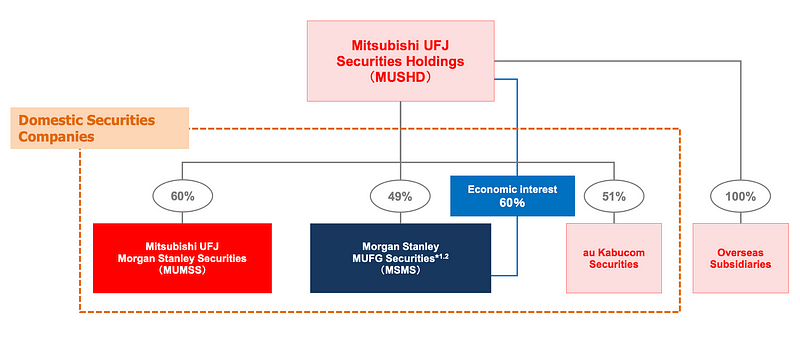

The company’s focus on strengthening its domestic securities businesses, expanding overseas, and leveraging its partnership with Morgan Stanley continued to contribute to its overall performance. MUFJ Securities maintains a robust financial position and strong credit ratings, providing a solid foundation for future growth.

Consolidated Performance Highlights

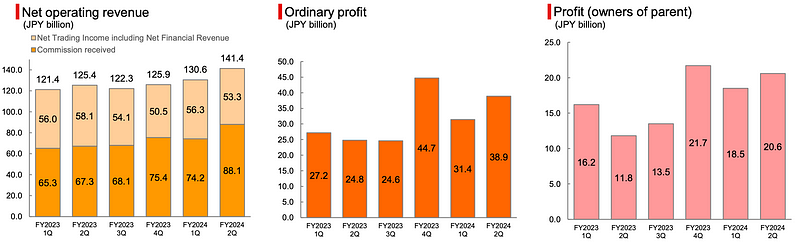

- Strong Financial Performance: MUFJ Securities reported robust financial results for the second quarter of FY2024, demonstrating growth in key metrics. Net operating revenue increased by 10% year-over-year (YoY) to JPY 272.1 billion, ordinary profit surged by 35% YoY to JPY 70.4 billion, and profit attributable to owners of parent rose by 39% YoY to JPY 39.1 billion. Quarter-over-quarter (QoQ), net operating revenue was up 8%, ordinary profit increased by 23%, and profit attributable to owners of parent climbed by 11%.

- First-Half Performance: The positive momentum continued from the first half of the fiscal year, with both revenue and profit showing YoY growth. This was driven by strong performance in the Retail/Middle Markets and Investment Banking segments. Retail/Middle Markets benefited from a favorable market environment, while Investment Banking was propelled by large secondary offerings and M&A deal activity. However, Global Markets faced challenges due to the underperformance of the domestic fixed income business and a decline in the solution business compared to the previous fiscal year.

- Second-Quarter Performance Drivers: The QoQ growth in the second quarter was fueled by the strong performance of overseas subsidiaries and the share of profit from Morgan Stanley MUFG Securities (MSMS).

Business Segment Overview

- Retail/Middle Markets: This segment experienced significant growth, with net operating revenue increasing by 15% YoY and ordinary profit surging by 139% YoY. This robust performance was attributed to sustained investor appetite even amidst market fluctuations in August. Increased inclusion of stock investment trusts in portfolio proposals and a rise in stock trading value contributed to the positive results. While investment trust sales slowed in the second quarter, sales of domestic and foreign bonds expanded. Assets under management (AUM) remained on a positive trajectory but saw a slight decline QoQ due to valuation adjustments.

- Wholesale: The Wholesale segment, which includes Global Markets and Investment Banking, experienced mixed results.

- Global Markets: Overall, net operating revenue in Global Markets grew by 5% YoY, but declined by 2% QoQ. Within Global Markets:

- Fixed income: Domestic subsidiaries delivered strong performance, driven by increased revenue from credit and interest rate derivative businesses, offsetting a decline in the rates business. Overseas subsidiaries maintained stable revenue due to strong performance in interest rate derivatives. However, the rates business slowed down in domestic subsidiaries during the second quarter, negatively impacting QoQ performance.

- Equity: Domestic subsidiaries benefited from block trades and position management related to unwinding cross-shareholdings. Overseas subsidiaries recorded higher revenue YoY and QoQ, thanks to the monetization of the equity solutions business.

- Investment Banking: This segment delivered substantial growth, with net operating revenue increasing by 21% YoY and 14% QoQ. The strong performance was driven by an expansion in the size of issuance markets in Japan and overseas, as well as several large secondary offerings in Japan.

- Domestic Securities Companies: MUFJ Securities’ domestic securities companies, including the joint ventures with Morgan Stanley (Japan JV and MSMS) and au Kabucom Securities, continued to perform well. Both revenue and profit increased for these entities, maintaining a high return on equity (ROE). The combined net operating revenue of Japan JV and au Kabucom Securities grew YoY, reaching approximately JPY 240 billion. While their combined market share remained around 20%, their combined ROE increased to 14%.

Financial Position

- Balance Sheet Strength: MUFJ Securities maintained a solid financial position. Total assets increased slightly to JPY 38.245 billion as of September 30, 2024. Liabilities also increased modestly, primarily driven by higher borrowings secured by securities. Shareholders’ equity grew, and net assets were up, reflecting the company’s profitability.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.