Metaplanet's fiscal year 2024 results

Metaplanet has boldly declared its fiscal year 2024 a resounding success, marking a transformative shift from its previous incarnation as a legacy, asset-heavy business to Asia's premier publicly traded Bitcoin Treasury Company. Its earnings presentation, emblazoned with the tagline "Secure the Future with Bitcoin," underscores the company's unwavering commitment to a Bitcoin-centric strategy. This commitment is further emphasized by prominent quotes advocating for Bitcoin from figures like former U.S. President Donald J. Trump, Senator Cynthia Lummis, and Bitcoin's pseudonymous creator, Satoshi Nakamoto, framing Bitcoin not just as an investment, but as a fundamental shift in financial thinking.

Metaplanet highlights extraordinary performance. The company proudly proclaims itself the best-performing stock worldwide in 2024, outpacing every index, asset class, and public company (among those with greater than $250m market cap and more than $50m of daily trading volume, as of December 31, 2024). This claim is central to Metaplanet's narrative, positioning itself as a pioneer in the corporate adoption of Bitcoin as a primary treasury reserve asset. The company's transition to a "Bitcoin Standard" is presented as a decisive move, unparalleled in speed and conviction by any other corporation.

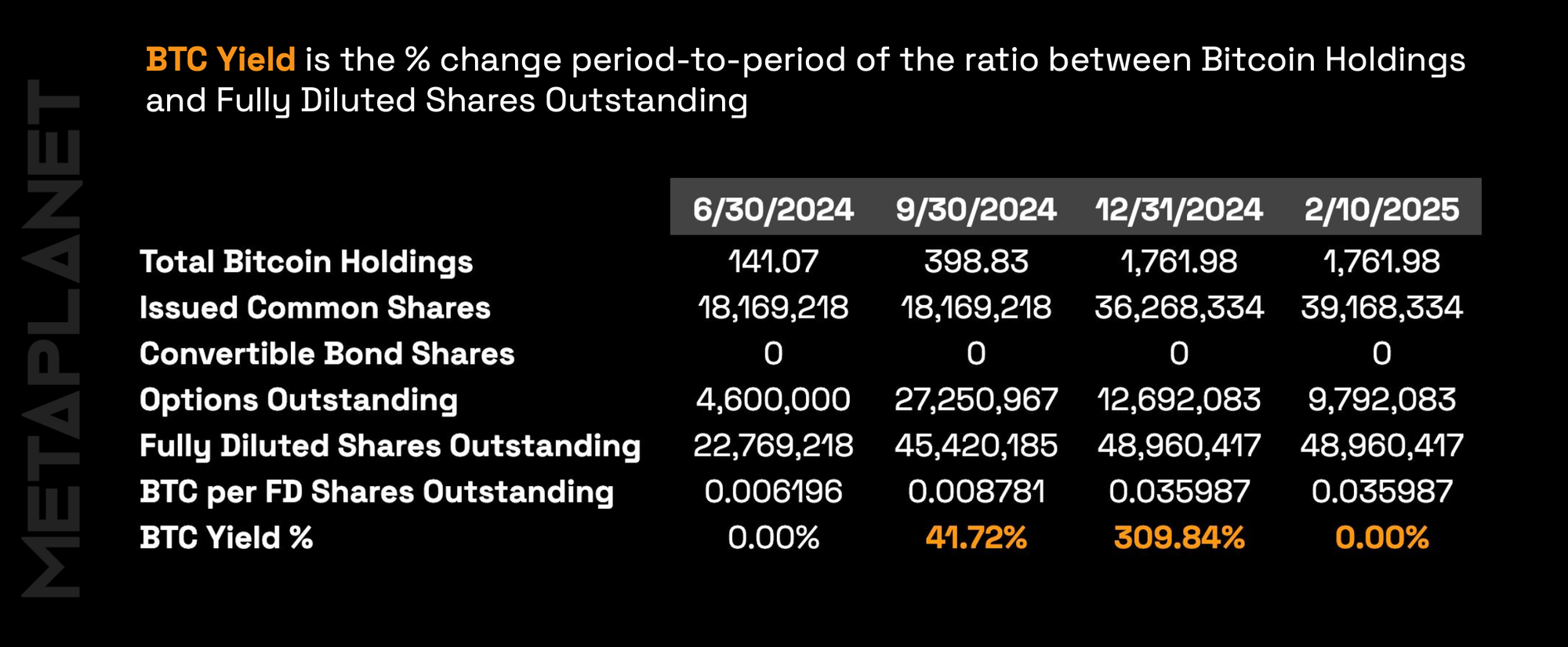

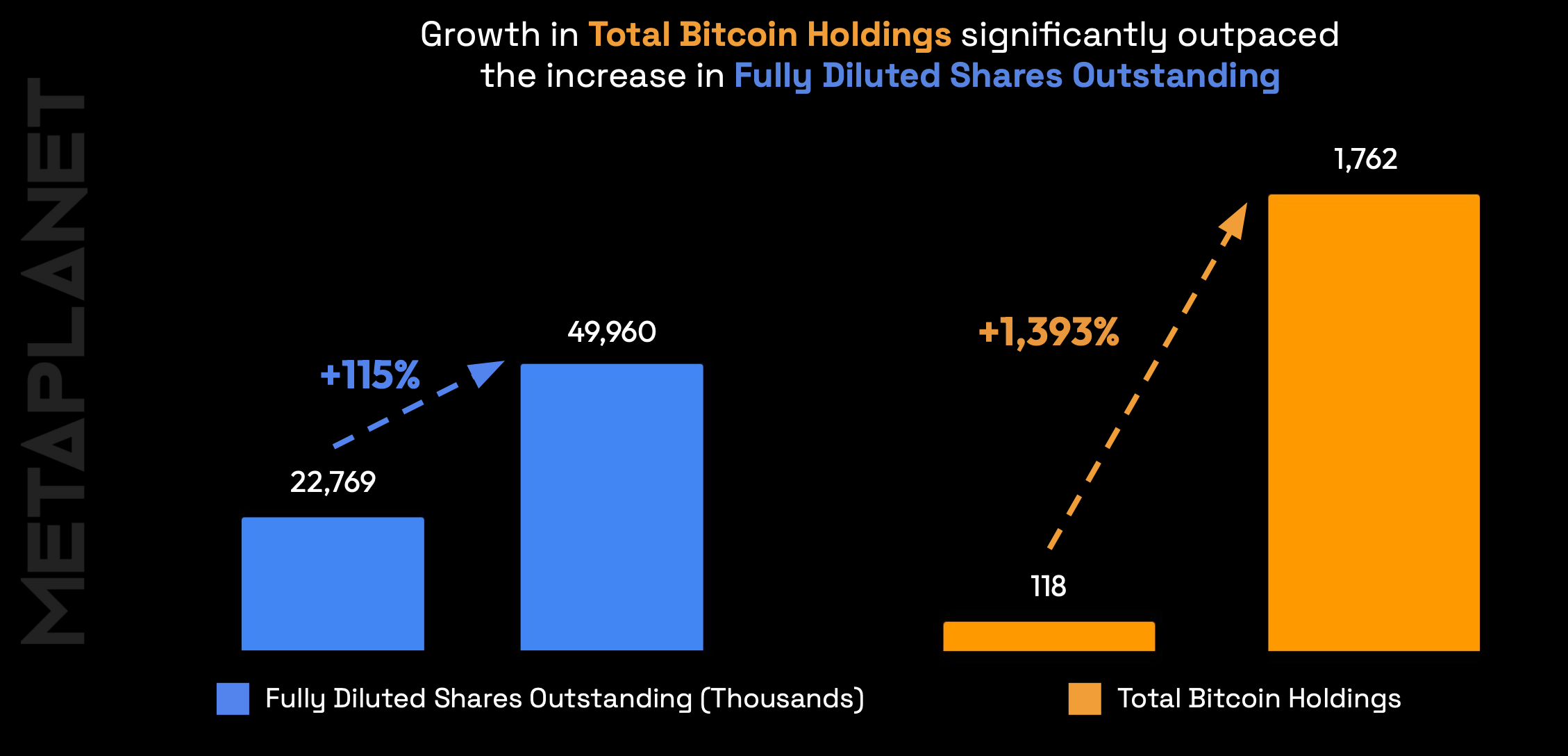

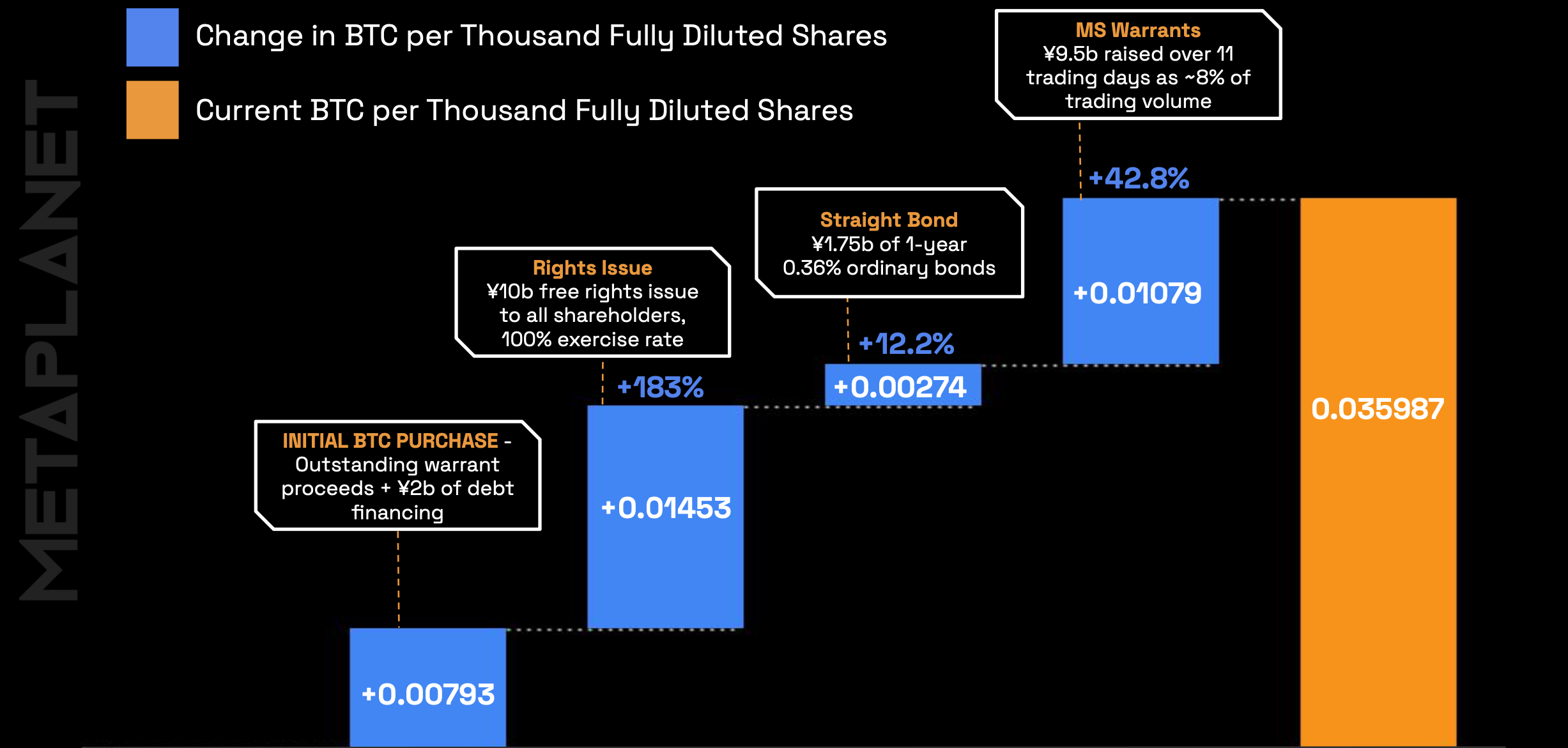

A crucial element of Metaplanet's strategy is its focus on maximizing "BTC Yield," defined as the percentage change in the ratio of Bitcoin holdings to fully diluted shares outstanding. This metric is presented as the key performance indicator for the company, directly reflecting its success in accumulating Bitcoin relative to share dilution. Metaplanet's suggests that its ability to access capital markets efficiently translates directly into increased Bitcoin holdings per share, ensuring that every yen raised contributes to growing its Bitcoin reserves.

Metaplanet's management discussion provides a clear and concise overview of the company's strategic pivot. In a single year, Metaplanet transitioned from a legacy, asset-heavy business to a Bitcoin-focused entity, now recognized as Asia's largest public Bitcoin holder and among the top 15 globally. The company achieved a remarkable 14x increase in its Bitcoin holdings relative to its market capitalization in April, a feat unmatched by any other public company. This rapid accumulation of Bitcoin is a testament to Metaplanet's aggressive and focused strategy.

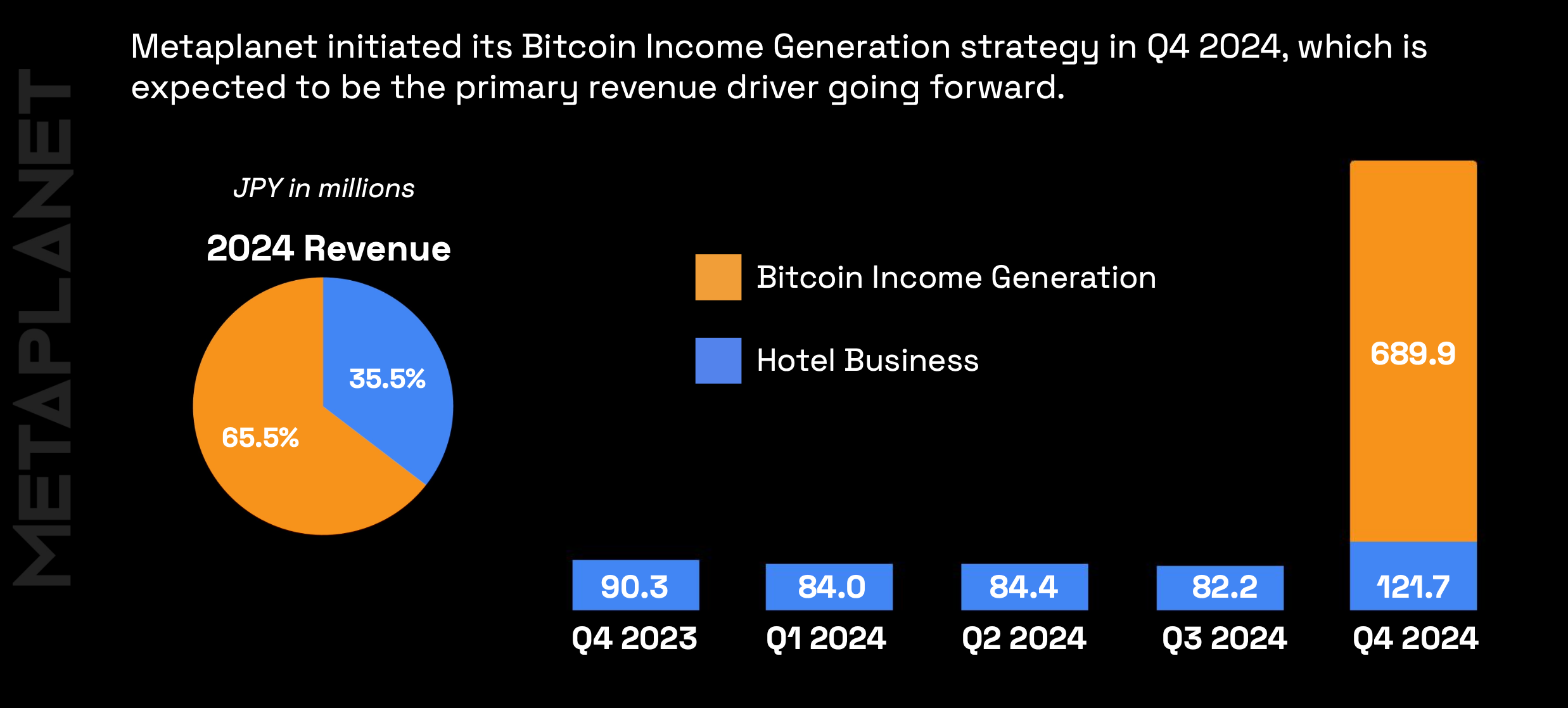

As part of Metaplanet's innovative approach to Bitcoin accumulation and income generation, the company launched "Bitcoin Income Generation" in Q4 2024, a structured program that monetizes Bitcoin's volatility through option premiums without impacting its cold storage reserves, which held 1,762 BTC by year-end. This strategy is crucial, as it allows Metaplanet to generate sustainable revenue, leveraging newly raised capital and excess collateral, to further strengthen its balance sheet and accelerate Bitcoin accumulation. The emphasis on "not touching our cold storage reserves" highlights the company's commitment to long-term Bitcoin holding and security.

Beyond its core treasury operations, Metaplanet is actively involved in expanding the Bitcoin ecosystem in Japan and beyond. The company has expanded Bitcoin Magazine Japan, launched educational initiatives, and is developing "The Bitcoin Hotel," envisioned as a hub for Bitcoin adoption and community engagement. These initiatives demonstrate Metaplanet's commitment to fostering a broader understanding and acceptance of Bitcoin, positioning itself not just as an investor, but as a key player in the growth of the Bitcoin community.

The company's mission is stated simply: to maximize BTC Yield by steadily increasing Bitcoin per share, creating long-term value for shareholders under a "hard money standard." This phraseology is significant, as it positions Bitcoin as a fundamentally sounder form of money compared to traditional fiat currencies. Metaplanet explicitly states its departure from the uncertainties of fiat currency, emphasizing its unwavering focus on Bitcoin accumulation. This commitment is reinforced by the company's assertion that it has "no price target for Bitcoin," with its time horizon declared as "forever," represented mathematically as ∞ / 21,000,000 (referencing the finite supply of Bitcoin).

Metaplanet stresses that its Bitcoin strategy is not merely a corporate decision but a commitment to a movement sparked by Satoshi Nakamoto over 15 years ago. The company sees itself as leading the transformation towards Bitcoin as the ultimate store of value, particularly in Japan and expanding its influence globally. This narrative positions Metaplanet as more than just a company; it's presented as a leader in a financial revolution.

Key milestones achieved in Metaplanet's first year of operating under the Bitcoin Standard include reaching market cap milestones, surpassing 1,000 total Bitcoin held, issuing Moving Strike (MS) Warrants, and successfully raising significant capital through a rights issue. The "21m Plan," involving the issuance of 21 million shares of 0% discount MS Warrants, is highlighted as the largest capital raise in Asian capital markets history specifically for purchasing Bitcoin. These milestones are mapped to the company's market cap progression, visually demonstrating the rapid growth and success of the strategy.

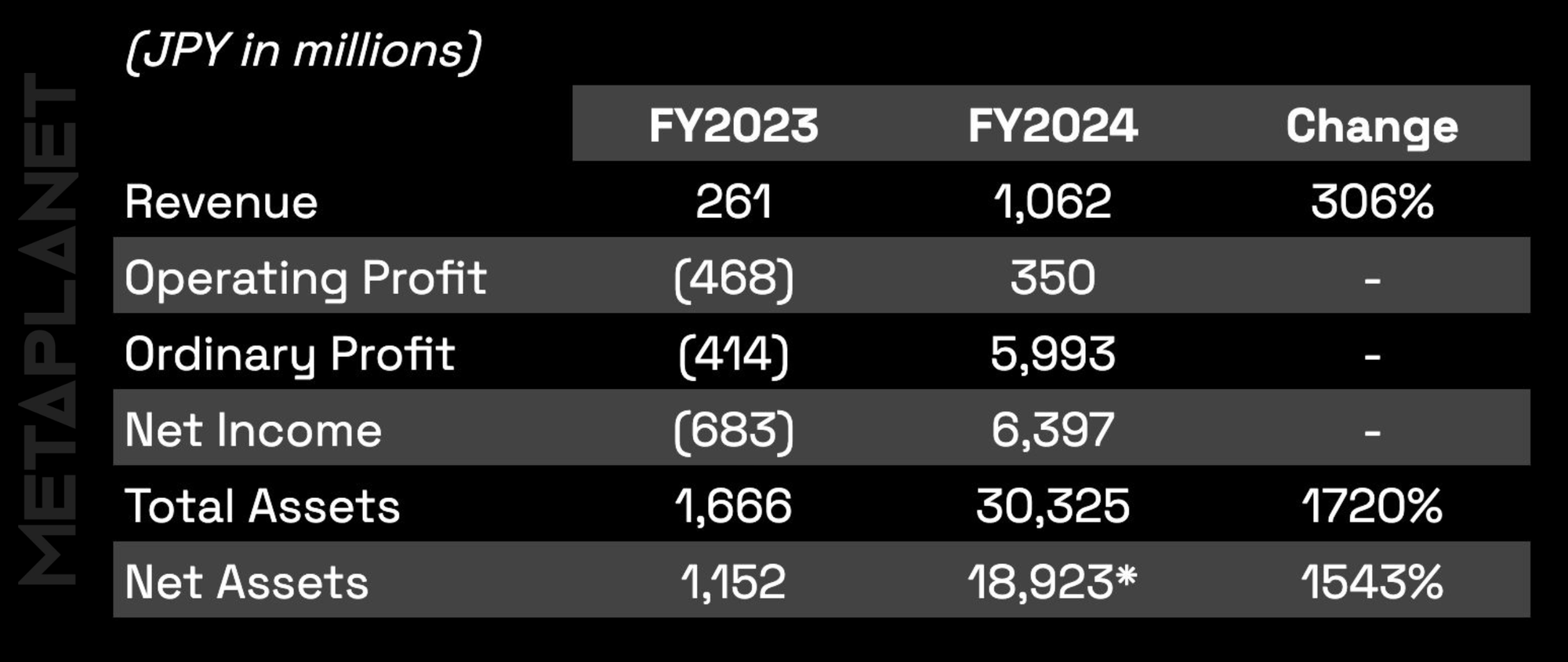

In terms of financial results, Metaplanet's revenue increased by 306% from FY2023 to FY2024, reaching 1,062 million JPY. The company transitioned from operating and ordinary losses in FY2023 to substantial profits in FY2024, with operating profit at 350 million JPY and ordinary profit at 5,993 million JPY. Net income followed a similar trajectory, shifting from a loss of 683 million JPY to a profit of 6,397 million JPY. Total assets grew by a staggering 1720%, reaching 30,325 million JPY, and net assets increased by 1543% to 18,923 million JPY. These figures paint a picture of a company experiencing explosive growth driven by its Bitcoin strategy.

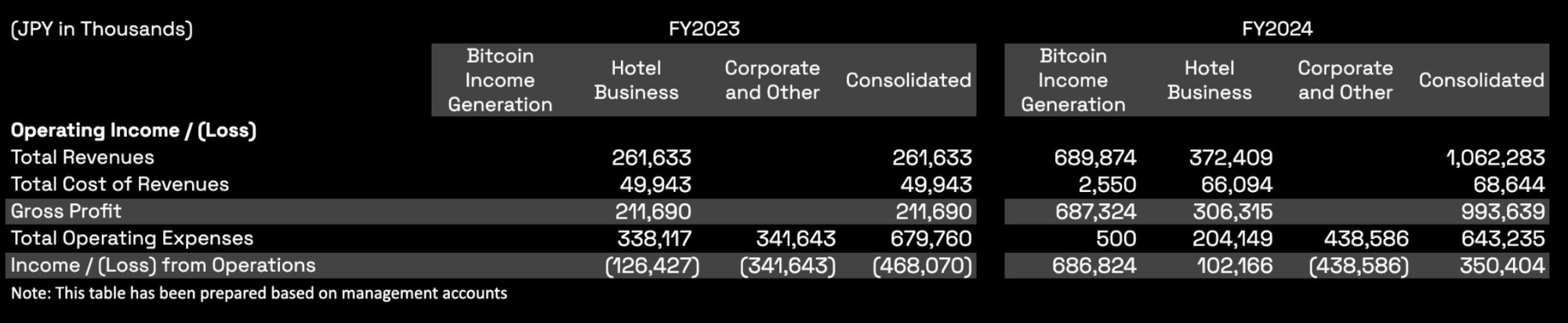

Metaplanet's operating income is based on two primary revenue-generating business lines: Bitcoin Income Generation and the Hotel Business. Bitcoin Income Generation capitalizes on Bitcoin's volatility to generate revenue via option premiums, with approximately 5% of raised funds allocated to this strategy. The Hotel Business, while still operational, is undergoing a transformation into the aforementioned Bitcoin Hotel. The presentation emphasizes that Metaplanet achieved its first operating profit since 2017, a crucial milestone demonstrating the company's ability to deploy capital productively into Bitcoin accumulation rather than covering operating expenses.

A breakdown of FY2024 revenues reveals that Bitcoin Income Generation accounted for 65.5% of total revenue, while the Hotel Business contributed the remaining 34.5%. The quarterly revenue figures show a significant increase in Bitcoin Income Generation revenue in Q4 2024, highlighting the growing importance of this strategy to the company's overall financial performance.

The income breakdown further illustrates the impact of Metaplanet's Bitcoin holdings. A substantial Bitcoin valuation gain of 5,457.6 million JPY significantly contributed to the company's pre-tax net income of 6,393.8 million JPY. This gain is broken down into quarterly figures, showcasing the increasing value of Metaplanet's Bitcoin treasury over time. The unrealized gain on Bitcoin holdings reached 5.46 billion JPY by the end of Q4 2024, reflecting the significant appreciation in Bitcoin's price.

Metaplanet's Bitcoin treasury operations are characterized by its disciplined and strategic capital deployment model. The company successfully increased its Bitcoin holdings from zero to 1,762 BTC within the year, achieved through a combination of internally generated capital, innovative financial instruments, and equity-linked funding strategies. The "21 Million Plan," featuring moving strike warrants, is again highlighted as a landmark capital raise in Asian markets, specifically designed for Bitcoin acquisition.

The value of Metaplanet's Bitcoin treasury is tracked over time, showing a consistent increase from 1.26 billion JPY in May 2024 to 26.28 billion JPY in January 2025. This growth reflects both the increase in Bitcoin holdings and the appreciation in Bitcoin's price. The presentation also visually represents Metaplanet's Bitcoin gains, highlighting the 5.46 billion JPY in unrealized gains on its Bitcoin holdings as of the close of Q4 2024.

Metaplanet's success in increasing Bitcoin per fully diluted share is illustrated by the impact of various financing activities, including the initial BTC purchase, a rights issue, a straight bond issuance, and the issuance of MS Warrants, on the BTC per share metric. Each activity is shown to have a positive impact, contributing to the overall increase in Bitcoin per share.

Fiscal year 2025 outlook

Looking ahead to FY2025, Metaplanet provides an outlook and guidance, forecasting revenue of 3,400 million JPY and operating profit of 2,500 million JPY, representing significant growth compared to FY2024. However, due to Bitcoin price volatility, the company explicitly states that it is unable to provide a definitive forecast for its value as of December 31, 2025, and therefore does not include forecasts for ordinary profit and net income. This caveat highlights the inherent risks associated with Bitcoin's price fluctuations.

Bitcoin Plan

Metaplanet outlines its ambitious "Bitcoin Plan," aiming to acquire 21,000 BTC by year-end 2026, effectively owning 1/1000th of all Bitcoin that will ever exist. This bold target underscores the company's long-term commitment to Bitcoin. A more immediate target of acquiring 10,000 Bitcoin by year-end 2025 is also set. The "Phase 1: Equity (21 Million Plan)" is highlighted again, emphasizing the issuance of 21 million shares in moving strike warrants as Asia's largest ever public equity capital raise specifically for Bitcoin acquisition.

Conclusion

In conclusion, Metaplanet's Fiscal Year 2024 Earnings Presentation paints a picture of a company undergoing a radical and successful transformation. The unwavering commitment to a Bitcoin-centric strategy, the impressive financial performance, the ambitious future targets, and the proactive engagement with the Bitcoin community all contribute to a compelling narrative of a company leading the way in corporate Bitcoin adoption. The full-year earnings are a testament to Metaplanet's belief in Bitcoin as the future of finance and its determination to be at the forefront of this revolution.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.