Mercari's FinTech Business Q2/FY2025 Results

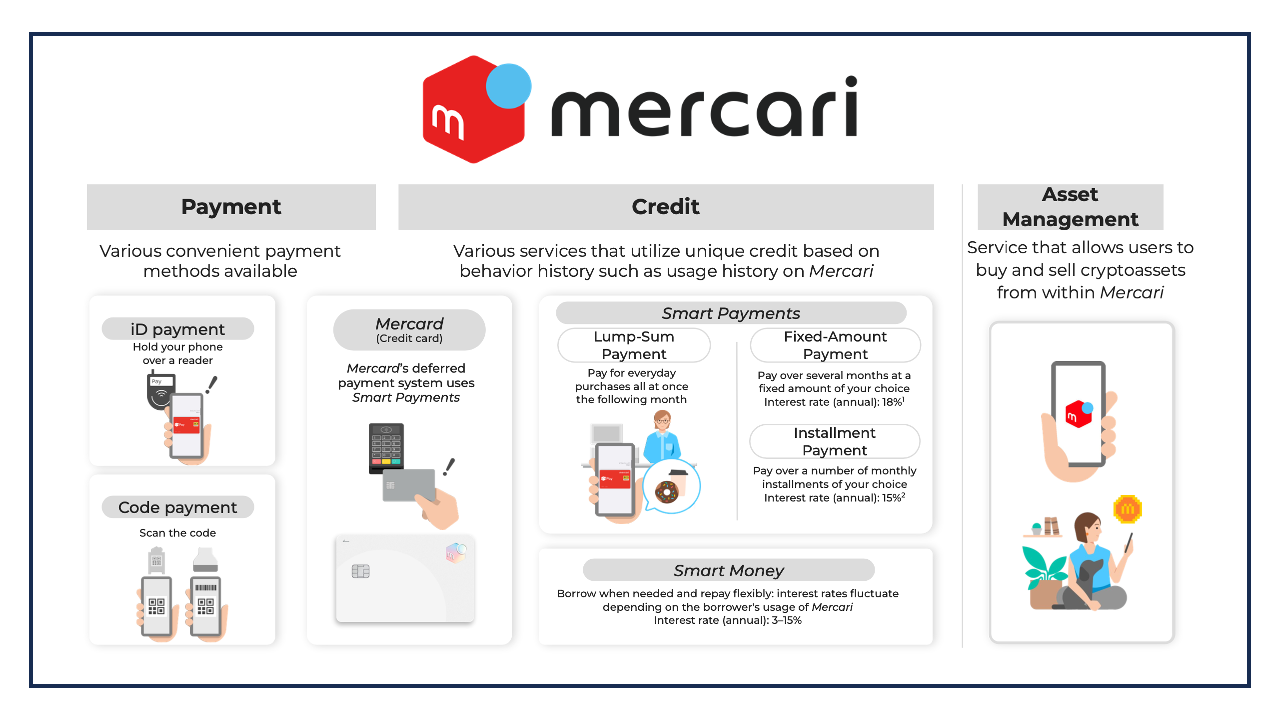

Mercari's FinTech business represents a crucial pillar in the company's diversified portfolio, leveraging its established marketplace platform to offer financial services and payment solutions. The company recognizes that fostering financial inclusion and creating seamless transactional experiences for its users is a key driver of long-term growth. The financial results presentation for the second quarter of fiscal year 2025 (ending December 31, 2024) provides valuable insights into the performance, strategic direction, and future ambitions of Mercari's FinTech operations.

Key Performance Indicators: Credit Balance Growth and Operating Profitability

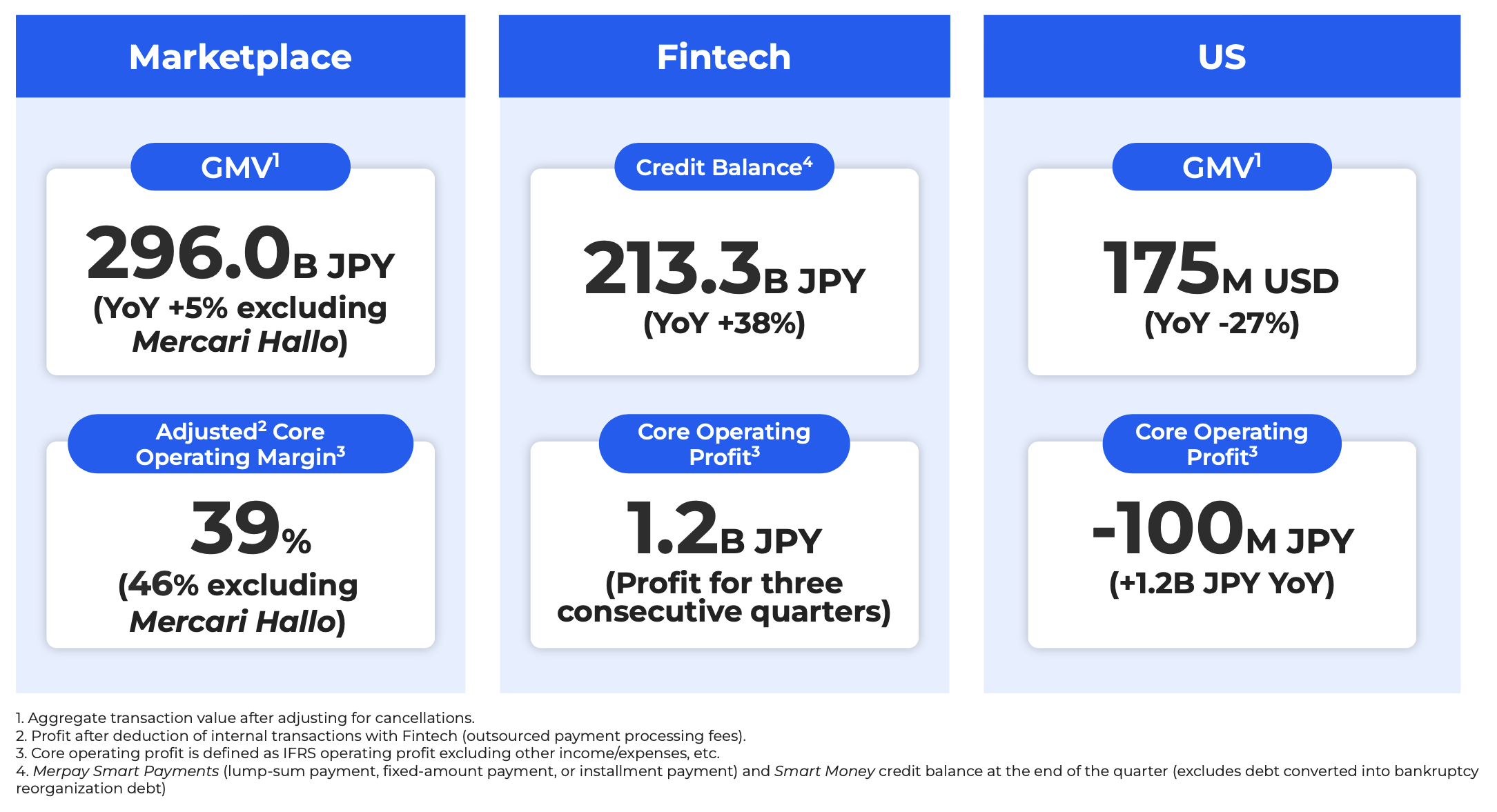

The earnings presentation prominently highlights two key performance indicators (KPIs) that underscore the success and potential of Mercari's FinTech business: credit balance growth and operating profitability.

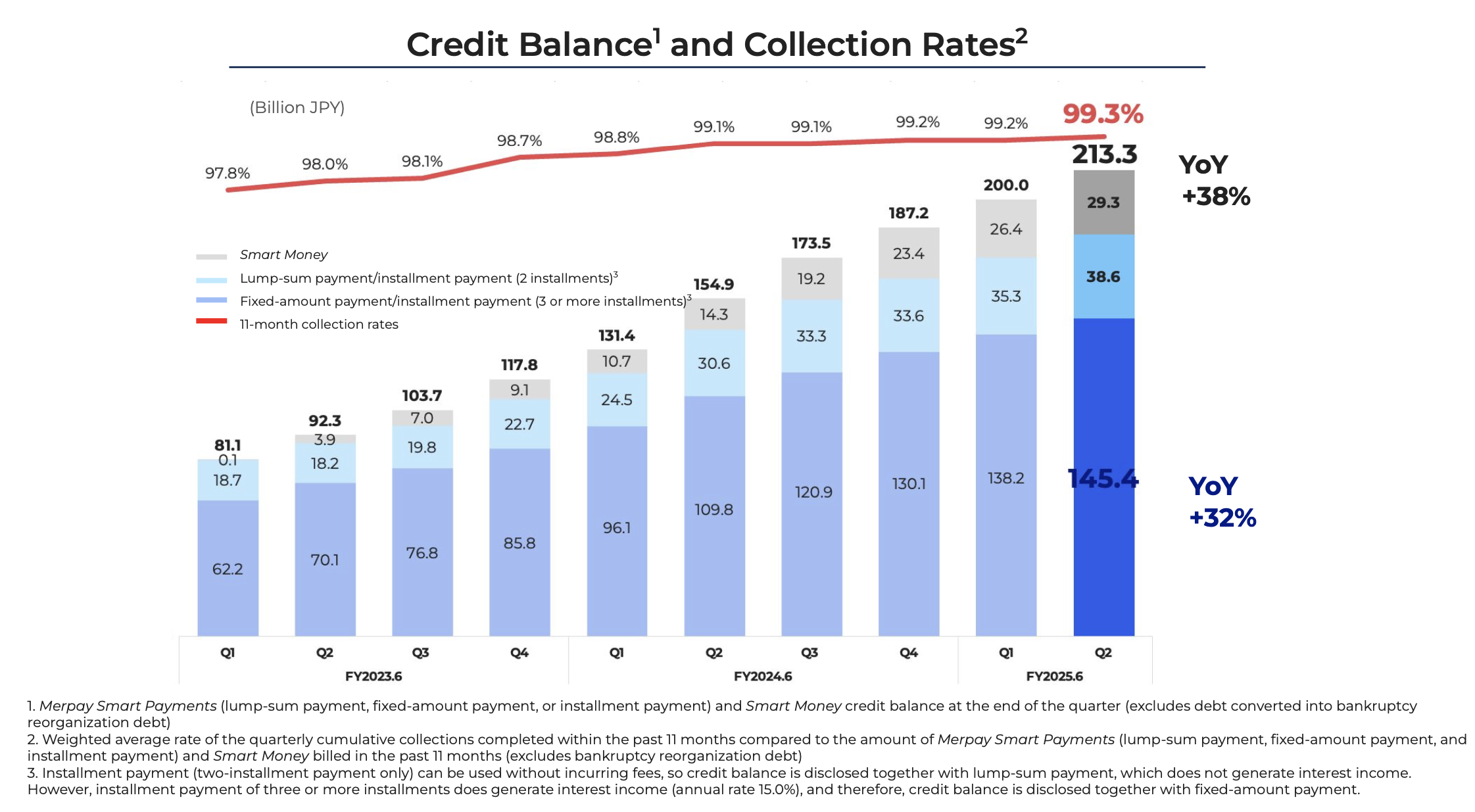

- Credit Balance Growth: The FinTech division experienced impressive growth in its credit balance, a critical metric reflecting the uptake and utilization of its lending and payment services. The credit balance soared by 38% year-on-year, reaching a substantial 213.3 billion yen. This significant increase suggests strong user adoption of Mercari's credit offerings, driven by factors such as competitive interest rates, convenient application processes, and seamless integration with the marketplace platform. The expanding credit balance also indicates that Mercari is effectively managing credit risk, ensuring the sustainability and long-term viability of its lending operations.

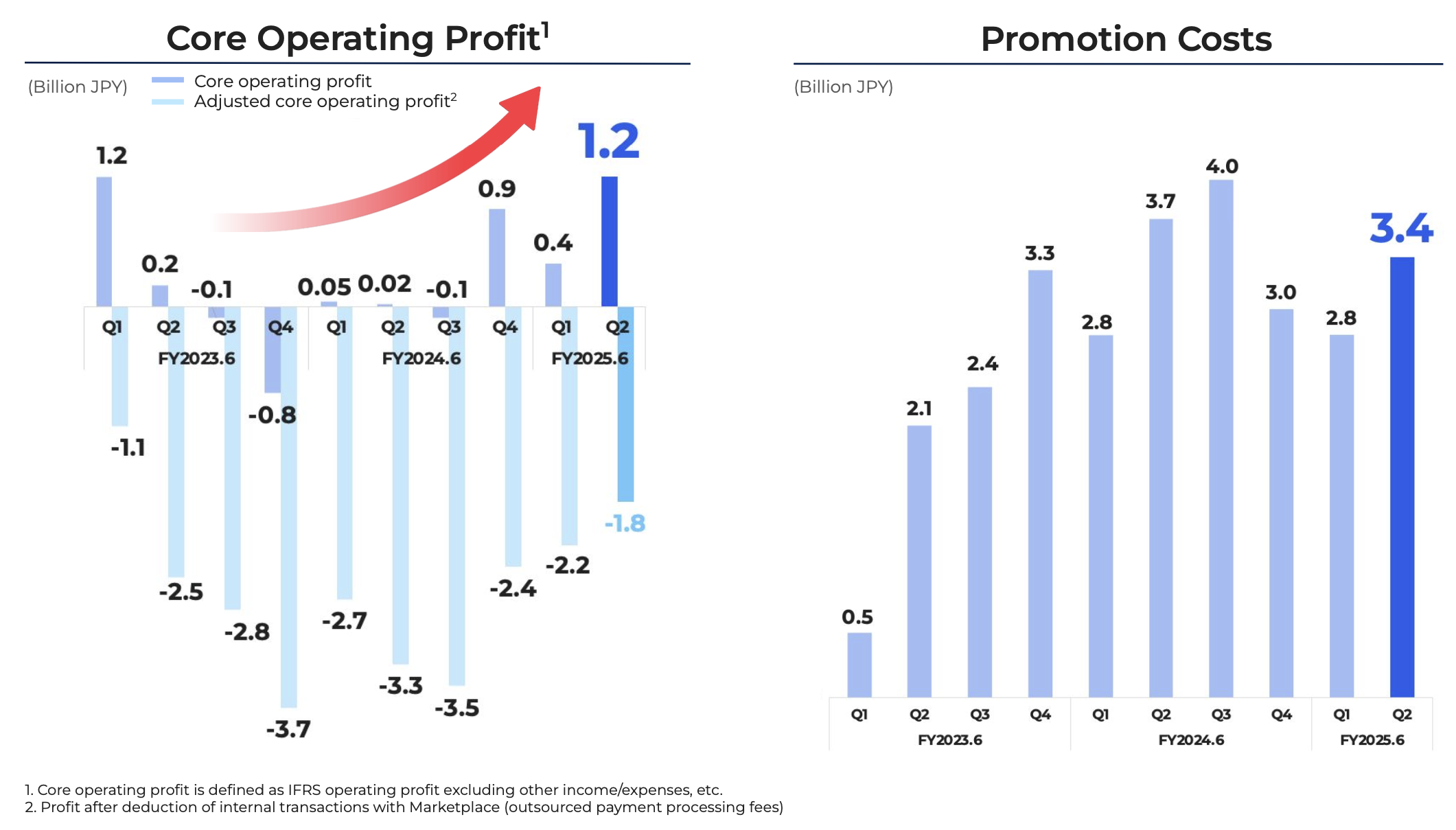

- Operating Profitability: Achieving and sustaining profitability is a paramount objective for any business, and Mercari's FinTech division has made commendable progress in this regard. The presentation notes that the division has achieved three consecutive profitable quarters, a testament to its efficient operations, effective revenue generation, and prudent cost management. The core operating profit for the second quarter reached 1.2 billion yen, further validating the division's ability to generate sustainable earnings. This profitability milestone is particularly noteworthy considering the significant investments required to develop and launch FinTech services, build robust technology infrastructure, and navigate complex regulatory landscapes.

Strategic Objectives: Sustainable Growth and User Base Expansion

Mercari has articulated clear strategic objectives for its FinTech business, focusing on sustainable growth and user base expansion. These objectives align with the company's broader mission of "circulating all forms of value to unleash the potential in all people."

- Sustainable Growth: Mercari recognizes that long-term success in the FinTech sector requires a commitment to sustainable growth. The company aims to achieve this by steadily accumulating credit balance, optimizing its lending and payment operations, and carefully managing credit risk. Sustainable growth also implies a focus on regulatory compliance, data security, and ethical lending practices, ensuring that Mercari's FinTech services are responsible and beneficial to its users.

- User Base Expansion: Expanding its user base is a crucial element of Mercari's growth strategy. The company intends to reach more customers by enhancing the usability of its FinTech services, making them more accessible, convenient, and attractive to a wider audience. This may involve simplifying the application process for credit products, offering personalized financial solutions, improving the user interface and experience of its mobile app, and expanding its marketing and outreach efforts.

Mercoin and Crypto Asset Integration: A Forward-Looking Initiative

Mercari's decision to integrate crypto assets into its FinTech ecosystem is a bold and forward-looking initiative that has the potential to reshape the company's competitive landscape. The presentation mentions the company's crypto asset business, branded as "Mercoin," which enables users to buy and sell Bitcoin and Ethereum directly through the Mercari platform. This integration provides several potential benefits:

- Attracting New Users: Crypto asset trading can attract a new segment of users to the Mercari platform, particularly those who are interested in digital currencies and blockchain technology.

- Enhancing User Engagement: Offering crypto asset services can increase user engagement with the Mercari platform, as users may spend more time exploring and utilizing the platform's features.

- Generating Revenue: Crypto asset trading can generate new revenue streams for Mercari through transaction fees and other related services.

- Creating Synergies: Integrating crypto assets with Mercari's existing FinTech services can create synergistic opportunities, such as enabling users to pay for purchases on the marketplace using Bitcoin or Ethereum.

To further incentivize crypto asset adoption, Mercari has launched a service that grants "Mercari points" each month to users who hold Ethereum. This initiative rewards users for participating in the crypto ecosystem and encourages them to retain their digital assets within the Mercari platform.

The Broader FinTech Landscape: Opportunities and Challenges

Mercari's FinTech business operates within a dynamic and rapidly evolving landscape, characterized by both opportunities and challenges.

- Opportunities: The FinTech sector is experiencing exponential growth, driven by factors such as increasing smartphone penetration, rising demand for digital financial services, and supportive regulatory environments. This growth presents significant opportunities for Mercari to expand its FinTech operations, capture market share, and offer innovative financial solutions to its user base.

- Challenges: The FinTech sector also faces several challenges, including intense competition, regulatory uncertainty, cybersecurity threats, and the need to maintain trust and confidence among consumers. Mercari must navigate these challenges effectively to ensure the long-term success of its FinTech business.

Strategic Imperatives for Future Success

Based on the presentation and the broader context of the FinTech sector, Mercari must focus on several strategic imperatives to solidify its position and achieve its long-term goals.

- Innovation: Mercari must continue to innovate and develop new FinTech services that meet the evolving needs of its users. This may involve exploring emerging technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to enhance its offerings, improve efficiency, and create personalized experiences.

- Partnerships: Strategic partnerships can be instrumental in accelerating Mercari's growth and expanding its reach. The company should consider collaborating with other FinTech firms, financial institutions, and technology providers to complement its capabilities, access new markets, and leverage specialized expertise.

- Regulatory Compliance: Navigating the complex and evolving regulatory landscape is crucial for Mercari's FinTech business. The company must invest in robust compliance programs, stay abreast of regulatory changes, and work proactively with regulators to ensure that its operations adhere to all applicable laws and regulations.

- Data Security: Data security is a paramount concern in the FinTech sector, as data breaches and cyberattacks can have severe consequences for companies and their customers. Mercari must invest in state-of-the-art security technologies, implement stringent data protection protocols, and train its employees on best practices for data security.

- Customer Trust: Maintaining customer trust and confidence is essential for Mercari's FinTech business. The company must prioritize transparency, ethical practices, and responsible lending to build strong relationships with its users and foster long-term loyalty.

Conclusion: A Promising Future for Mercari's FinTech Business

Mercari's FinTech business has demonstrated impressive growth and profitability in recent quarters, driven by a combination of strategic initiatives, innovative product offerings, and a favorable market environment. The company's commitment to sustainable growth, user base expansion, and integration of crypto assets positions it for continued success in the dynamic FinTech sector. By focusing on innovation, partnerships, regulatory compliance, data security, and customer trust, Mercari can solidify its position as a leading provider of financial services and payment solutions, contributing to its overall growth and fulfilling its mission of unleashing the potential in all people.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.