Mega Bank Earnings (III) — Mizuho

Since November 2023, Mizuho has been collaborating with the Tokyo University of the Arts, asking students to give form to the ideas they…

Since November 2023, Mizuho has been collaborating with the Tokyo University of the Arts, asking students to give form to the ideas they took from Mizuho’s Purpose, “Proactively innovate together with our clients for a prosperous and sustainable future”. This is the fourth time a student’s art work has been featured on the earnings presentation.

“This collage was made by cutting and rearranging photos. When cutting, I ignored all outlines and borders of any spaces or objects captured within them.” said Honoka Matsushita, second year master’s student. “Though once apart, each space and object with its newly defined boundaries, is brought together to fashion completely new connections. Every cut and every layer connects realms in ways that they were not before. In the same way that a thousand cranes, though each a separate entity, can join together to symbolize a collective hope, this visual becomes a prayer for unity, joining the disjointed with its continuous intersecting.”

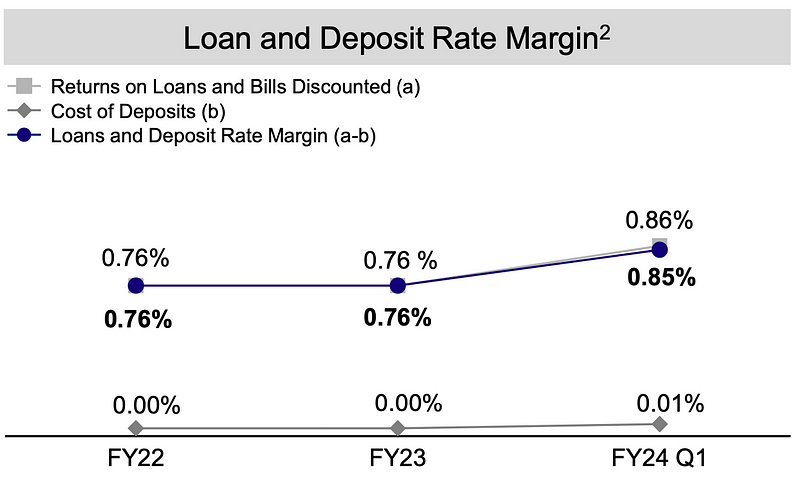

All three Japanese mega banks reported strong earnings last week. All of them performed strongly after the Bank of Japan raised its policy rate to 0.25%, as they should, since their net interest margin had just widened. While Mizuho (unlike MUFG) did not immediately pass through the 0.15% raise to its short-term interest rates (although Mizuho said it will consider such action), it did increase the deposit rate from 0.01% to 0.10%. For each of the banks, we have selected some key slides from the earnings presentations.

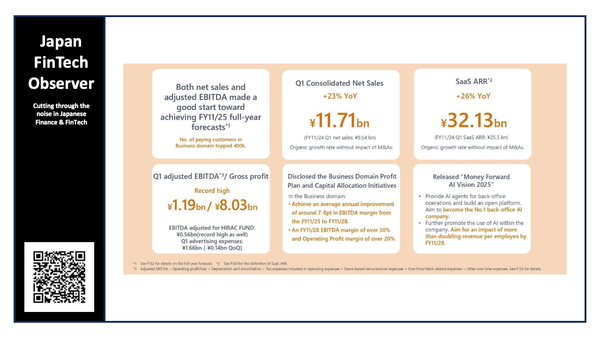

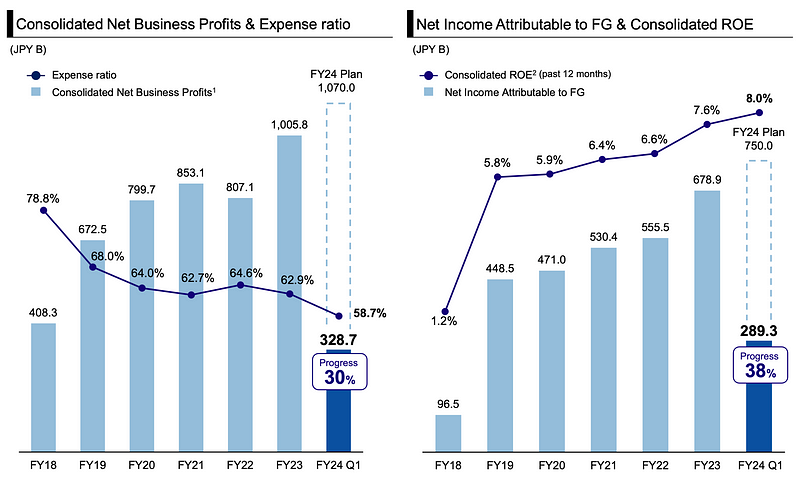

Mizuho reported net business profits of JPY 328.7, up by JPY 79.9bn YoY, and 30% progress towards the FY2024 target. Profit attributable to owners of parent was JPY 289.3bn, up by JPY 44.1bn YoY, and 38% progress towards the FY2024 target.

Mizuho attributes the results to a strong performance in Customer Groups in and outside Japan, as well as growth in banking income, capturing market movement. Return-on-Equity (ROE) improved by 0.5ppts to 8% in light of profit growth and efficiency improvements

At Mizuho, you see already a slight improvement in the net interest margin in the first fiscal quarter, based on the Bank of Japan action in March (raising the policy rate to a range of 0 to 0.1%). It is easy to project this out to at least a 0.9% margin given the July action.

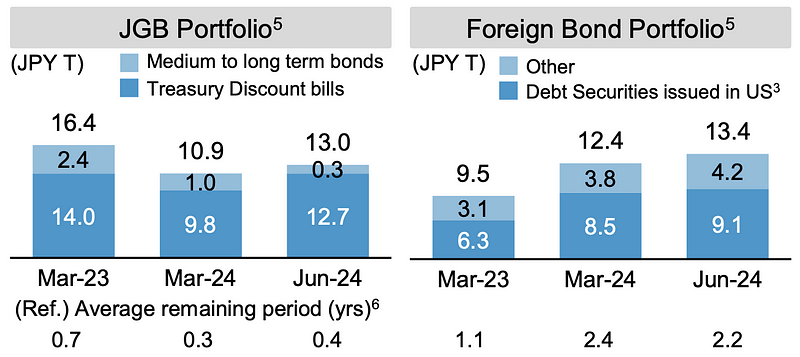

In terms of the average duration (after hedging) of the bond portfolio, the domestic side appears to be well positioned for a further rise in rates, while the duration on the foreign bond portfolio could probably be extended in light of upcoming Fed rate cuts.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn. Our global Finance & FinTech Podcast, “eXponential Finance” is also available through its own LinkedIn newsletter, or via our Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.