LY Corporation reports second quarter results

LY Corporation reported strong FY2024 Q2 results on November 5, 2024, revising its full-year guidance for adjusted EBITDA and adjusted EPS…

LY Corporation reported strong FY2024 Q2 results on November 5, 2024, revising its full-year guidance for adjusted EBITDA and adjusted EPS upwards.

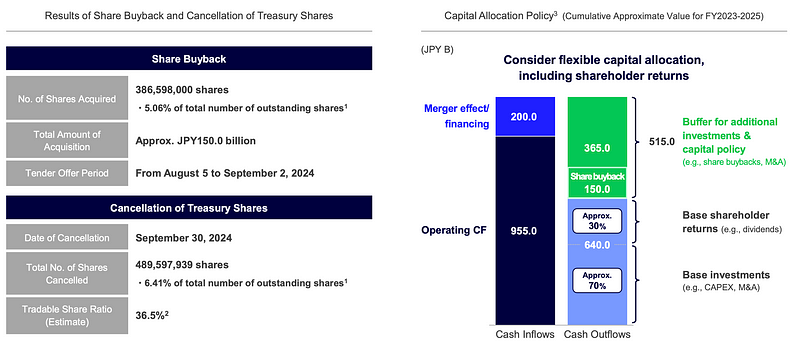

Progress is being made on addressing group-wide issues, including achieving continued listing requirements for the Prime Market through share buyback/cancellation of treasury shares and implementing security measures.

The company is focusing on enhancing LINE Official Account/LINE MINI App, increasing transaction value through LINE GIFT and LINE revamp, and accelerating the growth of the financial business through service linkage with PayPay.

FY2024 Q2 Business Results Summary

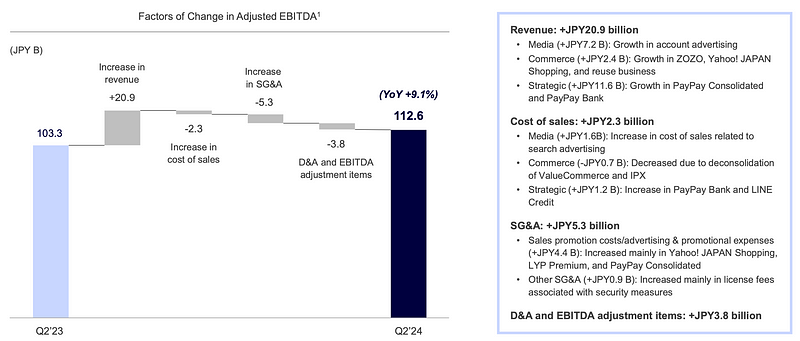

- Record Q2 Performance: The company achieved its highest ever Q2 results for both revenue (JPY462.2 billion, +4.7% YoY) and adjusted EBITDA (JPY112.6 billion, +9.1% YoY).

- Guidance Revision: Upward revision for consolidated business results guidance, including adjusted EBITDA and adjusted EPS.

Group-Wide Issues Progress

- Prime Market Listing: The share buyback/cancellation of treasury shares is expected to fulfill the continued listing requirements for the Prime Market.

- Security Measures: Security measures are being implemented as planned.

Product Reinforcement Measures

- Enhanced Monetization: Focus on enhancing LINE Official Account/LINE MINI App to support digital transformation and enrich customer experience, leading to improved monetization.

- Increased Transaction Value: Initiatives to increase transaction value include leveraging LINE GIFT and LINE revamp.

- Financial Business Growth: Accelerating growth of financial business through service linkage with PayPay.

Business Results — Media Business

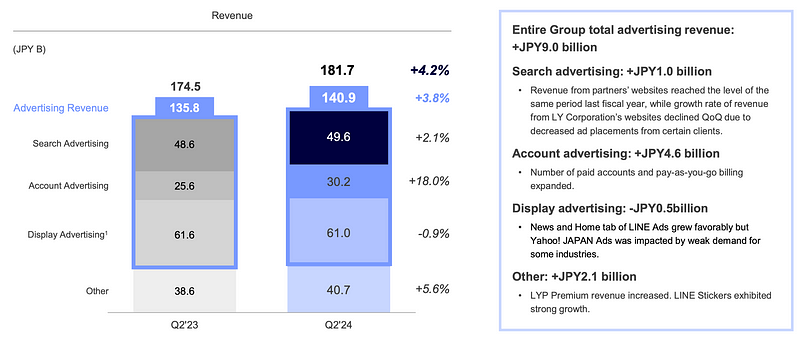

- Performance Highlights: Revenue and profit growth driven by account advertising, maintaining a high margin (over 30%).

- Revenue Drivers: Growth in account advertising and slowdown in the decrease of search advertising revenue from partners’ websites.

- Profit Drivers: Revenue growth and cost control measures.

- Account Advertising Growth: Steady growth in the number of paid accounts.

Business Results — Commerce Business

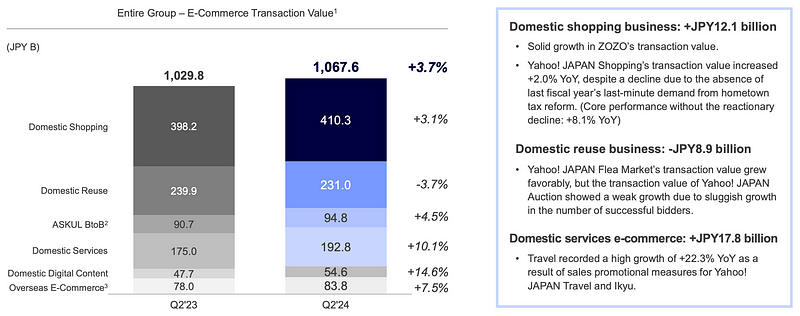

- Performance Highlights: Revenue growth in shopping and travel businesses offset the impact from the deconsolidation of subsidiaries.

- Transaction Value Growth: Travel business showed significant growth, while shopping business maintained positive growth despite the absence of last year’s demand from the hometown tax reform.

- Profit Drivers: Revenue growth and continued cost discipline.

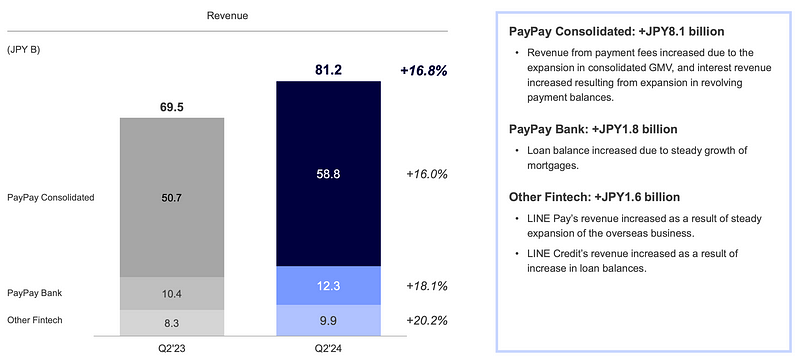

Business Results — Strategic Business

- Performance Highlights: PayPay Consolidated drove revenue and profit growth.

- Revenue Drivers: Growth across all businesses, including PayPay Consolidated, PayPay Bank, and other Fintech services.

- Profit Drivers: Revenue growth contributed to profit increase despite increased point-reward expenses.

- PayPay Consolidated Overview: Consolidated GMV exceeded +20% YoY growth, and profit increased significantly through profitability management and fixed cost reduction.

Post-Merger Review

- Merger Purposes Achieved: The company has steadily accomplished its merger purposes of “reinforcement of profitability” and “enhancement of product development capabilities.”

- Key Achievements: Exceeding FY2023 adjusted EBITDA target, achieving profitability for Strategic Business and PayPay Consolidated, introduction of in-house companies, and numerous new services/features.

Future Initiatives

- Official Account/MINI App: Reinforce LINE MINI App to increase user touchpoints and monetization, leveraging LINE’s unique strength to improve profitability.

- LINE Commerce: Aim for significant growth in annual transaction value of LINE GIFT and boost user engagement through the LINE revamp.

- PayPay Finance: Further accelerate growth in the financial business through service linkage with PayPay, including PayPay Card and PayPay Bank services.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.