Launch of “Progmat SaaS” and “Implementation Support Services”

Progmat, in collaboration with NTT DATA and SBI R3 Japan, has launched both the SaaS version of “Progmat,” a digital asset issuance and…

Progmat, in collaboration with NTT DATA and SBI R3 Japan, has launched both the SaaS version of “Progmat,” a digital asset issuance and management platform, and implementation support services.

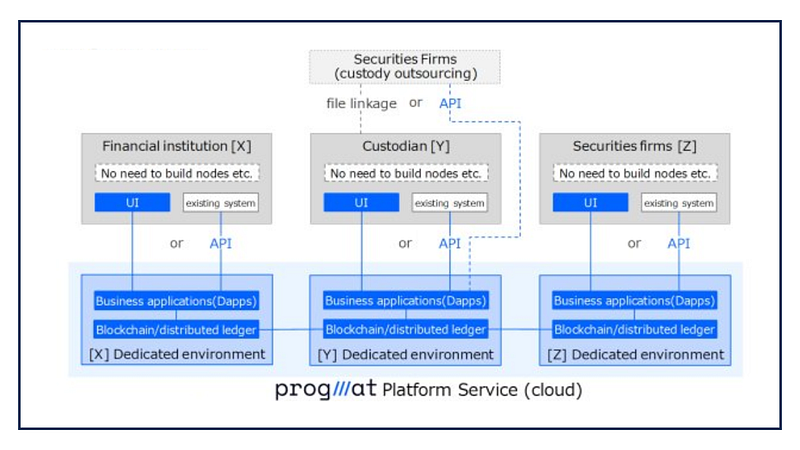

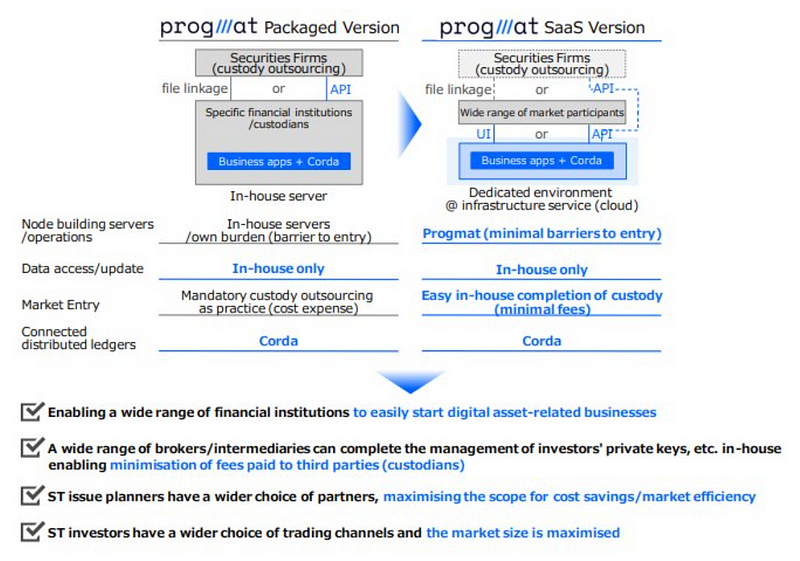

With the introduction of “Progmat SaaS,” a wide range of financial institutions can easily begin digital asset-related businesses (registry management, custody services, etc.) without having to build blockchain or distributed ledger nodes on their own servers. Additionally, a broad range of securities companies and intermediaries can manage investor private keys internally without outsourcing to third-party custodians. As a result, this expands options for businesses planning to issue Security Tokens (STs) and investors wanting to trade STs, which is expected to improve digital asset market efficiency and expand market scale.

Background of “Progmat SaaS” Launch

In Japan, with the 2020 amended Financial Instruments and Exchange Act regulating STs and the 2023 amended Payment Services Act regulating Stablecoins (SCs), the foundation for the digital asset market has been steadily developing. Japan is positioned to be advantageous within the global trend of “traditional finance × tokenization.”

Progmat was established in October 2023 as a neutral “joint venture/startup” aiming to facilitate “co-creation” among digital asset market participants across groups and to combine deep domain knowledge of financial markets with overwhelming infrastructure building capabilities “within a single organization”.

While ST projects worth approximately 270 billion yen have already been structured domestically, and “Progmat” has achieved the top domestic track record in terms of ST project handling and securities company network utilization, the previous package version required either building blockchain or distributed ledger nodes on company servers or paying fees to involve third-party custodians, which posed barriers to expanding market participation.

Purpose and Overview of “Progmat SaaS” Launch

To address these barriers, Progmat has developed “Progmat SaaS” that can be easily used by various market participants, and it is now available as of today. The main differences from the previous package version and expected effects are as follows:

The infrastructure services (cloud operations, etc.) supporting “Progmat SaaS” are provided in collaboration with NTT DATA, which has numerous shared system construction achievements, ensuring high quality, safety, and flexibility required for financial operations, enabling stable application operation continuity.

Additionally, through collaboration with SBI R3 Japan, “Progmat SaaS” is the first in Asia to support “Corda5” as its connected blockchain/distributed ledger. “Corda5” maintains the design philosophy of existing Corda while renovating the underlying system architecture to meet requirements for mission-critical systems such as CBDCs being considered by various central banks.

Specifically, it achieves further availability and scalability by adopting high-availability infrastructure technologies like Kafka and Kubernetes, and microservicizing internal processing. It also features improved infrastructure governance flexibility, making new node addition and management more efficient and flexible. Non-stop maintenance is planned for the future.

“Progmat SaaS” allows implementation methods suited to users’ situations, from automatic integration through API calls from existing systems of financial institutions and securities companies/intermediaries to screen input from free-provided UI (User Interface). Progmat and NTT DATA will provide “Implementation Support Services” that package everything from appropriate implementation method proposals to system integration support.

Future Plans

Mitsubishi UFJ Trust and Banking Corporation, currently using the package version of “Progmat,” plans to conduct a simultaneous migration to “Progmat SaaS” in February 2025, in cooperation with securities companies that are currently custody clients.

Other financial institutions and securities companies/intermediaries planning to implement the system will be announced accordingly when they begin usage.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.