Keyaki Capital Launches Japan's First Online Private Asset Investment Platform

Keyaki Capital, a Tokyo-based, VC-backed, and tech-enabled financial services platform led by CEO Taiki Kimura, announced the official launch of its Online Private Asset Investment Platform.

This platform is the first of its kind in Japan to exclusively offer private equity, private credit, and other private asset investment funds online to high-net-worth investors, following Keyaki Capital's registration to conduct electronic offering services (電子募集取扱業務) for privately placed funds under Japan’s Financial Instruments and Exchange Act.

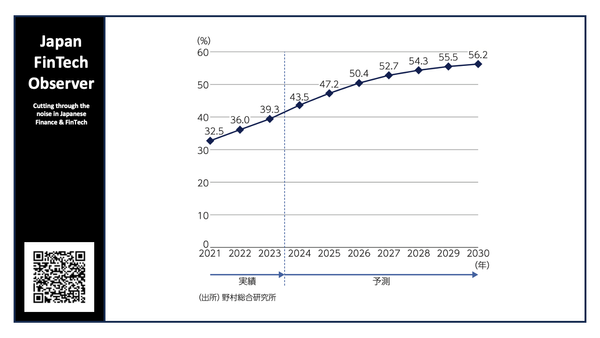

Globally, digital investment platforms providing individual investors with seamless access to institutional-quality private asset funds have rapidly expanded across North America, Europe, and Asia. Keyaki Capital is now pioneering this global trend in Japan, enabling domestic investors to benefit from greater transparency and easier access to previously unavailable private investment opportunities.

At launch, the platform features an open-ended Private Credit Fund currently distributed by Keyaki Capital, alongside the newly introduced Marina Investment Fund — a distinctive investment opportunity uniquely aligned with the firm’s corporate vision. Keyaki Capital also plans to introduce additional private capital funds, including private equity, private credit, real estate, and venture capital funds.

Since its establishment, Keyaki Capital has consistently pursued a broader mission to enhance transparency, investor protection, and ease of access to private market investments through digital innovation. Today’s launch marks an important step toward fulfilling that vision.

About Keyaki Capital

Founded in 2020, Keyaki Capital is a Tokyo-based, VC-backed, and tech-enabled financial services platform whose mission is to provide Japanese high-net-worth investors with greater access and transparency in alternative investment markets. Leveraging its proprietary, state-of-the-art digital investor portal, Keyaki Capital offers comprehensive services, including detailed investment offerings and portfolio tracking. The platform primarily targets investments in private equity, private credit, venture capital, and real estate assets, aiming to deliver an enriching and exhilarating investment experience for individual investors.

Staying true to this guiding philosophy, Keyaki Capital continues to diversify its offerings beyond traditional private equity and private credit. Last year, the firm successfully offered investors access to a unique fund investing in music copyrights associated with globally renowned artists. Moving forward, Keyaki Capital remains committed to introducing similarly distinctive and compelling investment opportunities that align with this vision.