JSCC to promote standardization of regulatory reporting through DRR & CDM

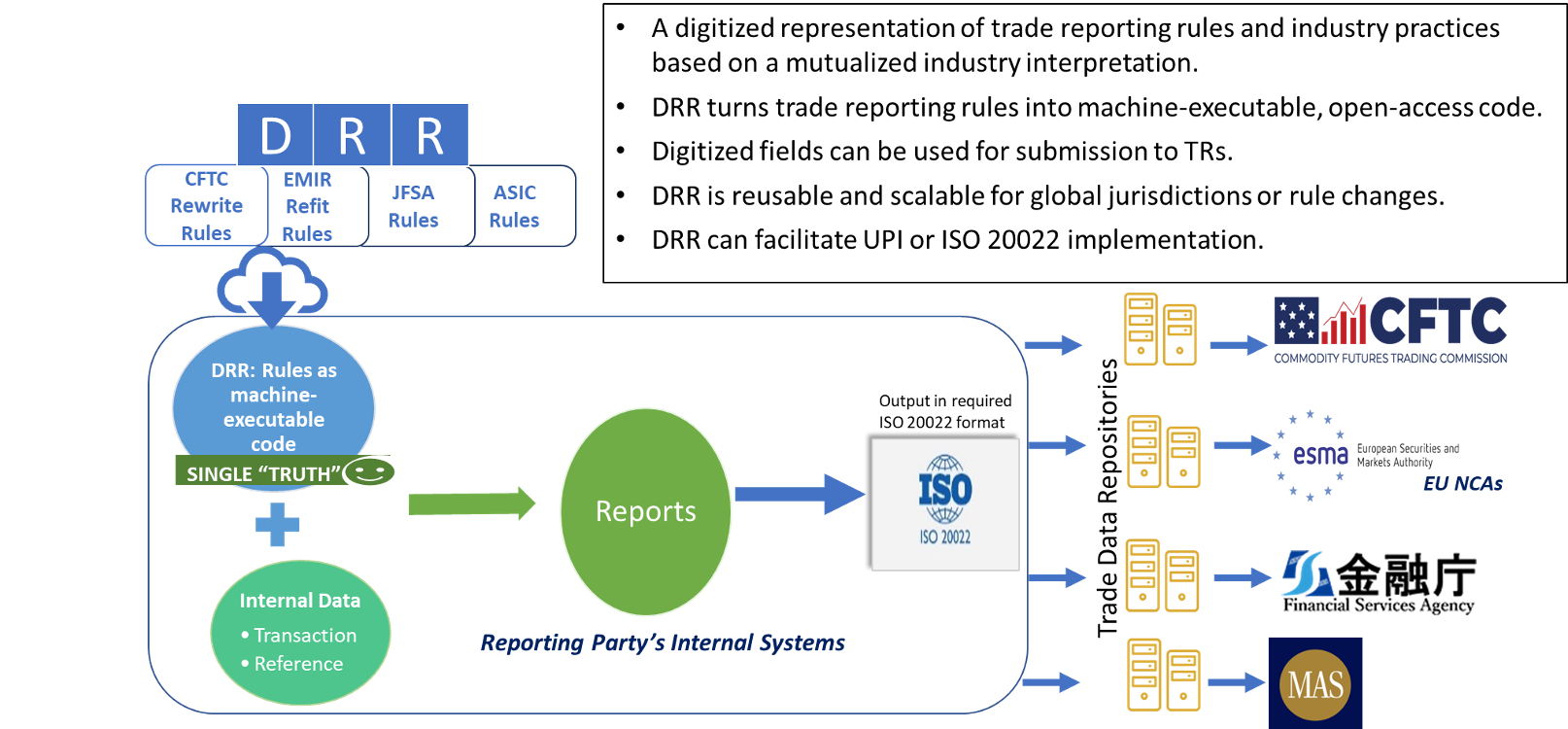

Leveraging the new standardized framework for regulatory reporting based upon ISDA’s globally promoted "Digital Regulatory Reporting (DRR)" solution and the FINOS open source managed "Common Domain Model (CDM)", the Japan Securities Clearing Corporation (JSCC) plans to begin production-parallel operations of its regulatory reporting to the Financial Services Agency (FSA) and the CFTC from June 2025 onwards. JSCC is the first CCP (Central Counterparty) and Japanese entity to announce the adoption of DRR and CDM within a production environment.

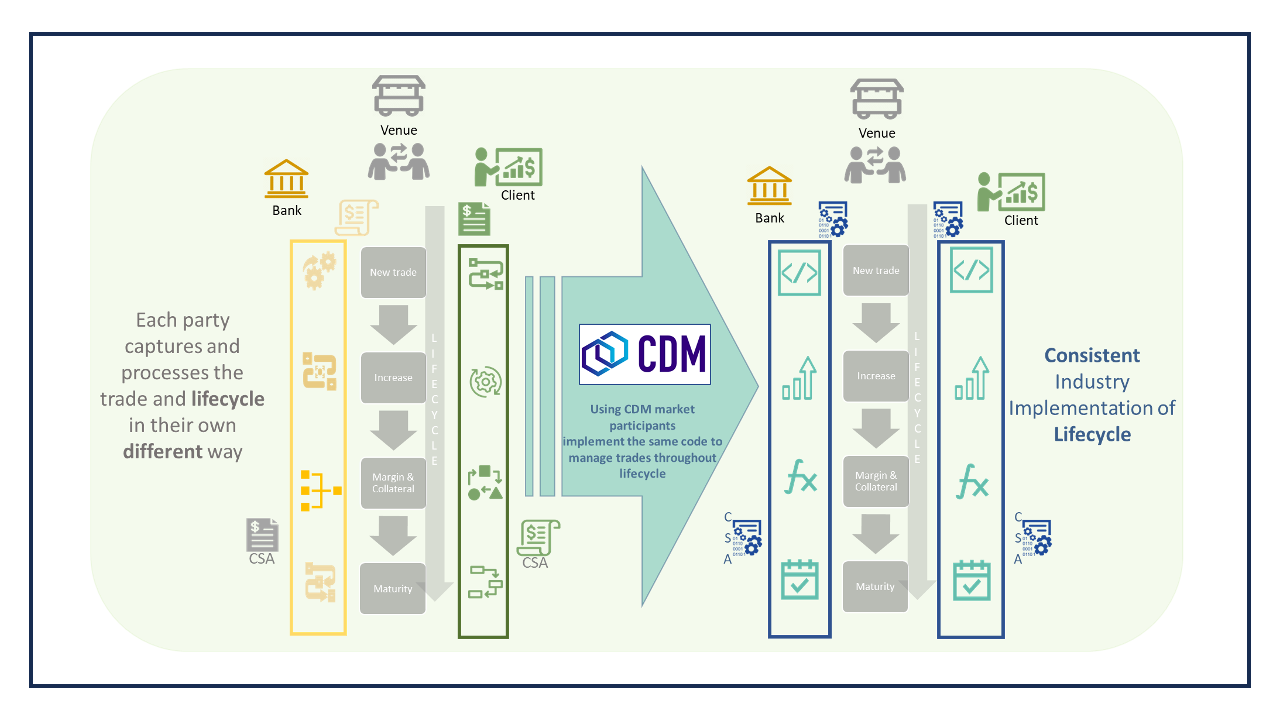

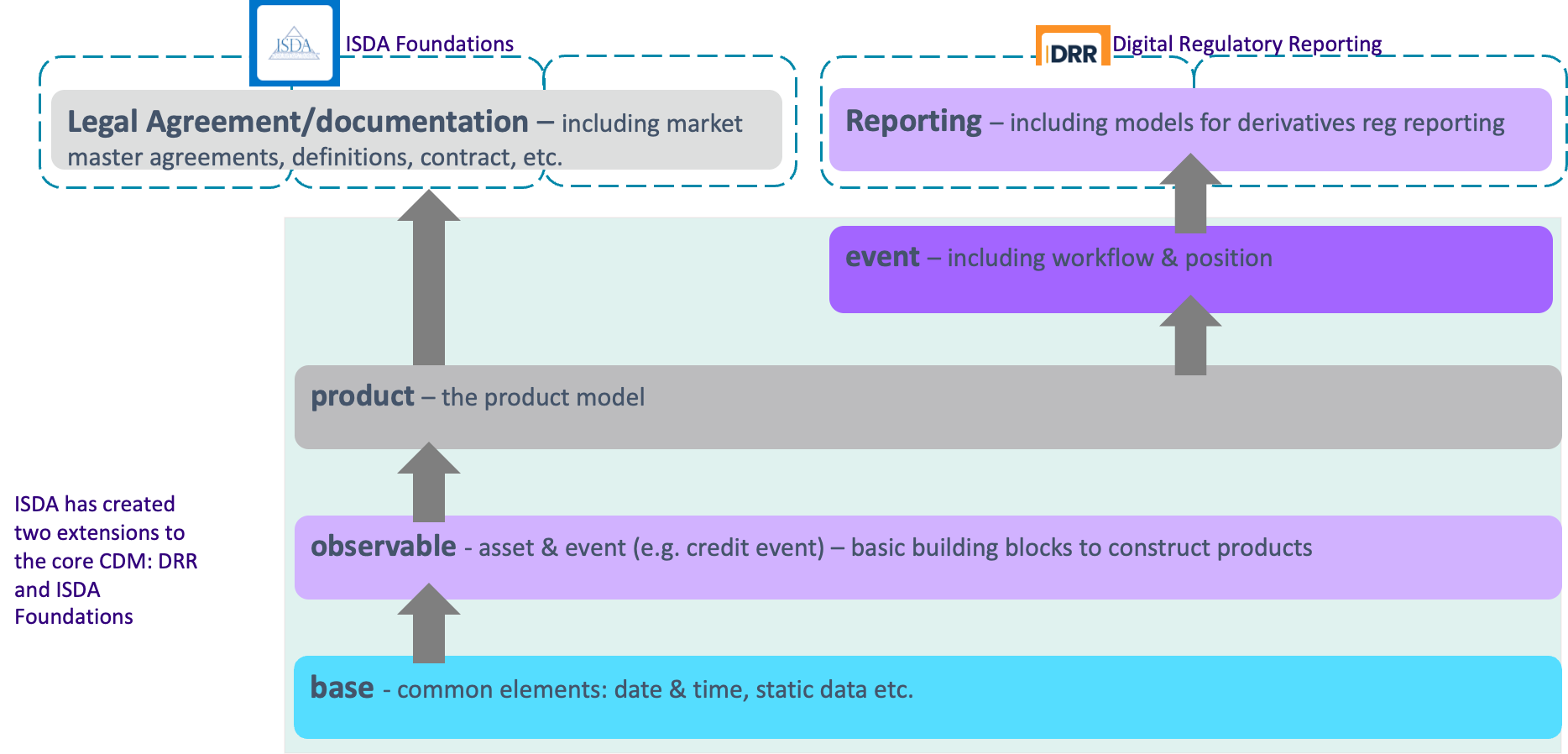

The Common Domain Model (CDM) is a standardized, machine-readable and machine-executable blueprint for how financial products are traded and managed across the transaction lifecycle

JSCC joined The Linux Foundation in October 2023 and FINOS in June 2024 prior to its proof of concept utilizing DRR/CDM in August 2024, and has since conducted extensive discussions and experiments with major financial market organizations on the possibilities and future potential of open source software (OSS) and ecosystem-friendly solutions that can be shared globally and across industries. At the FINOS premier "Open Source in Finance Forum" held in New York in September 2024, JSCC's visionary efforts to date were recognized with JSCC being awarded the "Trailblazer Award."

With the production parallel from June 2025, JSCC will begin comparative verification against its production data from the current system for IRS (interest rate swaps) transaction reporting to FSA and CFTC. JSCC will furthermore add CDS (credit default swaps) to its DRR/CDM based regulatory reporting and incrementally expand the DRR functionality (together with ISDA's plans to increase the number of target regulatory authorities).

Additionally, because CDM's future-oriented design framework may contribute to the innovative evolution of future financial systems, JSCC will continue on a mid-long term perspective to explore through experiments CDM's applicable scope.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.