JBA - Information Sharing of Fraudulently Used Accounts

In recent years, there has been a rapid increase in the amount of damage and number of reported cases of special fraud and SNS-based investment/romance scams. The banking industry needs to fundamentally strengthen countermeasures to protect customers' assets.

Financial institutions have been monitoring deposit accounts and transaction histories, freezing criminal accounts when detected to prevent the expansion of crimes, and contacting victims when suspicious transfers that may be fraudulent are detected to prevent the expansion of fraud damage.

However, the information that individual financial institutions can access is limited, and there are practical limitations in detecting criminal accounts and transfers suspected of fraud.

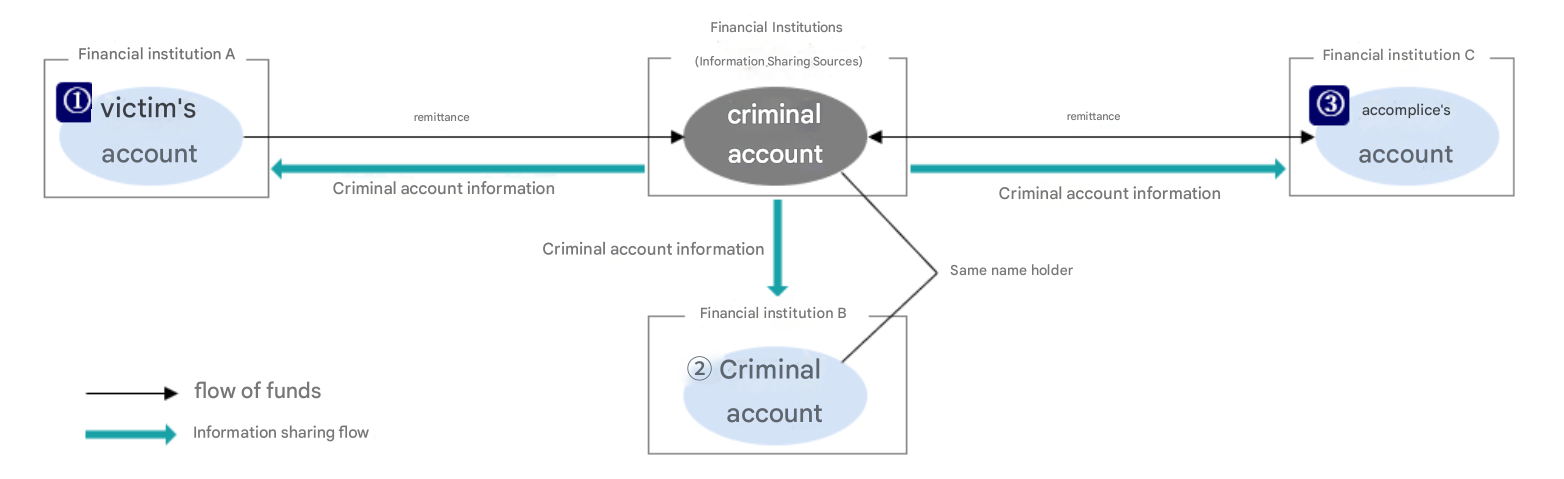

Therefore, it is necessary to build a framework for the entire financial industry to share information about criminal accounts. By utilizing the shared information, each financial institution will be able to detect:

- victim accounts,

- criminal accounts (same account holder), and

- accomplice accounts within their own institution.

Overview of this Framework

Financial institutions will share information about criminal accounts they have detected and frozen across the entire financial industry.

- Financial Institution A utilizes the shared information to detect victim accounts that have made transfers to criminal accounts. They then contact the victims to prevent the expansion of fraud damage.

- Financial Institution B utilizes the shared information to detect accounts with the same name as criminal accounts. They then freeze these accounts to prevent the expansion of criminal activity.

- Financial Institution C utilizes the shared information to detect accomplice accounts that have exchanged funds with criminal accounts. They then freeze these accounts to prevent the expansion of criminal activity.

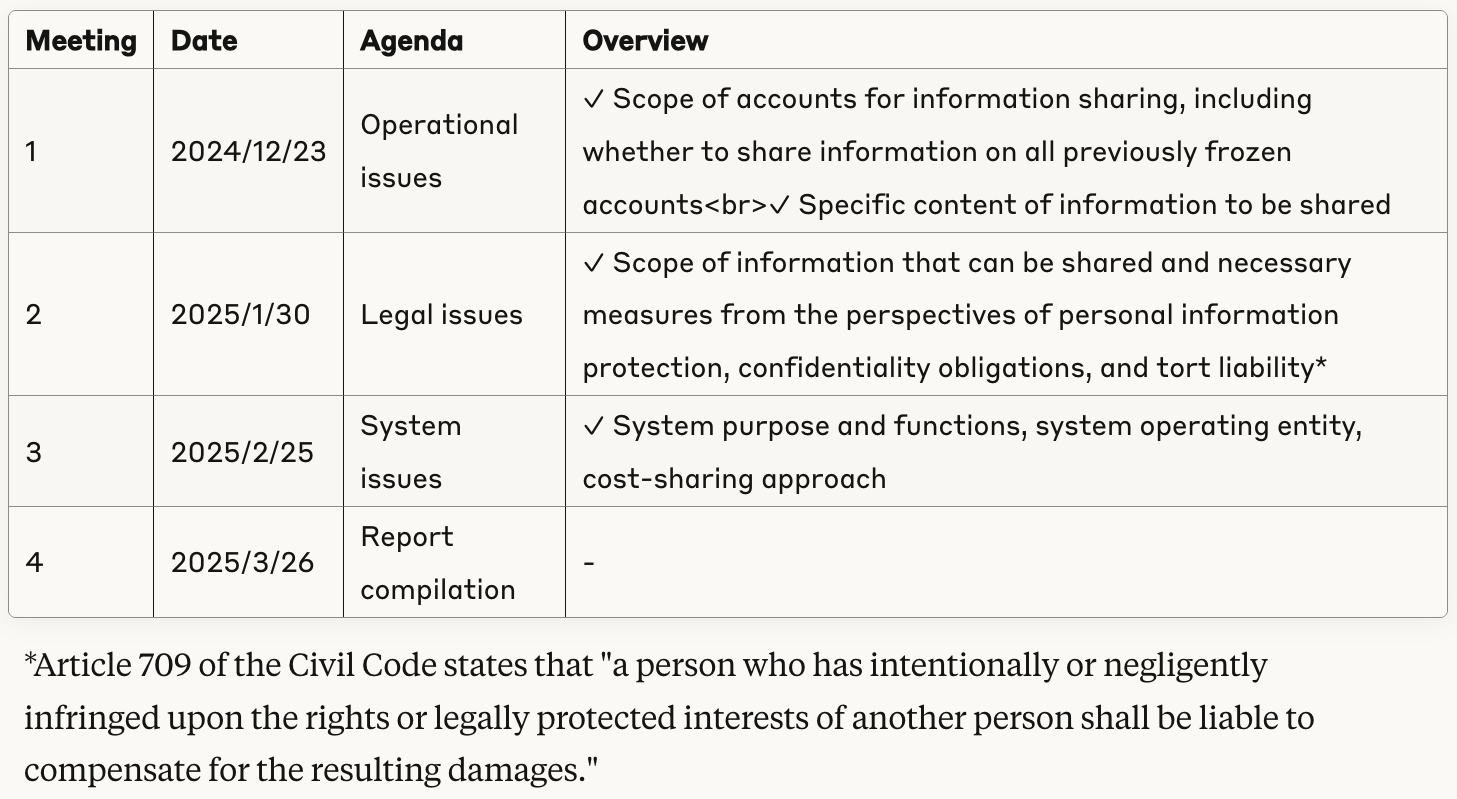

To establish this framework, in December 2024, the Japanese Bankers Association established the "Study Group on Information Sharing of Fraudulently Used Accounts" to discuss issues related to operations, legal requirements, and systems.

Meeting Schedule of the Study Group

Regarding legal issues, the Study Group believes that certain arrangements are possible. Going forward, discussions will be held with relevant authorities, and necessary measures will be implemented while proceeding with detailed operational design and system development planning. Once an environment for trial implementation is ready, information sharing of fraudulently used accounts will begin among a small number of banks. Based on the trial results, business and system requirements will be refined, leading to the design and development of a system for sharing information on fraudulently used accounts.