Japan FinTech Observer #88

Welcome to the eighty-eighth edition of the Japan FinTech Observer.

Welcome to the eighty-eighth edition of the Japan FinTech Observer.

Happy annual forecast season! Now that our horizon has moved out towards the end of 2025, we see quite a bit of divergence in our experts’ interest rate and FX forecasts. Nicholas Smith at CLSA started off with rate hikes “in December and twice more in 2025” for a policy rate of 1%. “Japan Optimist” Jesper Koll would not be surprised to see an end-2025 policy rate of “1.25 to 1.5%”. Goldman Sachs sees rate hikes about twice a year, for an end-2025 policy rate of 0.75% after hikes in December/January and July. They thus see a policy rate of 1.5% only at the end of the current BOJ forecast horizon in March 2027. The next BOJ Monetary Policy Meeting takes place on December 18 & 19.

Similarly, the 2025 year-end forecast for the JPY/USD rate ranges from 160 (HSBC), 159 (Goldman Sachs), 149 (Barclays), 143 (SMBC) to 138 (Morgan Stanley). For some of these, there is even an in-house division of opinion between the economists and FX strategists.

Wheeling and dealing: MUFG shifts a stake in Home Credit Philippines from its left to its right pocket, and then goes all-in on leading Japanese robo-advisor WealthNavi. Sony Financial acquires justInCase. Funds is acquiring a stake in a Taiwanese consumer finance company. And exotic options protocol Cega gets picked up as well. Habitto and Lecto have significant fundraises to report.

Here is what we are going to cover this week:

- Venture Capital & Private Markets: Lecto conducts its Series A round, has raised total funding of JPY 1.3bn to date; Habitto has raised JPY 1.8bn via its Series A; Global Infrastructure Management and SMFL Mirai Partners establish a new infrastructure fund; Incubate Fund partners talk about their India plans

- Insurance: Aon acquires the in-house insurance agency business of Mitsubishi Chemical Group; Sony Financial Group acquires justInCase; SPeak announced that Tokio Marine Holdings has adopted “JPort Match” to tap a global talent pool

- Banking: MUFG and MUFG Bank are entering into an agreement to sell a 25% stake of HC Consumer Finance Philippines to Security Bank; Mizuho Financial Group is considering making a push into a new area for the lender in India; Funds is acquiring a stake in Taiwan’s Asia Money Fintech Company; we take a look at Credit Saison’s second quarter results; Santander Corporate and Commercial Banking selects dentsu for its international growth platform for SMEs

- Payments: the Bank of Japan has published an English translation of the materials for the third general meeting of the CBDC Forum; Checkout.com announced its expansion into Japan supported by new direct acquiring capabilities

- Capital Markets: the Tokyo Stock Exchange has documented case studies of Prime Market and Standard Market-listed companies’ measures investors deemed as fulfilling the expectations they have for corporations; global hedge funds and private equity firms are gravitating toward Japanese companies

- Asset Management: MUFG Bank is making a tender offer for all outstanding shares and stock acquisition rights of WealthNavi

- Digital Assets: Japan Smart Chain is revealed; DMM Bitcoin will transfer customer accounts and deposited assets to SBI VC Trade, and plans to discontinue its business; Cega is being acquired by a “leading platform” and will sunset by the end of the year

- The Last Word: Global AI Vibrancy Rating

Venture Capital & Private Markets

- Lecto, which promotes digital transformation in credit management operations, has conducted a third-party allotment of new shares in its Series A round, with SMBC Venture Capital as the lead investor, Resona Capital, Mitsubishi UFJ Innovation Partners, Mizuho Capital as new investors, and existing investors ALL STAR SAAS FUND and D4V (Design for Ventures); the company also raised funds through debt financing from financial institutions, bringing its total funding to over 1.3 billion yen

- Habitto, the Japan-based digital bank looking to end financial anxiety for younger Japanese people, has raised US$11.7 million (JPY1.8 billion) via its Series A financing round; the digital bank, offering a connected financial experience and free financial advice, via its mobile app, has attracted leading venture firms QED Investors, DG Daiwa Ventures (DGDV) and Scrum Ventures; this marks QED Investors first investment in Japan, following several high-profile investments in similar B2C fintechs, including Nubank in Brazil, Klarna in Sweden and Jupiter in India; Habitto’s Series A round also saw returning investors Anthemis Group and other existing shareholders

- Global Infrastructure Management and SMFL Mirai Partners, a strategic subsidiary of Sumitomo Mitsui Finance & Lease, have jointly established the “Global Infrastructure Management Income Fund №2” on September 1, 2024, and have now completed their first investments through the acquisition of non-voting shares of Sendai International Airport, which operates Sendai Airport (the first privatized national airport), and completion of an anonymous partnership investment in a solar power plant portfolio

- Incubate Fund is one of the largest seed-stage funds in Japan with assets under management (AUM) of a billion dollars; the fund’s cofounder Masahiko Homma, NAO MURAKAMI, general partner and Rajeev Ranka, its India-based partner, spoke with the Economic Times in Bengaluru about their plans

Insurance

- Aon has signed a definitive agreement to acquire the in-house insurance agency business of Mitsubishi Chemical Group (MCG) enhancing Aon’s risk and health capability offering in Japan; the in-house insurance agency operates as part of Dia Rix, an in-house business services provider to MCG; Aon will acquire the insurance agency business which provides corporate and personal lines insurance to MCG group companies and employees in Japan

- Sony Financial Group has entered into an agreement to acquire all outstanding shares of justInCase, a small-amount and short-term insurance provider, making it a subsidiary, subject to regulatory approvals; this acquisition marks SFG’s entry into the small-amount and short-term insurance business; by collaborating with other SFG group companies, SFG aims to develop and offer new insurance products and services that transcend the traditional boundaries between life and non-life insurance

- SPeak announced that Tokio Marine Holdings (TMHD) has adopted “JPort Match,” a public relations activity and candidate pool formation support tool, for the recruitment of global talent; TMHD used JPort Match on a trial basis last year, and through recruitment public relations activities they were able to create a very large pool of candidates, which led to the hiring of excellent students

Banking

- MUFG and MUFG Bank are entering into an agreement to sell a 25% stake of HC Consumer Finance Philippines (HCPH) to Security Bank, MUFG’s equity-method affiliate commercial bank in the Philippines; the transaction value is expected to be approximately JPY26.5 billion; Bank of Ayudhya Public Company Limited (Krungsri), MUFG’s consolidated subsidiary commercial bank in the Kingdom of Thailand, will continue to hold a 75% ownership stake in HCPH; MUFG will remain the ultimate parent company of HCPH, having 20% ownership of Security Bank and 76.88% of Krungsri; the transaction is subject to regulatory approvals, with target closing in the first quarter of 2025

- Mizuho Financial Group is considering making a push into a new area for the lender in India focusing on private equity and venture capital firms, seeking to tap some of the most prolific dealmakers in the country

- Funds has entered into a share purchase agreement regarding the acquisition of shares in Asia Money Fintech Company (AMFC), which provides financial services such as Sales Finance and BNPL to individuals, utilizing its proprietary credit management know-how and scoring technology; as a result of the Agreement, Funds will acquire a portion of the common shares of AMFC, holding 13.87% of the voting rights; Funds is allowed to acquire a majority of the voting rights of AMFC by the end of May 2027, subject to certain conditions; with this capital alliance with AMFC, Funds aims to promote its overseas business, focusing on the consumer finance sector

- Credit Saison reported on the company’s performance for the first half of the fiscal year ending March 31, 2025 (FY2024); the key highlights of the results briefing included an update on the progress of the new medium-term management plan, the strong start to the plan with steadily improving earnings power and upward revisions to earnings forecasts, and a detailed discussion of the financial results digest for the second quarter of FY2024

- Santander Corporate and Commercial Banking has appointed dentsu to support the globalisation of its international growth platform for SMEs; the platform, which aims to simplify international trade for businesses around the world, is embarking on an ambitious growth journey spanning the next five years; launching into new markets will be essential for these plans, with sights set on 45 across the globe, including 10 core markets for the bank alongside additional markets related to its alliance banking partners

Payments

- The Bank of Japan has published an English translation of the materials for the third general meeting of the CBDC Forum held on October 17, 2024; the document explains the system under development for the pilot program and provides updates on progress made by different working groups

- Checkout.com announced its expansion into Japan supported by new direct acquiring capabilities; to lead this expansion, Checkout.com has appointed Noriko Sasaki as Country Manager for Japan; Noriko brings over 20 years of experience in the financial services and consulting industries, and has held many leadership roles at Citigroup as well as at PwC and Accenture; the opening of the new Tokyo office further enhances Checkout.com’s local presence, allowing for more personalized support for merchants; this builds on the company’s continued investment across the APAC region, following launches in Australia, New Zealand, Hong Kong and Singapore

Capital Markets

- The Tokyo Stock Exchange has documented case studies of Prime Market and Standard Market-listed companies’ measures investors deemed as fulfilling the expectations they have for corporations; these case studies are intended for listed companies that are considering taking action to implement management that is conscious of cost of capital and stock price, and also as a reference for future updates for listed companies that have already made disclosures

- Global hedge funds and private equity firms are gravitating toward Japanese companies in a bid to unlock as much as ¥25 trillion ($165 billion) in undervalued real estate; the hidden value of property on corporate balance sheets is showing up as a theme behind some of the biggest activist campaigns and mergers and acquisitions announced in Japan this year; in the latest move, Elliott Investment Management unveiled a 5.03% holding in Tokyo Gas, with a real estate portfolio that the US firm estimates is worth about ¥1.5 trillion — almost as much as the utility’s entire market value, Bloomberg reported last week

Asset Management

- MUFG Bank is making a tender offer for all outstanding shares and stock acquisition rights of WealthNavi, a publicly traded robo-advisor company listed on the Tokyo Stock Exchange Growth Market; MUFG believes that WealthNavi’s technology, agile product development capabilities, and strong brand recognition in the robo-advisor market will synergistically enhance MUFG’s existing offerings and accelerate its growth in the wealth management space; specific synergies include accelerating Monetary Advisory Platform (MAP) development, expanding asset management functionalities, strengthening their online brokerage strategy, and leveraging WealthNavi’s management expertise and know-how; we also have covered the question “Why is MUFG acquiring WealthNavi” on our short-form news podcast

Digital Assets

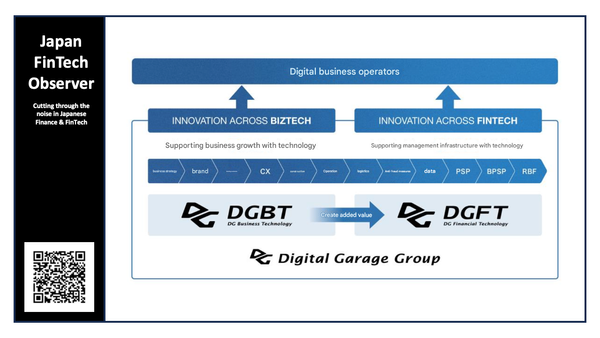

- Joichi Ito, President of Chiba Technical University and co-founder of Digital Garage, and Russell Cummer, Founder and former Chairman of Paidy (Japan’s leading BNPL service), have jointly launched AltX Research KK to develop Japan Smart Chain (JSC), a Japan-sovereign, Ethereum blockchain optimised for Japanese regulations; Japan Smart Chain aims to solve key regulatory and consumer protection challenges for digital transactions, unlocking sizable efficiencies for Japan-based companies, consumers, and innovators; with the reveal last week, they also have published a JSC Whitepaper

- DMM Bitcoin will transfer customer accounts and deposited assets to SBI VC Trade, and plans to discontinue its business after the transfer is completed; under this agreement, all accounts and deposited assets (Japanese yen and cryptocurrencies) currently with DMM Bitcoin are scheduled to be transferred to SBI VC Trade around March 2025; margin trading unresolved positions will not be transferred, and customers will be expected to settle all such positions by a certain date before the transfer date

- Cega, a leading on-chain exotic options and structured investment productsprotocol, has announced it is being acquired by a “leading platform” and will sunset its operations by the end of the year; Cega, which operates across Solana, Ethereum, and Ethereum Layer 2 network Arbitrum, claims to be the first to bring exotic options to DeFi with its initial Solana launch in June 2022; while regular options allow users to buy or sell an underlying asset at a specific price and time, exotic options are more customized and typically have additional conditions attached

- The exposure of Japanese services to global illicit entities such as sanctioned entities, darknet markets (DNMs), and ransomware services is generally low, as most Japanese services cater primarily to Japanese users; however, this does not imply that Japan is totally immune from crypto-related crime; public reports, including those from JAFIC, Japan’s financial intelligence unit (FIU), emphasize that crypto poses a significant money laundering risk; although Japanese exposure to international illicit entities may be limited, the country is not devoid of its own local challenges; off-chain criminal entities that leverage crypto are prevalent, yet often fly under the radar, according to Chainalysis

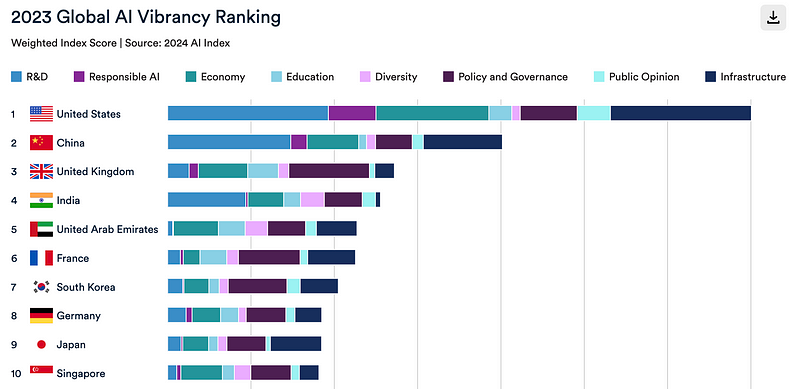

Global AI Vibrancy Rating

The Stanford Institute for Human-Centered Artificial Intelligence (HAI) has released a new “Global AI Vibrancy Tool”, an interactive visualization that facilitates cross-country comparisons of AI vibrancy across 36 countries, using 42 indicators organized into 8 pillars.

It provides a transparent evaluation of each country’s AI standing based on user preferences, identifies key national indicators to guide policy decisions, and highlights centers of AI excellence in both advanced and emerging economies.

As one of the most comprehensive indices of AI vibrancy globally, the tool offers valuable insights for understanding and fostering AI development.

One could expect the US and China ahead of the pack, although the gap between first and second place might come as a bit of a surprise. After that, the field is still wide open, as the gap between third and tenth is relatively narrow. This tool will provide good tracking of the developments going forward.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.