Japan FinTech Observer #86

Welcome to the eighty-sixth edition of the Japan FinTech Observer.

Welcome to the eighty-sixth edition of the Japan FinTech Observer.

We are almost done with earnings season, the mega banks reported stellar results last week, and announced additional share buybacks of JPY 300bn (MUFG), 150bn (SMBC), and 100bn (Mizuho). For the latter, it is the first buyback in 16 years. To celebrate, they also tied the knot with Rakuten Card. We are going to catch up on some of the listed FinTech companies this week, and the insurers are due as well.

I am going to have to eat my broom — after receiving SEC clearance, Coincheck is going to list on Nasdaq through a De-SPAC transaction (are they really?). It is late 2024, SPACs are supposed to have died quite a while ago. Long live the SPAC!

No macro views this time (some will be relieved), we are going to review the forecast for the next BOJ rate hike again next week (preliminary GDP, producer prices and consumption indices came in this week largely in line with BOJ expectations).

Here is what we are going to cover this week:

- Venture Capital & Private Markets: SmartBank has raised JPY 2.93bn in a Series B first close; Headline Asia leads Tradom’s JPY 413m seed round; Green Carbon raised additional funds from SMBC Venture Capital and Mitsubishi UFJ Capital; Seven Bank has participated with JPY 50m in SUSHI TOP MARKETING’s Series A; Pacific Meta has invested an undisclosed amount in 0xPPL

- Insurance: Mitsui Sumitomo Insurance, Sumitomo Mitsui Financial Group, and Cyreeg Holdings will establish a joint venture company to promote the strengthening of cybersecurity measures across Japanese companies

- Banking: Strong second quarter and first half earnings results from Rakuten Bank, MUFG, SMBC Group, and Mizuho

- Payments: Mizuho acquires 14.99% of Rakuten Card; not-so-strong earnings from Orico; PayPay has increased the per-transaction and 24-hour payment limit to JPY 1m; Datachain has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business; Digital Asset Markets has obtained a patent for a debit service provision system that allows users to choose between traditional cash held in bank accounts and digital assets held in cryptocurrency exchange accounts as the primary settlement method

- Capital Markets: Tradeweb Markets and the TSE offer institutional investors enhanced access to liquidity in Japanese ETFs; Webull Securities has integrated with TradingView; AlpacaTech, MINKABU and Snowflake partner to provide AI data cloud solutions; SBI Holdings plans to delist SBI FinTech Solutions through a tender offer

- Digital Assets: Coincheck is expected to list as early as December through a De-SPAC transaction; the Japan Blockchain Foundation will commence the Initial Exchange Offering (IEO) of the “Japan Open Chain Token (JOC)” this week; SBINFT Corporation has launched “SBINFT LAUNCHPAD”; DMM Crypto has discontinued the “Seamoon Protocol”; Vlightup has announced the start of TRUSTAUTHY development

- The Last Word: Tokyo Financial Award

Venture Capital & Private Markets

- The Ministry of the Environment has developed the “Guidelines for GHG Impact Calculation and Assessment of Climate Tech for Investors and Startups” as a framework for investors and startups to calculate and assess the environmental impact of Climate Tech startups during investment screening; these guidelines focus on the environmental impact of Climate Tech startups, particularly their future GHG reduction effects (GHG impact); they compile concepts and procedures for calculating and evaluating GHG impact, intended as a reference for investors during investment screening; additionally, these guidelines can be useful for startups when calculating their future GHG impact and explaining it to investors

- Hokuyo Bank and Hokkaido Co-Creation Partners have established the “Hokuyo SDGs Promotion Fund №3” (hereinafter “Fund №3”) as a successor to the “Hokuyo SDGs Promotion Fund №2” (hereinafter “Fund №2”), which was established in June 2022 with the aim of contributing to Hokkaido’s sustainable development by solving regional business challenges through funding companies that align with SDGs concepts; over 2 years and 4 months, the fund invested approximately 400 million yen in 21 companies, primarily startups, achieving notable results in promoting entrepreneurship, employment, and economic growth in Hokkaido

- SmartBank, provider of the prepaid card household budget app “B/43,” has completed its Series B round first close, raising 2.93 billion yen through a third-party allocation of shares; the round was led by SMBC-GB Growth, with participation from existing shareholders and new investors including Seven Bank and Japan Post Spiral Regional Innovation; combined with 1.15 billion yen in debt financing from multiple financial institutions in April 2024, this completes the Series B round first close

- Headline Asia, a member of Headline conducting global investment activities primarily in Asia, has executed an investment in Tradom, which develops and provides the “Tradom FX Solution” system for appropriate foreign exchange risk control; Tradom has raised 413 million yen through a third-party allocation of shares, with Headline Asia as the lead investor among eight participating companies; this funding will accelerate the development of an enterprise plan that enables more sophisticated foreign exchange management and FX risk management through their “Tradom FX Solution” system for corporate clients

- Green Carbon has raised funds through a third-party allocation of shares, with two new subscribers: SMBC Venture Capital, the investment branch of the Sumitomo Mitsui Financial Group, and Mitsubishi UFJ Capital, the investment branch of the MUFG; Green Carbon is developing a nature-based carbon credit businesses across Japan, Southeast Asia, and Oceania

- Seven Bank has participated with JPY 50m in SUSHI TOP MARKETING’s Series A, bringing the total amount raised to JPY 130m; with this newly raised capital, Sushi Top Marketing, which is specializing in marketing and communication design utilizing NFTs, will accelerate technology development, talent acquisition, and marketing activities both domestically and internationally

- Pacific Meta has invested an undisclosed amount in 0xPPL, a Web3 social protocol that aims to create a social network for people using cryptocurrencies, positioning itself as a trusted source of information in the Web3 space; currently, 0xPPL offers a portfolio feature that allows users to track their own and friends’ on-chain activities, as well as visualize assets across multiple blockchains; additionally, it provides a multiplayer mode that enables users to interact with each other

Investments outside FinTech

- newmo has raised approximately 6.3 billion yen through a third-party allocation of shares to multiple investors, including existing investors, in an additional Series A round; this brings the total Series A funding to approximately 16.7 billion yen, with cumulative funding since founding reaching approximately 18.7 billion yen.newmo is a startup founded in January 2024, aiming to realize “sustainable regional transportation from a user perspective”; in March, they acquired management rights to Kishi-ko, a taxi company in Osaka, and in July, Miraito; the newmo group now owns over 600 taxi vehicles and employs more than 1,000 people

- ShareDine, which has a network of 10,000 chefs, has raised over 1.8 billion yen in its Series B first close through a third-party allocation of shares led by JIC Venture Growth Investments, with DBJ Capital and Aozora Corporate Investment as subscribers, along with loans from multiple financial institutions

- Boomi, a leader in intelligent integration and automation, has established a joint venture company, Boomi Japan Corporation, through a strategic investment from SunBridge Partners

- TDK Ventures announced investment team for Its India innovation hub location: TDK Ventures’ India presence seeks to identify and scale the impact of the country’s extraordinary entrepreneurs and help accelerate their vision for energy, environmental, and digital transformation

Insurance

- Sumitomo Mitsui Financial Group, Mitsui Sumitomo Insurance, a member of MS&AD Insurance Group, and Cyreeg Holdings have signed a basic agreement to establish a joint venture company that will promote the strengthening of cybersecurity measures across Japanese companies by combining SMBC Group’s customer relationships with Mitsui Sumitomo Insurance and Cyreeg HD’s advanced technical capabilities and expertise in cybersecurity

Banking

- Rakuten Bank’s first-half 2024 results are in, and they have blown past expectations; profits are up significantly, and the bank has raised its full-year net profit guidance by a whopping 22%, from ¥37.8 billion to ¥46.2 billion; this performance beat stems from a combination of factors, including lower restructuring costs than anticipated and the positive impact of the July interest rate hike by the Bank of Japan (BOJ); while the dividend policy remains unchanged, the overall picture is overwhelmingly positive

- Mitsubishi UFJ Financial Group (MUFG) delivered a stellar performance in the first half of fiscal year 2025, exceeding expectations and prompting an upward revision of full-year targets; the results, announced on November 14, 2024, showcase the bank’s robust financial health and strategic execution; first-half net income represents an impressive 83% of the full-year guidance of ¥1.5 trillion, surpassing consensus estimates from both Goldman Sachs and Bloomberg

- Sumitomo Mitsui Financial Group (SMFG) announced its financial results for the first half of the fiscal year 2025 (H1 FY3/25), ending September 30, 2024; the group reported strong performance across the board, driven by solid business performance and larger-than-anticipated gains on stock sales; SMFG increased dividend per share (DPS) to ¥120, reflecting a payout ratio of 40%, and announced additional share buybacks of up to ¥150 billion, bringing the total for the full year to ¥250 billion

- Mizuho Financial Group reported robust first-half FY24 results, exceeding expectations and prompting an upgrade to full-year guidance; the company also announced its first share buyback in 16 years and increased its dividend, signaling confidence in its future performance and a commitment to rewarding shareholders

Payments

- As previously announced on October 1, 2024, Rakuten Card and Mizuho Financial Group have agreed to enter into a strategic capital and business alliance between the two companies; in conjunction with this Alliance, Rakuten Group and Mizuho FG concluded a share transfer agreement, with Rakuten transferring 14.99% of Rakuten Card’s common stock to Mizuho FG

- Consumer credit stalwart Orico reported financial results for the second quarter of the fiscal year ending March 2025 on November 15, 2024, revising its earnings per share forecast downwards by 40%, below the previous fiscal year’s level; Orico is in transition, focused on leveraging its expertise in installment credit profitably into a variety of partnerships (Mizuho FG, Rakuten Group, AEON Financial Service), and advancing its digital transformation agenda to enhance corporate value

- PayPay has increased the per-transaction and 24-hour payment limit of its cashless payment service from 500,000 yen to 1 million yen; for payments using the blue screen “PayPay Credit,” which previously had a maximum payment limit of 500,000 yen (per transaction and within 24 hours), the new change means that transactions can now exceed 1 million yen per transaction, with limits determined by the user’s “PayPay Card (including PayPay Card Gold)” credit line, similar to regular credit cards

- Datachain Corporation has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business; under this contract agreement, Datachain will receive a portion of the revenue generated from stablecoins issued through “Progmat Coin,” Progmat’s stablecoin issuance management platform

- Digital Asset Markets has obtained a patent for a debit service provision system that allows users to hold digital assets and select a variety of assets for liquidation, enabling instant settlement; the system utilizes blockchain technology and smart contracts to manage transactions and ensure secure and efficient processing; this system allows users to choose between traditional cash held in bank accounts and digital assets held in cryptocurrency exchange accounts as the primary settlement method; it also provides the option to specify a preferred digital asset for settlement and the ratio of cash and digital assets to be used for settlement

Capital Markets

- Tradeweb Markets, a leading, global operator of electronic marketplaces for rates, credit, equities and money markets, and the Tokyo Stock Exchange (TSE) have collaborated to offer institutional investors enhanced access to liquidity in Japanese exchange-traded funds (ETFs); the launch of a new direct link between Tradeweb and TSE’s request-for-quote (RFQ) platform, CONNEQTOR, allows Tradeweb buy-side clients to include CONNEQTOR liquidity providers when launching a trade enquiry on the Tradeweb Japan-listed ETF marketplace; Global X Japan executed the first transaction using this new connectivity

- Webull Securities, the Japanese subsidiary of Webull, has integrated with TradingView, a charting platform and social network for traders and investors; this integration will enable Japanese Webull users to trade both U.S. and Japanese stocks directly from TradingView’s charting platform; additionally, millions of Japanese TradingView users will be able to easily connect to Webull’s trading system and trade both U.S. and Japanese stocks

- AlpacaTech, a subsidiary of FOLIO Holdings that provides innovative financial solutions within the SBI Group, is building a new data cloud utilizing Snowflake’s AI data cloud platform through a business partnership with MINKABU THE INFONOID and its subsidiary MINKABU Solution Services; by integrating access to MINKABU Group’s diverse data into the Snowflake environment, they will begin providing AI data cloud solutions to customers through advanced analysis, including fact-checking of news data using generative AI, report creation, and decision support through qualitative analysis

- SBI Financial Services (SBIFS), a subsidiary of SBI Holdings (SBIHD), plans to acquire all outstanding shares of SBI FinTech Solutions through a tender offer; this includes shares listed on the KOSDAQ market in South Korea via Korean Depositary Receipts (KDRs); SBIHD already owns 77.48% of the target company’s KDRs, SBI FinTech Solutions holds approximately 4.2% of its own KDRs

Digital Assets

- Coincheck Group, a consolidated subsidiary of Monex Group, has been diligently preparing for listing its common stock on the Nasdaq Global Market through a previously announced business combination with Thunder Bridge Capital Partners IV (THCP), a special purpose acquisition company (SPAC) listed on Nasdaq; Monex Group has now announced that the registration statements have become effective on November 12, 2024; Coincheck is therefore expected to list as early as December

- Japan Blockchain Foundation, which operates and manages the consortium for “Japan Open Chain (JOC),” will commence the Initial Exchange Offering (IEO) of the “Japan Open Chain Token (JOC)” on the “BitTrade IEO” platform starting November 20, 2024; the JOC Token (Japan Open Chain Token) is a utility token for the Japan Open Chain, a blockchain project committed to adhering to Japanese regulations, offering a fast, secure blockchain managed by trustworthy operators

- SBINFT Corporation has launched “SBINFT LAUNCHPAD,” a specialized NFT sales service for businesses issuing and selling NFTs such as gaming NFTs and ticket NFTs, starting November 15, 2024; four titles — “Coin Musume,” “BOUNTY HUNTERS,” “Edomae Monsters,” and “Sakigake Sangokushi Taisen” — will begin selling NFTs sequentially

- Failing fast — Seamoon Protocol discontinued: DMM Crypto has decided to discontinue the economic zone initiative “Seamoon Protocol”; DMM Crypto was established in January 2023 to develop the DMM Group’s web3 business, and in June of the same year, launched the economic zone concept “Seamoon Protocol” utilizing its own token

- Vlightup has announced the start of TRUSTAUTHY development, emerging out of the Antler Japan residency program; TRUSTAUTHY achieves smooth and secure transactions while reducing fraudulent trading risks through features including “GeoAuth” (a real-time authentication function based on location information), behavior-based credit score evaluation, and advanced recovery capabilities; the testnet sandbox release is scheduled for Spring 2025

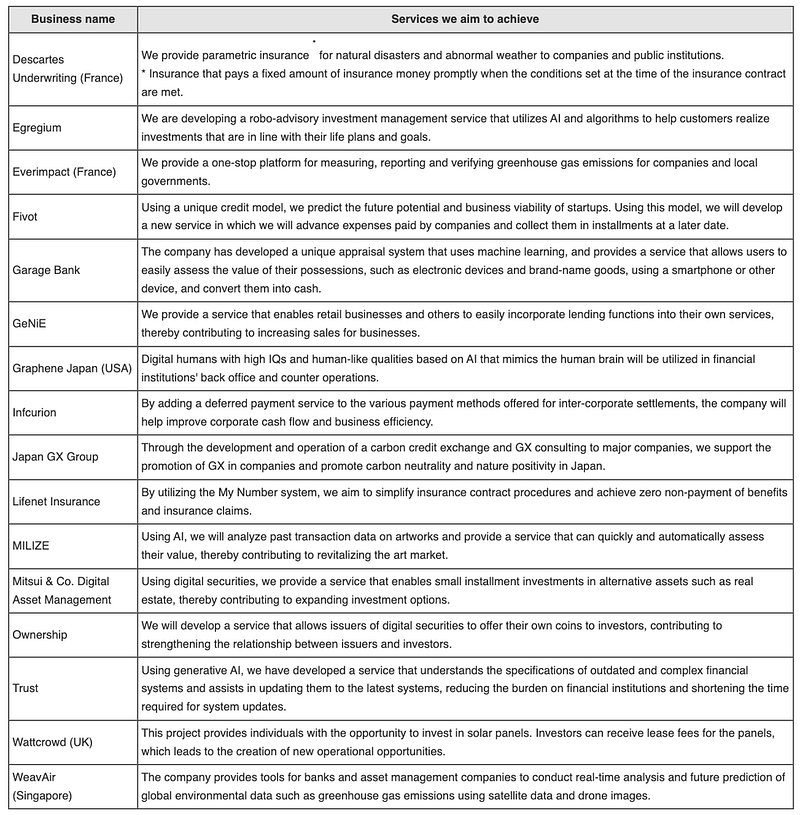

The Last Word: Tokyo Financial Award

Tokyo aims to become “an innovation and financial hub in Asia that realizes a sustainable society,” and is working to become a leading city in sustainable finance and a city that gives birth to globally active startups.

The Tokyo Metropolitan Government has received a record 136 applications from both Japan and overseas for the Financial Innovation Category of the Tokyo Financial Awards, and the 16 listed below have passed the first round of screening.

These startups will receive support from the project (mentorship programs, business matching, support for overseas outreach, etc.) and continue to refine their business ideas. After that, a final screening will be held in January and the top three companies will be awarded during a ceremony during “Japan FinTech Week” in March.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.