Japan FinTech Observer #85

Welcome to the eighty-fifth edition of the Japan FinTech Observer.

Welcome to the eighty-fifth edition of the Japan FinTech Observer.

Japan now has a post-election minority government. Germany has a pre-election minority government. The US is transitioning to a new administration. That is where three of the world’s five largest economies stand.

As a reminder, Japan’s Lower House was dissolved on October 9, and elections took place on October 27. Apparently, Germany cannot vote in January “due to a lack of paper” to print the ballots. I do not have enough face palm emojis to express my disgust, so let us turn to the happy world of FinTech.

Here is what we are going to cover this week:

- Venture Capital & Private Markets: the FSA’s and METI’s “Expert Panel on Venture Capital Funds” has published “Venture Capital: Recommendations and Expectations”, Mizuho Bank has invested USD 20m for a partial equity stake in Pollination, a specialist climate change investment and advisory firm; the SMBC Asia Rising Fund has closed investments in MODIFI, Easy Home Finance, and M2P Fintech; Lifetime Ventures leads Artio’s seed round; cryptocurrency exchange Bitbank has established Bitbank Ventures; DNX Ventures has launched a venture studio

- Insurance: MS&AD Insurance Group announced the completion of its current share buy-back program, and published its annual Integrated Report

- Banking: the Bank of Yokohama and IBM have conducted a proof of concept utilizing Generative AI for creating loan review documents

- Payments: strong earnings reports from LY Corporation and Digital Garage; PayPay announced an expanded partnership with Alipay+; Intelligent Wave is adapting its card connection & authentication to AWS; InComm Payments acquires digital gift card provider Mafin from J ESCOM

- Capital Markets: the TSE has extended the trading hours of the cash equity market by 30 minutes; Sumitomo Mitsui Financial Group and enechain have established a new joint venture company, named “eXstend”, to provide fuel price volatility hedging; Japan’s financial regulator is urging Nomura Holdings to examine the cause of an alleged robbery and attempted murder committed by a former employee

- Digital Assets: SBI Digital Markets has renewed its participation in the Monetary Authority of Singapore’s Project Guardian pilots; NTT Digital, with Amazon and StraitsX, has showcased a pioneering use case for tokenizing accounts payable; OSL Group, a Hong Kong publicly listed company fully dedicated to digital assets, acquired an 81.38% stake in CoinBest; Ginco and Multipeak will collaborate on a blue carbon credit generation and biodiversity credit initiative

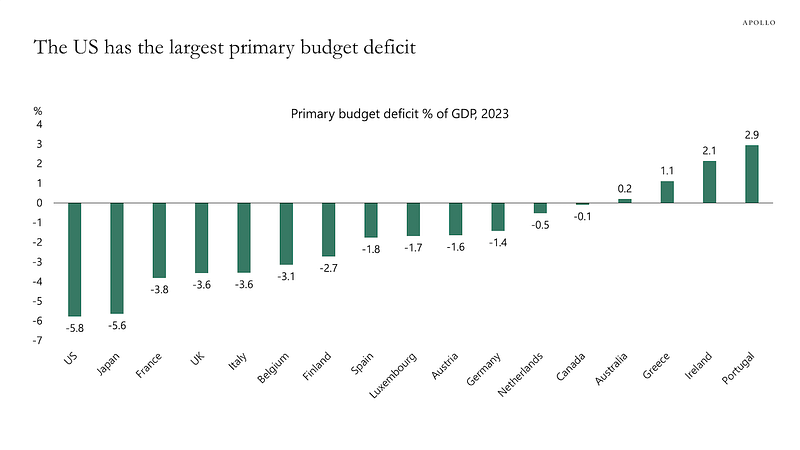

- The Last Word: Primary Budget Deficits

Venture Capital & Private Markets

- The Financial Services Agency (FSA) and the Ministry of Economy, Trade and Industry (METI) jointly held the “Expert Panel on Venture Capital Funds” from April to June 2024, in order to encourage the development of the VC sector; after public consultation, the Expert Panel finalized and published the paper “Venture Capital: Recommendations and Expectations”, which outlines the recommended and expected practices for Venture Capital firms in Japan, particularly those seeking funding from domestic and international institutional investors; it aims to enhance the attractiveness of VC as a long-term asset class, foster the growth of the VC industry, and ultimately contribute to the development of a thriving startup ecosystem

- Mizuho Bank and Pollination have agreed to form a strategic partnership to support Mizuho’s clients’ efforts to implement decarbonisation steps; as part of the agreement, Mizuho Bank has invested USD 20m for a partial equity stake in Pollination, a specialist climate change investment and advisory firm working to accelerate the transition to a net zero, nature positive future; launched in 2019, Pollination brings together world leaders across a diverse range of fields, including finance, investment, corporate governance and strategy, technology, law, and policy, to unlock sustainable solutions

- SMBC Asia Rising Fund closes investments in MODIFI, a leading global platformer for B2B cross-border supply chain finance for 1,800+ SMEs across 55+ countries, based in the Netherlands; Easy Home Finance, a leading provider of online mortgages tailored to India’s affordable housing initiatives, leveraging in-house technology such as AI-based underwriting and data-centric property evaluation; and M2P Fintech, a global Banking-as-a-Service platform from India, powering next-gen Fintech, offering API infrastructure with a comprehensive technology stack

- Lifetime Ventures leads Artio’s seed round: climate insurtech startup Artio has raised GBP 550k to pioneer insurance solutions for early-stage carbon removal projects through its proprietary risk modelling platform; the round was led by Lifetime Ventures, leveraging their deep climate tech expertise, alongside SFC Capital, one of the UK’s most active pre-seed investors

- Cryptocurrency exchange Bitbank has established Bitbank Ventures, with the aim of conducting more serious investment activities in projects that utilize crypto assets and blockchain technology; Bitbank has collaborated with multiple projects and crypto funds and has been continuously engaged in investment activities; Bitbank believes that innovative solutions will be born and social implementation will progress in the future by utilizing crypto assets and blockchain technology, which realize value transfer on the Internet in a more open manner

- Indianapolis-based High Alpha Innovation has teamed up with DNX Ventures to launch a Tokyo venture studio focused on software startups, which twice a year will offer a three- to six-month program to help entrepreneurs build and launch startups; the studio will also support these startups post-launch.Upon completion of the program, startups can receive seed funding of up to 50 million yen (about $327,000 at the current exchange rate)

Insurance

- MS&AD Insurance Group announced the completion of its current share buy-back program; a final purchase on November 1 exhausted the authorized funds, while only 44% of the maximum authorized shares, for a total of around 3.6% of total shares issued, were repurchased

- Also, the MS&AD Insurance Group published its Integrated Report to provide customers, stockholders, investors, and all other stakeholders with an understanding of their initiatives aimed at solving social issues and increasing corporate value throughout our business; in the last fiscal year, various problems occurred because of business practices in the non-life insurance industry, including price-fixing and fraudulent insurance claims by agents; in response to these problems, the MS&AD Insurance Group has returned to their “Mission,” “Vision,” and “Values” and they are working to transform into companies committed to serving the “best interests of our customers”

Banking

- The Bank of Yokohama, a member of the Concordia Financial Group, in collaboration with IBM Japan, has conducted a proof of concept utilizing Generative AI for creating loan review documents, with the results confirming its usefulness in terms of improving employee efficiency and enhancing credit assessment skills; once implemented in operations, it is expected to achieve efficiency gains of up to 19,500 hours annually (equivalent to approximately 8 hours per month per loan officer)

Payments

- LY Corporation reported strong FY2024 Q2 results, revising its full-year guidance for adjusted EBITDA and adjusted EPS upwards; progress is being made on addressing group-wide issues, including achieving continued listing requirements for the Prime Market through share buyback/cancellation of treasury shares and implementing security measures; PayPay Consolidated drove revenue and profit growth, with additional contributions from PayPay Bank, and other Fintech services resulting in Consolidated GMV YoY growth in excess of +20%

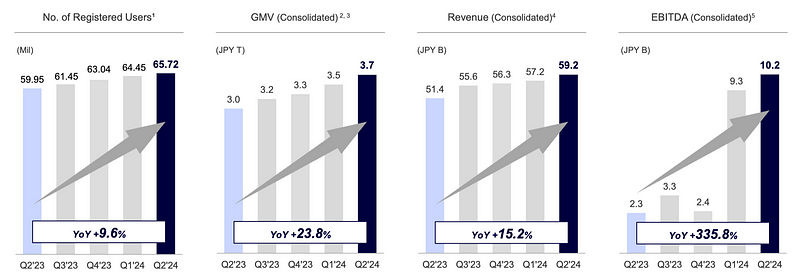

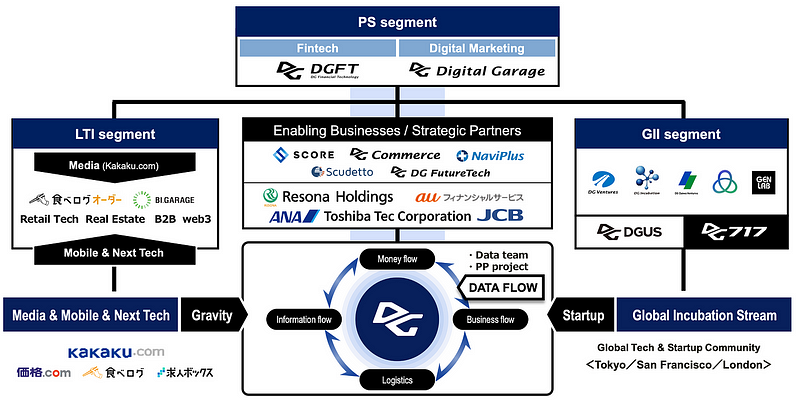

- Digital Garage presented its second quarter earnings for the fiscal year ending March 2025, demonstrating a strong core business performance fespite a non-cash accounting loss due to the fair value valuation of Blockstream and rapid Japanese Yen appreciation; the payment business saw a 23% profit increase in Q2 alone and is on track for +20% full-year growth; payment transaction volume increased by 20%, driven by growth in general retail, financial accounts, and restaurants, along with increased use of QR code payments, particularly Cloud Pay in offline areas

- PayPay announced an expanded partnership with Alipay+, Ant International’s cross-border mobile payment and digitalisation technology solution, broadening its merchant coverage network across Japan; by working with local partners including PayPay, Alipay+ will now connect over 3 million local merchants to the global payment ecosystem, enabling local businesses and payment partners to provide global visitors seamless and secure payment and travel experiences with their preferred domestic e-wallets

- Intelligent Wave is adapting its card connection & authentication to AWS: Intelligent Wave Inc.’s (IWI’s) NET+1 (Net Plus One) is a software product that provides the network connection, authorization, and authentication functions required for card payments; traditionally, IWI has provided “NET+1” on-premise, built on high-performance hardware that combines high availability and fault tolerance; development of “NET+1” to be compatible with AWS is scheduled to be completed around April 2025, and sales will be focused primarily on card companies, banks, and other financial institutions that are promoting the modernization, openness, and cloudification of their systems

- InComm Payments acquires digital gift card provider Mafin from J ESCOM; J ESCOM completed the acquisition of Mafin in June 2022; since then, it has been actively developing the digital gift business in Japan by utilizing business expertise from Korea, which is an advanced country in digital gifts, and as a result, both distribution volume and sales have been progressing steadily, however, the path to profitability is still long

Capital Markets

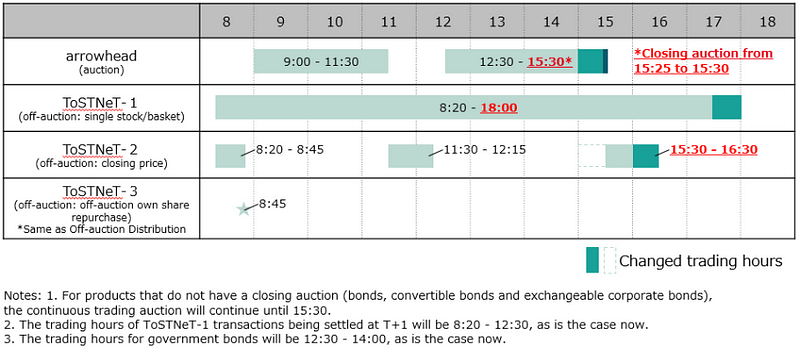

- The Tokyo Stock Exchange (TSE) has successfully completed the migration and confirmation work for the system upgrade of its cash equity trading system “arrowhead,” the ToSTNeT system, and the Market Information System; the upgraded system went live at the start of trading last week, as originally scheduled; in conjunction with the system upgrade, TSE has extended the trading hours of the cash equity market by 30 minutes beginning on the go-live date; the trading hours of the derivatives market have also be changed on the same date in connection with the extension of trading hours of the cash equity market; in addition, TSE has introduced a closing auction session in the cash equity market at the end of the afternoon session

- Sumitomo Mitsui Financial Group and enechain have established a new joint venture company, named “eXstend”, with JPY 1bn in capital and a 50/50 ownership structure; the purpose of establishing eXstend is to provide fuel price volatility hedging opportunities to power companies and support their stable business operations; eXstend’s role is not to take positions and bear fuel price volatility risks itself, but to facilitate smooth transactions between hedgers and optimal counterparties participating in enechain’s market by organizing commercial flows and providing trading opportunities

- Japan’s financial regulator is urging Nomura Holdings to examine the cause of an alleged robbery and attempted murder committed by a former employee, and to formulate measures to prevent similar incidents; this follows reports that a 29-year-old man was arrested on suspicion of having drugged an elderly customer and his spouse in Hiroshima, stealing about ¥26 million ($170,000) in cash from their home and setting it on fire; the suspect has been accused of robbery, arson and attempted murder

- The Bank of Japan has published a research paper on the “Developments in the Japanese Money Markets and their Functioning with Excess Reserves”; while implementing a variety of unconventional monetary policy measures, the Bank of Japan has provided ample reserves that far exceed the levels of required reserves for most of the past 25 years; the report assesses the impact of the unconventional monetary policy measures on the money markets by looking back on the rate formation and transaction trends in the money markets with such excess reserves

Digital Assets

- SBI Digital Markets (SBIDM) has renewed its participation in the Monetary Authority of Singapore’s Project Guardian pilots, taking part in the Fixed Income and Asset and Wealth Management pilots with a focus on driving commercial adoption; through its collaboration with financial institutions, SBIDM is actively building an end-to-end framework for the primary and secondary market distribution of tokenized securities by connecting regulated digital asset exchanges across multiple jurisdictions

- NTT Digital, with Amazon and StraitsX, has showcased a pioneering use case for tokenizing accounts payable, utilizing “scramberry WALLET SUITE,” a digital wallet solution for businesses; the “scramberry WALLET SUITE,” which has been available to corporate customers since September 2024, has been updated to support overseas users; additionally, it became possible to develop it as a browser application, and the wallet function can be readily incorporated into web services and smartphone native applications

- OSL Group, a Hong Kong publicly listed company fully dedicated to digital assets, announced the signing of a share purchase agreement by its wholly-owned subsidiary to acquire an 81.38% stake in CoinBest, a crypto asset exchange service provider licensed by the Financial Services Agency in Japan; Coinbest was established in 2017, and achieved its cryptocurrency exchange registration in September 2020

- Ginco and Multipeak have signed a Memorandum of Understanding to collaborate on a groundbreaking blue carbon credit generation and biodiversity credit initiative; this partnership leverages cutting-edge digital technologies, including blockchain, to enhance accountability, verifiability, and sustainability in environmental conservation efforts, contributing directly to global climate action

The Last Word: Primary Budget Deficits

According to Apollo Global Management, the US has the largest primary budget deficit with 5.8% of GDP. Japan is not far behind, coming in at 5.6%. The effect of the Bank of Japan’s normalization of monetary policy on the budget deficit — i.e. higher interest expense — is largely under-appreciated. Some of that will be offset by higher tax revenue if the “virtuous cycle between wages and prices” will in fact be established, however, it seems obvious that at some point taxes will need to rise (or expenditures cut).

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.