Japan FinTech Observer #74

Welcome to the seventy-fourth edition of the Japan FinTech Observer.

Welcome to the seventy-fourth edition of the Japan FinTech Observer.

We will host the Japan FinTech Observer weekly call again on Monday evening, starting at 8pm JST on LinkedIn Audio. You can find this week’s event here.

Canadian Alimentation Couche-Tard (ACT), with one-fifth of the stores but 1.5x the market capitalization, is making a bid for 7&I Holdings. “Japan’s M&A scene may never be the same again,” says Leo Lewis in the Financial Times.

The partnership of the Astar Foundation and Sony is due to launch Soneium, an Ethereum Layer 2. The ASTR token remains at less than half recent highs, and at about a quarter of a spiky peak. With an abundance of Layer 2s already in the market, this move smells like the “not invented here” syndrome.

The Fed will cut interest rates in September, and the JPY closed Friday nearer to USD 1.40 than to 1.50. Or, in other words, we are still just about where we started the year, when analysts were predicting up to six US rate cuts. Among the analysts we follow, there remains a split opinion regarding the next BOJ move: October or January.

Otherwise, here is what we are going to cover this week:

- Venture Capital & Private Markets: M&A rebound signals a new era for corporate dealmaking in Japan, according to J.P. Morgan; MUFG Bank will make an additional investment in DMI Finance — a digital financial services business in India; the Cool Japan Fund (CJF) has decided to commit up to USD 20 million to a fund that invests in Japanese startups seeking global growth; GMO VenturePartners participates in India’s TransBnk — Transaction Banking Platform Series A

- Insurance: Dai-ichi Life and Microsoft have entered into a multi-year strategic global partnership

- Payments: OBC, a developer of core business systems, and PayPay have concluded an MoU for digital salary payments

- Banking: MUFG Bank has sold 24 million shares of U.S. Bancorp common stock; MUFG Bank also signed a Framework Agreement (FA) with the Ministry of Digital Technologies of Uzbekistan; the Financial Services Agency, in conjunction with the National Police Agency, requested additional measures to prevent the fraudulent use of savings accounts; the Financial Services Agency held several meetings with Japanese financial industry groups in July 2024, covering a wide range of topics

- Capital Markets: the Tokyo Stock Exchange has provided a comprehensive update on its governance activities; Carbon EX has formed a business alliance with Tohoku Bank; Dojima rice futures started trading, and a listing ceremony was held this week

- Digital Assets: Sony Block Solutions Labs is building a public Ethereum layer 2, with the Astar Foundation as a strategic partner, other launch partners are Alchemy, Chainlink, Circle, Optimism Foundation, and The Graph; Japanese Firm Metaplanet Buys Another $3.4 Million in Bitcoin; Casio announced a collaboration with the move-and-earn Web3 lifestyle app STEPN GO

- The Last Word: Grok

eXponential Finance Podcast

We have released the 140th edition of the eXponential Finance Podcast, featuring a discussion with Professor Stephen Nagy based on his latest edited volume, “Southeast Asia and the Indo-Pacific Construct.”

This episode is available on Apple Podcasts, YouTube, Amazon Music, and many other major platforms via our Spotify Podcaster Page.

Venture Capital & Private Markets

- M&A rebound signals a new era for corporate dealmaking in Japan, according to J.P. Morgan: (I) New guidelines from the Ministry of Economy, Trade and Industry on corporate takeovers and the Tokyo Stock Exchange reforms have helped pave the way for a new era of Japanese corporate governance and dealmaking in the region; (II) the Japan M&A market has had a strong first half, with deal volume up around 20% compared to same period in 2023; shareholder activism in Japan continues to gain momentum, increasing the number of takeover proposals

- Mitsubishi UFJ Financial Group and its consolidated subsidiary, MUFG Bank, announced that MUFG Bank will make an additional investment of INR 27,988 million (approximately JPY 49 billion) in DMI Finance — a digital financial services business in India; in April 2023, MUFG made a strategic investment in DMI Finance; the company has since successfully expanded its business scale by building a robust track record in its consumer finance business through the partnership model and the cross-sell loans service

- The Cool Japan Fund (CJF) has decided to commit up to USD 20 million to a fund that invests in Japanese startups seeking global growth opportunities; the national government originally created the Cool Japan Fund in 2013 to support overseas sales of cultural products such as anime and Japanese cuisine, and saw it as a potential winner that could drive growth; by the end of 2022, it had racked up a deficit of JPY 30.9bn (USD 218m) from investments that did not pan out, and there were heated discussions among the ministries whether CJF should be folded

- GMO VenturePartners,Inc. participates in TransBnk — Transaction Banking Platform Series A: India’s banking solutions fintech TransBnk raised $4 million in Series A funding led by early-stage venture capital (VC) fund 8i Ventures; the round was co-led by Accion Venture Lab, a global impact investor backing early-stage fintech startups, along with participation from GMO Venture Partners, Ratio Ventures Limited, Force Ventures LLP, and a group of family offices, institutions, and angel investors

- A joint venture of Canada’s Manulife Investment Management and Tokyo-based Kenedix has acquired a nine-asset multi-family portfolio in Japan for JPY 23 billion ($160 million); the latest buy brings the joint venture’s portfolio to 1,200 units across 19 properties, mostly in Tokyo, since the $170 million enterprise was launched in 2022 with nine seed assets; the portfolio has maintained an average occupancy rate exceeding 95 percent, according to the partners

Insurance

- We hosted an eXponential Finance LinkedIn Live session with Terence Ho, Co-Founder & Commercial Officer at Nanoinsure Technology Group, an insurance platform provider that has recently entered the Japanese market; the recording of the discussion is available on the Tokyo FinTech YouTube channel

- Dai-ichi Life and Microsoft have entered into a multi-year strategic global partnership to accelerate digital innovation and the organization’s transformation into the “Insurance services business” beyond the current traditional life insurance business; the vision for the Dai-ichi Life Group in fiscal 2030 is to become №1 in Japan in the 4 areas of “Customer satisfaction”, ”Employee satisfaction” , “Services innovation” and “Enterprise value”, as well as to become an insurance group in the global top tier and a leader in the future of the insurance industry

Payments

- OBIC Business Consultants (OBC), a developer of core business systems, and PayPay have concluded a memorandum of understanding regarding functional collaboration for digital salary payments; on August 9, 2024, PayPay was designated by the Minister of Health, Labor and Welfare as a money transfer business that supports digital salary payments to the accounts of money transfer businesses; on August 14, the “PayPay Salary Receipt” service was launched for employees of SoftBank Group companies, and the service is scheduled to be launched for all PayPay users by the end of 2024

Banking

- MUFG Bank has sold 24 million shares of U.S. Bancorp (“USB”) common stock it had additionally acquired in August 2023; the sale of USB shares was completed with consideration to MUFG’s regulatory capital efficiency; MUFG will continue to hold its initial investment of approximately 44 million shares given its intention of maintaining a long-term relationship with USB remains unchanged

- MUFG Bank also signed a Framework Agreement (FA) with the Ministry of Digital Technologies of Uzbekistan, taking the opportunity of the “Central Asia plus Japan” Dialogue and Summit Meeting; through the FA, both parties aim to expand information and communication infrastructure within Uzbekistan in order to increase the capacity for organizing Internet channels, voice, and other telecommunications services

- There has been a sharp increase in “SNS-based investment and romance scams,” in which fraudsters gain the trust of others through social media and then defraud them of money under the pretext of investments, etc; in addition, there have been cases of the misuse of corporate accounts, making it urgent to take measures against financial crimes committed through savings accounts; in response to this, the Financial Services Agency, in conjunction with the National Police Agency, requested additional measures to prevent the fraudulent use of savings accounts

- The Financial Services Agency held several meetings with Japanese financial industry groups in July 2024, covering a wide range of topics; as the participation is rotating on a monthly basis, not all industry groups are represented every month; in July, the FSA met with the Japan Regional Bank Association, the National Association of Credit Banks, the Trust Association, the Life Insurance Association of Japan, the General Insurance Association of Japan, and the Japan Securities Dealers Association

Capital Markets

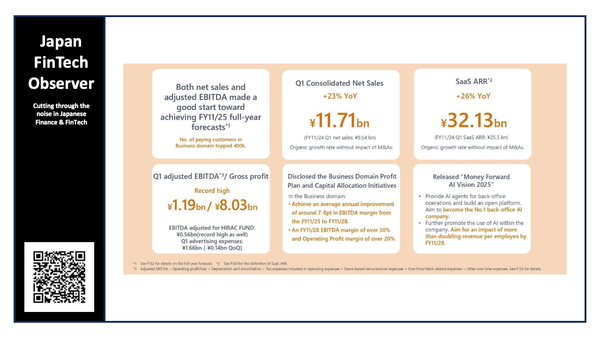

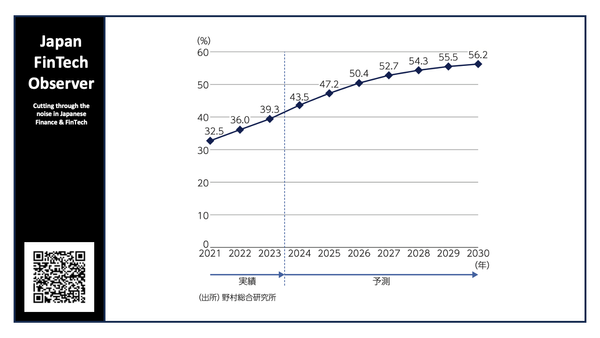

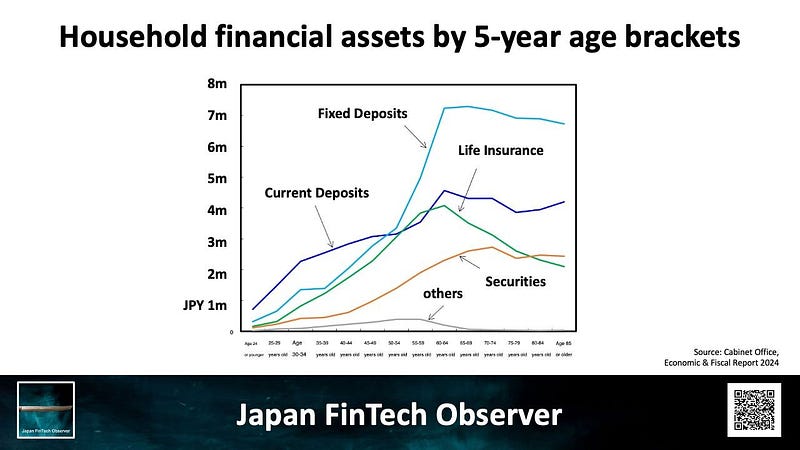

- The Cabinet Office has published its annual “Economic & Fiscal Report”, which included the above graph, highlighting the older generation holding massive assets, and much of that in cash; “the challenge is to encourage households to effectively utilize their wealth in economic activity”

- The Tokyo Stock Exchange has provided a comprehensive update on its governance activities, including the “Action to Implement Management that is Conscious of Cost of Capital and Stock Price”, revisions to the code of corporate conduct for Management Buy-Outs (MBOs) and subsidiary conversions, and an update on the number of companies subject to transitional measures because they did not meet listing criteria

- Carbon EX has formed a business alliance with Tohoku Bank; through the provision of carbon credits and non-fossil fuel certificates on “Carbon EX,” a carbon credit and emissions trading platform operated by Carbon EX that handles a wide range of credits from around the world, the two companies will support corporate environmental contribution activities

- Dojima rice futures started trading on August 13, and a listing ceremony was held this week, after the Osaka Dejima Exchange (ODX) had received approval from the Ministry of Agriculture, Forestry and Fisheries, Japan and the Ministry of Economy, Trade and Industry in June for the establishment of a Rice Index Market

Digital Assets

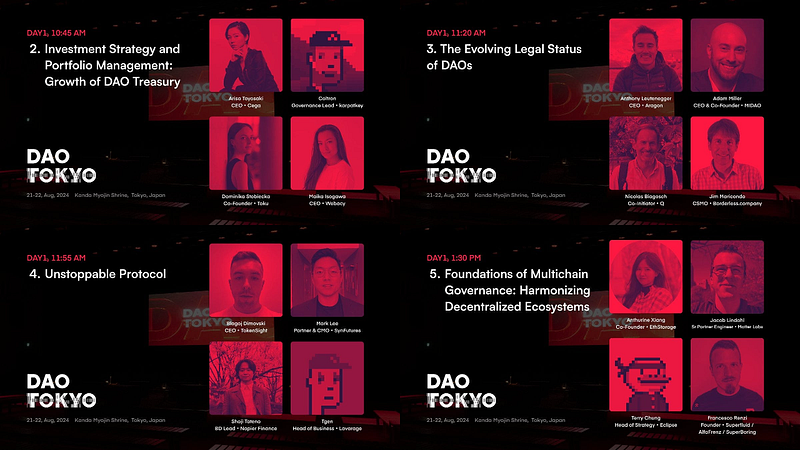

- The DAO Tokyo 2024 conference took place this week, followed by ETH Tokyo; for the former, we captured the highlights of four panels for you: (I) Investment Strategy and Portfolio Management, (II) the Evolving Legal Status of DAOs, (III) Unstoppable Protocol, and (IV) Foundations of Multichain Governance

- Soneium, by Sony Block Solutions Labs is building a public Ethereum layer 2 next-generation blockchain ecosystem designed to invoke emotion and empower creativity; Soneium will connect the blockchain technology (Web3) with the everyday internet services (Web2); this connection will make things easier for users, helping more people start using blockchain; it’s a strategic initiative to integrate Astar Foundation Network (zkEVM) more closely with Soneium, leveraging the strengths of both ecosystems to drive forward the vision; other launch partners are Alchemy, Chainlink, Circle, Optimism Foundation, and The Graph

- Japanese Firm Metaplanet Buys Another $3.4 Million in Bitcoin; the investment firm’s stock price jumped by over 10% on the news that it had completed its planned purchase of JPY 1 billion using a loan

- Yuto Takei at Mercari, Inc. and Kazuyuki Shudo at Kyoto University got their paper “Effective Ethereum Staking in Cryptocurrency Exchanges” accepted at the IEEE Blockchain conference, which was held in Copenhagen this week

- Casio announced a collaboration with the move-and-earn Web3 lifestyle app STEPN GO as part of the VIRTUAL G-SHOCK project involving the G-SHOCK brand of shock-resistant watches; FSL, the Web3 product development studio that operates STEPN GO, will release a limited-edition offering of 800 total NFTs featuring four types of virtual sneakers; these exclusive digital items will be available via Raffle Mint on MOOAR, FSL’s NFT marketplace, from August 26 through 29

The Last Word — Grok

Grok, draw me a picture of a peaceful Japan. I just had nothing else to say today.

If you would like to see more of our content, please head over to the Tokyo FinTech YouTube Channel or check out the eXponential Finance Podcast. Registrations for the Tokyo FinTech Meetup have moved to Luma.

We have also created two LinkedIn groups, the “Japan Startup Observer” if your interest in Japan goes beyond FinTech, and the “FinTechs of India” to capture the developments on the subcontinent. We invite you to join both these groups.

Have an awesome week ahead.