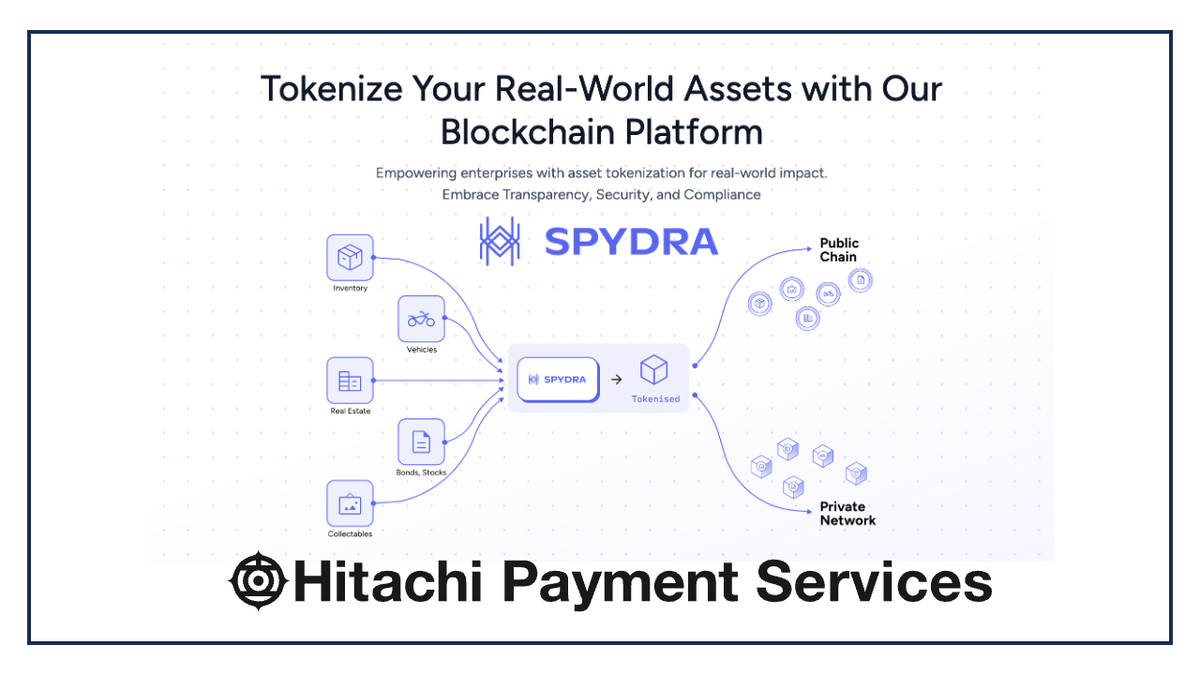

Hitachi Payment Services invests in Spydra Technologies

Hitachi Payment Services has made a strategic minority investment in Spydra Technologies to develop and introduce innovative offerings in the rapidly evolving domains of Web 3.0, Central Bank Digital Currency (CBDC) and Blockchain Technology.

Spydra is a low-code enterprise blockchain platform specializing in real-world asset tokenization. Spydra enables asset owners and issuers to seamlessly tokenize and manage their assets on-chain, offering customizable solutions for equity, debt, and hybrid financial products. The platform supports both permissioned and public blockchain networks, allowing flexibility in compliance and transparency requirements. It integrates with various payment systems, supports custodial and non-custodial options, and facilitates secondary market trading. Beyond unlocking new liquidity streams, Spydra’s asset tokenization solutions enhance traceability and transparency, making them valuable for industries requiring rigorous supply chain verification and auditability.

Spydra’s extensive expertise in enterprise blockchain solutions aligns with Hitachi Payment Services’ commitment to drive innovation in digital payments through groundbreaking technologies. The investment in Spydra is part of the Hitachi Payments Accelerator (HPX) Program, an initiative aimed at collaborating with fintech startups through partnerships and investments to meet the evolving needs of businesses, merchants and customers.

Through this partnership, Hitachi Payment Services aims to integrate blockchain-powered capabilities into its payment infrastructure, to develop innovative payment solutions, improve payment efficiency, enhance security and reduce fraud. Furthermore, it will work towards addressing the challenges associated with cross-border payments, leveraging the potential of CBDC implementation for optimizing payments, while reducing costs and enabling instant settlements. CBDC also has the potential to drive financial inclusion by providing secure and accessible digital payment services to the underserved and unserved sections of society.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.