Hitachi & 12 companies conduct PoC to improve & standardize AML practices in digital assets

Hitachi, together with NTT Digital, OPTAGE, Crypto Garage, JPYC, Chainalysis Japan, Digital Platformer, NEC, Nomura, bitbank, finoject, Hokkoku Bank, and Laser Digital Japan, has begun a proof-of-concept experiment from February to April 2025 aimed at improving the effectiveness and standardization of anti-money laundering practices for digital asset trading including cryptocurrency, stablecoins, and NFTs.

In this experiment, Hitachi and the participating companies will collaborate to share essential AML systems, human resources, and information to improve efficiency and sophistication of AML measures in the digital asset market. Traditionally, digital asset trading companies have individually handled AML compliance, which presents challenges in terms of cost and human resource burdens, with additional regulatory compliance requirements expected in the future. Therefore, this experiment aims to improve efficiency by addressing human resource shortages and enhancing the accuracy and speed of operations.

Based on the results of this experiment, Hitachi and the participating companies will expand their collaborative framework with other digital asset trading companies involved in AML compliance. Furthermore, they will contribute to the realization of safe and secure digital asset trading through strengthened AML risk management across the entire digital asset market, the prevention of crimes and fraud such as money laundering, and the development of Web3 in Japan.

Background

In recent years, while the digital asset market has grown rapidly, the anonymity of blockchain transactions has led to an increase in money laundering and criminal misuse. As a result, international AML regulations are being strengthened to create an environment where users can safely and securely use various digital asset services and to realize sound financial transactions. However, digital asset trading-related businesses such as cryptocurrency exchanges and Web3-related companies are individually addressing regulatory compliance, resulting in issues such as costs and shortages of specialized personnel familiar with AML operations and technology, making it difficult to advance AML measures in the digital asset market.

Therefore, through collaboration between Hitachi and the participating companies, this experiment aims to enhance and make AML operations more efficient by consolidating and standardizing the AML operations that each company currently conducts individually.

Overview of the Experiment

This experiment, conducted from February to April 2025, will verify the effectiveness of sharing systems, human resources, and information for monitoring operations, which are highly important from the perspective of detecting inflows of criminal funds and transactions with criminals, among AML operations.

- First, digital asset money laundering information that was previously collected, stored, and analyzed individually by digital asset trading companies will be shared by participating companies on a dedicated platform provided by Hitachi.

- The information will then be analyzed on the platform and fed back to each company, which will use it for AML operations in domestic blockchain transactions, verifying the effectiveness of improved AML accuracy and cost reduction.

- Additionally, by automating monitoring operations using open transaction data, the experiment aims to improve efficiency and reduce the workload of monitoring operations.

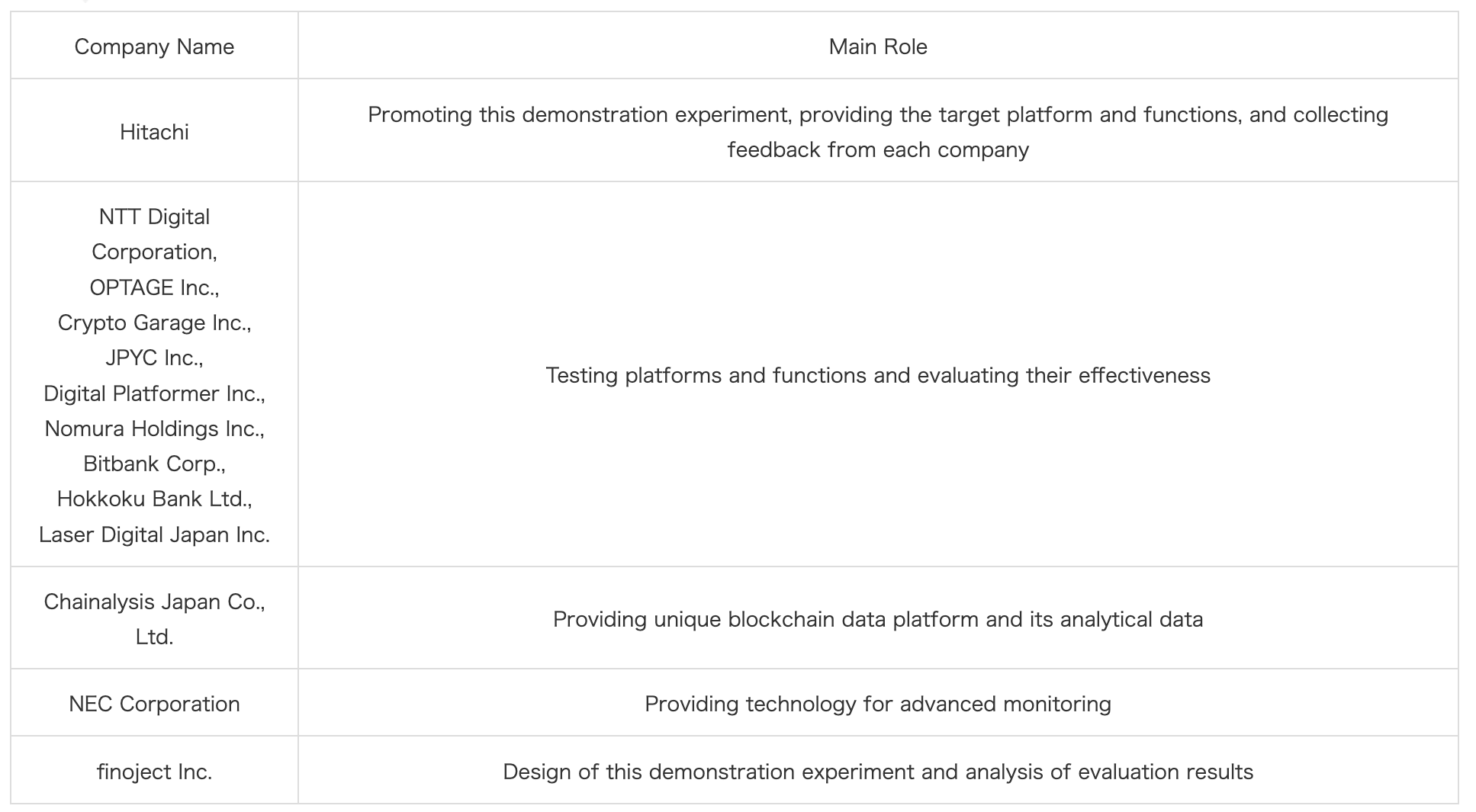

Roles of Hitachi and Participating Companies

Future Initiatives

Based on the results of this experiment, Hitachi and the participating companies will expand their collaborative framework with digital asset trading companies involved in AML compliance, contributing to strengthening AML measures across the entire digital asset market.

Even after the experiment, they will continue to work on technology development for further improving AML accuracy, such as sharing information on regulatory compliance among companies and utilizing various data beyond blockchain transactions and AI to strengthen AML risk management.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.