GMO Aozora Net Bank now offers business bank accounts for sole proprietors

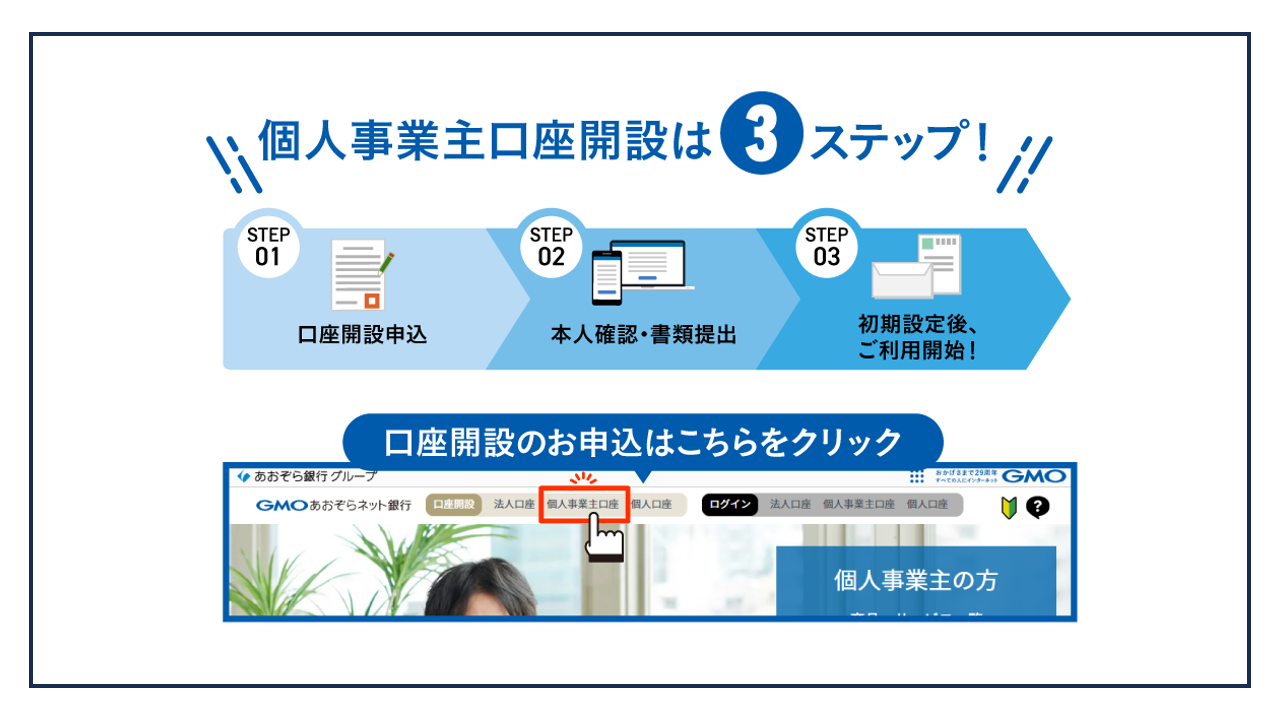

GMO Aozora Net Bank now allows standalone sole proprietorship accounts to be opened. These have previously required opening a personal account first.

This initiative is part of the company's improved support for small and start-up businesses, which it positions as one of its medium- to long-term strategies. First, GMO Aozora Net Bank will begin with an initiative to reduce the hassle of opening a sole proprietorship account, and will gradually expand services for sole proprietorship customers in the future.

GMO Aozora Net Bank has deployed the "Individual Business Account Opening Navigator", which allows customers to submit the documents required for account opening and check the opening status, making it convenient and quick to apply for an individual business account.

In addition, for customers who apply for an account using a selfie video to verify their identity, they can check their initial login information on the "Individual Business Account Opening Navigator" after the account opening is completed, so they can use the account from the day the account is opened.

About GMO Aozora Net Bank

With the corporate vision of "Everything for our customers. Aiming to be the No. 1 technology bank," GMO Aozora Net Bank was established in July 2018 as a new online bank. By developing systems in-house, the company is able to provide financial and payment services that are tailored to their customers with a sense of speed.

Due to the online account opening application, the time from application to start of use, low fees, convenient fundraising services, and extensive banking APIs, the number of customers, especially small and start-up companies, has increased rapidly.

In response to this, GMO Aozora Net Bank has set three major pillars as their medium- to long-term strategy:

- No. 1 bank for small and start-up companies,

- No. 1 embedded financial services, and

- No. 1 tech-first bank.

With the growth of its customers' businesses equaling their own growth, GMO Aozora Net Bank is working hard to develop new systems and provide new services in order to be a bank that grows together with its customers.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.