Funding Societies secures investment from Cool Japan Fund

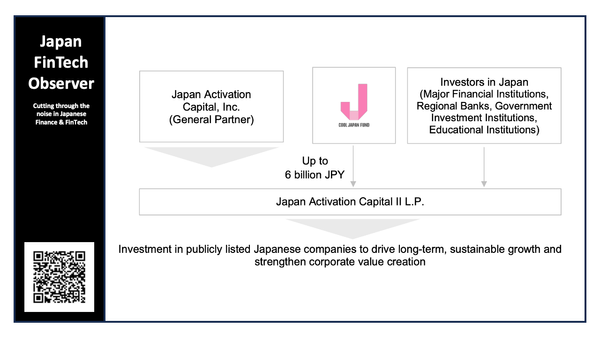

Funding Societies has raised US$25 million in equity investment from Cool Japan Fund (CJF). The investment from CJF signifies the fund's first investment into a FinTech company in Southeast Asia.

Funding Societies will funnel the investment to deepen its core business in SME financing across its five markets - Singapore, Indonesia, Malaysia, Thailand, and Vietnam - whilst further expanding its payment business since embarking on it in 2022.

Having served SMEs in fulfilling their business potential for a decade, the company will focus on helping businesses get paid faster through innovative receivables and financing solutions. It will also leverage technology and AI to digitise and automate lending origination processes. These initiatives and synergies between payments and lending, align with the company's objectives of achieving growth and profitability.

Annually, Japanese direct investment in the ASEAN region averaged about US$18.6 billion. Furthermore, there are approximately 15,000 business establishments set up by Japanese companies in the region. In a 2024 survey conducted by the Japan Bank for International Cooperation, asking 500 Japanese companies their top 10 promising countries for overseas business development, ASEAN countries made up half the list.

Through this investment, Funding Societies will also embark on a partnership with CJF, leveraging the former's strong track record in serving SMEs in Southeast Asia, to provide financial services to support Japanese companies. The partnership will foster positive commercial relations for Japanese companies and local SMEs in the region, and help expand overseas demand for attractive products and services unique to Japanese lifestyle and culture by supporting the overseas business expansion of Japanese companies engaged in providing them.

Revenue of digital financial services in Southeast Asia is projected to be on the ascent, with digital lending to be the biggest driver – contributing approximately 65% of the total revenue. The total loanbook has a year-on-year growth of over 20% to US$71 billion from 2023 to 2024 (only covering under 1% of the US$2.5 trillion credit access gap in the region), and is expected to grow steadily to approximately US$200-300 billion by 2030.

This injection follows successful milestones in 2024 achieved by Funding Societies including: a strategic equity investment from Maybank; and a third annual credit facility from HSBC's ASEAN Growth Fund which is part of an accumulative commitment of over US$100 million credit facility with the bank.

To date, Funding Societies has achieved over US$4 billion in business financing serving about 100,000 SMEs, and processed an annualised payments gross transactions value (GTV) of over US$1.4 billion – since expanding into its payments business in 2022.

About Funding Societies | Modalku

Funding Societies | Modalku is the largest unified SME digital finance platform in Southeast Asia. It is licensed in Singapore, Indonesia, Thailand, registered in Malaysia, and operates in Vietnam. The FinTech company provides US$1 billion annually of business financing to small and medium-sized enterprises (SMEs). Since embarking on its strategic milestone to expand into payments, the company processes an annualised US$1.4 billion in gross transactions value, following the acquisition of regional digital payments platform CardUp in 2022.

Funding Societies | Modalku is backed by SoftBank Vision Fund 2, Maybank, Khazanah Nasional Berhad, CGC Digital (the digital arm of the Credit Guarantee Corporation Malaysia Berhad), SBVA (previously SoftBank Ventures Asia), Peak XV Partners (previously Sequoia Capital India), Alpha JWC Ventures, SMBC Bank, BRI Ventures, VNG Corporation, Rapyd Ventures, Endeavor, EBDI, SGInnovative, Qualgro, and Golden Gate Ventures among others.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.